Report Overview

When the entire travel industry comes to an abrupt stop, marketing is often among the first expenses to be cut, as it’s not considered critical spending and it doesn’t make sense to promote travel when nobody is allowed to travel.

However, budget cuts without having an optimization strategy risk losing marketing talent and opportunities to keep up with consumer needs and shifting behavior in the short term, to eventually falling behind in market share and revenue when the economy bounces back.

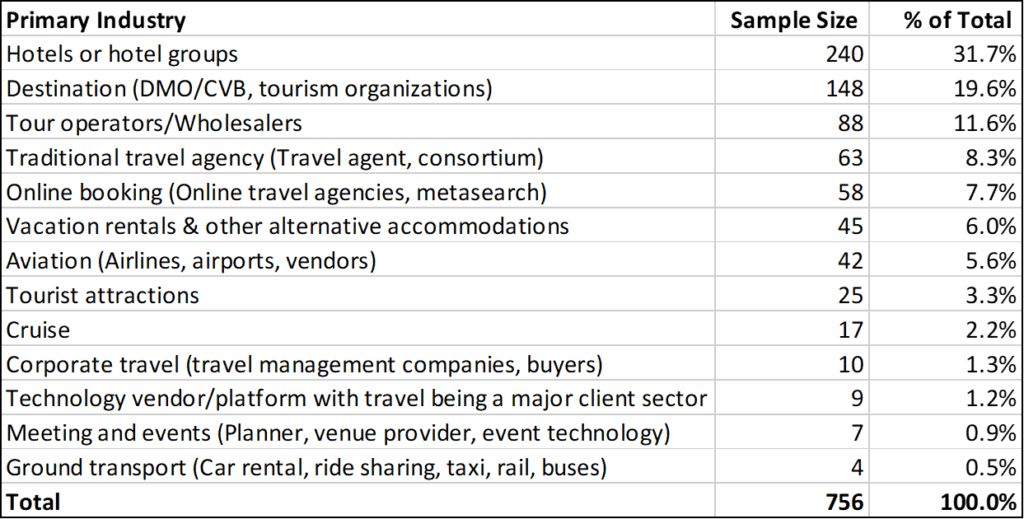

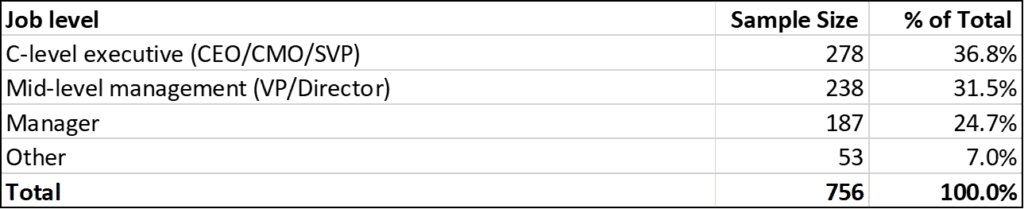

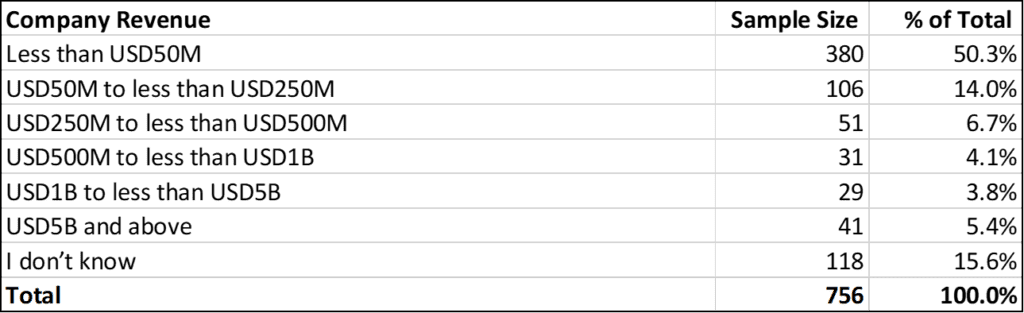

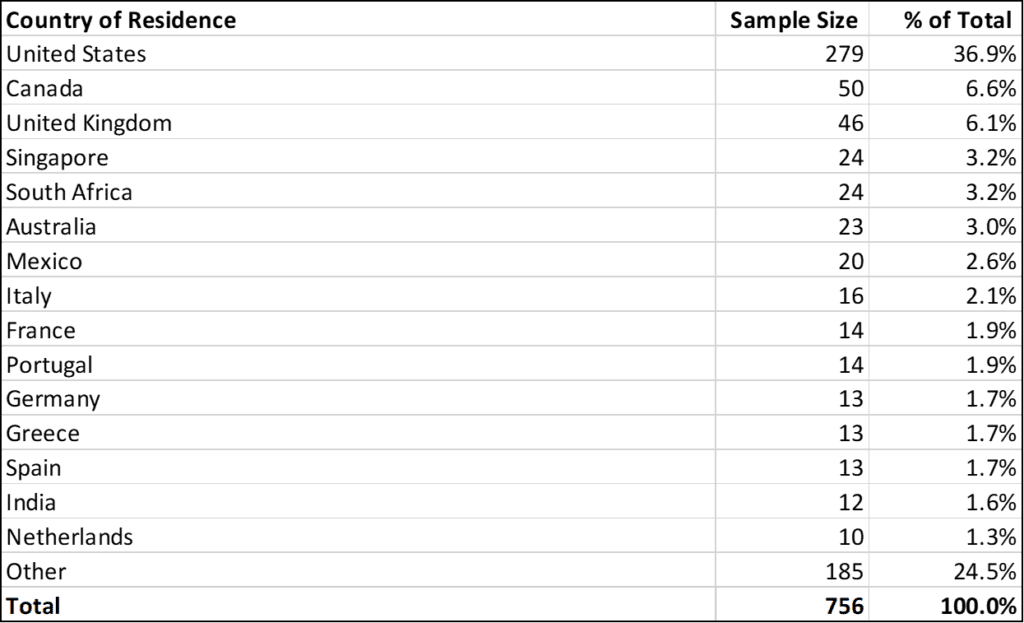

We surveyed 756 travel marketing professionals globally to assess the impact of COVID-19 on marketing and advertising spending and identify challenges and opportunities travel marketers are facing in response to the pandemic.

In addition to the benchmark data from this survey, we examine tactics and strategies that winning companies and marketing teams have in common in navigating through a crisis and provide best practices for leading the marketing team out of this crisis stronger.

What You'll Learn From This Report

- Benchmark data on levels of marketing budget cuts, breaking down by travel vertical

- Key tactics that travel marketers are adopting and major challenges they are facing in response to COVID-19

- Travel marketers’ predictions on the timing of full recovery

- A framework and best practices on how to be best positioned to come out the pandemic stronger

Executives Interviewed

- Kristie Goshow – Chief Marketing Officer, Preferred Hotels & Resorts

- Louise Casamento, Sr. Director of Marketing, Oracle Hospitality

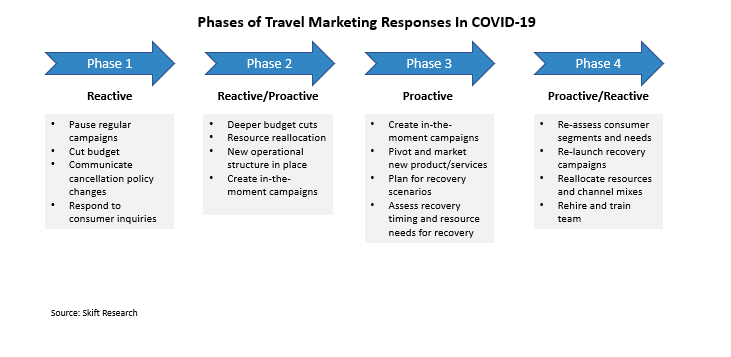

Phases of Marketing Responses During COVID-19

Most of the analysis of and advice on what is the right marketing during this crisis reads as a checklist. You need to do these things and avoid doing those things. In reality, companies are dealing with this abrupt and absolute disruption in the same way that individuals are. Most companies will react and respond to stresses in different phases, each in close correspondence with the chronological stage and nature of the crisis.

Actions in the first phase have been characterized by shock, a sharp brake on activities, and response to immediate new demands. In the second phase, companies start to pay attention to the broader contextual environment, in addition to the direct impact on its own business. There should be some structure in place around the immediate responses in this phase and some companies will find new and innovative ways to pivot marketing campaigns addressing in-the-moment issues faced by the consumers.

The third phase comes when lockdowns start to be lifted with caution, businesses are reopened gradually, and there is some travel uplift. Most companies will watch and examine closely all travel indicators and start to market again on capturing some traction of the early travelers. The fourth phase is when travel restrictions are lifted, either locally, regionally or globally. Companies will expand marketing to capture the market share in this phase. However, there will be a lot of uncertainty around the macro-economy and the full travel recovery, which makes the fourth phase a prolonged period of ups and downs.

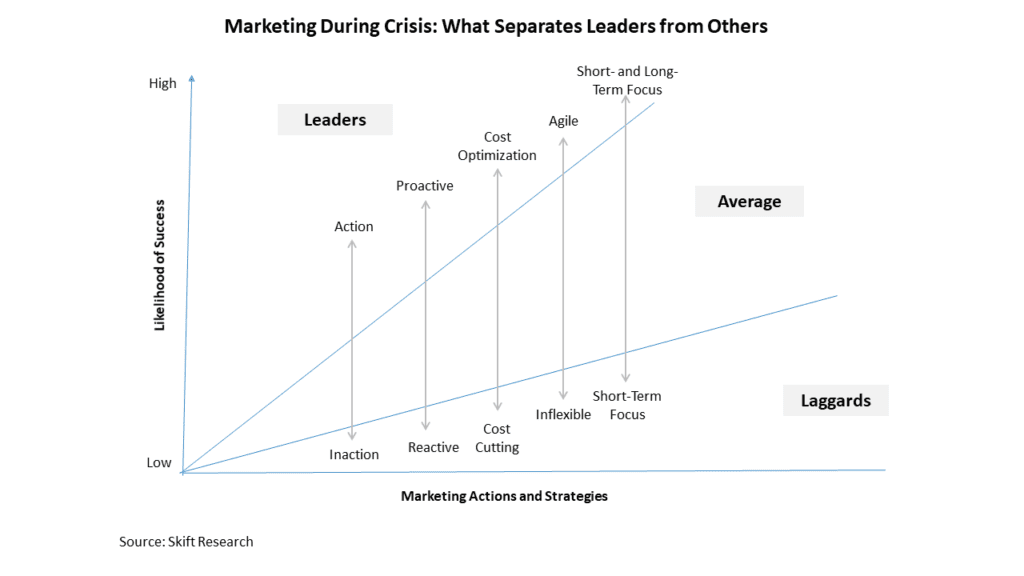

Of course, companies and leadership teams vary. While these phases and typical actions lay out the general trajectories that marketing responses of travel sectors take, there are substantial divergences in specific actions within each phase. More importantly, the ability to take more holistic and parallel actions, instead of operating in a purely sequential order as the crisis itself unfolds, are often defining differences between leaders and the mass.

Phase One: Deep Marketing Cuts

When no room or seat can or should be filled, it doesn’t make sense to market and sell rooms or seats. Performance marketing needs to be put on pause so that budget doesn’t get wasted. When the entire population is living under fear of losing lives and struggling to cope with lost jobs and home confinement, your brand marketing campaigns that inspire people to travel will appear to be tone-deaf and need to be shelved.

These are all necessary cuts. What’s more severe is the systemic reduction of marketing budget as a consequence of revenue loss. Under normal circumstances, marketing is considered as a critical engine that drives revenue growth. According to the annual CMO surveys conducted by research firms such as Deloitte and Gartner in the past few years, in 30-50% of companies, marketing is responsible for revenue growth. While industries and companies vary, a commonly agreed-on estimate is that, on average, companies spend about 10% of revenues on marketing. It is not unusual for large companies with revenues above $1 billion to allocate at least 15% of revenues to marketing and research and development (R&D).

At Skift Research, we have already started to estimate the financial damage the pandemic has caused for different travel sectors. For instance, in our Impact of COVID-19 on the Hotel Industry report we pieced together a myriad of hotel performance data to give a 360-degree view of the dire situation that the hospitality industry is in, including occupancy rates, cancellation rates, RevPAR (revenue per available room), pricing changes, reservation/booking and search trends. Digging into the online travel sector, we estimate that the largest seven public online travel agencies will lose at least $11.5 billion in revenue this year due to the virus (see The Impact of COVID-19 on the Online Travel Industry for details). The sharp revenue decline has led to widespread marketing budget slashes across all travel sectors.

For this report, we conducted a short survey with our large network of travel companies and travel professionals to get a sense of how profoundly the pandemic has impacted travel marketing teams. We received 756 complete responses in three days. Many C-suite executives and senior marketing managers participated in the survey. The respondents are from all major travel verticals and 73 countries. The level of interest indicates the lack of, and therefore huge need for, solid benchmark data as marketers navigate through this unprecedented crisis.

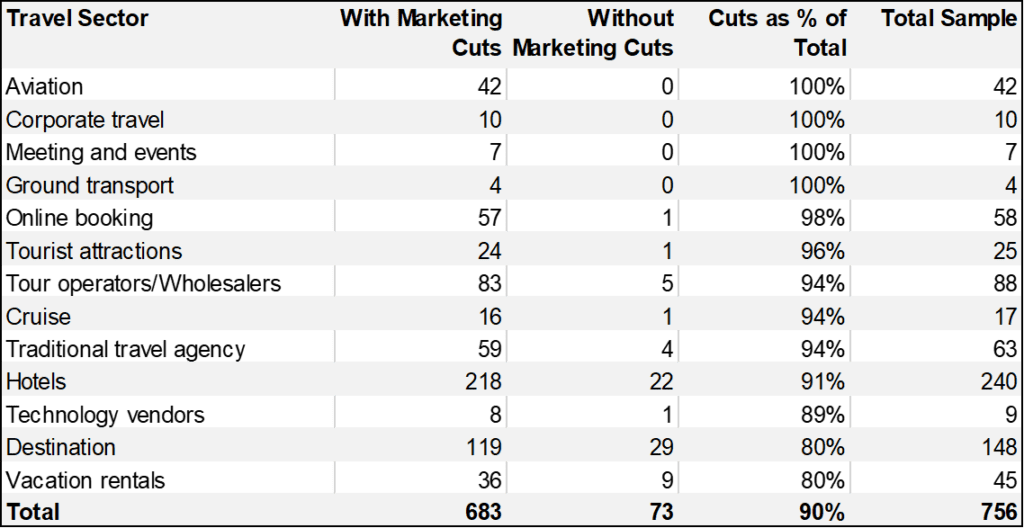

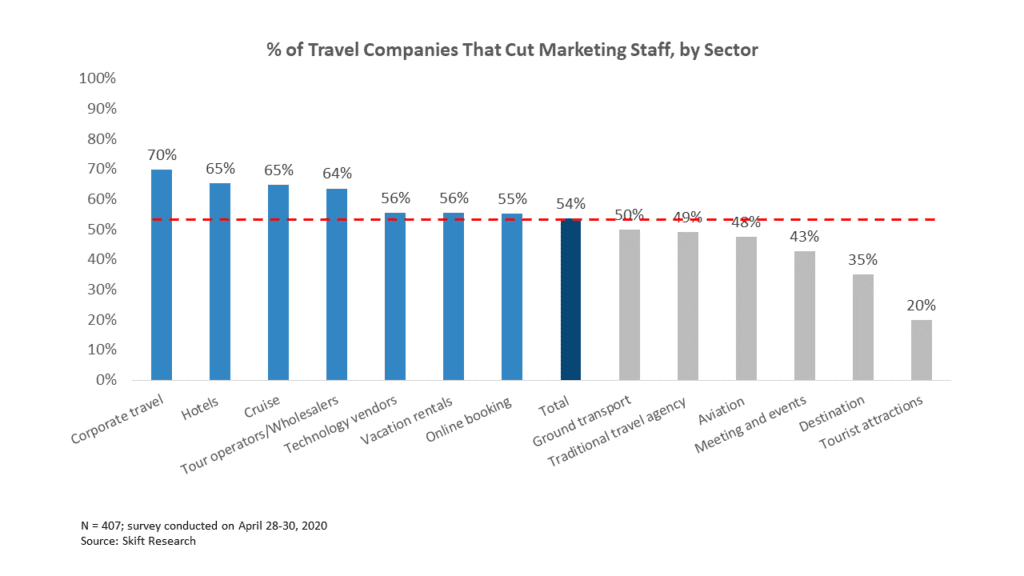

Even though we had all guessed how bad the numbers would be, what our survey respondents revealed is nothing but jaw-dropping. Out of the 756 companies surveyed, only 10% haven’t cut their marketing budget. Airlines, corporate travel, and meetings and events are the hardest hit sectors within travel. As shown in our survey, companies in these sectors suffer the biggest marketing cuts as a result, with all participating companies indicating budget cuts for marketing teams.

Hotels, vacation rentals, and destinations are the most resilient segments. For the accommodation sector in general, occupancy rates are plummeting. But some companies quickly pivoted to provide services to accommodate essential service workers, healthcare providers, and individuals who need space for self-quarantine, which has helped them to stay open and relevant. We will look into more detail at this practice later in the report.

With travel revenue deeply crippled, national and local governments need to rely on destination organizations (DMOs) to estimate the financial damage, research and assess recovery signs, and provide guidelines for members and stakeholders. The accentuated role of the DMOs has shielded them from funding cuts, if the majority of their funding is from the government instead of member contributions.

Cuts in Paid Media

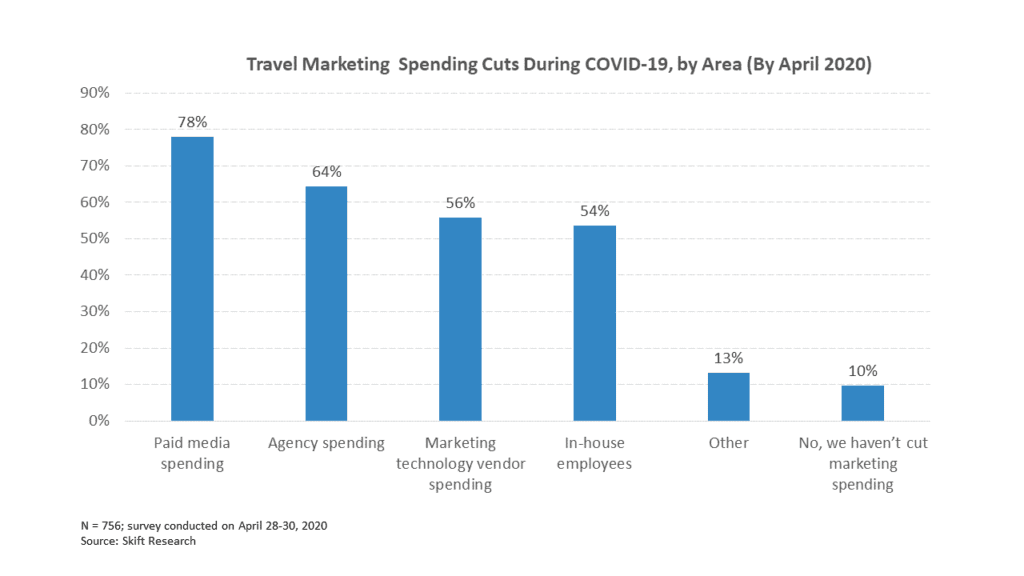

Media spending across all industries has been cut down significantly and is expected to continue the decline at least until June. The U.S. Interactive Advertising Bureau (IAB), the digital advertising trade organization, conducted a survey of media planners, buyers, and brand executives who are responsible for media budgets in late March. 70% of buyers had already paused or adjusted their planned ad spending between March and June.

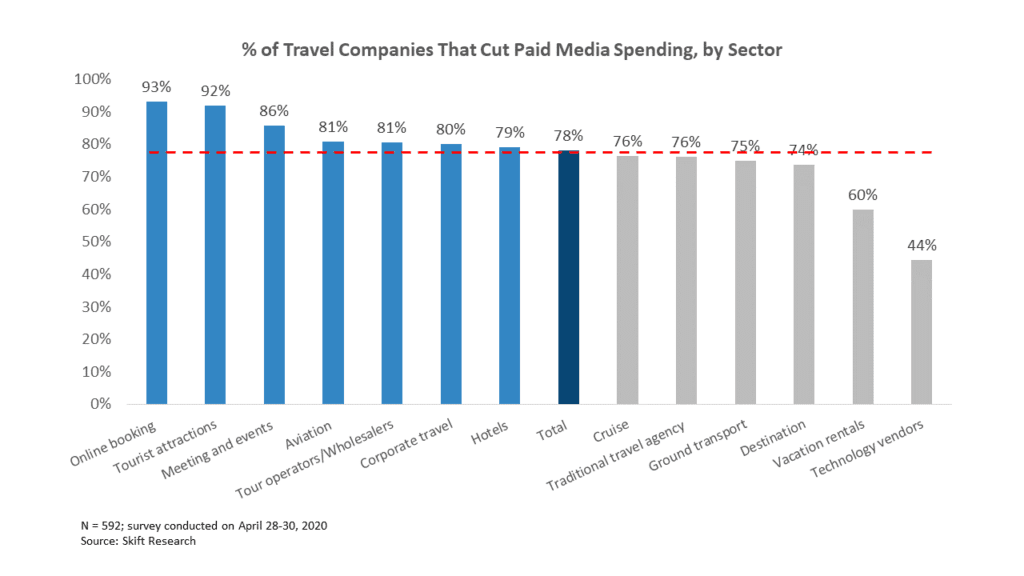

The budget slash for paid media is even more dire within the travel industry. Seventy-eight percent of companies surveyed have cut down paid media spending. When most people are ordered to stay at home and there is no guarantee of when they can safely travel again, travel companies need to assess their specific sources of revenue and cut down performance marketing to avoid waste. And in most cases, brand marketing campaigns are usually filled with images of happy crowds and paradise-like entertainment and destinations. They would be a stark contrast with the reality people were forced in and need to be pulled out from all marketing channels right away.

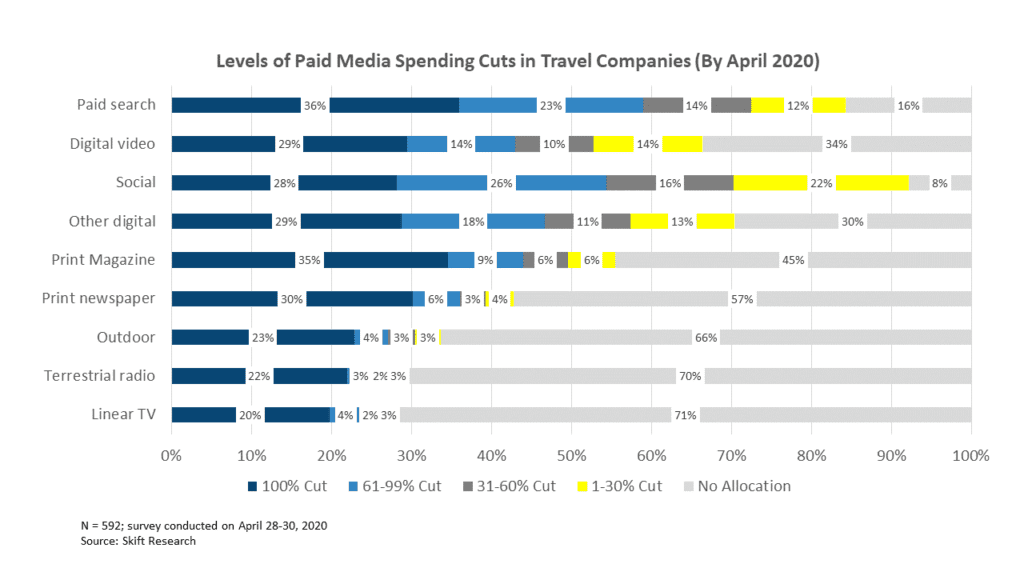

The deep cuts spread across all media channels and formats. Paid search and social had risen to be the dominant ad channels for years. For the surveyed companies that indicated they cut down media spending, only 8% didn’t invest in social and 16% didn’t invest in paid search prior to the pandemic. Both of these two critical marketing channels were slashed by deep budget cuts. Of the companies who cut down paid media, 36% withdrew all search spending and 28% withdrew all social spending. Digital video advertising is the third most important ad format, with streaming video content yet to reach the saturation point. Of the travel companies surveyed, 66% had allocated marketing budget on digital video, of which 29% removed all their digital video campaigns since COVID-19 started.

As we were working on this report, Google and Facebook both announced their Q1 earnings. Both parties of the duopoly digital media world mentioned steep revenue decline in March, despite the overall positive growth in Q1. Alphabets’ CFO Ruth Porat said in Q1 earnings call that while search revenue was up 9% in Q1, March saw an “abrupt” decline of revenue. The year-over-year search revenue drop was in the mid-teens.

Skift Research estimates that in 2019, the travel industry spent about $16 billion advertising with Google, which accounted for 12% of Google’s total advertising revenue. We expect to see the travel verticals cut at least 30-40% of their spending on Google in 2020. The two biggest online travel competitors, Expedia Group and Booking Holdings, are likely to slash their search spending by more than half in 2020. As we estimated in our Deep Dive Into Google’s Impact on Travel 2020 report, the global OTA duopoly spent over $8 billion on performance advertising in 2019, with a majority of that going to Google. In mid-April, Expedia’s chairman Berry Diller told CNBC in an Interview that “at Expedia, for instance, we spend $5 billion a year on advertising. We won’t spend $1 billion on advertising probably this year.” Similarly, as reported by CNBC, Mark Mahaney, an analyst at RBC Capital Markets, predicts that Booking could slash Google ad spending on Google from about $4 billion in 2019 to $1 – 2 billion in 2020.

Investment in traditional media channels have been in decline for years. However, depending on the specific verticals and consumer segments, some traditional channels are still effective marketing outlets. For instance, print with powerful images is still a very effective tool for the tours and activities sector targeting older audiences. With better attribution and measurement tools, linear TV is increasingly bundled as part of the larger video strategy to reach audiences anywhere on any screen.

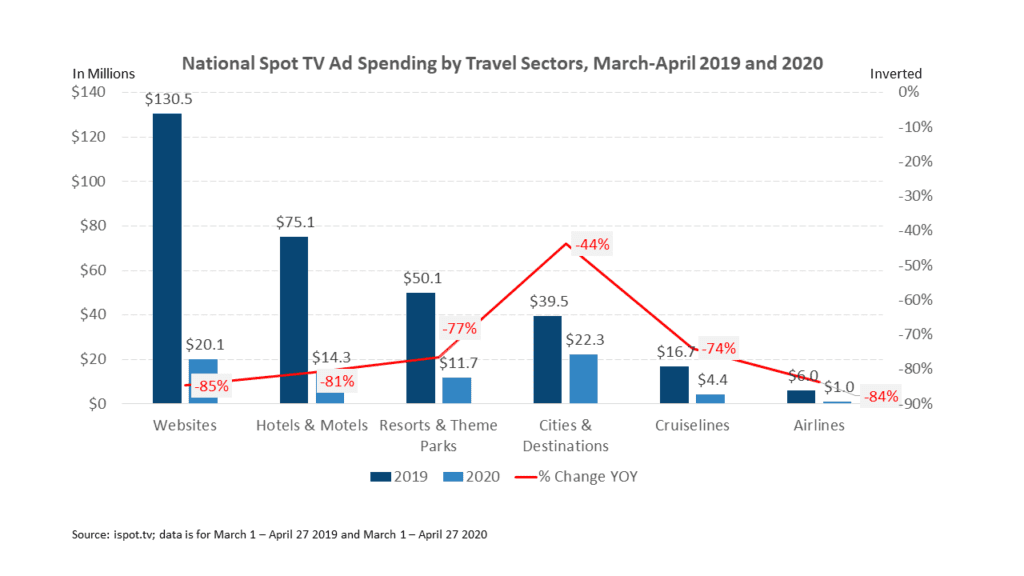

Similar to digital, for the companies that ran advertising campaigns in linear TV, print, outdoor and terrestrial radio, there have been deep cuts on all the budget allocations in these channels, with a large majority of them pulling 100% of spending. Data from ispot.tv, a TV advertising analytics and measurement firm with national spot TV data for the U.S. market, showed the actual ad spending decline in dollar figures. From March 1 to April 27 2020, the major travel verticals spent $73.8 million on national tv ads, a 78% decline from the $318 million in the same time period of 2019. Online travel sites, hotels and airlines saw the steepest decline, all with over an 80% YOY drop in spending.

Cuts in Agency Spending

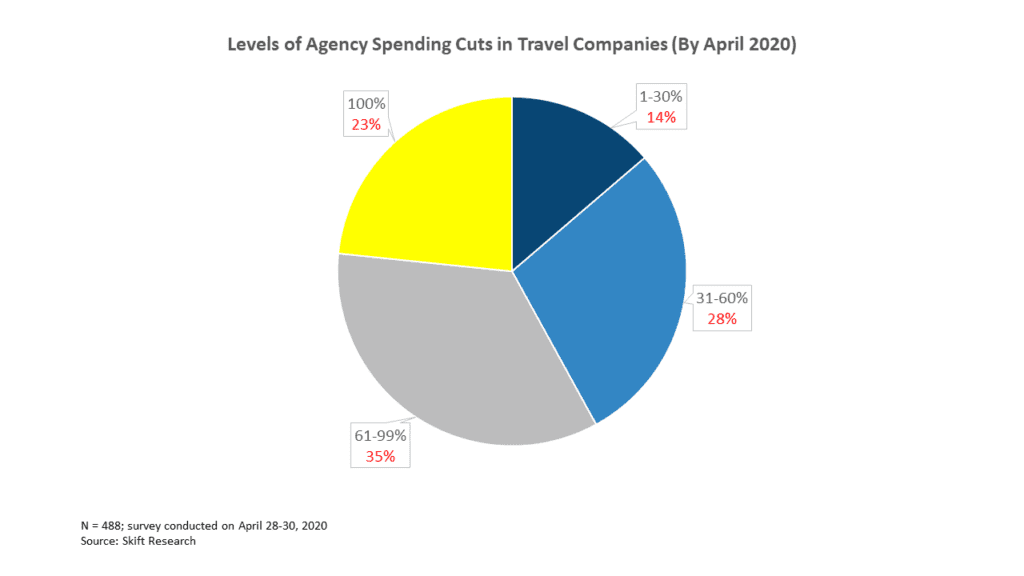

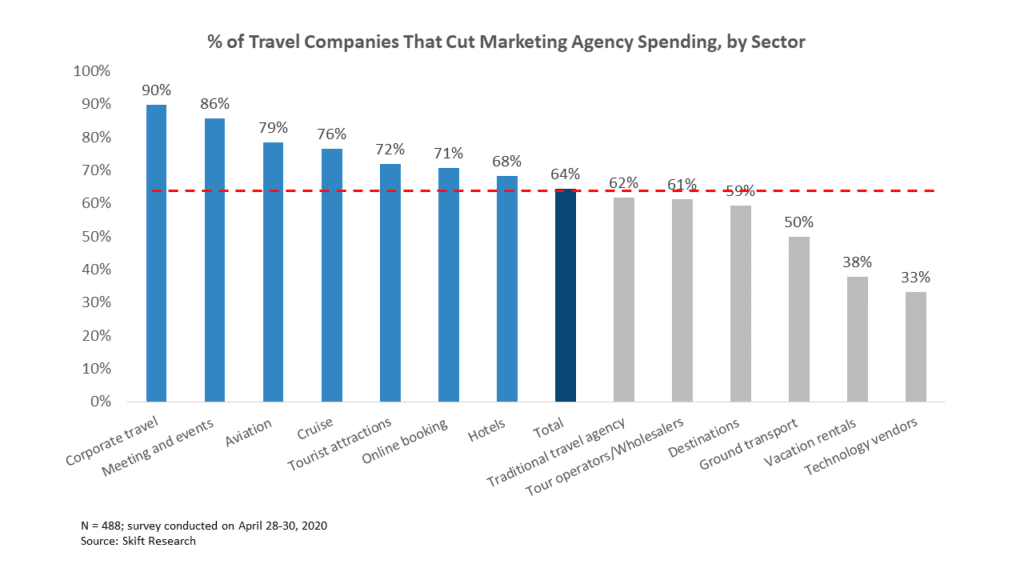

Agency spending, which is closely tied to media investment, faces the second highest cut. 64% of surveyed travel companies indicated they had cut agency spending. Among those who cut spending, nearly a quarter severed agency partnership completely.

Cuts in Martech Spending

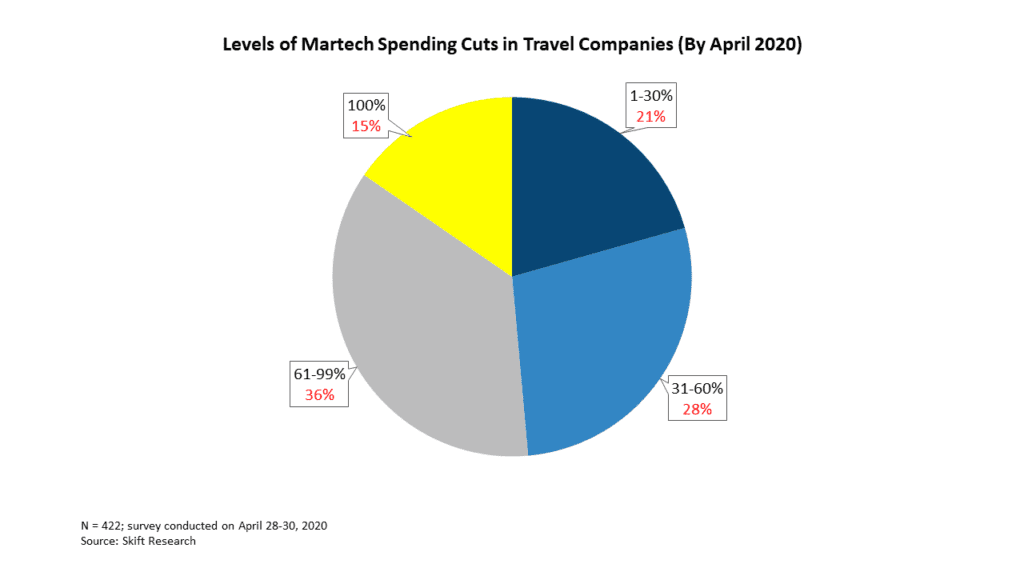

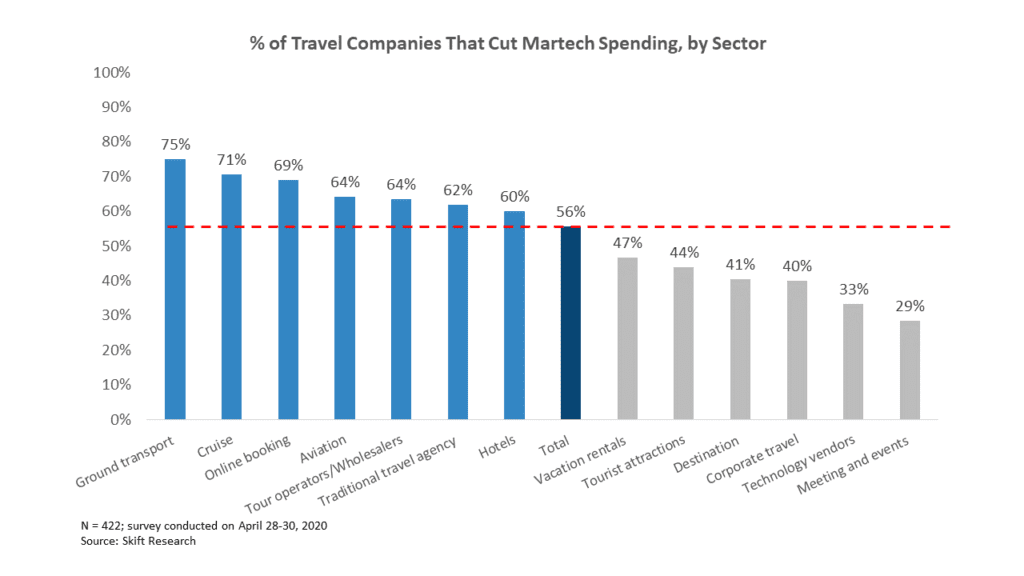

The days are gone when you can do marketing without the support of marketing technology. Increasingly, the centrality of data is a key factor that gave rise to marketing’s crucial role in business. As Skift Research estimated, roughly 25% of travel marketing’s budget is spent on technology investment and vendor purchases. In a survey we conducted in early 2019, 73% travel marketing executives said martech is crucial to their companies’ competitive edge (See The State of Marketing Technology in Travel 2019 for more details).

About 56% of travel companies in our survey indicated they had cut down martech spending since the pandemic. For those who cut down vendor services, over half decreased spending by 60% or more. On the one hand, the industry was overdue for a much-needed but oft-delayed consolidation of redundant martech systems. If the pandemic was the catalyst for these cuts, so be it. But businesses that cut deeper than needed will find that inadequate martech infrastructure can greatly limit marketing’s capacity for effective tactics during the crisis and, even worse, once the recovery phase arrives.

Cuts in Marketing Staff

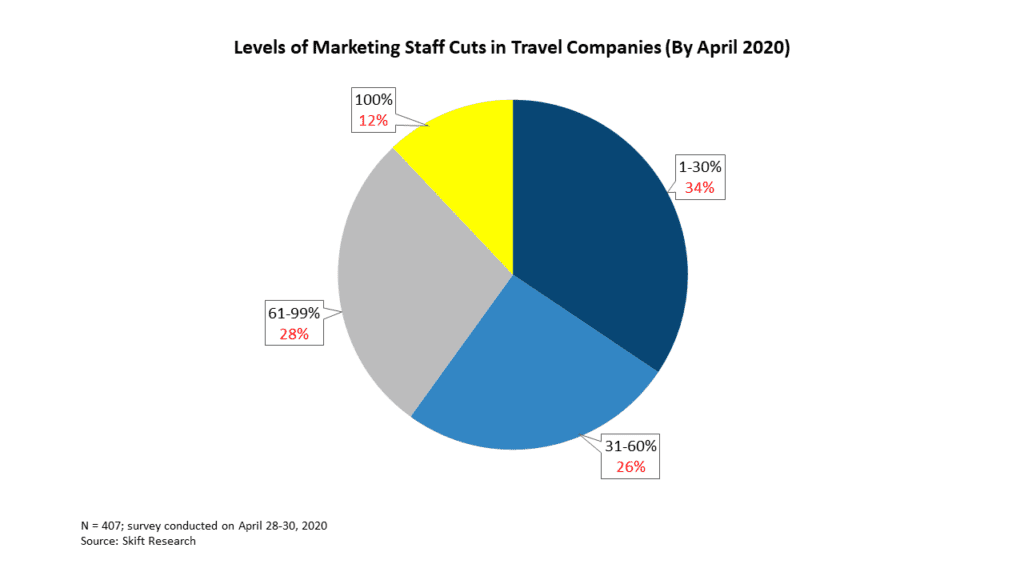

In-house employees are the least affected, among all the major marketing areas. But even here, 54% of companies surveyed made some cuts. And 12% of the affected companies shut down their entire marketing department. If we put the number against the entire sample size of our survey, that means 6.5% of all travel companies have already closed down their marketing division.

Marketing Cuts by Travel Vertical

The following data exhibits provide detailed sector-by-sector marketing cuts for each major area of spending. In general, the verticals that are undergoing more wide-spread cuts, as shown above, are also the ones that are seeing deeper cuts in each marketing function and capacity. Online travel, aviation, hotels, tours and activities, and meetings and events are all registering quick revenue declines and as a result, over-index other verticals in cutting down paid media and agency partnership. Tech vendors tend to have more diversified products and services or a subscription based pricing model that makes revenue less likely to dry up right away . They also need to keep marketing up to help their clients navigate through the crisis. The sector seems the least likely to have seen paid media and agency cuts among all verticals.

What’s interesting to see is how corporate travel and meeting and events sectors are holding up their martech investment spend. While on average, 56% of companies had cut down martech spending, only 40% of corporate travel companies and 29% of meeting and events companies had done so, making them two of the bottom three sectors in martech reduction prevalence. It’s hard to prove if the assumption is valid yet, but we believe the work of EventMB, our Skift brand and the world’s most influential media and research outlet for event professionals, might have contributed to this anomaly. EventMB was the first vocal source in the industry to coin the term “pivot to virtual,” and provides practical guidelines and tools for shifting physical events to virtual. As of March 18, 90% of event professionals saw some or most of their business gone. In the immediate days after the first lockdowns, EventMB held a two-hour “Pivot to Virtual” event, offering advice from the world’s most renowned experts on crisis communication and virtual events. The event drew in 2,600 live attendees and over 7,000 on-demand viewers. And the industry has seen a surge of online events. Technology investment, including martech, is key to making the transition a success.

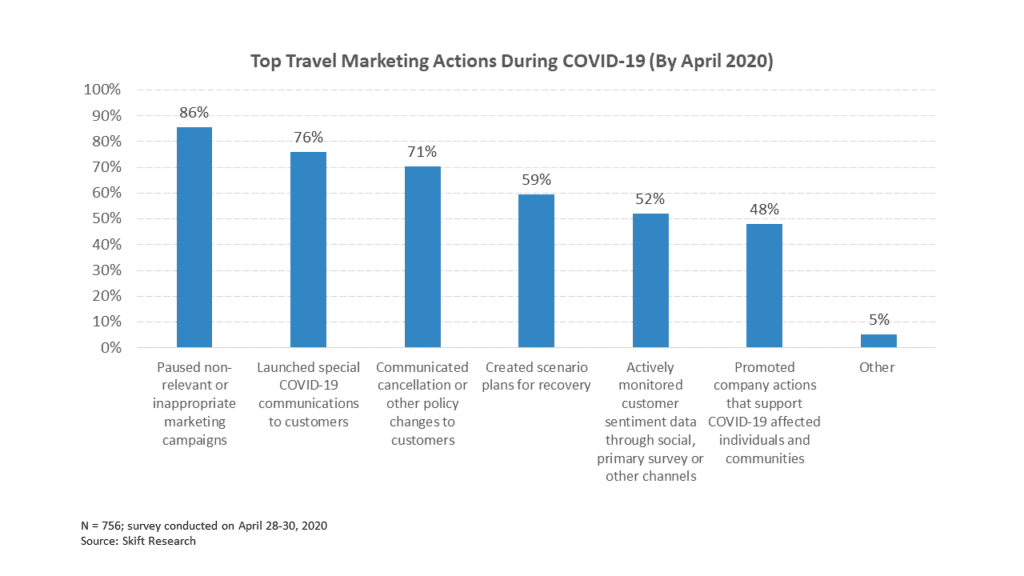

Phase One and Two: Communications Rising to the Center of Marketing

In addition to budget reduction, another immediate new marketing demand in the first and second phases are consumer communications. When travel is prohibited by law or consumers are too afraid to travel, the most important thing for travel companies to do is to make sure their customers can cancel or postpone their booking with ease and communicate policy changes to them as soon as possible.

Most travel companies have done so. By late January, most major U.S. airlines had already issued travel waivers to countries experiencing the worst outbreak. As the virus spread to more countries and regions, airlines have been constantly updating their policies to accommodate more changes. By the end of April, on top of waiving cancellation or change fees to existing bookings, major airlines all offered fee waivers for new bookings, with various timeframes. Large public hotel companies have also acted fast in changing their reservation policies.

With all the changes and updates, marketing needs to step in and ensure customers have a clear understanding of what the changes entail and what are the steps they need to take to change their booking. Emails, websites, and social are the core channels to deliver prompt messages and answer consumer inquiries.

In addition to communicating to consumers about policy changes, letting customers know that the company empathizes with the difficult situation and providing emotional support is also a commonly adopted marketing tactic.

Of the 756 companies surveyed, 71% have communicated cancellation or other policy changes to consumers. In addition, 76% have launched COVID-19 related communications to customers. Echoing the level of media cut revealed above, 86% of participants shared that they had paused non-relevant or inappropriate marketing campaigns.

Phase Two and Three: Pivoting Services and Creating In-The-Moment Marketing

After the initial focus on responding to the abrupt disruption, travel marketers need to recalibrate strategies around the new reality that consumers are in, which is being confined at home and dealing with the living difficulties associated with the disease, and create new campaigns that can help relieve the distress or solve their problems.

Three major themes have emerged during these phases. One is inspirational marketing that reminds people that while they cannot and should not travel at the moment, travel will be even more inspiring for the world once the pandemic is over. Uplifting and positive content and messages that alleviate anxiety and promote a sense of solidarity will go a long way to enhancing the brand. A good example is the “Can’t Skip Hope” video campaign by Visit Portugal. A series of captivating images with equally powerful narration – “Sometimes to rise is to stand still” – sends an uplifting and empowering message for people who feel stuck.

The second theme is practical marketing. Here travel marketers offer virtual classes, activities, and experiences for consumers, for free. Many hotels, tour operators, tourist attractions, and destinations started to offer a myriad of online activities from late March. Travel Saint Lucia, for instance, kicked off a “7 Minutes in St Lucia” campaign, inviting followers to experience the destination via Instagram Live. The program streams yoga practice in view of its famous Pitons, world-famous volcanic spires, cooking classes, dance parties, and guided meditations.

The third theme is social responsibility marketing. With so many people’s lives impacted by the pandemic, what can travel companies do to help? Many travel companies stepped up to create programs that can help their employees, the local community, and the fight against the virus. Done right, this can have some profound long-lasting impact on a brand’s image and loyalty. Nearly half of the travel marketing teams in our survey have promoted company actions for crisis relief. We will look into some cases in detail in the sections below.

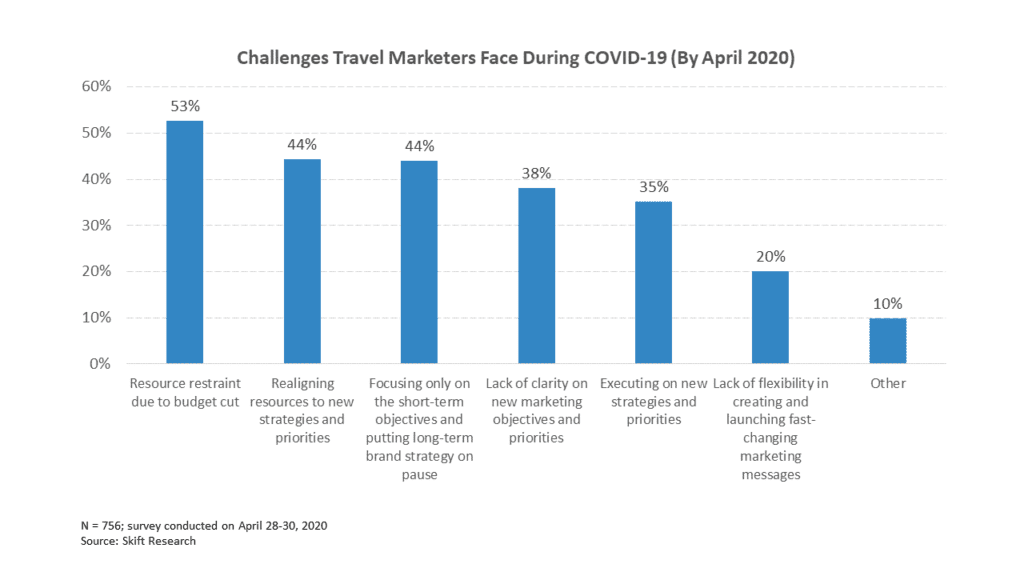

However, with deep budget cuts, travel marketers are overwhelmingly facing resource restraints on executing the new marketing initiatives, most of which need to be created from scratch. When asked about the top challenges during this difficult time, 53% of travel marketing executives stressed resource restraint due to budget cuts as the top challenge and another 44% pointed out that realigning limited resources to new strategies and priorities is challenging.

Phase 4: Preparing for the Full Recovery

The biggest unknown for every individual and company now is when the pandemic will be under control and in what form. As we enter May, many U.S. states have relaxed their lockdown policies and partially reopened. Yet, without a viable solution to the virus itself, the question remains if there might be a resurgence of cases that can quickly collapse into the hellish past again.

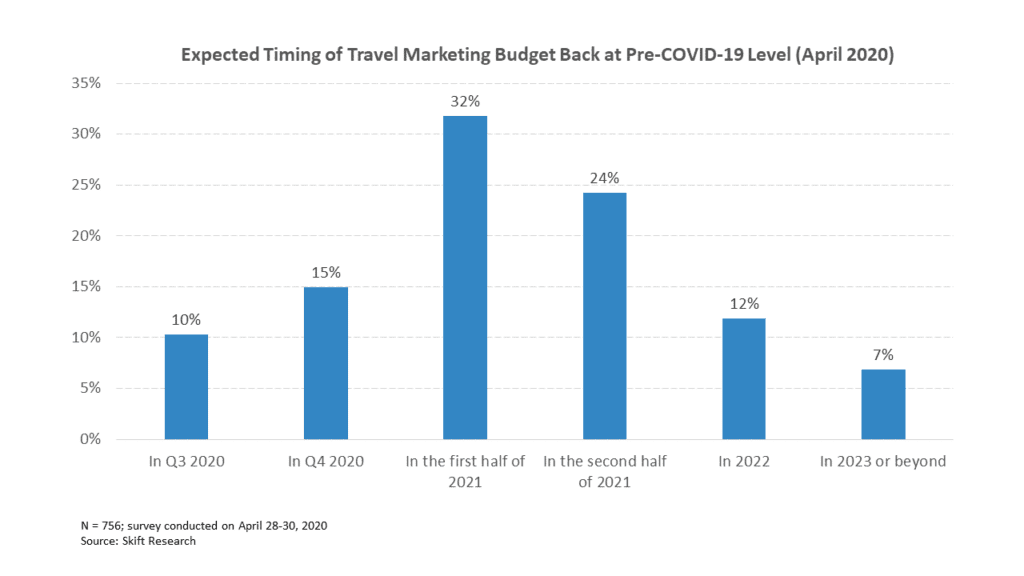

From where we stand now, it doesn’t look promising we can completely contain the virus through vaccination or effective treatment before the end of 2020. But there should be some phased opening up and coordinated efforts to lift travel restrictions. Travel marketing professionals’ projections of when full recovery will happen is a reflection of this thinking.

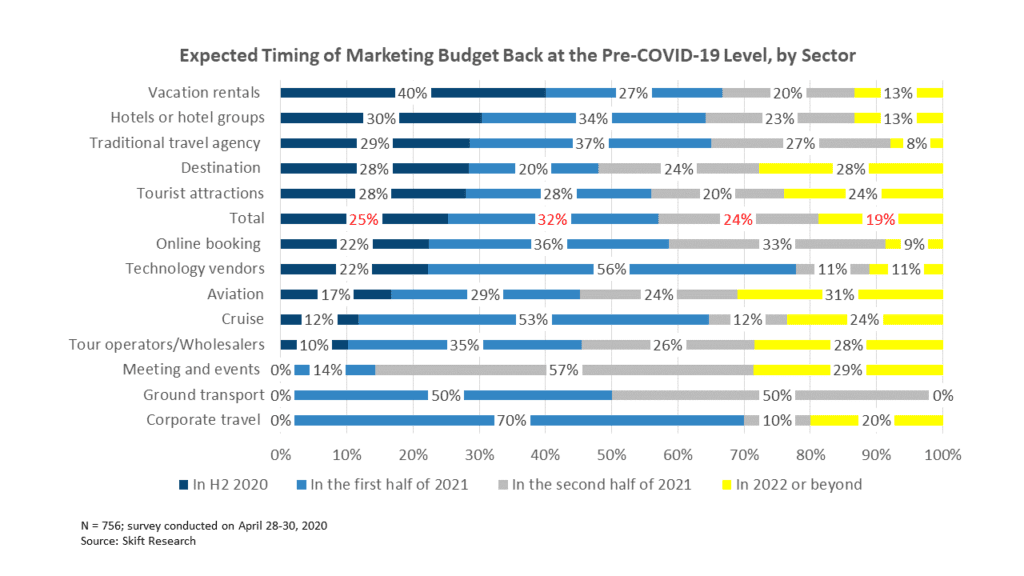

Marketing executives from different travel verticals expect to see their marketing budget back to the pre-COVID-19 level at different timelines. Domestic leisure travel by car is likely to come back the earliest. In our U.S. March Travel Tracker survey, two thirds of Americans said their first trip after the outbreak would be a road trip. Sectors that can cater to this travel segment, including accommodation, destinations, and attractions are the most optimistic about bouncing back in the second half of 2020. On the other end of the spectrum are meetings and events, corporate travel, and tour operators. Many government officials and healthy experts predict large social gatherings won’t happen safely until the second half of 2021. And many tour operators rely on multi-day travel or international travelers, the leisure segment that’s the slowest to recover.

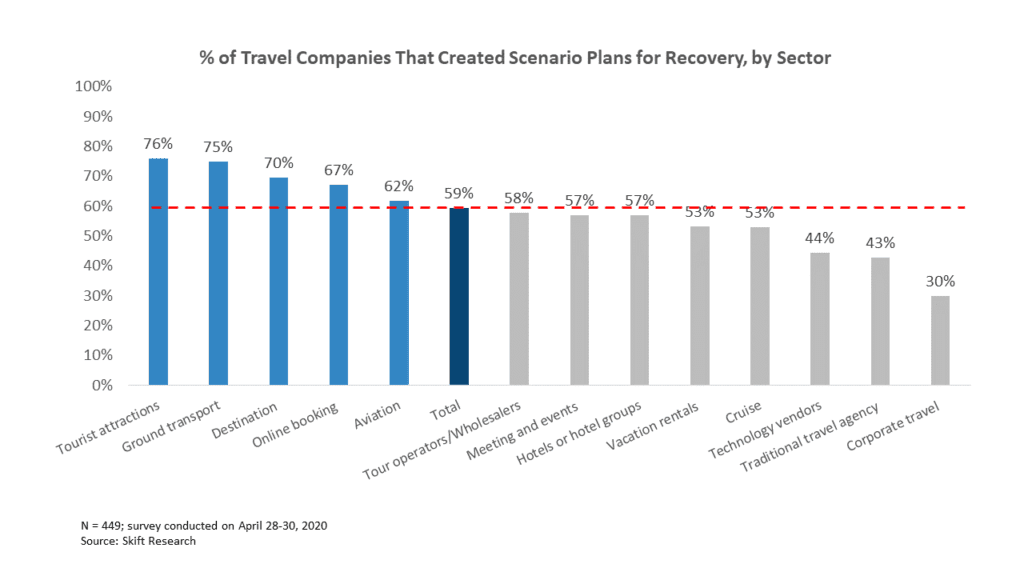

What’s certain is that with a disruption at this large scale, the recovery roadmap will be slow and complex. To be able to respond to the opportunities and challenges ahead quickly and effectively, leaders of travel marketing teams need to create detailed scenario plans. What’s the worst scenario? What’s the most likely scenario? What’s the best scenario? What would be the most appropriate strategy and tactics under each scenario? These are all crucial questions for marketing teams to assess resources and capabilities and get prepared. Yet, by the end of April when we conducted the survey, 42% of travel marketing teams surveyed hadn’t created scenario plans for recovery.

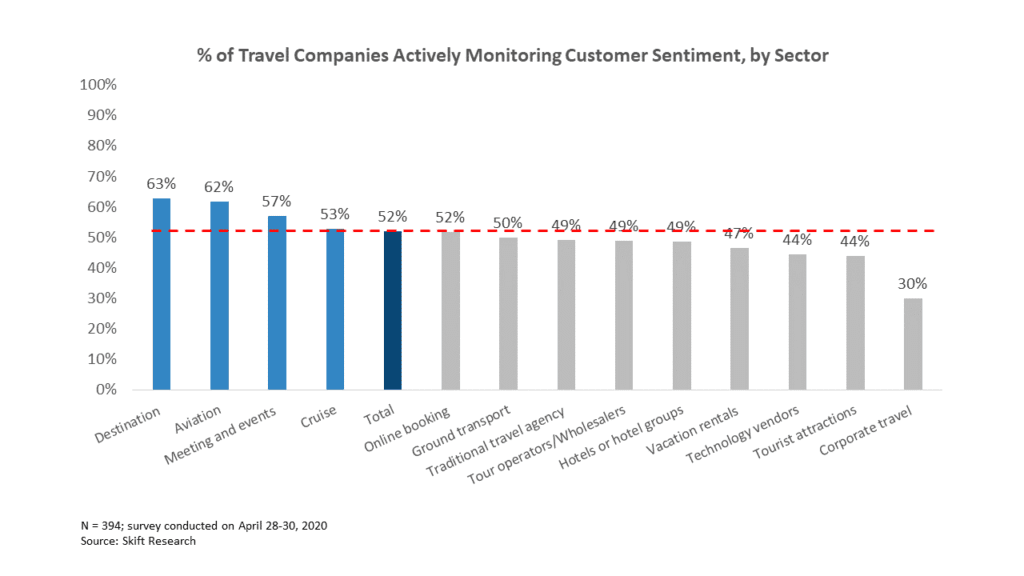

Another critical action during this phase is closely monitoring consumer behavioral and attitudinal shifts to capture signals of opportunities. In this data-rich world, most marketers already have many sources at their fingertips to do so. Social media, consumer databases, and customer service centers are all great owned channels to implement real-time monitoring and insights. In addition to passive listening, regular surveys, either first-party or from research partners, can validate the observational insights and identify expectations more quickly. These measurements and insights are not only necessary for marketing decisions, but of critical importance for company-level strategies.

Who Will Be Best Positioned to Come Out of the Pandemic Stronger

The reality is: there will be winners and losers on the other side of this crisis. History has proven so and will continue to prove so. History has also proven that performance gaps between leaders and the rest of the pack often get bigger after a recession and then the gaps will get flattened in a couple of years. This means leadership matters much more during downturns than in time of stability and growth. A 2010 study led by two Harvard Business School professors of 4,700 public companies during and after the three global recessions prior to the 2019 recession has provided some profound and replicable lessons for not just surviving, but thriving out of a recession. The first unsettling finding is the detrimental impact the recessions have on companies. Of the 4,700 companies analyzed, 17% didn’t survive a recession. For those who did survive, 80% of them had not regained their pre-recession sales and profits three years after a recession. Only 9% of the analyzed companies performed better on key financial indicators than they had before a recession.

These outperforming companies all shared a similar trait in mastering the balance between cutting costs to survive the revenue loss during the recession and continued investment to prepare for growth after the recession. As summarized by Ranjay Gulati and Nitin Nohria, the co-authors of the article distilling key takeaways of the study, “These companies reduce costs selectively by focusing more on operational efficiency than their rivals do, even as they invest relatively comprehensively in the future by spending on marketing, R&D, and new assets. Their multipronged strategy …. is the best antidote to a recession.”

While no two downturns are the same, the successes and failures of the past provide patterns that marketers can emulate to navigate out of this crisis stronger. In managing marketing expenses, CMOs and the senior executive teams must have a clear vision of what’s wasteful and redundant versus what’s necessary and crucial. Leaders can then continue to invest in areas that are crucial for short-, medium- and long-term businesses.

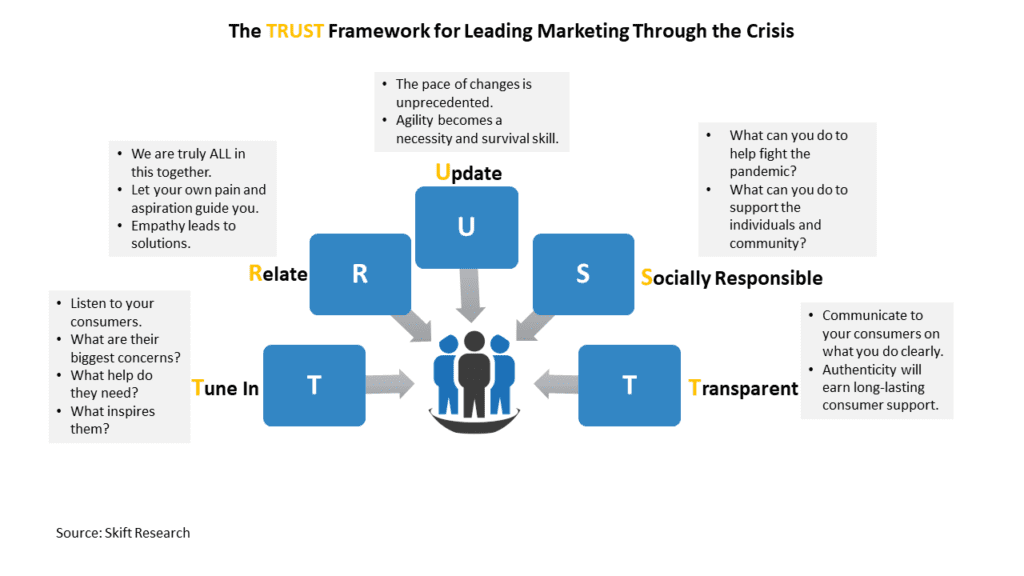

To win in this crisis, leading CMOs need an agile strategy that allows their teams to detect, adapt to, and respond to changes. A wait-and-see approach has little chance of weathering through this adversity. People are going through pains and fear now. Focusing attention on consumer needs and helping them mitigate the stress has a higher chance of turning challenges into opportunities. Building and growing a strong brand through these people-centric actions will ensure a faster and long-term recovery and growth.

Bold strategies and a cautious growth mindset will likely set winners apart from the pack. Many marketing leaders decide not to make big moves until there is more clarity on the market outlook. But that will be too late. Constant evaluation of the evolving situation needs to lead to decisions that put their company ahead of the curve, so it can be the first to offer new services to new consumer needs. Companies that will succeed are the ones who are planning for the post-crisis world now. We expect to see two major themes that will define the path of recovery and success for the travel markets post-COVID-19.

The New Normal

While there are various versions and speculations on what the new normal entails, there is one element that everyone agrees will greatly impact travel behavior after the pandemic: a new focus on safety and health. The traumatic experience during the lockdown will have a lasting effect on people’s psychology. While major travel companies have already adopted new cleaning and disinfecting protocols to mitigate the fear, it’s only the tip of the iceberg. It requires an industry-wide overhaul to gain consumer trust. And companies who lead the process will win big.

The New Consumer Segmentation

Travel is among the most pent-up consumer segments that are going to see a surge of demand after this crisis. There is no question about it. However, travelers coming out of this pandemic will be different from those before we entered it. An experience like this will greatly intensify the psychological divides of individuals. Remember the college crowds at Miami beach in the middle of the outbreak? Economic situation allowed, there will be people who are like those college students, plunge into travel right away, regardless of the public concerns about the possibility of another wave of outbreak . And there will be people who act with extreme caution to a degree of paranoia. The typical consumer sociodemographic segmentation needs to be reexamined and redefined to understand who will travel first and what needs to be done to get the others to travel again.

Q&A with Kristie Goshow, Chief Marketing Officer of Preferred Hotels & Resorts

How much have you cut your marketing budget since the onset of the crisis? Did you put all paid media on halt or are you still running some campaigns?

First and foremost, remaining visible throughout the pandemic has been a critical objective for our holistic engagement efforts across all key stakeholders groups we serve: the traveler, the travel trade, corporate buyers, and our member hotels. Any adjustments made to our paid media strategy are reviewed within the context of our integrated marketing plans in each region of the world. While we did reduce our investments in paid media towards late March, we have, and plan to continue doing so, maintained a minimum spend to capture any opportunities for longer-lead business. Meta[search] has continued to deliver some booking volume, albeit vastly reduced, and has also demonstrated that certain source markets and traveler types are booking for August and September arrival. Based on these indicators, it makes good sense to sustain this approach over the short and medium term.

Has the crisis changed marketing’s role?

From our perspective, the role of marketing will always be the activity of “asking for the business” across channels, audiences, and geographies. That has not changed during the crisis and will only become even more important post-crisis, as hoteliers start to understand the behavioral changes of their buyer communities and pivot their product, message, and campaign deployment accordingly. This situation has, however, highlighted the importance of an up-to-date crisis management plan and the requisite internal capabilities to ensure that all engagement (brand social, public relations, sales team outreach, loyalty and marketing campaigns) continues in a thoughtful, effective way to protect the integrity of a hotel’s brand and positioning.

What’s the focus of the marketing team at the moment?

Our approach has been highly pragmatic. Our core marketing group has continued to focus on business projects that are essential to the commercial success of our hotels – both before and after the pandemic.

Communicating effectively with member hotels, partners, and end consumers is as important as ever. We are obviously revisiting all written materials and creative assets to ensure these are sensitive to the current situation and undertaking a gap analysis to see what new needs we may have.

Although we have pivoted our message away from “information to book” to “inspiration to dream,” we are preparing a series of recovery campaigns that will deploy domestically as each market begins to lift their travel restrictions. It’s imperative that we guide hotels away from discount wars and mega-deals, so we are designing a blended approach based on certain assumptions around domestic demand drivers, traveler expectations, corporate per diems, “new seasonal patterns,” and a revised “value quotient.”

Like most other travel and hospitality brands, our team is working hard on a series of rebound initiatives. And although we never expected to find ourselves in this situation, we are testing our creativity to deliver what we hope will be fresh and innovative campaigns for the new paradigm of travel.

Is Preferred pivoting service offerings during the lockdown? What’s marketing’s role in it if so?

As with many of the large chains, we are working closely with our service provider LRA to review our existing standards within our Integrated Quality Assurance program and identify changes our hotels will need to make in regards to standards for cleaning, housekeeping, and food and beverage service. These updates will allow us to support our independent hotels in actioning on new protocols for ensuring guest protection and health to the best of their ability and communicating these updates to attract future travelers.

Further, through our sister company, PHG Consulting, our team is providing crisis management services to independent hotels and tourism destinations worldwide, helping them mitigate the pandemic to lessen the impact of COVID-19 and be well positioned to bounce back once recovery begins. We assist in defining and communicating their messages clearly and with full transparency; control their position and maintain visibility through a variety of services ranging from public relations to travel trade outreach; and have an array of strategies in place to employ on their behalf during the recovery period to drive arrivals and revenue.

How is the marketing team prepared for recovery?

In addition to the commentary above, we are evaluating additional routes to market, new partnerships, and fresh angles on existing collaborations. The extent of flexibility and “original thinking” being offered by our existing brand partners has presented opportunities that would have otherwise been overlooked.

Lead by Turning Customer-Centric to People-Centric

The only uplifting part of this pandemic is the fact that for the first time in our lives, the entire human population is truly in it all together. We are all connected, after all. Can we turn this once-in-a-lifetime challenge into a once-in-a-lifetime opportunity?

Marketers have been adopting a customer-centric approach to guide marketing strategies for years. Now that we are all on the same side of the pandemic, winning marketers are those who can expand their relationship to include all of those affected by this: customers, employees, suppliers, partners, neighbors and communities. Working with all these affected people and earning trust will have a lasting impact on building a strong brand.

Expand communication channels

Individuals and companies alike, we have never been in a situation where things are changing on a daily basis. In a situation that is changing hour by hour, it has never been more critical for travel companies to keep in touch with their customers. The messages need to be consistent across all channels, website, email, social media, and others

This is an opportunity for marketing, PR, and communications teams to work together and connect on a daily basis on new challenges. All messaging and campaigns need to be a coordinated effort.

Example

Marriott: When you go to Marriott.com , you get two messages right away. One message is their priority is their guests during COVID-19. The other is Marriott is providing rooms for frontline doctors and nurses. When you click on the “COVID-19 Update and Extended Cancellation Policy”, you enter a page with the entire suite of information related to Marriott’s policy and community responses to COVID-19. The messages are transparent, simple, and clear.

Create relevant and empowering marketing messages and campaigns

Be agile and able to pivot communications in real-time. In normal terms, a marketing campaign launch might take at least a few months. That strategy won’t work during this crisis.

For global brands that have operations in multiple regions and countries, this also means your marketing messages and campaigns should be relevant to the local situation as the pandemic hits different regions with different phases.

Example

National Cowboy Museum: While the Oklahoma City based museum closed to visitors, they found their very own celebrity in the security and operations manager, Tim Tiller. He became a social media hit helping increase the museum’s social media profile. From March 17 to April 26, the museum’s Twitter followers grew from just shy of 10,000 to 309,000. The museum’s Instagram and Facebook followings grew by 510 percent and 69 percent, respectively, during the same time frame.

Pivot service offering and communicate to consumers

Many travel companies pivot their service offerings to meet the needs arisen from the pandemic. Marketing teams need to work closely with the executive and the product teams and communicate to consumers in real-time about the new services.

Example 1

China-Based Huazhu Group: They decided to remain open and not lay off any employees during the crisis in China. The chain pivoted service to corporate travelers who needed accommodation for self-quarantine. They also instituted a sales package that included 26-steps cleaning process, intelligent non-contact services and COVID-19 health insurance for staff and consumers and heavily marketed the package to corporate travelers.

Example 2

Oracle Hospitality: As Louise Casamento, Sr. Director of Marketing told Skift Research, “We are providing our customers information and resources to pivot in this environment. For example, several customers are choosing to, or are required to move their property to a hospital environment. We are offering free virtual consulting services to help customers convert hotels to a hospital. Separately, we have published online checklist for using Oracle OPERA to operationalize a hotel property as a “hospital” and PMS and POS checklists for our customers to use when closing their properties due to government edict or market conditions. We are enabling restaurants to easily add delivery capabilities through our partnerships with delivery companies. We are releasing webinars and short tips and tricks videos that advise customers on how to get new usage out of their existing Oracle solutions, during and post COVID.”

Support your employees

As estimated byOxford Economics, nearly 4 million people working in or for the U.S hospitality industry would likely lose their jobs due to the pandemic. How can you help your furloughed or laid-off employees to mitigate the financial difficulties?

Example

Hilton: The company has proactively partnered with companies seeing high demand for temporary workers during the crisis to help its furloughed employees. Through an online portal, furloughed Hilton workers have an expedited recruiting and onboarding path to companies like Amazon, CVS, Walgreens, and grocery stores like Albertsons and Publix.

Purpose driven marketing

There has been a rise of research and advocacy for purpose driven businesses in the past few years. Not only does a purpose driven company have a higher chance of gaining loyal consumers, it also is more likely to succeed. Research by Harvard Business Review Analytic Services and EY found that companies that operate with a clear and driving sense of purpose, beyond the goal of just making money, outperformed the S&P 500 by a factor of 10 between 1996 and 2011.

People will remember what you do at a time like this. Looking outside of your company’s internal priorities and taking bold initiatives to keep your employees, consumers, and communities safe and secure will go a long way. Reimagining a higher purpose and acting on it in a situation like this might never happen again.

Example 1

Etihad: This second largest airline in the UAE , started offering their food facilities to provide meals for affected populations, giving away thousands of meals everyday.

Example 2

Philadelphia Convention and Visitors Bureau: In addition to offering virtual activities for would-be visitors, the destination marketer created online campaigns connecting locals with restaurants and other services to support the suffered businesses.