Report Overview

The second iteration of Skift Research’s U.S. Affluent Traveler Survey (previously known as the U.S. High-Income Traveler Survey) reveals trends related to the travel behavior and preferences of this highly sought-after travel segment. Affluent Americans make up just 20% of the U.S. population, but they account for 51% of total travel expenditures, making them a highly lucrative group to target. Understanding their attitudes and desires is key for travel brands and destinations looking to attract them. In this report, we will look in-depth into the significance of Affluent Travelers to the industry through analysis of the key findings of this year’s survey, beginning with the Affluent Traveler group as a whole. We then provide a deeper look at how income level, age, families with children, and travel frequency impact travel behavior and preferences in different ways. We provide key actionable takeaways throughout.

Survey Methodology:

Skift Research’s U.S. Affluent Traveler Survey 2018 collected responses from 1,304 respondents who live in the U.S. Respondents were screened for combined household incomes of at least $100,000 and indicated that they had taken at least one leisure trip in the last 12 months. For this project, a leisure trip is defined as at least two-nights’ stay, 200 miles or more away from home. The survey was fielded by a trusted third-party consumer panel provider.

What You'll Learn From This Report

- Trip incidence for Affluent Travelers

- Attitudinal and behavioral data that indicate how Affluent Travelers prioritize experiences while traveling

- Affluent Travelers’ primary resources and preferences in travel planning and destination selection

- Common booking channels for air travel and accommodations

- Use and satisfaction data showing how Affluent Travelers are increasingly embracing alternative accommodation options

- Affluent Travelers’ behavior and attitudes around the concept of luxury

- How the “Super Affluent” (those with a combined household income over $200,000) differ from the less affluent travelers

- Key differences between Affluent Travelers with and without children in the household

- Key differences by age

- Key differences according to travel frequency

Executive Summary

Of all segments of U.S. travelers, perhaps none is as sought after as those who are affluent. This comes as no surprise considering this group’s huge spending power in relation to its size. According to Skift Research’s analysis of data from the Bureau of Labor Statistics’ 2016 Consumer Expenditure Survey, Americans who make over $100,000 make up just 20% of the total U.S. population. They make up for their size in spending power, as they account for 51% of total travel-related spending, including lodging, transportation, food and beverage, and activities. This is equivalent to $110 billion, or $4,200 per person. Clearly, Affluent Travelers have the means to travel more often and for longer durations. They can also opt for luxury accommodations when they want to and pursue the most exciting and memorable experiences in-destination.

The term “Affluent Traveler” is often interchanged at whim with the term “Luxury Traveler.” As Skift has noted, however, luxury travel has been evolving, and continues to do so. We have observed that luxury travel has moved away from its traditional association with the fanciest hotels and first class flights, and toward meaningful, yet still exclusive, experiences in-destination. This evolution continues, and is becoming even more personal and subjective. The new ultimate luxury goes beyond the experience itself to encompass the journey toward personal fulfillment and self-improvement that an experience can help facilitate. Some refer to this trend as “transformational travel.” From the results of our U.S. Affluent Traveler Survey 2018, we see that this group as a whole tends to display attitudes, preferences, and behaviors that fit within this new definition of luxury, but we also find some variation within the group that indicates otherwise.

These variations show the risk in generalizing all Affluent Travelers as Luxury Travelers, no matter how that term may be defined. In this report, we also segmented Affluent Travelers according to more specific income brackets, whether they have children in the household, age groups, and trip frequency. Through these lenses, we are able to provide a more refined consumer portrait so that travel brands can better appeal to the unique segments within the Affluent Traveler group using the most relevant marketing channels and tactics.

Affluent Travelers at a Glance: Trip Behavior

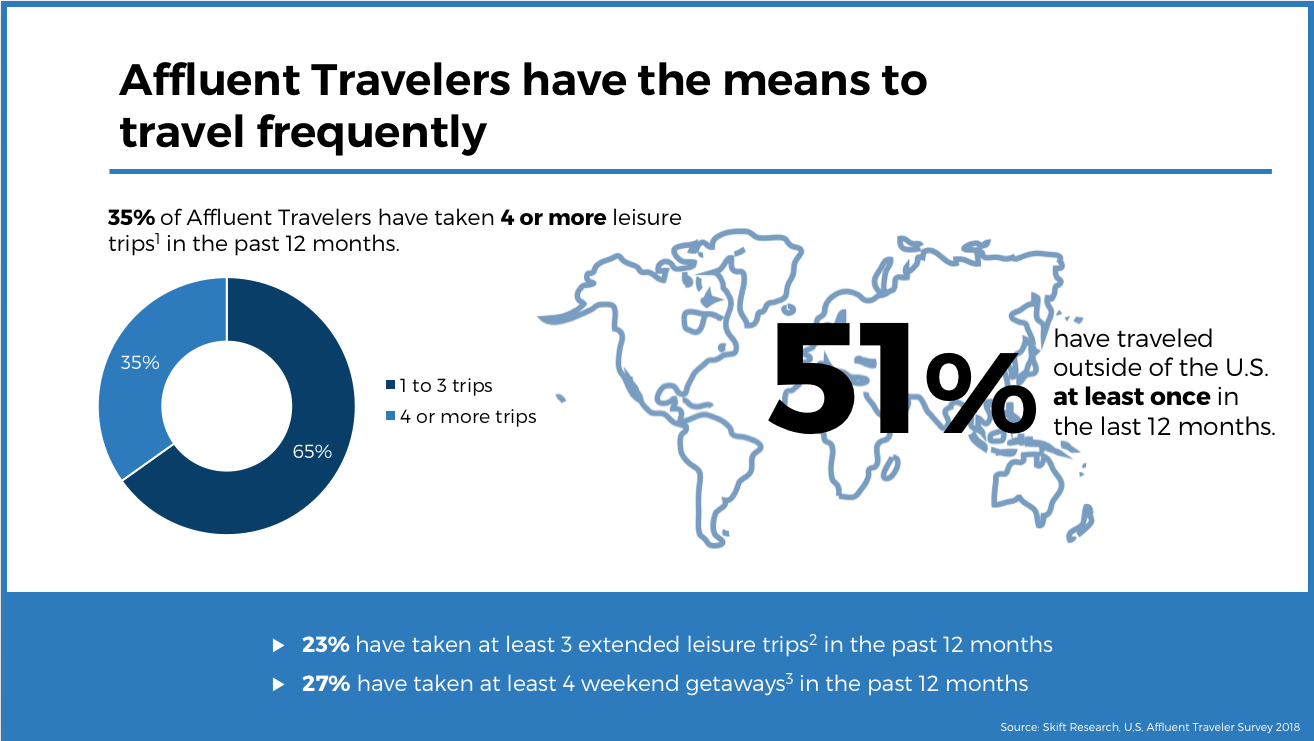

Higher household income means more money to spend on leisure and entertainment. This is evident in Affluent Traveler’s trip frequency. Over one-third of Affluent Travelers surveyed have taken four or more leisure trips in the past 12 months.

Their interest in travel spans across all types of vacation destinations, whether it’s a local resort town a few hundred miles from home, or a particular locale that requires a longer trip duration. Affluent travelers can afford to take more international trips, for example, which tend to be longer and more expensive. Over half of the travelers surveyed had taken at least one international trip in the past 12 months.

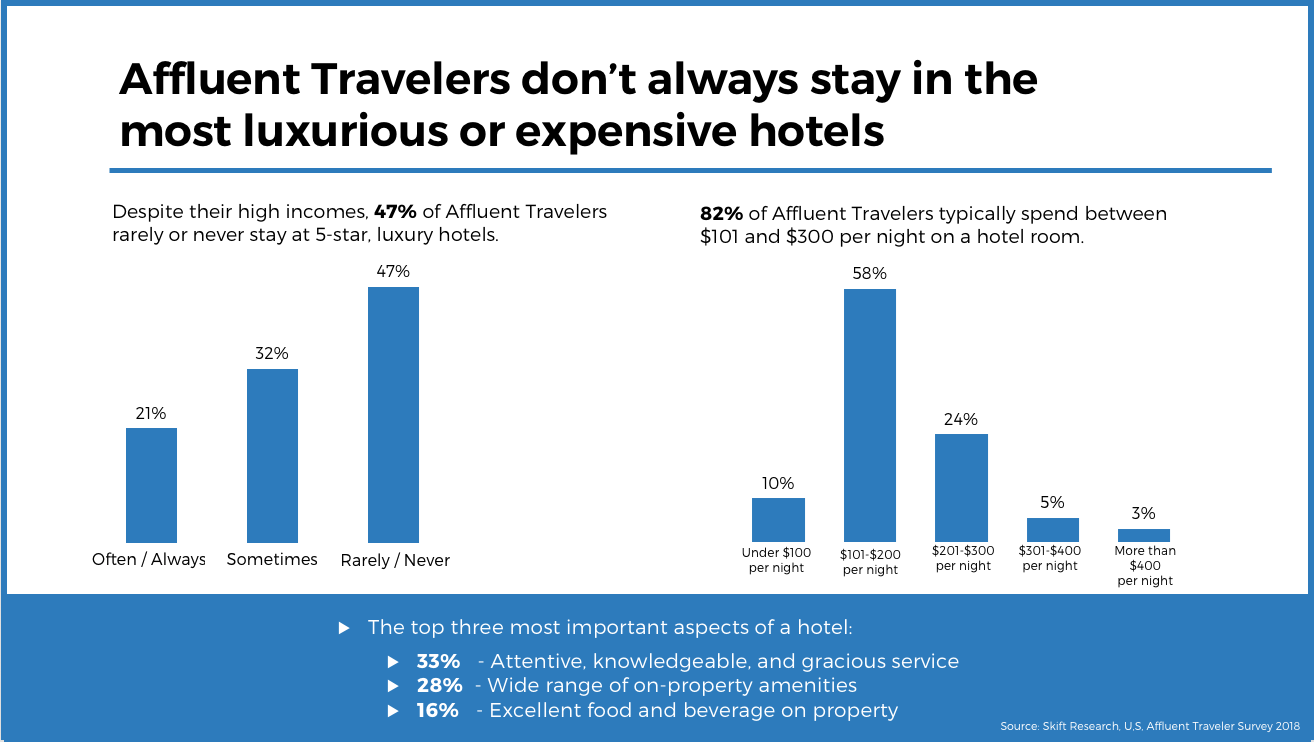

While Affluent Travelers have the means to take more trips to a variety of destinations, this does not mean that they always splurge on the most expensive or luxurious hotel. In fact, 47% of Affluent Travelers never or rarely stay in luxury hotels. This illustrates how affluence in travel doesn’t necessarily equate to traditional ideas of luxury travel. As we will see in the next section, many Affluent Travelers prioritize spending more money on other aspects of their travels instead of on more expensive hotels. Even so, they still have high expectations in other ways when it comes to the hotels they choose. Top-notch service and on-property amenities are still sought after by Affluent Travelers.

1. At least 2-nights’ stay, 200+ miles from home

2. At least 6-nights’ stay

3. At least 2-nights’ stay

Affluent Travelers at a Glance: Trip Priorities

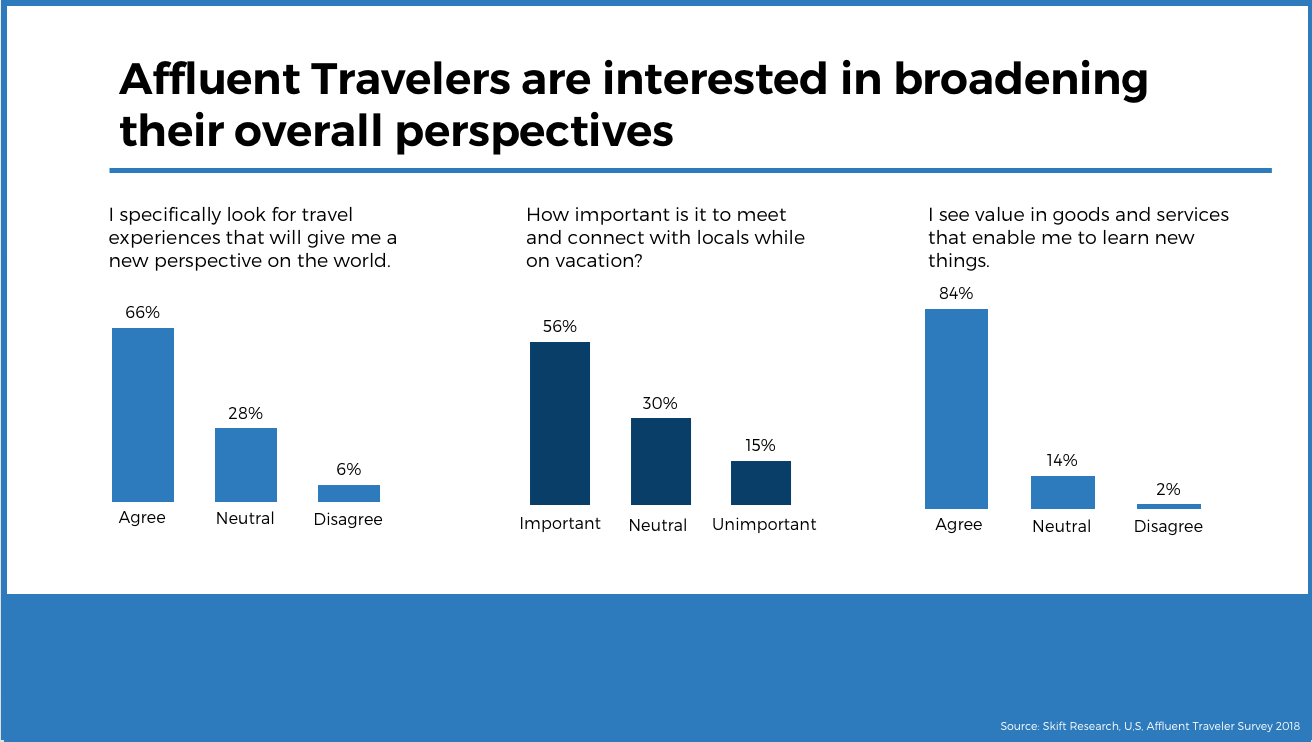

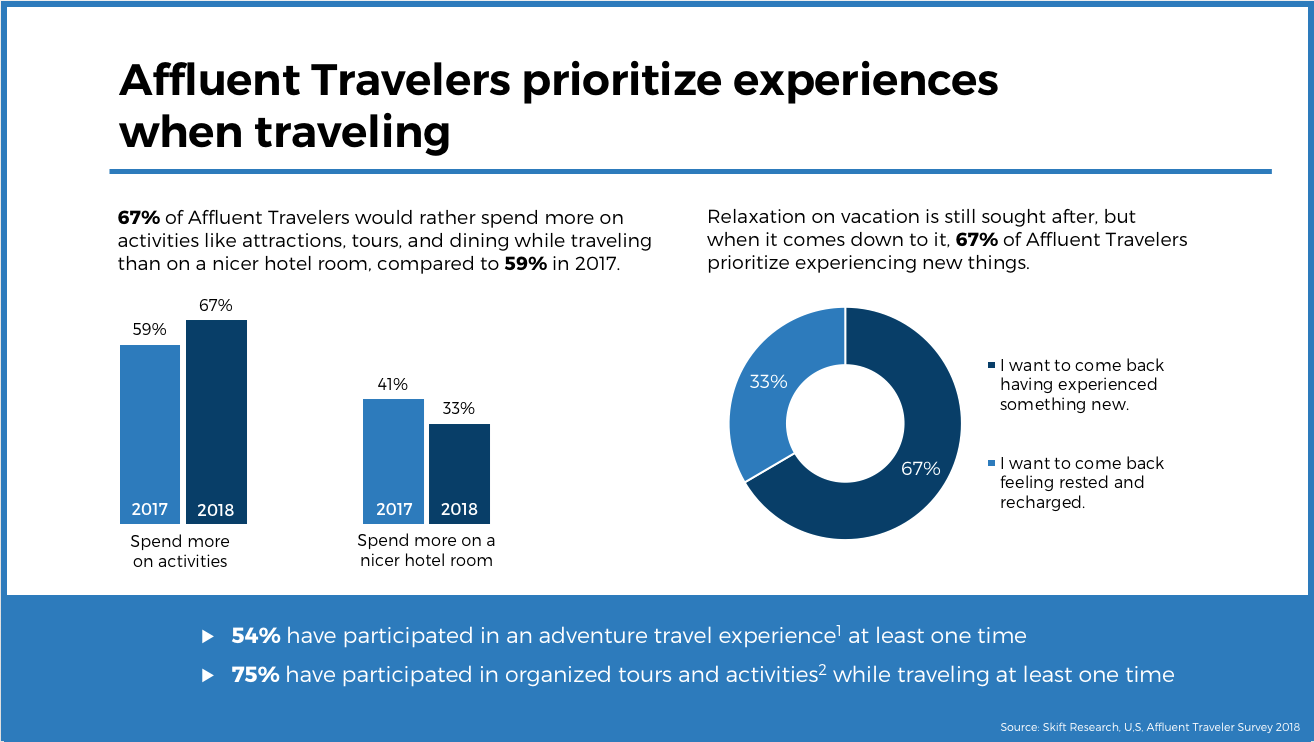

Affluent Travelers have not been immune to the trend of experiential travel. In fact, they are a key driving group of this trend due to their larger disposable incomes and exploratory mindsets. As we saw before, Affluent Travelers aren’t typically high spenders when it comes to hotels, and we now see that this is related to the fact that they prioritize spending on experiences instead. With their money, Affluent Travelers have the means to include a variety of experiences in their travels, from dining, to museums, and more elaborate tours and excursions.

Experiences while traveling help Affluent Travelers broaden their perspectives of the world and even reach new levels of personal fulfillment. Marc Dardenne, group chief operating officer of Jumeirah Group, spoke with Skift earlier this year and tied this mindset to the new definition of luxury travel: “I think of today’s luxury traveler as a curious traveler. Before, we wanted consistency in luxury but now we want to be enriched in cultural experiences and learning, and having engagement.” We see this curiosity in the attitudes and priorities of Affluent Travelers.

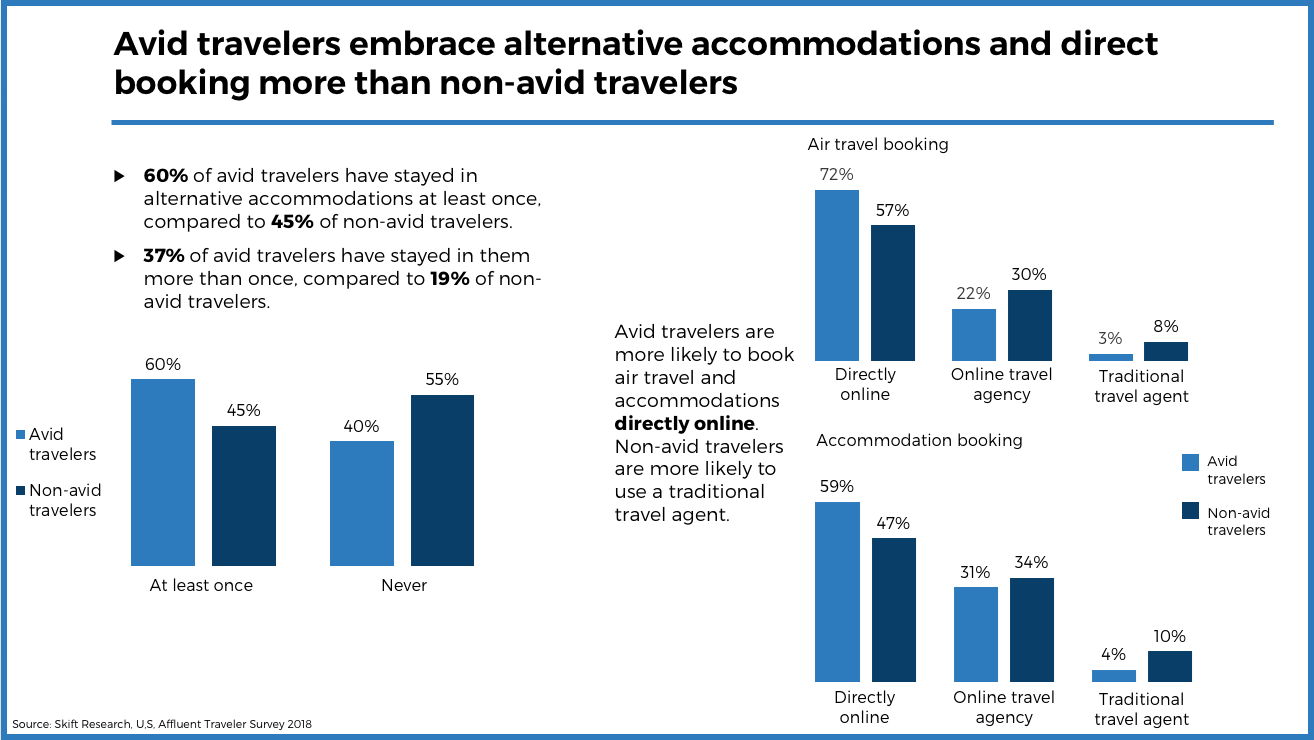

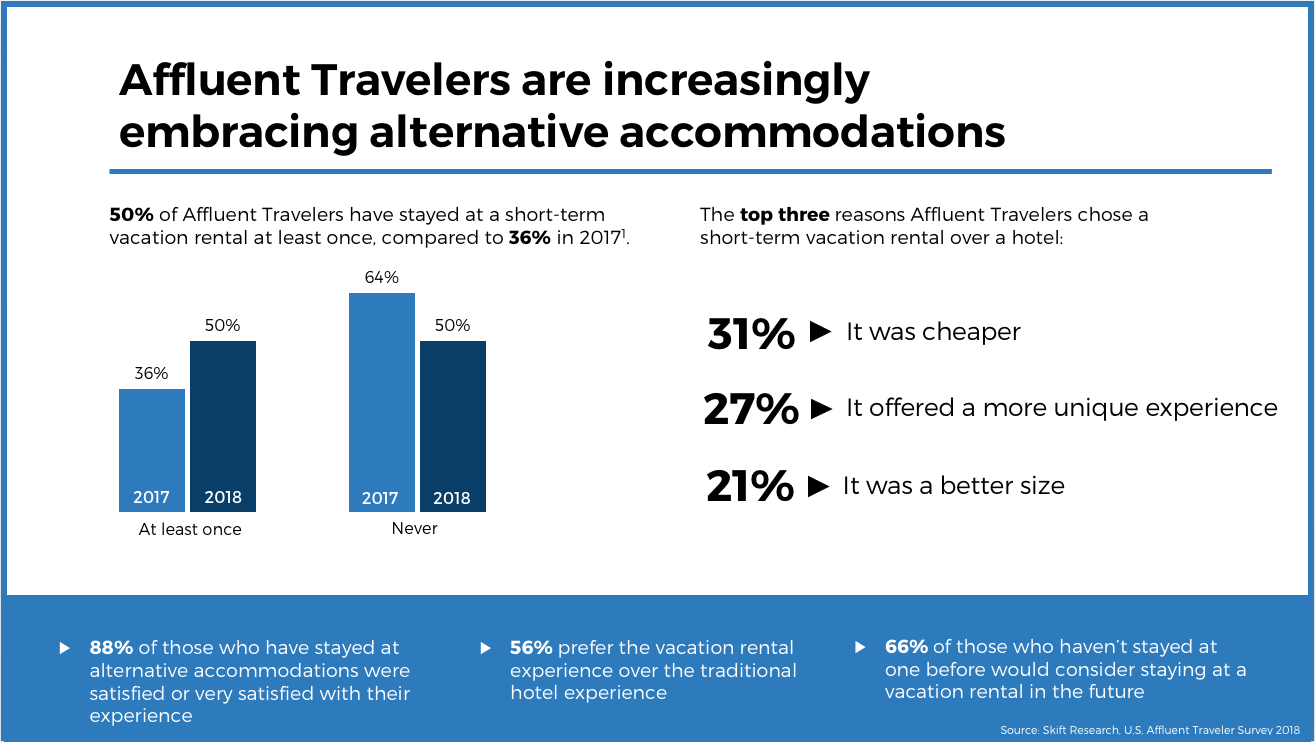

Another example of Affluent Travelers’ enthusiasm for experiences is their adoption of alternative accommodations. Half of the respondents in our 2018 survey have stayed in short-term apartment or home rentals while traveling at least once. Not only do Affluent Travelers often find that choosing alternative accommodations offers a different experience over traditional hotels, they also point out that the cheaper price is a key determining factor. If they are able to spend less money on more interesting and memorable lodging, then they have more to allocate toward other activities.

1. Adventure travel: Usually involves exploration of travel in an unusual, exotic, remote, or wilderness destination. Usually involves some kind of real or perceived risk, and might require specialized skills or physical exertion. Include, but are not limited to: safaris, treks, scuba diving, kayaking, etc.

2. Organized tours and activities: Include, but are not limited to, private or group sightseeing tours, food and wine tours, and classes and workshops. Organized tours and activities are organized by tour operators and are usually booked through the operator directly or a third-party booking platform. They are usually led by guides.

1. Please note that in 2017, the survey asked specifically about past Airbnb use, while 2018 asked about any short-term vacation rental use.

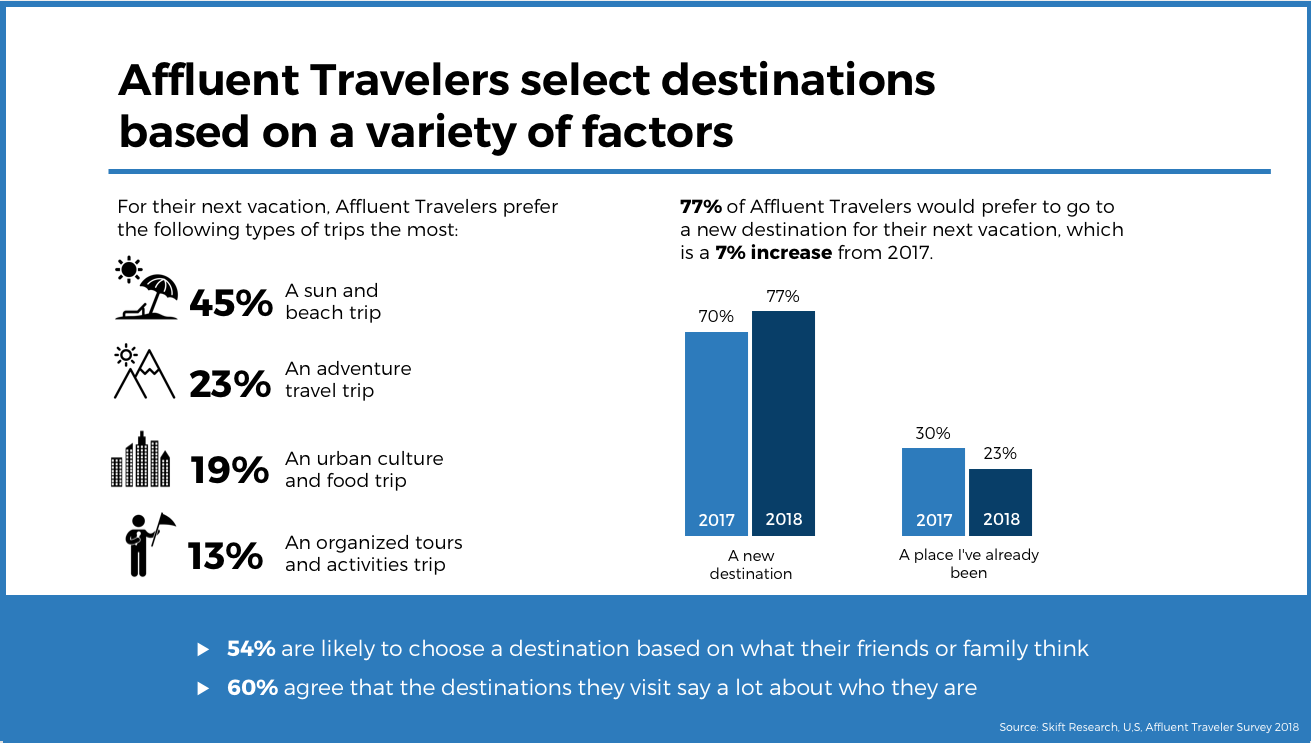

Affluent Travelers at a Glance: Planning and Booking Preferences

Even though Affluent Travelers travel quite often, they still put a lot of thought into their destination selection, often considering the choice a reflection of who they are as a person. Overall, Affluent Travelers are open to a variety of trip types, from sun and beach trips, to urban culture and food trips. Above all else, though, they want to visit destinations they’ve never been to before, and this preference is on the rise. Visiting a new destination—whether it’s an entirely new country, city, or even just a new part of place that they’ve already been to—lends itself to finding new experiences.

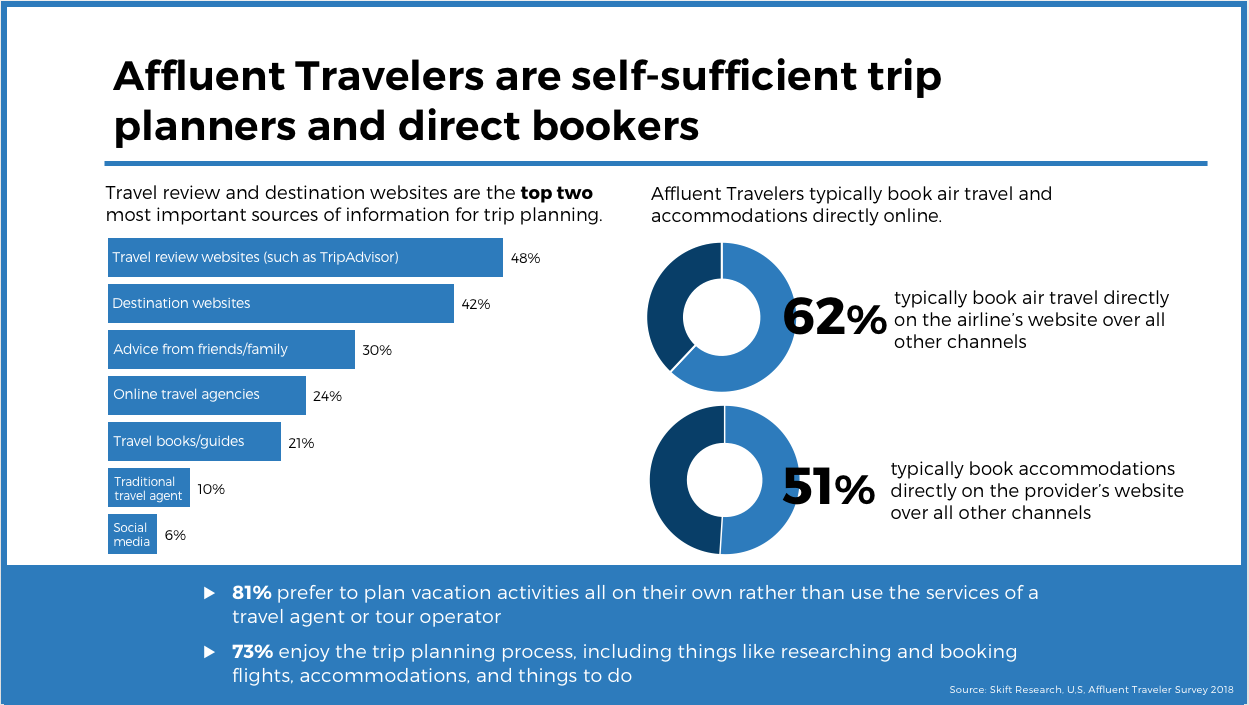

Online resources, including travel review websites like TripAdvisor and destination websites, are often turned to as trip planning sources, while social media is considered the least important source. Advice from friends or family is also highly regarded. Considering this in conjunction with the finding that most Affluent Travelers book air travel and accommodations directly on the airline or accommodation provider’s website over other booking channels, indicates that this segment goes into the planning and booking processes in one of two ways: 1) with a clear idea of what they are looking for, or 2) with trust in peer-driven information sources. Either way, they exhibit a desire to keep the processes as simple as possible. They don’t feel the need to comparison shop or filter through tons of information to find the flights, accommodations, and activities they’re looking for. They trust the opinions of others, whether it’s their family and friends, or other travelers’ reviews on TripAdvisor, to do the vetting for them when needed.

Affluent Travelers at a Glance: Attitudes about Luxury and Brand Loyalty

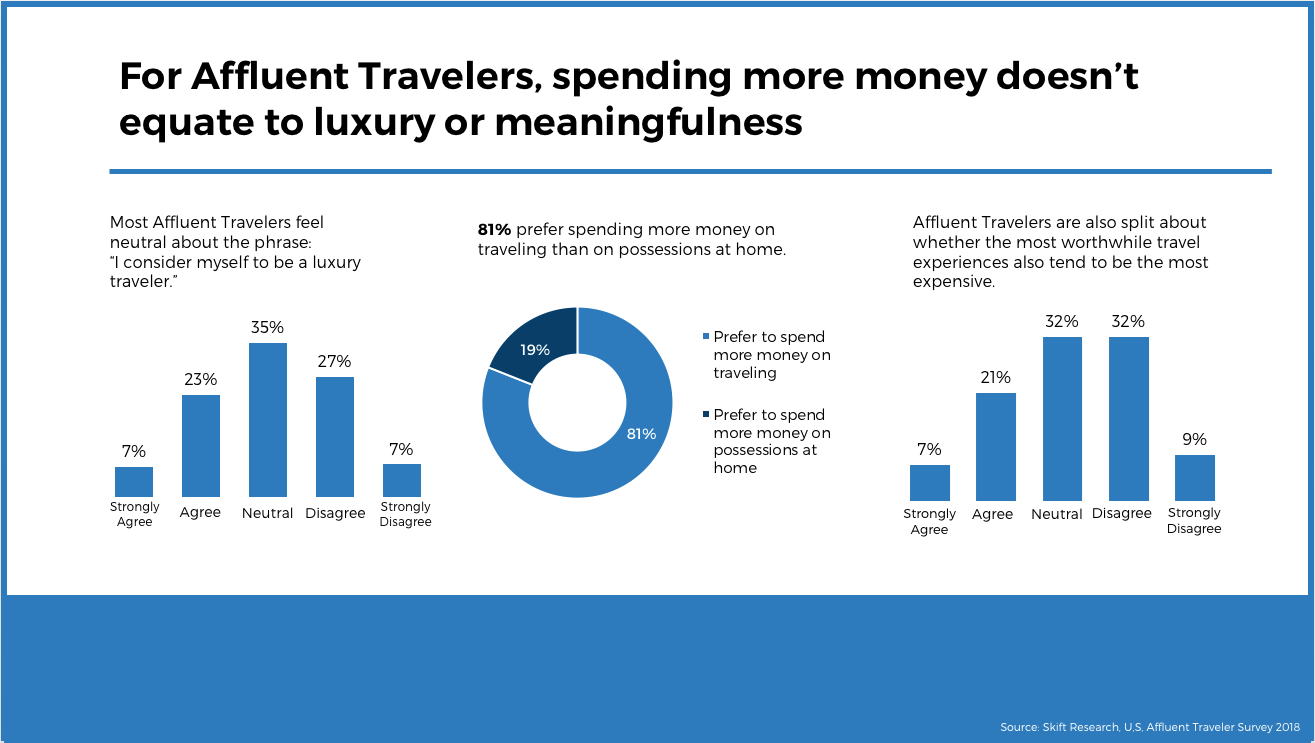

As discussed previously, the attitudes and behaviors of Affluent Travelers are likely to illustrate the new luxury of transformative travel. However, in their minds, luxury might still connote the traditional vision of 5-star, luxury hotels. Since most rarely or never splurge on pricey hotels, they tend to not see themselves in a luxury light.

Other findings further validate the shift from traditional notions of luxury. Affluent Travelers are keen to spend more money on traveling than they are on possessions at home, and a majority of them don’t believe that the most worthwhile travel experiences need to be expensive.

All of this isn’t to say that hotels don’t have a role to play for the new luxury traveler. As we mentioned before, Affluent Travelers still have high expectations for hotels, especially when it comes to service-oriented aspects. Tina Edmundson, Marriott’s global brand officer for luxury and lifestyle brands, recently spoke to Skift about the evolving role of hotels based on new customer expectations: “In the past, we were just the deliverer of the experience. Now we’re almost in this position of being enablers in these transformative experiences they are seeking out.”

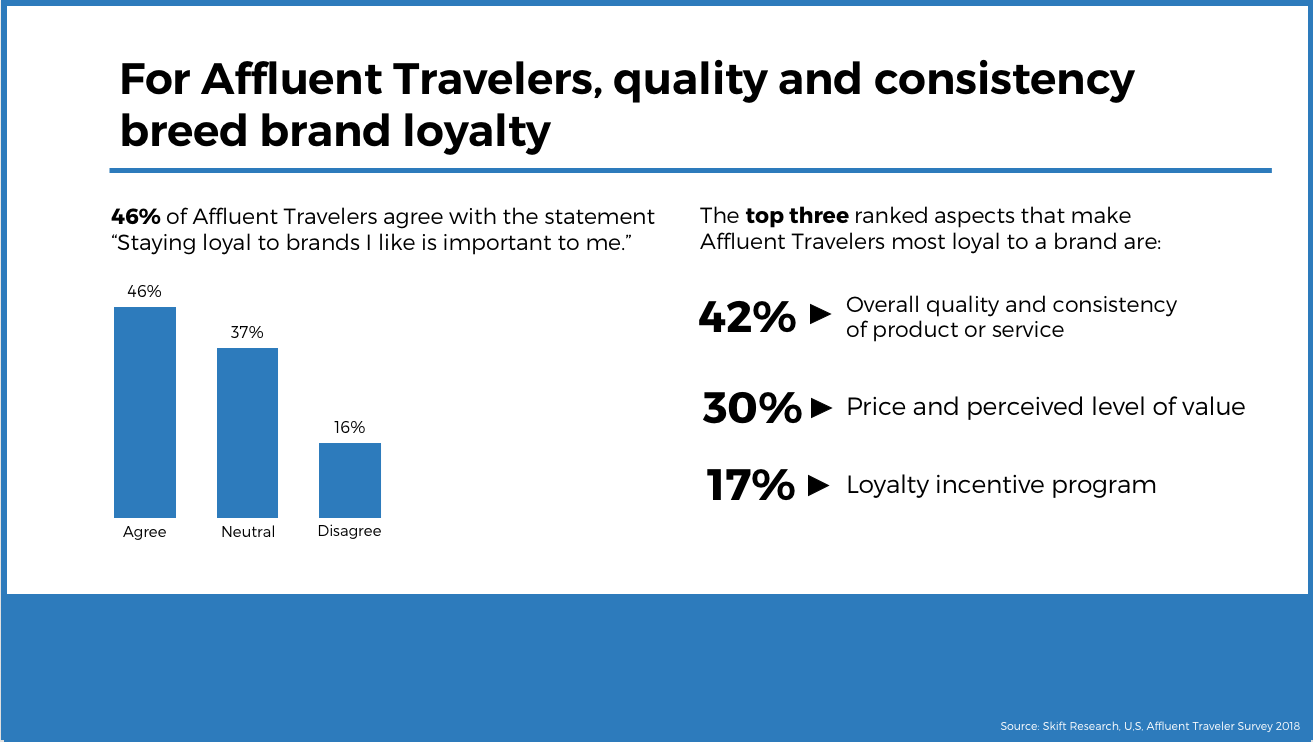

Affluent Travelers have new expectations when it comes to travel, and these spread to the brands that they engage with along the way and in-destination. Hotels and other travel brands have much to gain by meeting, and hopefully exceeding, these evolving standards. Brand loyalty is still important to many Affluent Travelers, and they are more likely to stay loyal to a brand when they can perceive the value they are getting for their money through the excellent quality of a product or service.

A Closer Look at Income: Super Affluents vs. Less Affluent

Despite the common traits discussed above, we recognize that the Affluent Traveler group encompasses a diverse group of people with more nuanced behavioral and attitudinal differences. To understand variation within the group better, we compared results of three more specific household income brackets: $100,000-$149,000; $150,000-$199,999; and Over $200,000. For simplicity’s sake, we gave these groupings their own names: Emerging Affluents, Mainstream Affluents, and Super Affluents, respectively. We were most interested in comparing the Super Affluent group to its less-affluent peer groups due to this group’s potent spending power. According to Skift Research’s analysis of the Bureau of Labor Statistics’ 2016 Consumer Expenditure Survey data, Super Affluents account for 22% of all yearly U.S. travel expenditure, or $7,400 per person. In comparison, Mainstream Affluents account for 12% of total travel expenditure, or $4,400 per person; and Emerging Affluents (which include about twice as many people as Mainstream Affluents) account for 17%, or $2,700 per person.

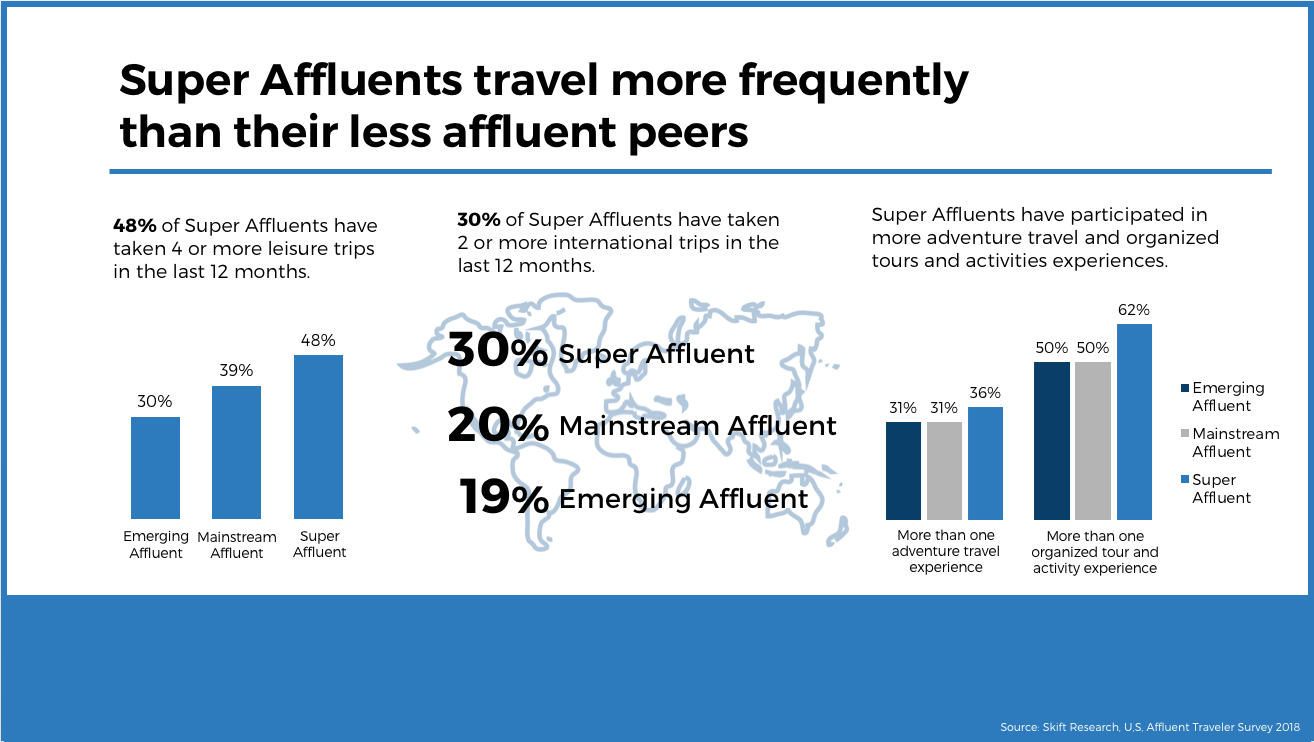

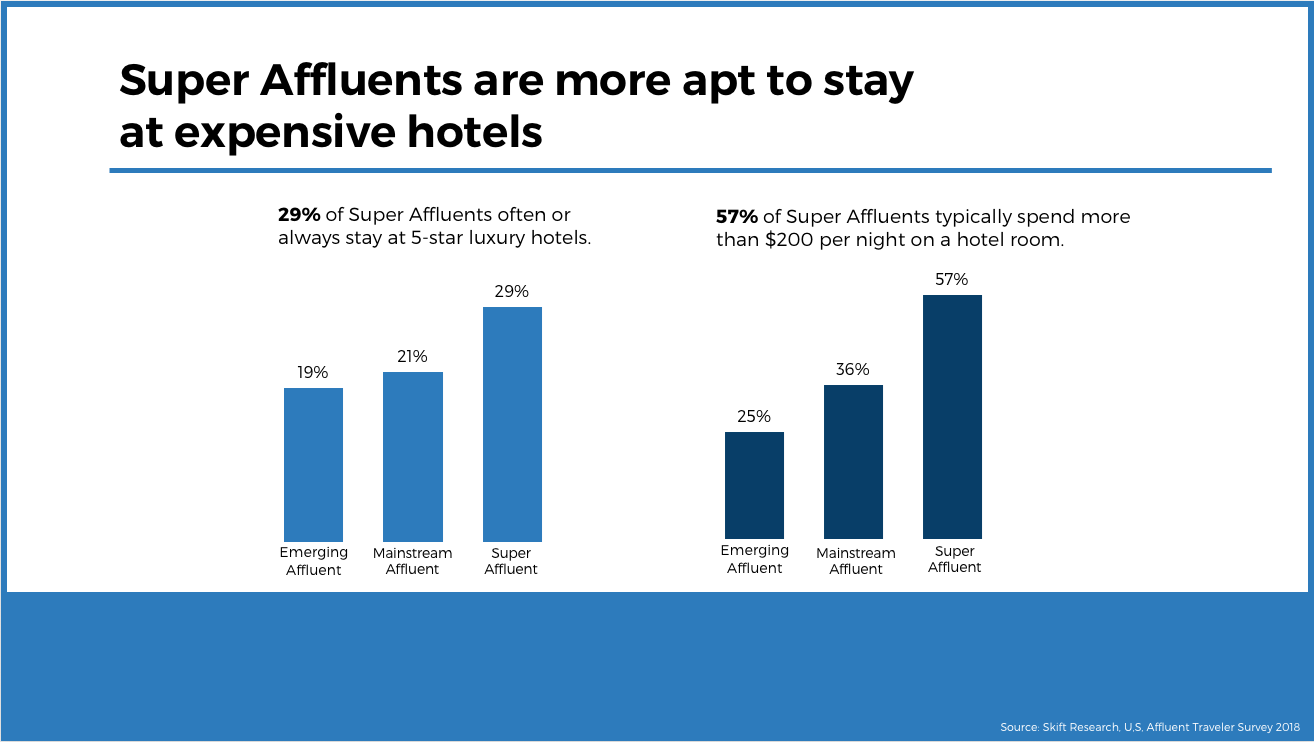

Given their high expenditures on travel, it is logical that the Super Affluents in our survey are the most frequent travelers and the most likely to travel internationally compared to the other groups. They are also more likely to partake in adventure travel and organized tours and activities. This group is also the most likely to splurge on hotels and to stay more often in luxury hotels, further illustrating the place of luxury hotels in the market, even as the definition of luxury is expanding beyond accommodations.

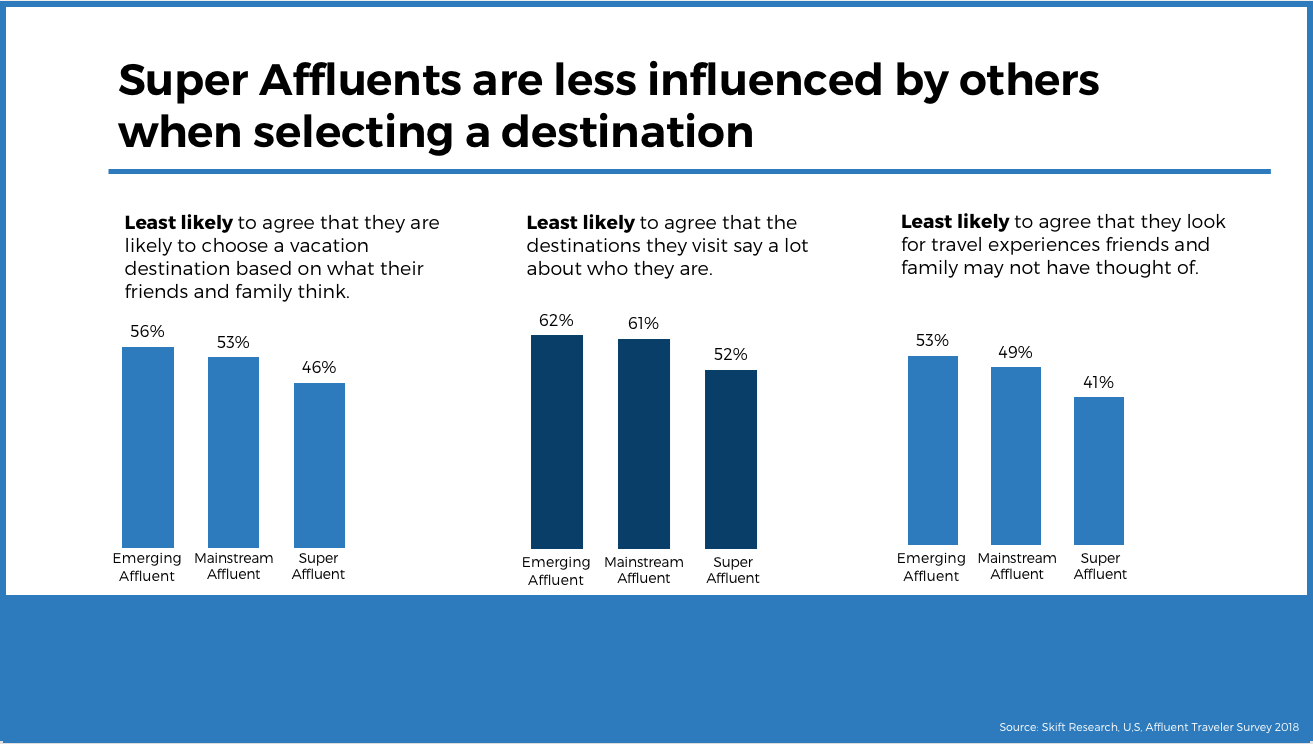

Despite their propensity to spend, Super Affluents are not making all their travel decisions to impress others. When it comes to selecting a destination, for example, they are the least likely to be influenced by the thoughts or opinions of their peers. Perhaps because they travel so frequently, they may have developed a somewhat relaxed attitude about what others think about every one of their trips. Or, perhaps their high economic status correlates with higher confidence that causes them to be less influenced by others. Either way, when compared to their less affluent peers, Super Affluents are the least likely to choose a vacation destination based on what friends and family think and the least likely to agree that the destinations they visit say a lot about who they are.

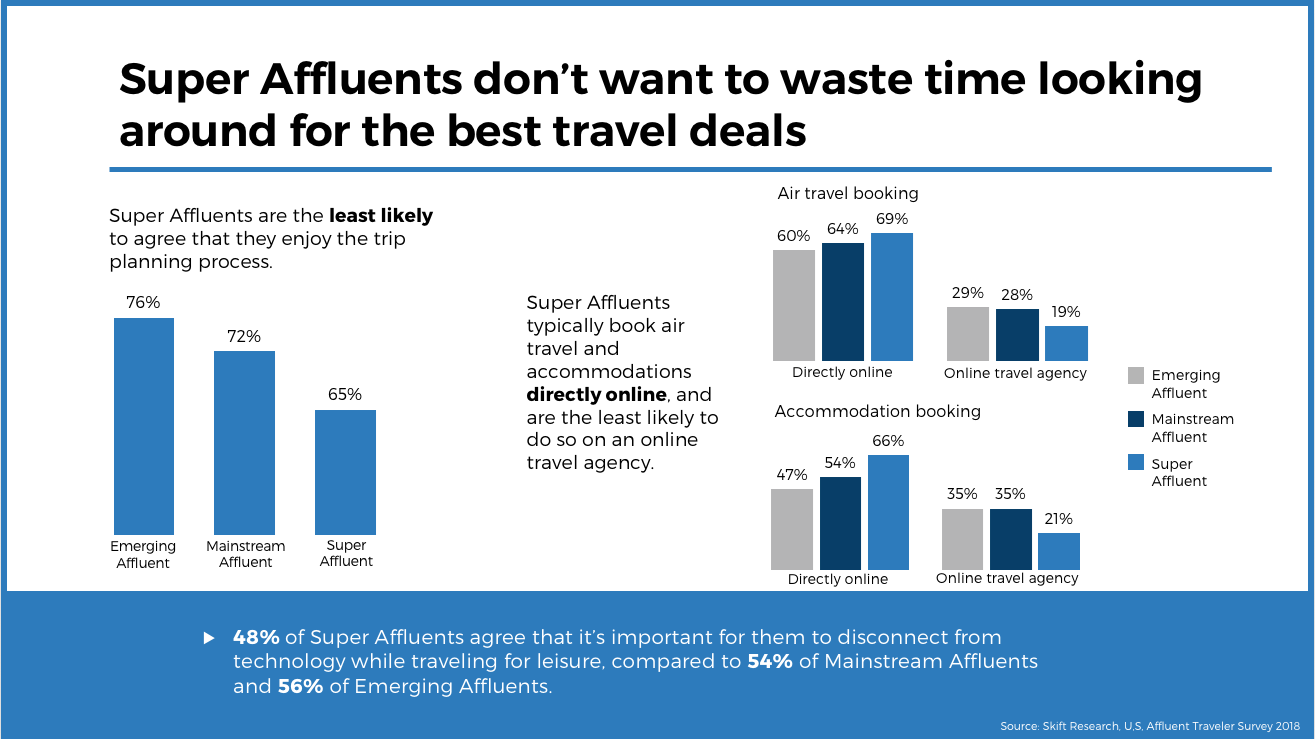

This free-thinking, independent attitude carries over into Super Affluents’ planning and booking behavior. They are the least likely to enjoy the trip planning process and the most likely to book air travel and accommodations directly on the airline or accommodation provider’s website. For this group, it’s not worth a little bit of cost savings to spend a lot of time shopping around on an online travel agency, when they have the means to book with their preferred brands for the room or flight that works best for them.

A Closer Look at Families: Affluent Travelers With and Without Children

Next, we compared Affluent Travelers with children under 18 in the household with those without children to see how families fit into the affluent travel picture.

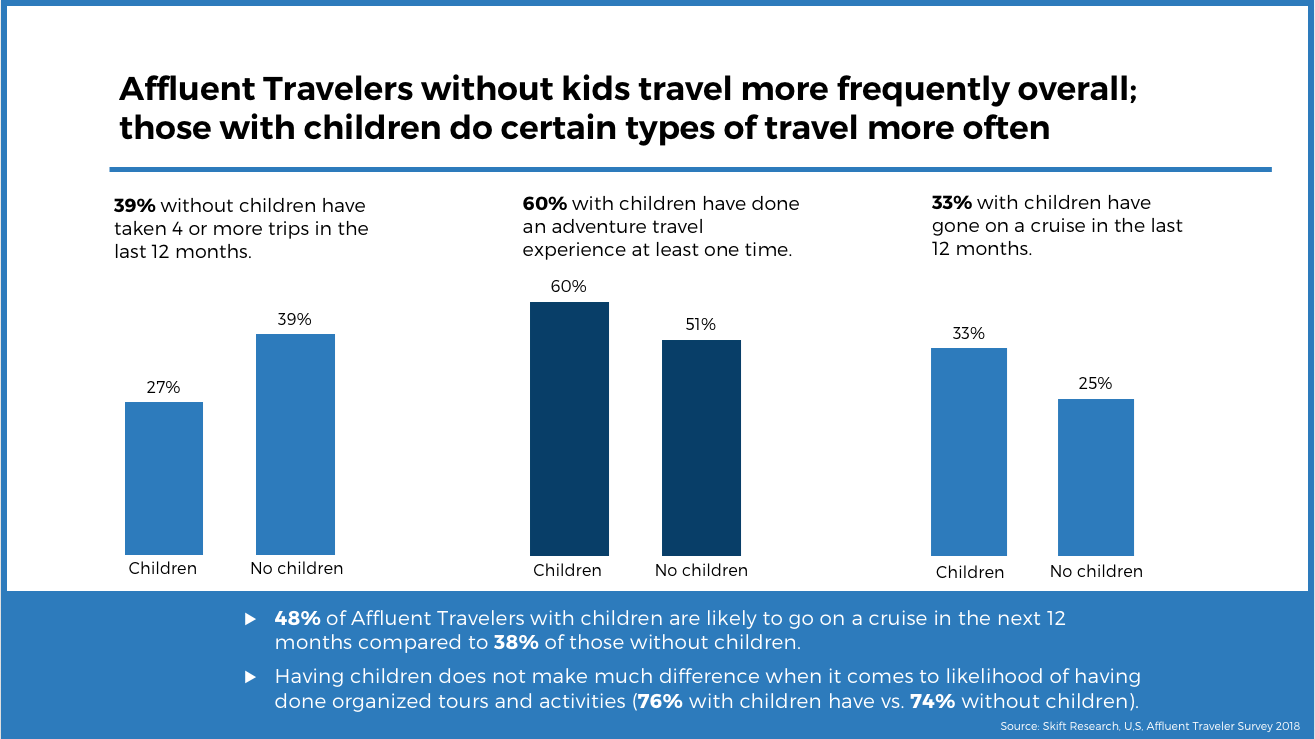

We found that overall, having children is linked to fewer trips. However, compared to Affluent Travelers without children, those with children are more likely to have gone on cruises and participate in adventure travel.

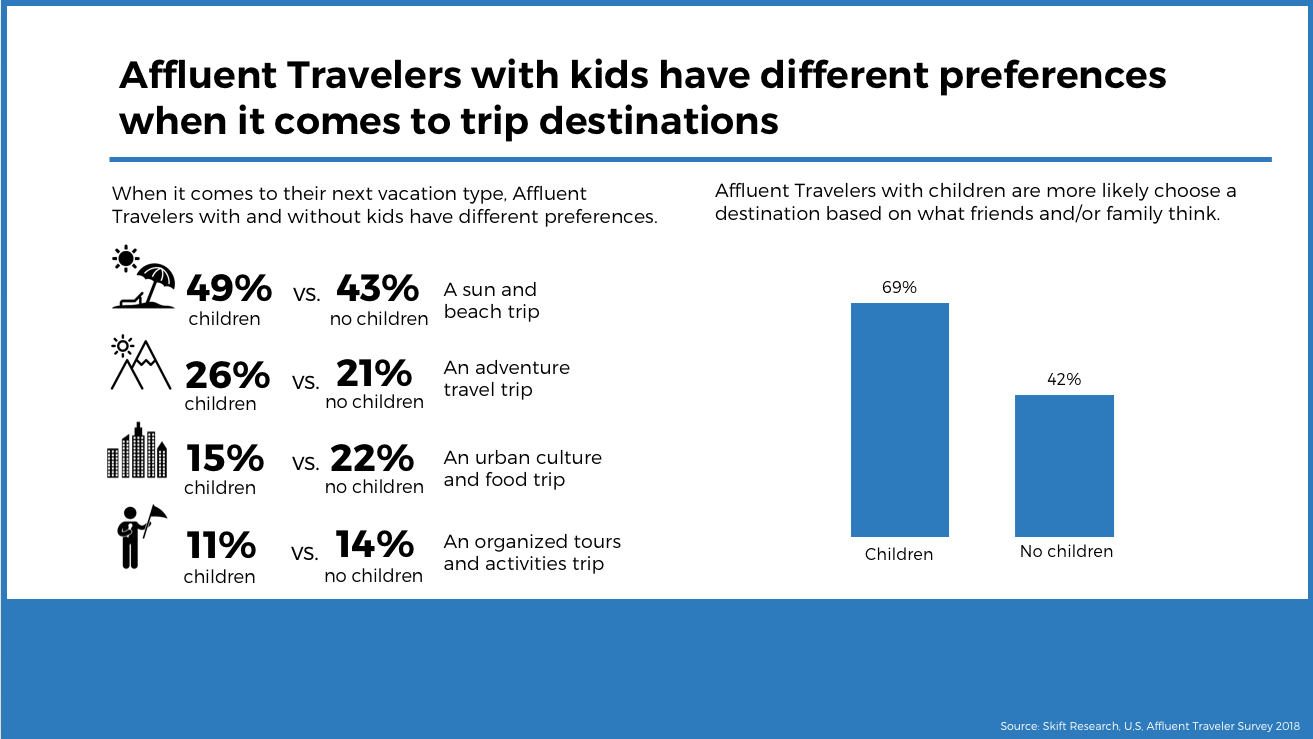

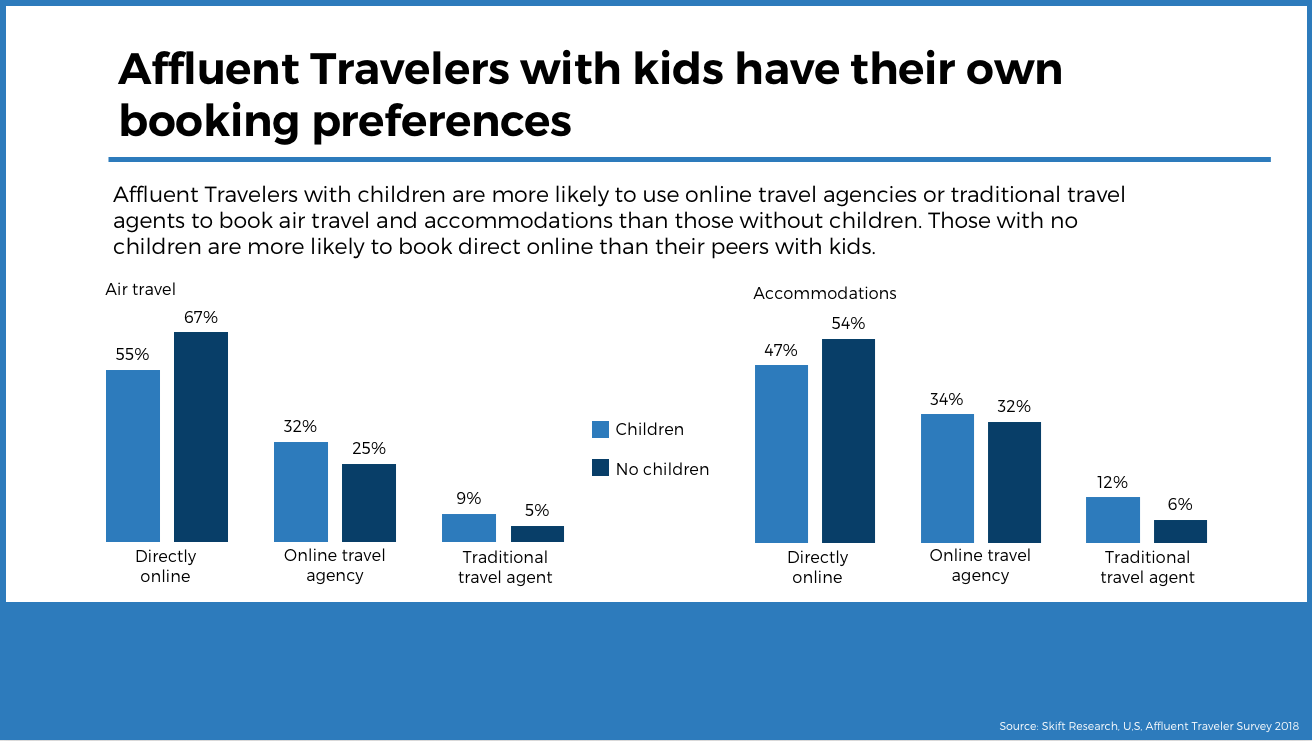

Affluent Travelers with kids also spend more time overall crowdsourcing opinions and shopping around when planning and booking trips. They are more influenced by the opinions of others when selecting a destination, and they are a bit more likely to shop around on an online travel agency than their peers without kids. Also, while it’s still not a common choice for any segment, those with children are about twice as likely to hand off these responsibilities to a traditional travel agent, perhaps in an effort to save themselves time while still hoping to find the best choices for their families.

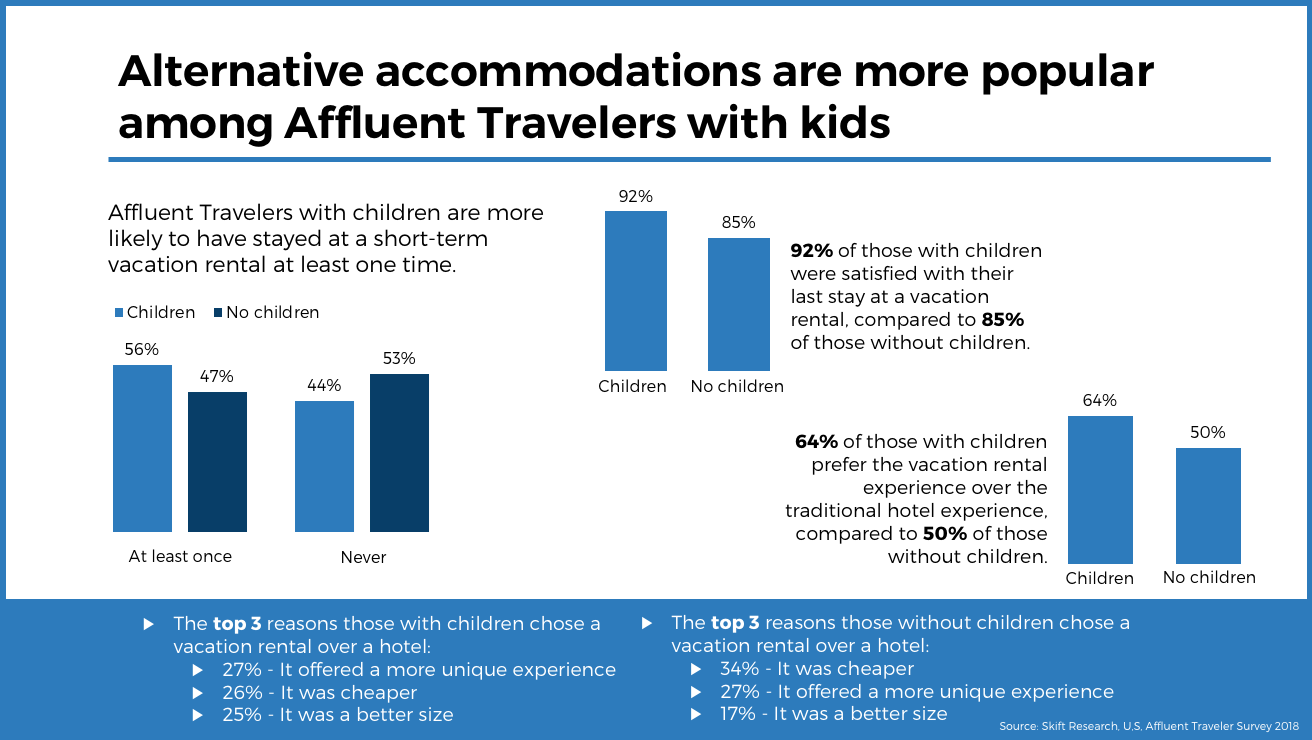

When it comes to accommodations, the habits of Affluent Travelers with kids don’t stand out too starkly in terms of typical nightly hotel spend, although they are slightly more likely to claim that they often or always stay at 5-star, luxury hotels. What really sets this segment apart is their use of and satisfaction with alternative accommodations. Those with children stay in alternative accommodations more frequently than Affluent Travelers without children. They also tend to be highly satisfied with this type of experience and are much more likely to prefer it over the traditional hotel experience.

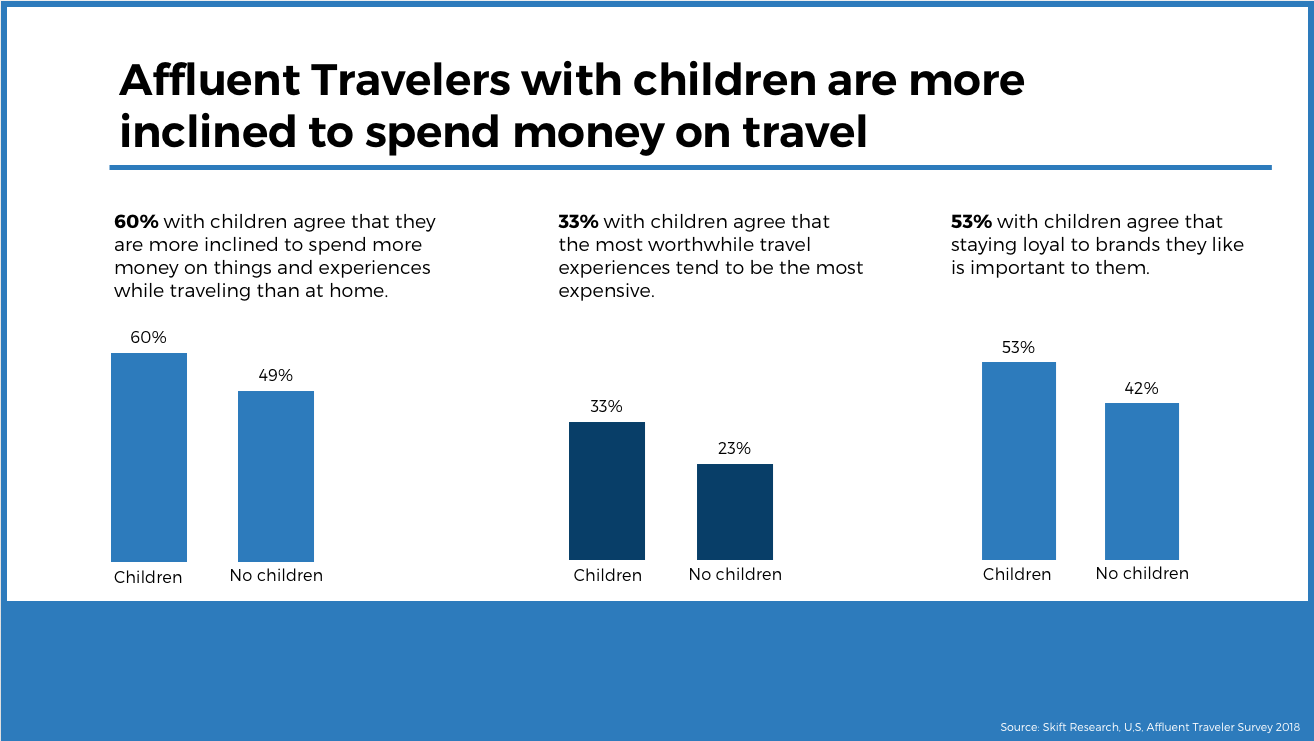

Traveling with children adds more expense to traveling, and this includes finding experiences that are entertaining and educational for kids. Staying in alternative accommodations can help on both fronts. Affluent Travelers with children are likely to choose alternative accommodations because they offer a different experience and are a larger size than traditional hotels. They also cite the typically cheaper price as an important factor. Despite this, they are more inclined to spend more money on things and experiences when traveling than they are at home. They are more likely to agree that spending more money can help make a trip meaningful for their families.

A Closer Look at Age: Trip Behavior and Attitudes by Age Group

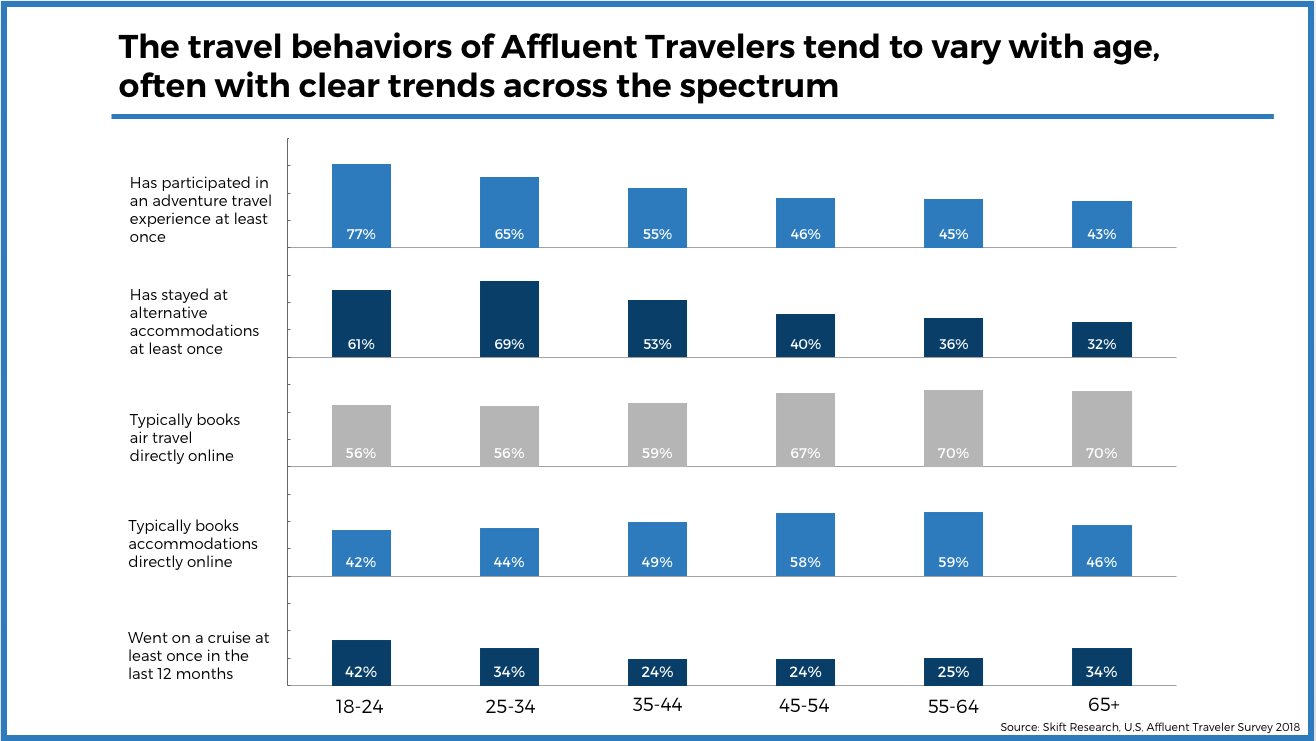

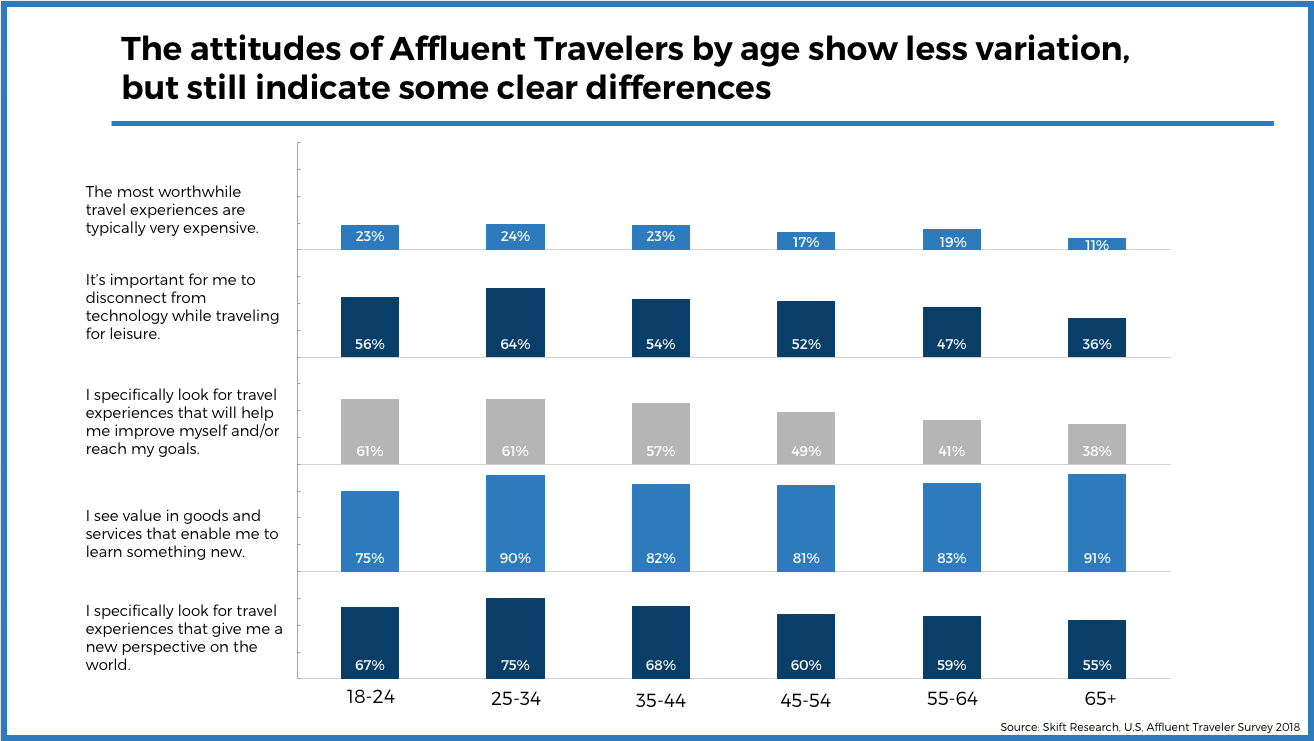

As every consumer-facing business knows, age is one of the key factors impacting consumer behavior and attitude. When we looked at trip behavior across six age groups, we found that, not surprisingly, the likelihood of having stayed in alternative accommodations goes down steadily as age goes up. Participation in adventure travel experiences followed a similar pattern. When it comes to booking, older Affluent Travelers are more likely to book air travel directly on the airline’s website and, except for the 65+ group, they are more likely to book accommodations directly on the provider’s website.

We also find that younger and older travelers value different types of experiences and value them for different reasons. Younger travelers appreciate experiences that help them improve themselves, reach their personal goals, or expand their perspectives about the world. The importance of these values, however, declines as age increases. On the other end, older age groups place a lot of value on products and services that enable them to learn new things, and they are the least likely to believe that the most worthwhile travel experiences are typically very expensive.

A Closer Look at Trip Frequency: Key Differences Between Avid and Non-Avid Travelers

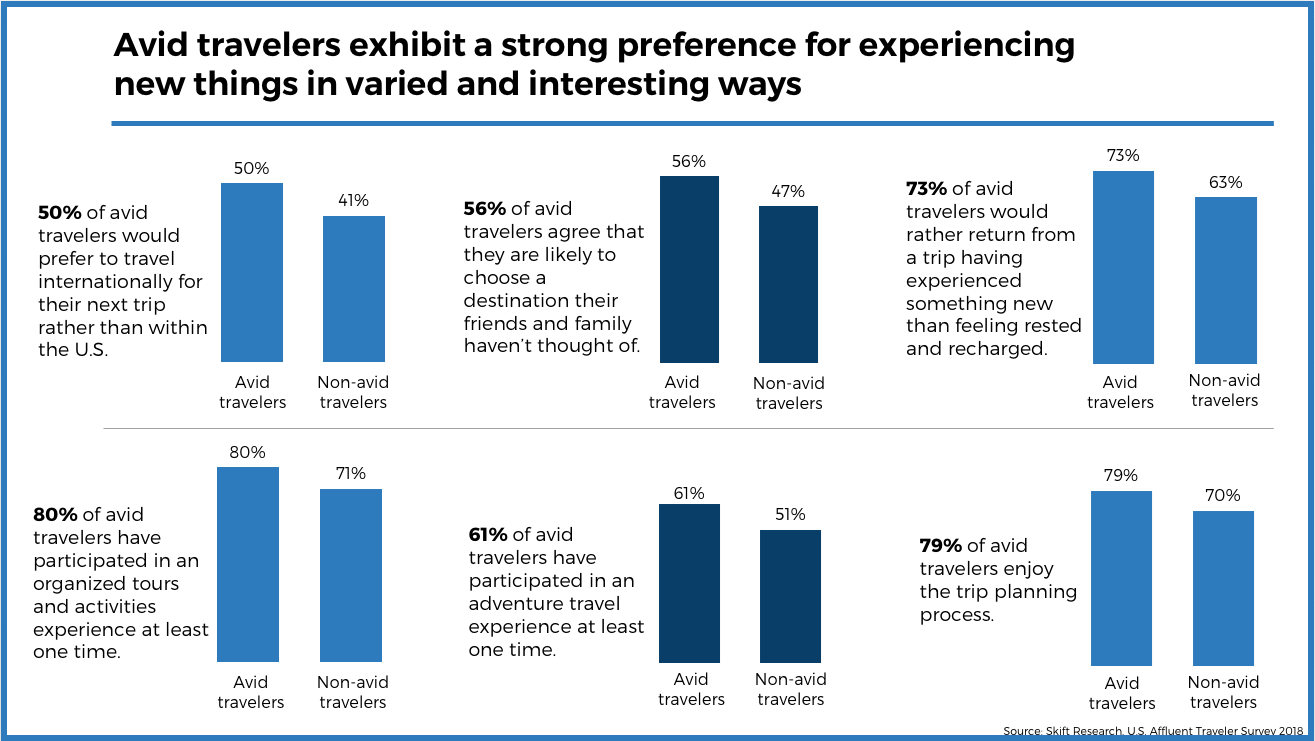

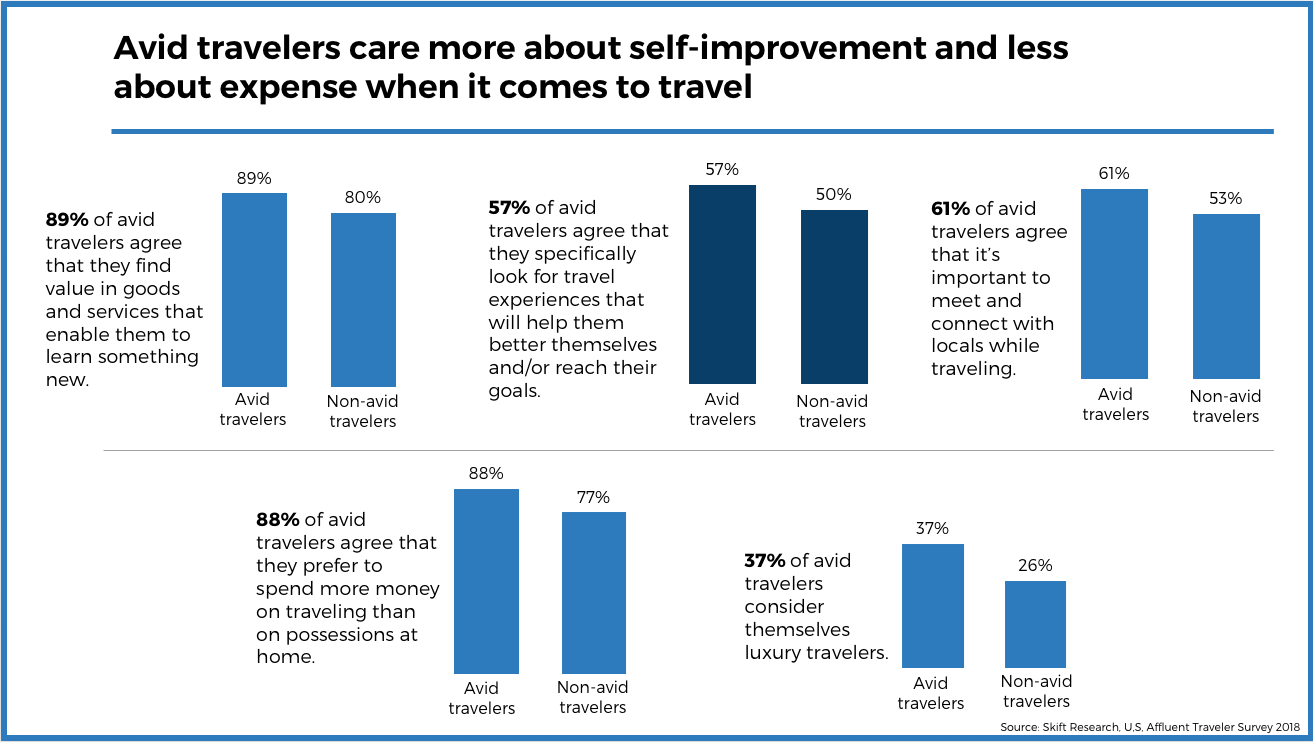

The final deep dive of the survey data was based on trip frequency. We compared Affluent Travelers who have taken one to three leisure trips in the past year to those who have taken four or more in the same time period. We dubbed these groups “non-avid travelers” and “avid travelers,” respectively. Of all the Affluent Traveler segments that we’ve analyzed thus far, avid travelers seem to fit the definition of the “new luxury traveler” more than any other.

We say this because of the value they place on experiences while traveling, and especially what they hope to gain from them. Their penchant for experiencing new things compared to non-avid travelers is clear: They are more likely to want to choose a destination that their friends and family haven’t thought of, return from a trip having experienced something new rather than feeling rested and recharged, and they’re just as likely to travel internationally for their next trip as they are to stay in the U.S. Given these indicators, it’s no surprise that avid travelers have participated in adventure travel and organized tours and activities more often than non-avid travelers, and have stayed at alternative accommodations more frequently.

It is not only these behaviors that align with the “new luxury,” but also avid, Affluent Travelers’ commonly held attitudes. More avid travelers, for example, specifically look for travel experiences that will help them better themselves and/or reach their goals. This is, quite literally, the definition of the new ultimate luxury. Interestingly, more avid travelers actually consider themselves to be luxury travelers (although most do not) compared to non-avid travelers. How they are defining this term and comparing their own behaviors and preferences to it would be an interesting topic for future research.

Understanding Affluent Travelers: Putting it all Together

As a whole, Affluent Travelers do indeed share some commonalities when it comes to their travel habits, preferences, and attitudes. There are clear trends across the board: Affluent Travelers prioritize experiences, desire broadening their perspectives through travel, and don’t see themselves as luxury travelers in the traditional fashion.

Yet, delving into specific segments of this group reveals more nuanced behavioral and attitudinal patterns. Income, age, travel frequency, and having children all impact travel planning and in-destination behaviors. To attract this lucrative consumer segment, it’s imperative that travel brands understand their desires and habits at both the macro and granular levels. At either level, providing the most relevant and high-quality services are the keys to success.

Icon Credits:

- World: Wayne Tyler Sall from Noun Project

- Mountain: Laurin Kraan from Noun Project

- Beach: Gillad Fried from Noun Project

- City: Cris Dobbins from Noun Project

- Tour Guide: Gan Khoon Lay from Noun Project