Hotel Tech Benchmark – Methodology

Shining a Spotlight on Hotel Tech

The space of hotel technology is booming, but also often misunderstood.

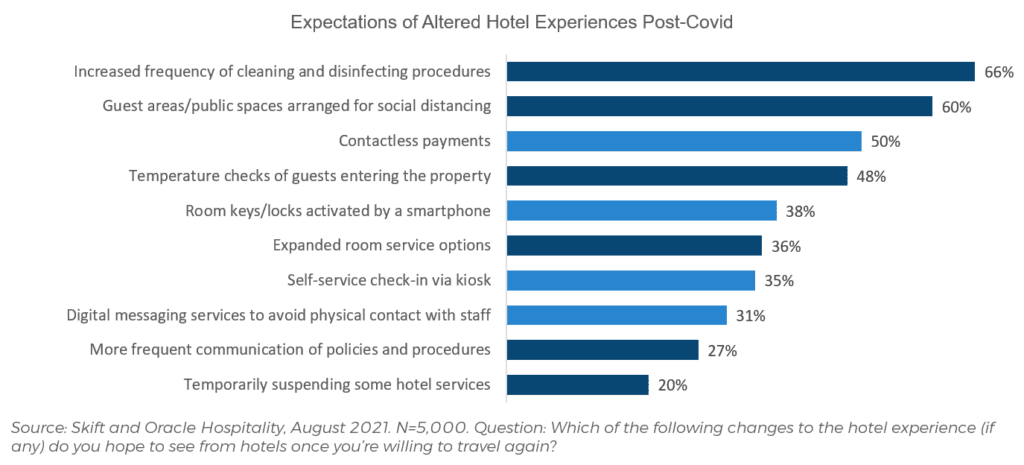

Booming because the pandemic has driven home once again the need for hotels to have first rate technology to enhance the guest and staff experience. The beginning of the pandemic saw a run on the adoption of contactless technology like messaging services, in-room ordering, and online check-in, which also boosted keyless entry systems. According to a recent survey by Skift and Oracle Hospitality, these technologies are now expected by many hotel guests.

The hotel tech space is often misunderstood, because this is a space where well-known legacy brands compete with hosts of start-ups, where each vendor is trying to find its niche by offering a set of solutions that needs to fit into the hotel tech stack. The hotel industry is extremely fragmented and immensely varied in the service levels and amenities offered, which require bespoke tech stacks for almost every hotel. Many hotels use anywhere from 10 to 50 tech vendors and systems to be able to operate effectively.

This constantly offers opportunities for new tech vendors or new products from existing vendors to improve things like improving staff efficiency, utilizing data streams, enhancing guest communication, and letting all different technology systems work effectively together. The highly fragmented nature of the hotel industry, however, means that most hotel tech vendors do not see the astronomical growth that investors expect from technology providers, since a lot of the legwork still happens on the ground. This is of course not true for all vendors, depending on their strategy and the area of specialization, but that only makes the space more intricate.

Skift Research has contributed to the literature which explains this space through a number of research reports, including our popular The Property Management Systems Landscape 2020 report, a discussion of revenue management systems in The Hotel Revenue Management Landscape 2019, a focus on distribution technology in Hotel Distribution 2020 Part II: The Tech Landscape, and most recently a look at payment processing tech in The State of Hotel Payments 2021. We have also given attention to marketing and guest-facing technologies in reports like Contactless Tech in Hospitality 2020 and An Expanded View of Hotel Loyalty Tech 2019.

Introducing the Hotel Tech Benchmark

The Hotel Tech Benchmark by Skift Research offers clarity in this convoluted space. Skift Research has done extensive outreach to hotel tech vendors to participate in this new tool. Participating tech vendors were asked to provide details about their company, products, and clientele.

Skift Research has collated this information, and used this as the input for the Hotel Tech Benchmark, combined with our estimates and knowledge garnered from extensive discussions with industry experts.

It is impossible to completely demystify the hotel tech space, and stay on top of everything that’s new and different, but the Benchmark will answer some critical questions:

- What is the annual revenue generated from each hotel tech category?

- How many hotels utilize particular technologies?

- What is the total current and addressable market?

- Where do growth opportunities lie?

- What are the most important business models i.e. how do tech vendors make money?

- Which are the largest vendors in each category, and what market share do they have?

- How do vendors differentiate themselves from their competitors?

The Hotel Tech Taxonomy

To be able to provide a comprehensive view of the hotel tech space, we have divided the extensive hotel tech ecosystem into four categories, with between five to eight types of software below each.

Under Operations, the most important piece of technology is the property management system, which is the heart of any hotel tech stack. Other tech in this category includes specialized departmental systems like spa management, sales and catering software, accounting software, and housekeeping and staff collaboration tools. Business intelligence software, API connectivity, and marketplaces offer solutions for hoteliers to better integrate tech systems and data flows. Payment processing and point-of-sale technology is vital for the operation of any hotel.

The Revenue Management category includes any systems and tools that help hotels understand the market and set the correct prices. Revenue management systems come in a number of different shapes and sizes, where we make a distinction between full stack RMSs and revenue systems which only have a limited scope, or are an add-on to other systems, like a PMS or channel manager. Upselling tools allow hotels to add revenue beyond room prices. Tools to better understand the competitive landscape include rate parity tools and rate shoppers

In a highly competitive market, hotels need to ace their distribution and marketing strategies. With a plethora of different distribution and promotional channels, this has become much harder. Distribution and Marketing technologies help hoteliers. Most important are two mainstays of hotel distribution, the Central Reservation System (CRS), which is particularly important for hotel chains, and the Channel Manager (CM), which connects the hotel to all different distribution channels. Booking engines, which allow hotels to accept bookings on their own website, are also extremely important.

From a marketing point of view, the Customer Relationship Management (CRM) system is gaining importance in the hotel space, with reputation management tools also growing in popularity.

Finally, the Guest-Facing Tech category largely includes technologies which offer guests a more contactless experience, and allow hoteliers to better communicate with its guests. Online check-in and keyless entry have seen high adaptation during the pandemic, as have guest messaging tools.

| Operations | Revenue Management | Distribution and Marketing | Guest-Facing Tech |

|---|---|---|---|

| Analytics & Business Intelligence (BI) | Full stack Revenue Management Systems (RMS) | Booking engines | Concierge & Guest experiences |

| API Connectivity & Marketplaces | Limited scope RM tools or add-ons | Central Reservation Systems (CRS) | Guest apps & In-room tech |

| Finance & Accounting | Rate parity tools | Channel managers (CM) | Guest messaging & Chatbots |

| Payment processing & Point-of-sale (POS) | Rate shoppers & market intelligence | Customer Relationship Management (CRM) | Keyless entry |

| Property Management Systems (PMS) | Upselling tools | Digital Marketing, Metasearch & Ad tech | Online check-in & Kiosks |

| Sales & events software | Reputation and review management | ||

| Spa management | Website builders & direct booking tools | ||

| Task management, Housekeeping & Staff collaboration tools |

Surveying Tech Vendors

Around 50 tech vendors have so far provided information about their company, and this number is growing constantly. We are doing extensive outreach, having so far requested information from more than 350 companies by sending them an Excel-based survey.

Participating companies have provided extensive information about their operations, including:

- Historic and current revenues

- Revenue streams

- Historic and current employee count

- Geographic coverage

- Product breakdown, including software functionality, launch date, pricing models, and integrations

- No. of hotels and rooms per product

We continue to reach out to vendors, but also invite any tech vendor not participating yet to reach out to Skift Research.

Calculating Market Sizes

Market sizes and market potential are calculated bottom-up, using information from vendor input as well as publicly available information on company websites and in franchise disclosure agreements.

The total size of the hotel industry, which informs our ability to calculate market sizes, is a point of contention in the industry. We have used industry sources and our own estimates to determine the size of the hotel industry in terms of hotels and rooms.

There are many estimates of the number of hotels in the world, with most somewhere between half a million and a million. We collected information from different sources to estimate the total number of hotels worldwide at 600,000.

This is much higher than the often quoted STR figure, which is below 200,000 but excludes properties with less than 10 rooms, and while known for its strong coverage of highly branded markets like the U.S., struggles to capture more independent markets in Europe and Asia.

Therefore, other sources were taken into consideration. Euromonitor International, a market research company which includes coverage on independent and chained hotels for 100 countries estimates the market is just short of 600,000. Expedia asserts it has more than 600,000 properties on its platform, although this is likely to include more than just hotels.

Data on the number of rooms also shows extreme differences between sources. STR asserts that the average hotel has 92 rooms, while Euromonitor International puts this figure at 55. As both disregard small properties to different degrees, with STR particularly having limited coverage of independent and smaller hotels, we estimate that the average hotel has 50 rooms, to total 30 million rooms worldwide.

We’re Just Getting Started

Using input from hotel tech vendors, the Benchmark provides vendor landscapes for all tech categories. Skift Research has calculated the total market size of each category, as well as the total addressable market, highlighting opportunities for market expansion. But this is only the start.

In further rollout stages we will expand this scope by also starting to offer insights into hotelier spending habits on tech. It will become the prime benchmark tool for hoteliers to compare their tech spending and investments with competitors, and a reference point for hoteliers and tech vendors to better understand the tech landscape. In the case of tech vendors and investors, they will gain a better knowledge of who their competitors are, where hoteliers spend their tech dollars, and therefore where future growth opportunities lie.