Report Overview

DMOs hold a special position in the tourism industry. They can be envisaged to be at the helm of the industry in a sense that they bridge all relevant stakeholders and act as a central communication channel with access to enormous data of both the stakeholders and the consumers.

The last two years have proven to be an extremely challenging time for DMOs. The entire industry was being put on hold, and DMOs had an additional unprecedented responsibility to their audience: encouraging people to travel less and even avoid traveling.

Skift Research conducted its Destination Marketing 2022 survey in December 2021 to know how Covid impacted the working of Destination Marketing Organizations (DMOs). In addition, we interviewed executives from seven key DMOs to get additional insights from the ground.

Through our survey findings and industry discussions we aim to assess how DMOs reacted to and dealt with the pandemic and make sense of what the future holds and how DMOs will shape up in 2022. These findings will be particularly useful for DMOs to gain peer insights, executive interviews and Skift analysis that can help them optimize their own strategies and for other travel industry stakeholders to push their DMOs to work in the right direction.

What You'll Learn From This Report

- The pre-Covid setup of DMOs

- Impact of Covid on DMO operations

- DMO responses to Covid in shifting roles, priorities and marketing strategies

- Recovery aid and timeline

- Marketing spends, channels and priorities for 2022

- Emerging trends in destination management for long-term recovery

Executives Interviewed

- Chang Chee Pey, Assistant Chief Executive, Singapore Tourism Board Marketing Group

- Chris Heywood, EVP, Global Communications, NYC & Company

- HE Saood Abdulaziz Al Hosani, Undersecretary of the Department of Culture and Tourism, Abu Dhabi

- John De Fries, CEO, Hawaii Tourism Authority

- Nina Zantout, Head of Strategy and Deputy Director Destination Management & Corporate Development, visitBerlin

- Robert Dougan, Executive General Manager of Strategy and Research, Tourism Australia

- Representatives of the Azerbaijan tourism Board

Executive Summary

The pandemic has revealed a lot about tourism and the way it is managed in destinations worldwide. From Venice to Virginia Beach, the first half of 2020 has highlighted the importance of tourism on a destination’s economy, and in some places exposed where its strategy might be unsustainable in the long term.

The scope of work for Destination Management Organizations (DMOs) broadened massively to keep up with the changing trends and patterns owing to the pandemic. In this report we examine the pre-Covid setup of DMOs, how DMOs evolved during the pandemic and how they make sense of what the future holds.

We conducted a survey in December 2021 of about 100 professionals from destination management organizations (including Convention Visitors Bureau) globally to analyze the functioning of DMOs across five key facets: funding, revenue, expenses, staffing levels, and marketing. For each of the facets we have assessed the trend from the pre-Covid to the post-Covid phase.

We found that funding, revenue and expenses are expected to increase in 2022 compared to the last two years, in line with the macro travel recovery trend. However, at this point it is crucial for DMOs to diversify their funding and revenue sources along with allocating their expenses in a targeted manner. Staffing levels are expected to more or less reach 2019 levels in 2022. Digital marketing is expected to remain the dominant marketing channel going forward, although marketing approaches like partnership marketing, cross-DMO collaborations and community marketing are expected to show better results in the near future.

As DMOs continue to find their footing in the new travel landscape, DMO functions are expected to broaden even more with increased emphasis on sustainability initiatives, airport route development, and stakeholder engagement.

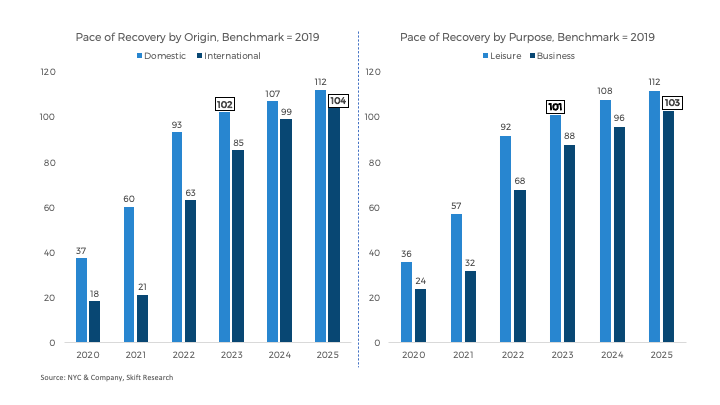

Furthermore, we interviewed executives from seven key DMOs. Through our survey and discussions with industry stakeholders we gauged the recovery timeline of the traveler volume and discussed the pace of recovery by origin and purpose. Consensus is that full recovery is expected only after 2024.

The overall goal of the report is to highlight the lessons learned through battling the crisis and the fundamental areas that can contribute to a sustainable recovery and growth.

Grave Impact of the Pandemic on Tourism

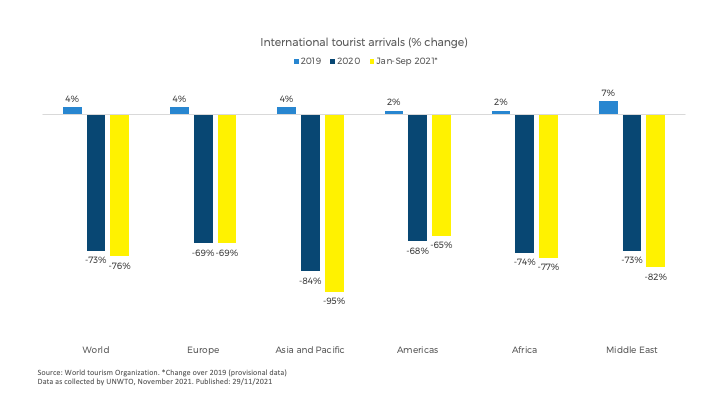

The Covid outbreak caused a global travel collapse since mid-March 2020, with cross-border travel taking the gravest hit. The arrivals of international tourists showed a sharp decline of 73% in 2020. Between January and September 2021, worldwide international tourist arrivals were 20% lower compared to 2020 and 76% below the pre-pandemic levels.

The last quarter of 2021 was expected to see a travel boom owing to the holiday season, but the emergence of the Omicron variant in early December is resulting in countries re-imposing more extensive travel restrictions and making the future uncertain yet again.

The only thing certain is that the pace of recovery will remain slow and uneven across world regions due to varying degrees of mobility restrictions, vaccination rates, and traveler confidence.

Exhibit 1: International tourist arrivals decreased sharply in 2020 and 2021 as compared to 2019

Given this dire decrease in international travel, many destinations have focused on domestic and nearby markets to make up for the loss. However, for a considerable number of countries, revenue from international tourism contributes significantly to their GDP and revival of international tourism is crucial for their tourism industry.

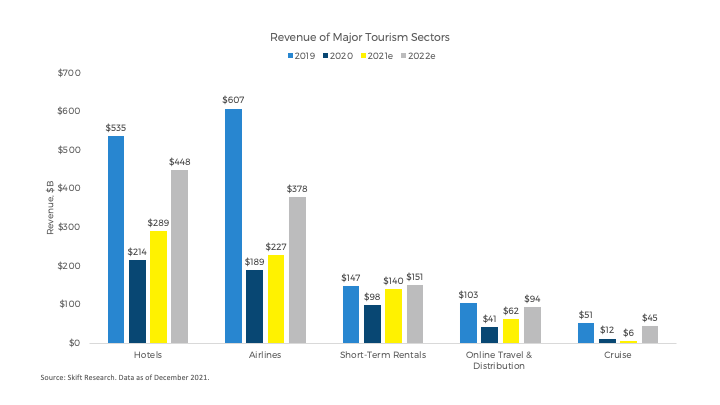

As per UNWTO, the impact of Covid on tourism could result in more than $4 trillion loss to the global economy. In our annual outlook for the travel industry, Skift Research created 2022 global forecasts for all major travel sectors. Revenue of these sectors are expected to reach 2019 levels by 2024 at the earliest.

Exhibit 2: Revenue of major travel sectors is expected to reach 2019 levels by 2024 at the earliest.

Survey Methodology

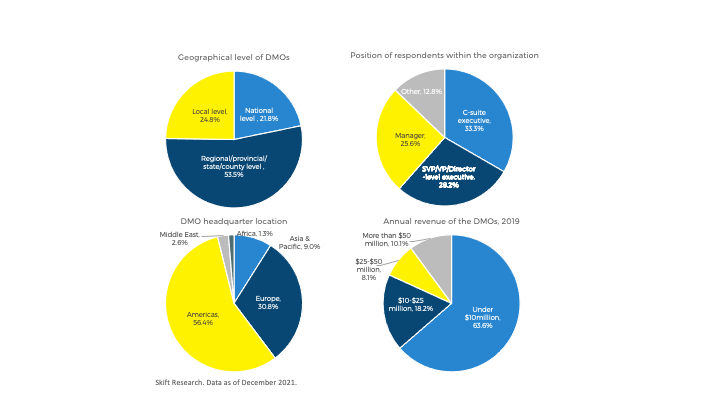

Skift Research’s Destination Marketing 2022 survey was conducted in December 2021 to examine how Covid impacted the roles and priorities of DMOs and what destination organizations are doing to prepare for changes post pandemic. The total sample size is ~100, representing DMOs across different regions and levels of management. The charts below display the demographics of the survey sample and their represented organizations.

Exhibit 3: Demographics of the survey sample and their represented organizations

The Pre-Covid Setup

In ordinary times, the role of a DMO is to generate demand for tourism from key source markets by building their destinations’ brands and raising traveler awareness about their respective destination offerings.

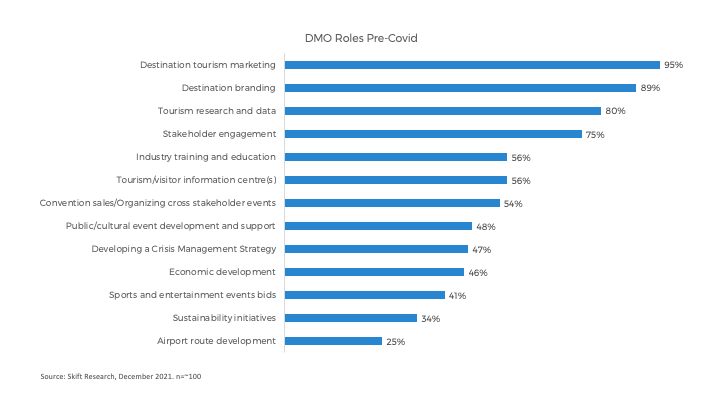

With the travel industry enjoying nearly a decade of unfettered growth, DMOs had been increasingly taking on additional roles. Skift Megatrends 2019 discussed how progressive DMOs were already developing new partnerships with local organizations to improve the destination experience, based on trends reshaping consumer expectations in the global visitor economy. So much so, that many destination leaders started calling themselves DMMOs – Destination Marketing and Management Organizations.

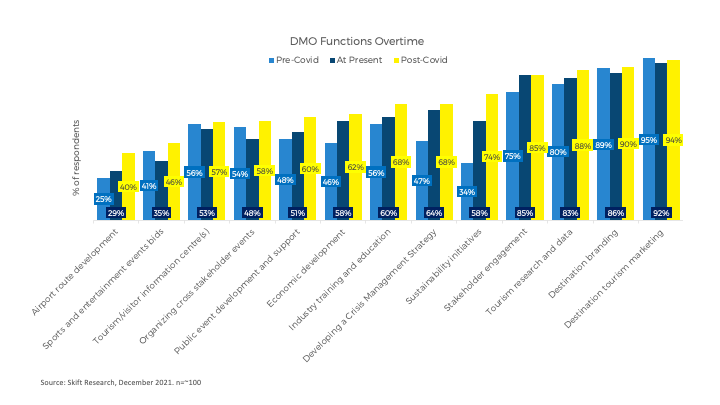

Our survey data confirmed these expanded responsibilities. According to our data, 75% of respondents said their organizations were responsible for stakeholder engagement in 2019 while 80% of them said that their organizations were focusing on tourism research and data in 2019, along with concentrating on their core job of destination branding and marketing.

Exhibit 4: Destination tourism marketing and branding remained the core DMO functions pre-Covid

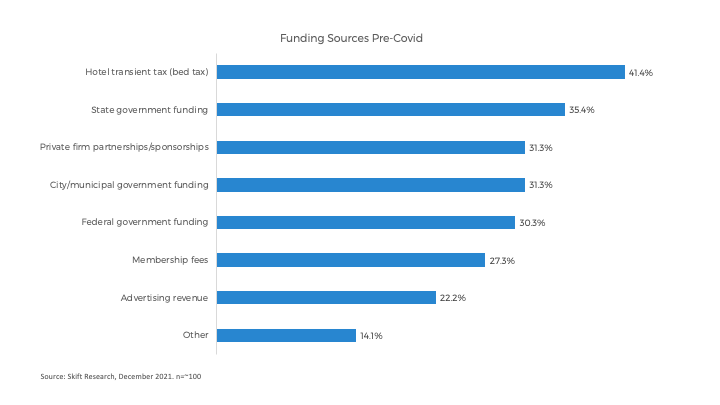

As regards to funding, DMOs usually raised funds via public channels but they could also be funded privately. Among public channels, the most common way for DMOs to secure funding is via hotel occupancy tax and therefore local governments. In addition, DMOs could accrue government grants, membership dues, advertising revenue, marketplace revenue and other forms of public & private funding.

Our survey results validated that hotel transient tax was the dominant funding source pre-Covid while state/city government funding and private firm partnerships/sponsorships were ranked as the other major sources of funding.

Exhibit 5: Hotel transient tax was the dominant funding source for DMOs pre-Covid

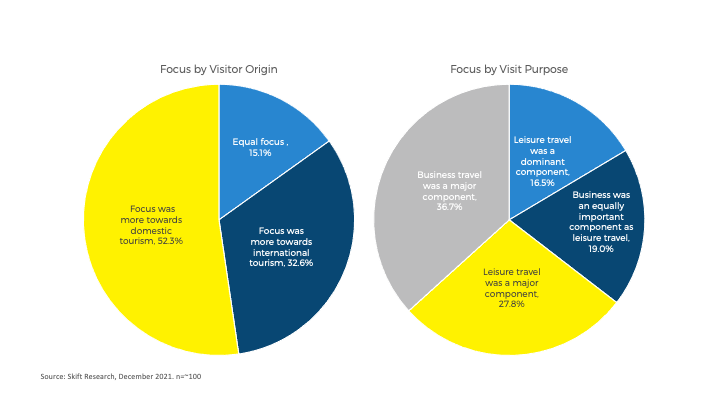

More than half of the survey respondents said that their organizations focused more on domestic tourism pre-Covid and around 37% said that business travel was a major component of overall tourism to their destination before Covid hit. It should be noted that our survey sample majorly consists of regional and local level DMOs and hence their focus might be skewed more towards domestic tourism.

Exhibit 6: Based on the survey responses, domestic tourism and business travel were the focus areas for DMOs pre-Covid

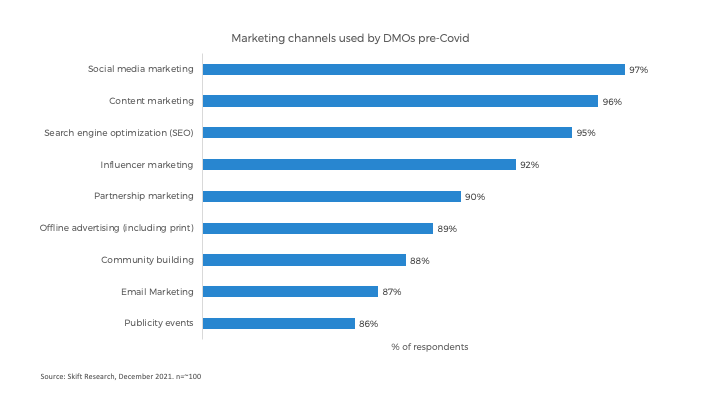

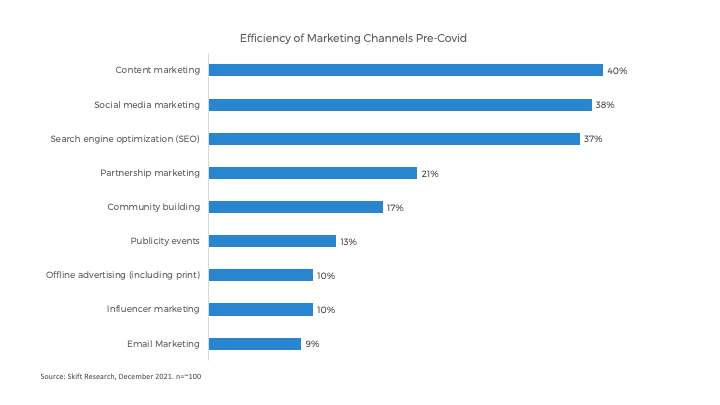

Even before the pandemic hit, DMOs were evolved enough to be using a wide range of marketing channels. Our survey results showed that more than 85% of the respondents said that their organizations were using almost all relevant channels.

Exhibit 7: DMOs used a wide range of marketing channels in the pre-Covid phase

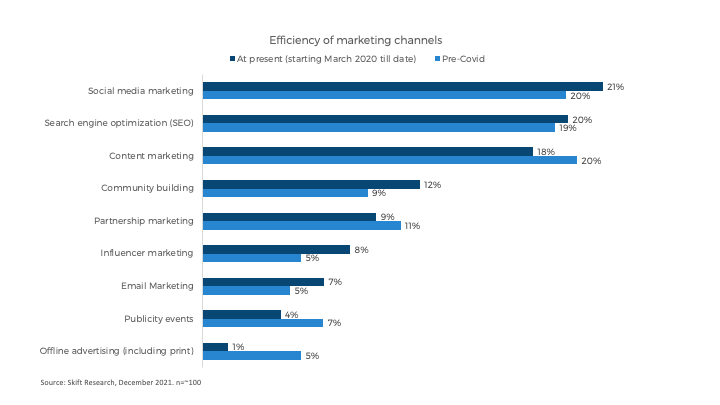

Digital marketing channels like content marketing, social media marketing and search engine optimization were marked as ‘very effective’ marketing channels pre-Covid.

Exhibit 8: Digital marketing was the most effective form of marketing pre-Covid

Evolution of the DMO Landscape with the Advent of Covid

The pandemic broadened the role that DMOs can play in dealing with a crisis and recovering from it. Chris Heywood, EVP, Global Communications at NYC & Company told Skift: “It has been such a change. Role of DMO has shifted. DMO became a mouthpiece to deliver real time information to our leaders and to our members. We were indispensable during the crisis.”

Heywood further discussed: “During a typical year, we will be doing all sorts of sales & marketing activity in a particular destination, with Covid our infrastructure changed, 50% of staff was laid off, budget cuts, we lost significant funds from our private revenues, and we disbanded our international network. In the interim we were focussing on revitalising the city by engaging our own New Yorkers and now since international tourism is expected to open up we have a different set of challenges.”

Below we have highlighted the changes that occurred in the DMO industry as a result of the pandemic.

Negative impact on traveler volume and revenue for majority DMOs

When asked how Covid has impacted the traveler volume in their destinations, 77% of the respondents said that the traveler volume decreased.

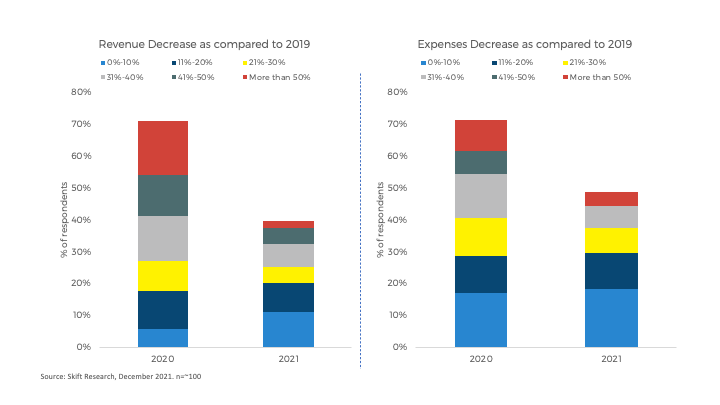

About 70% of the respondents asserted that the revenue of their DMO decreased in 2020 as compared to 2019 with 16% saying that the decrease in revenue was more than 50%. However, the revenue situation slightly improved in 2021, with 60% of them saying that their organization’s revenue in 2021 would be above the 2019 level.

Expenses showed a similar trend of decreasing aggressively in 2020 followed by a slight increase in 2021. However, the severity of decrease in revenue in 2020 was higher in 2020 as compared to 2021. For example, 16% of the respondents said that the revenue of their organizations decreased by more than 50% while 10% said that the expenses decreased more than 50%. This shows that in this phase DMOs were still trying to gauge the situation and streamline their expenses accordingly.

On the other hand, in 2021 the revenue decrease is behind expense decrease indicating that destinations were cautious of overspending given the abrupt travel recovery.

Exhibit 9: Revenue and expenses of DMOs decreased in 2020 in line with the diminishing travel demand before slightly increasing in 2021

Interestingly, 21% of the respondents said that the traveller volume to their destination increased during the pandemic. We went on to ask the reasons for the increase in traveler volume in these destinations and found that destinations which offer places to practice social distancing outperformed during the pandemic. Also, according to the respondents, the right marketing promotions, emphasis on health and safety and the surge in domestic travel due to international travel restrictions boosted traveler volumes in these destinations.

A good example of a destination which witnessed an increase in traveler volume by pulling the right strings at the right time is Abu Dhabi. HE Saood Abdulaziz Al Hosani, Undersecretary of the Department of Culture and Tourism – Abu Dhabi , shared with Skift, “Despite the pandemic, the UAE recorded a 55% hotel occupancy rate in 2020 when other hotels in the Middle East recorded just 43% occupancy. The pandemic created new opportunities for domestic tourism, with a surge in demand recorded over the past year contributing $11 billion (AED 41 billion) to the national economy. The majority of Abu Dhabi’s successful steer through the pandemic was due to the government’s continued commitment to the community’s and visitors’ health and safety. DCT Abu Dhabi’s Go Safe certification programme was crucial in demonstrating our commitment to public safety and responsible tourism and we were able to instill confidence and trust in its citizens, residents and tourists.”

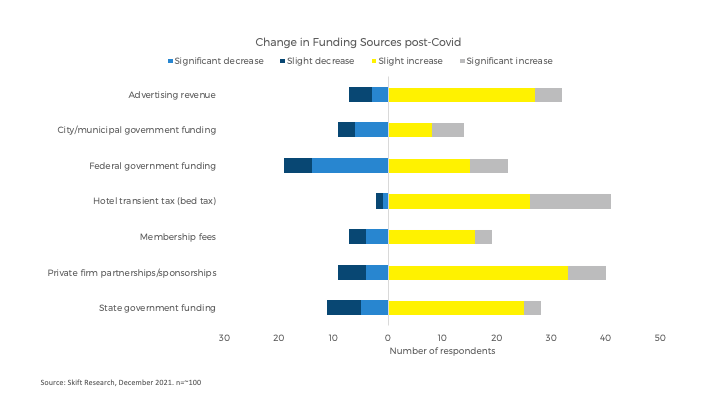

Funding cuts – Recovery funds come to aid

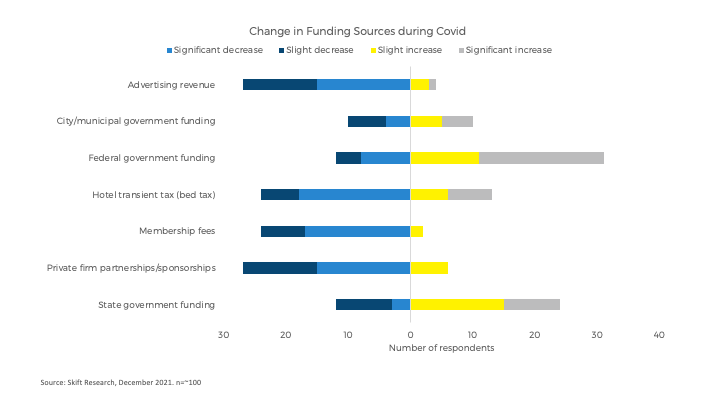

54% of the respondents stated that their organization did not receive the same level of funding starting March 2020 till date compared to 2019. Survey results suggest that with the advent of Covid, advertising revenue, hotel transient tax, membership fees and sponsorships from private firms were pulled back to a great extent while government funding at a city/state and federal level became important financing sources for DMOs.

John De Fries, CEO, Hawaii Tourism Authority, told Skift: “Until Full Year 2021-2022, HTA was funded by a dedicated portion of the Transient Accommodations Tax (TAT) charged by the state on hotel rooms and other short-term lodging. Every dollar invested in HTA returned $20 in state tax revenues. In their 2021 session, state legislators needed to balance the many needs of Hawaii’s residents with lower tax revenue projected from our heavily tourism-dependent economy. HTA’s budget was cut from $76 million to $60 million, and the dedicated funding from the TAT was removed.”

Exhibit 10: Government funding sources gained importance during Covid

With the hotel demand and occupancy rates tanked, DMOs became completely cash strapped. However, tourism is a major contributor to world economies and DMOs play a crucial part in developing and promoting tourism. Hence, to keep the show running most of the DMOs gained access to recovery funds to ensure that they can continue to provide critical business support and start to prepare for recovery.

Sixty percent of the respondents of our survey said that their DMO received recovery funds. 55% of the funds received came from the Federal government. The second biggest source was the State/Province government followed by the City/Municipal government.

Declining staffing levels

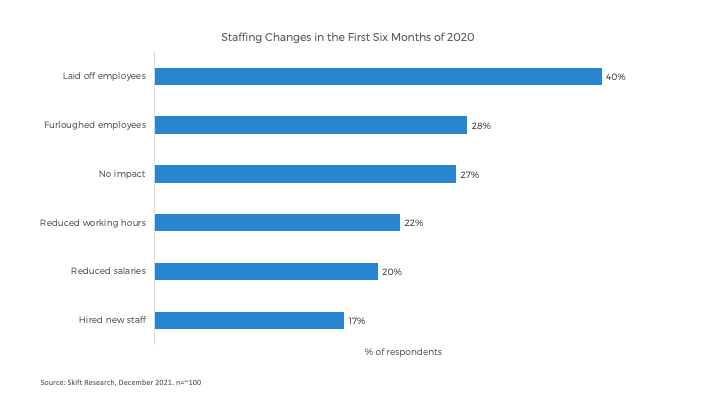

In 2020, 62 million travel jobs were lost, representing a drop of 19%, leaving just 272 million employed across the sector globally, compared to 334 million in 2019.

Destinations were no exception to this drastic workforce reduction. Forty percent of our surveyed respondents said that their organizations laid off employees in the first six months of 2020 and 28% said they furloughed employees during this time period. Survey results suggest that around a quarter of employees were laid off and furloughed.

In addition, 20% of surveyed organizations reduced the working hours and salaries of their employees. Although 17% say that DMOs hired new staff during the first six months of 2020, the number of employees actually hired is negligible. 27% of the DMOs in our sample managed to keep their staff size the same as in 2019.

Exhibit 11: Considerable share of employees in the DMO industry were laid off during the first six months of 2020

Marketing strategy underwent an overhaul

Marketing spend decreased

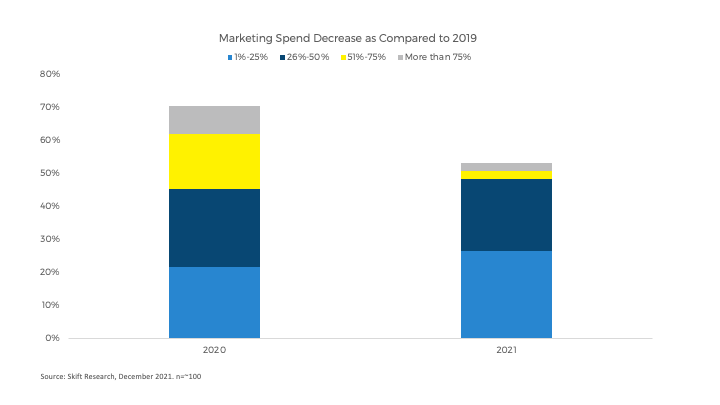

Marketing remained the foremost function of DMOs. Seventy-two percent of the respondents said that the marketing spends decreased in 2020 and the number for 2021, while better, was still at 54%.

The decrease in marketing spends in 2020 can be attributed to budget cuts overall but also insignificant travel demand. As Heywood from NYC & Company said, “When the pandemic started, we had nothing to market as people could not come.” As the situation got slightly better in 2021, DMOs started launching campaigns to lure travelers and ensure visitation as soon as travel restrictions were eased.

Exhibit 12: Marketing spend decreased in 2020 before slightly improving in 2021

Increased focus on domestic tourism

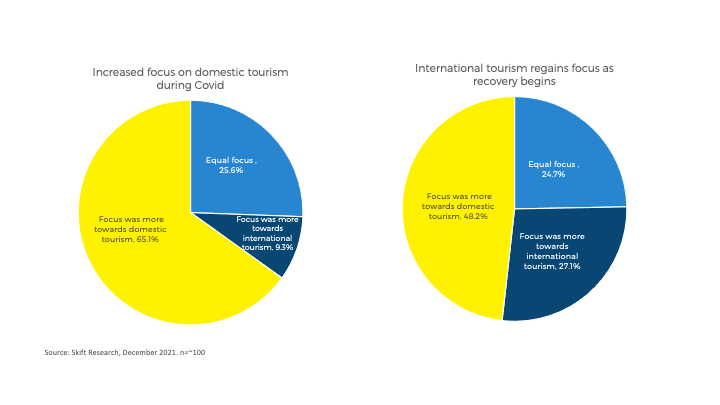

With wide spread restrictions on cross-border travel up until the recent few months, 65% of the respondents said that their organization focused more on domestic tourism during Covid as compared to 52% before Covid hit (refer exhibit 6).

For example, Chang Chee Pey, Assistant Chief Executive, Singapore Tourism Board commented: “Our marketing strategies had to evolve to target a new domestic audience. STB launched the SingapoRediscovers domestic campaign in July 2020 to encourage locals to explore different sides of the country and in December 2020, STB launched complimentary SingapoRediscovers Voucher Scheme that provided Singaporeans with $100 worth of tourism credits as an incentive to support local tourism businesses.”

Representatives from the Azerbaijan Tourism Board further solidified the importance of domestic tourism during the pandemic, they told Skift: “During the pandemic, one of the main roles added to ATB’s functions was the promotion of domestic tourism, creating accessible tourism products for locals, putting them into a domestic tourism platform and communicating them to relevant target audiences. Acting as a hub for industry partners, including tour guides, accommodation providers, tour agencies and operators, has become a new role too to support the human capital within the industry.”

Offline marketing channels take a back seat; Innovative marketing campaigns became crucial

Survey results reflected that while digital channels like social media marketing and search engine optimization continued to be the top most marketing channels, community building, email and influencer marketing got a few extra points in terms of their efficiency during the pandemic.

On the other hand, publicity events and offline advertising channels were proven to be ineffective marketing channels during Covid given the restrictions on holding gatherings and the risk of virus transmission.

Chee Pey at the Singapore Tourism Board told Skift, “During the pandemic, digital channels were critical ones that allowed us to engage with our target audience when we were unable to do so physically. We expect this to continue going forward.”

Exhibit 13: Digital marketing remained an impactful marketing channel during Covid

60% of the respondents of our survey said that their DMOs’ marketing message changed when the destination started witnessing signs of recovery from Covid based on changes in traveller preferences.

Slight recovery marked the beginning of in-the-moment marketing campaigns. For example, in January 2021 NYC and Company tweaked its very famous NYC Restaurant Week event to NYC Restaurant Week To Go. This simple change to make the most of the situation was a win-win allowing customers to enjoy favourite restaurants while staying at home at a bargain price, and allowing restaurants, many for the first time, to make takeout/delivery a revenue stream to help get through the winter months.

DMO roles accentuated further

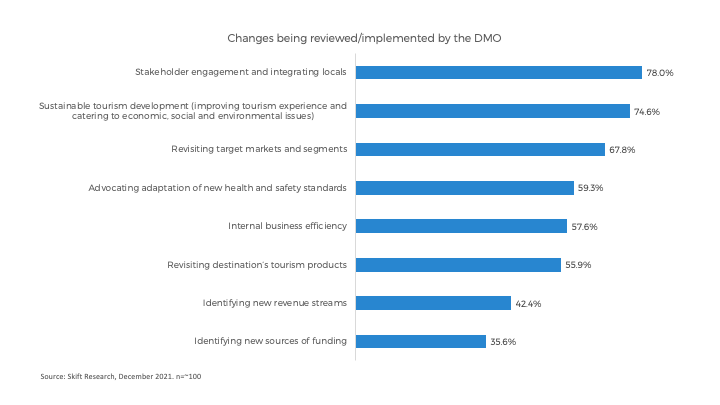

In the initial stage of Covid, in particular, DMOs around the world needed to encourage people to stop travelling. Even for destinations that bounced back faster thanks to a larger domestic travel market, the marketing focus needed to be on responsible and safe travel. According to our survey, 84% of the respondents said that their organization reviewed its primary roles and responsibilities as a result of the pandemic and 58% said that their organization changed its primary roles and responsibilities.

Stakeholder engagement, integrating locals, focus on sustainable tourism development and revisiting target markets and segments were the top few changes being reviewed at DMOs.

Other than the areas mentioned in the chart below, respondents highlighted that their organization’s main focus has been on transparent, timely communication, and brand positioning. Additionally, DMOs have been re-evaluating their membership models and made a shift from marketing members to marketing the entire destination.

Exhibit 14: In line with the changing industry landscape, DMOs reviewed and changed their focus areas

Recovery Timeline

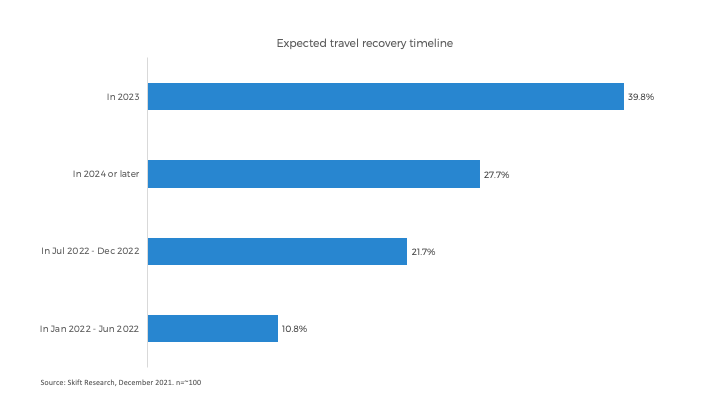

Forty percent of the respondents expect travel to reach pre-pandemic levels in 2023 while ~30% feel recovery might happen in 2024 or later. As per the survey results, recovery in 2022 seems a far-fetched possibility.

Exhibit 15: Recovery in 2022 seems a like a bleak possibility

As far as the pace of recovery by purpose is concerned, 93% of the respondents believe that business travel to their destination will recover slower than leisure travel. However, Robert Dougan, Executive General Manager of Strategy and Research, Tourism Australia told Skift, “Business demand is not as dire as it was expected to be. Leisure will definitely recover before business but the gap might be narrower.”

NYC & Company shared with us the expected timelines for recovery of travel volume by origin and purpose wherein domestic demand is expected to surpass 2019 levels in 2023 and international will breakeven in 2025. Similarly, leisure travel is expected to recover sooner in 2023 and business will follow in 2025.

Exhibit 16: Domestic demand and leisure travel is expected to recover faster as compared to international and business travel respectively

Movers and Shakers

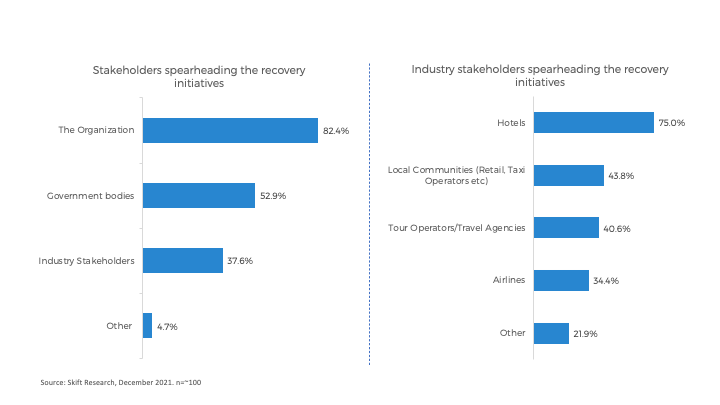

As per the survey, DMOs feel that they themselves are leading the way and spearheading the recovery initiatives, while they see hotels as leading industry stakeholder in spearheading recovery on the ground.

Exhibit 17: DMOs themselves are leading the recovery initiatives

What will 2022 Look Like for DMOs?

Increase in revenue

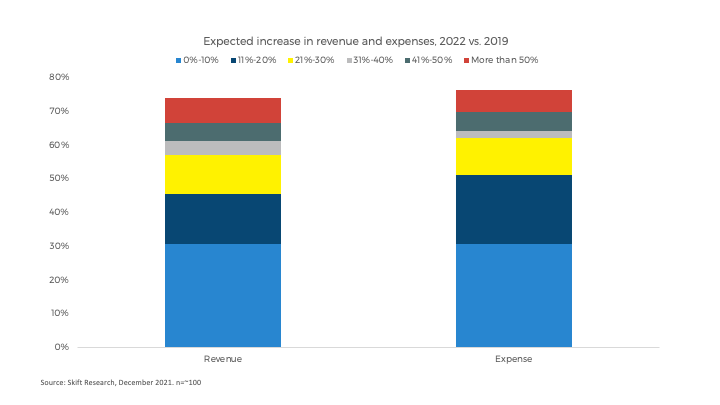

Our survey results indicate that the respondents are bullish on the fact that their organizations’ revenue will increase in 2022 as compared to 2019, with 60% expecting their revenue to increase in 2021 and 75% expecting their revenue to increase in 2022 considering 2019 revenue as the baseline. However, half of them believe that the increase will be less than 20%, indicating that the traveler volume is expected to recover only partially in 2022, quite so in line with the recovery timeline suggested by our survey results (refer exhibit 15)

Note that the survey was conducted in December 2021 and does not take into account the impact of the Omicron variant. The recovery might be further suppressed if destinations levy travel restrictions again.

Nina Zantout, Head of Strategy and Deputy Director Destination Management & Corporate Development, visitBerlin confirmed that full recovery in 2022 is a bleak possibility, “visitBerlin receives public funds for its tasks in Destination Management and Marketing and generates its own revenues through product sales. ~55% of our budget is own revenues. We received additional funding out of the recovery fund from the City of Berlin for the tourism sector in 2020 and 2021 in order to intensify the Berlin marketing, initiate new campaigns and to support the industry with tourism know-how. We do not expect to reach the same budget in 2022 as in 2019.”

On the expense side, it is notable that the expected increase in expense is exactly in line with revenue expectation, pointing towards the increased confidence of DMOs in handling the ever-changing Covid situation as compared to the situation in 2021 where expense increase was behind revenue increase and destinations were cautious of overspending (refer exhibit 9).

As far as expense allocation is concerned, DMOs are being nimble and are using their resources judiciously to get quick returns. Dougan from tourism Australia stated, “There are two major shifts in budget allocation. One, we have increased investment in the industry. And second, in the short term a higher ratio towards partnerships and conversions – we want to get people in the country as soon as possible once borders reopen.”

Exhibit 18: DMO expenses are expected to increase in line with increase in revenue in 2022

Funding sources come to a full circle

Most organizations believe the Covid-induced funding changes are transient and once we put the pandemic behind us, their funding sources and amounts will be back to pre-Covid level or continue to grow. Among all the surveyed respondents, 80% said they expect their organizations to get more funding post-Covid compared to 2019.

Respondents expect hotel transient tax to return back as the leading source of funding post-Covid. Advertising revenue and membership fees which were not contributing substantially before Covid are expected to become significant funding sources going forward.

However, 73% of them agreed with the statement “My organization will seek to develop new sources of funding”, indicating changes in the original balance of funding sources. Heavy reliance on hotel tax related funding is being contested in the industry and many industry experts believe that the hotel bed tax should no longer be the sole source of funding for their activities.

Lebawit Lily Girma, Global Tourism Reporter at Skift discussed the funding crisis at destinations in her recent article. Kristen Jarnagin, CEO of Discover Long Island is quoted in the article saying: “I personally think the industry long-term needs to diversify beyond just hotels because of what we’re going through right now and, just like any other corporation would in America, you would look at any funding stream you had to be successful, and that’s exactly what we should do.”

Forty percent of the respondents also said that their organization expects to receive recovery funds in the future with the major source expected to be the Federal government, suggesting that DMOs will not be all out of the woods as yet and will still need outside support in 2022.

Exhibit 19: Hotel transient tax is expected to become the dominant source of funding post-Covid

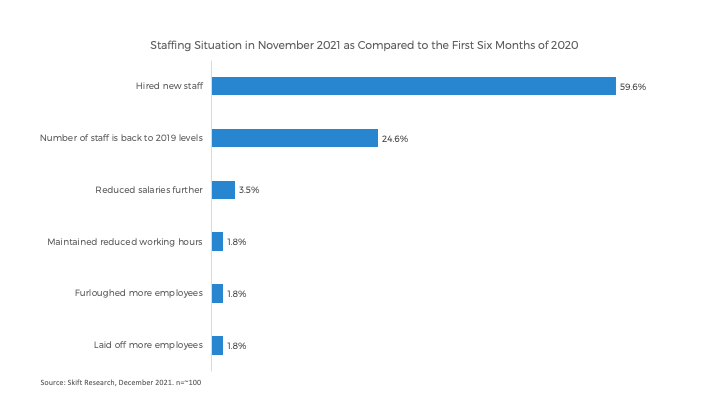

Staffing levels to stabilize

In 2021, as the demand for travel began to strengthen in line with the easing of restrictions and the recovering domestic market, the labor supply in the travel sector was unable to match the rising labor demand, particularly during the second half of 2021. Many countries, especially the U.S. and some European countries, showed significant staff shortages, with employment demand starting to outstrip the available labor supply.

Our survey results represent the same trend in late 2021, with 60% of the respondents saying that their organizations hired new staff while only 25% of them were successful in taking the number of staff back to 2019 levels.

According to World Travel & Tourism Council’s latest economic projections from October 2021, travel sector’s employment is set to rise by 0.7% in 2021, representing 2 million jobs, followed by an 18% increase in 2022 to reach 324 million jobs – only 10 million below 2019 levels. Considering that DMOs will follow the overall industry trend, staff levels are expected to stabilize in 2022.

Exhibit 20: Staffing levels in DMOs is expected to stabilize to a certain degree in 2022

Marketing trends

Marketing spend to increase moderately

77% of the survey respondents believe that marketing spends will increase in 2022, with around half of them saying that the increase will be less than 25% indicating that DMOs’ marketing budgets will remain tight and they should define their marketing focus and allocate resources carefully.

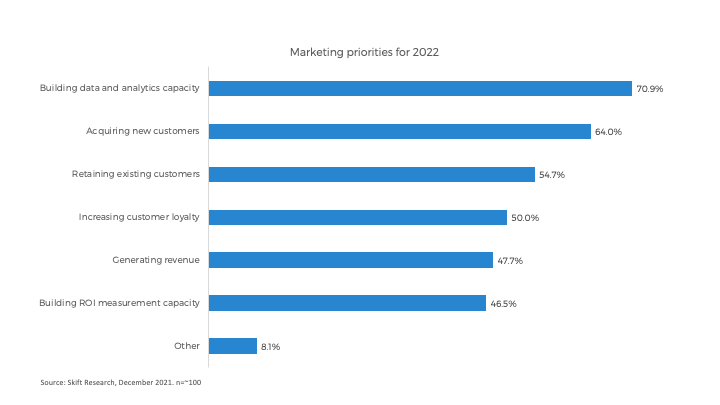

Marketing priorities adjusted

Building brand and destination awareness was rated as the most important marketing priority for 2022. Chee Pey at the Singapore Tourism Board commented, “The most significant shift in STB’s marketing was from driving visitor arrivals and spend, to retaining destination mindshare globally. Our priority is to make Singapore the destination of choice, as consumers prepare to travel again.”

The priority next in line is to pursue a yield-driven marketing approach by building optimal data and analytics capacity. With limited funding and resources to channel, DMOs have realised the importance of taking a highly targeted approach. Heywood at NYC and Company told Skift, “We have to be very nimble in what channel to use, following the opportunities we are presented with, for example, we have shifted our resources from the Chinese market – we are simply doing a very targeted marketing. We will fish where the fish are.”

One of the major lessons for DMOs during Covid has been to diversify their revenue streams (42% of the respondents said that their organizations started to identify new revenue streams after Covid hit – refer exhibit 14). Over-reliance on a few markets has significantly challenged their revenue base and operations during the crisis. Hence, acquiring new customers, rated as a top marketing priority by the survey respondents, ought to be a crucial strategy in the years to come.

Retaining existing customers, ensuring repeat visitation, building return on investment measurement methods and generating revenue remain other marketing priorities for 2022.

Exhibit 21: DMOs look to adjust their marketing priorities in 2022

International tourism regains importance

Twenty-seven percent of the survey respondents said that their organizations will focus more on international tourism as recovery begins as opposed to 9% of them saying that their organizations’ focus was international tourism during Covid.

Despite the surge in domestic tourism during Covid, DMOs are bent towards investing in international tourism as that is where the major chunk of tourism revenue comes from. Heywood from NYC & Company told Skift, “In New York, 50% of our spending comes from international travel. Currently domestic is important – it is 80% of the volume right now, however, getting back international is crucial for the industry. It is basically a concentric recovery where the focus was first on hyperlocal, then on local/regional, followed by domestic and then international markets.”

Exhibit 22: International tourism is expected to regain importance once recovery begins

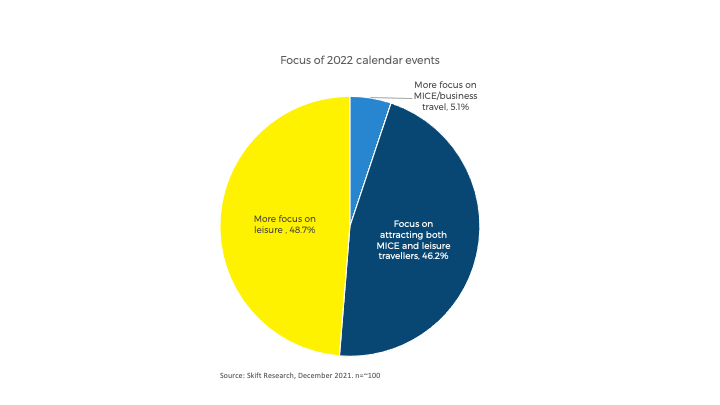

Business tourism starts to regain importance

When asked about the focus of their organization’s calendar events for 2022, 46% of the respondents said that the organization will focus both on leisure and business tourism, signifying that despite of an expected lag in the recovery of business tourism, DMOs are willing to dedicate their time and resources in reinvigorating business demand.

Exhibit 23: DMOs aim to focus both on leisure and business segments in 2022

Through our discussions with DMOs like NYC & Company, STB and Azerbaijan Tourism Board, we recognise that they are already pushing campaigns and promotions focusing on business tourism revival.

Marketing messages to be modified

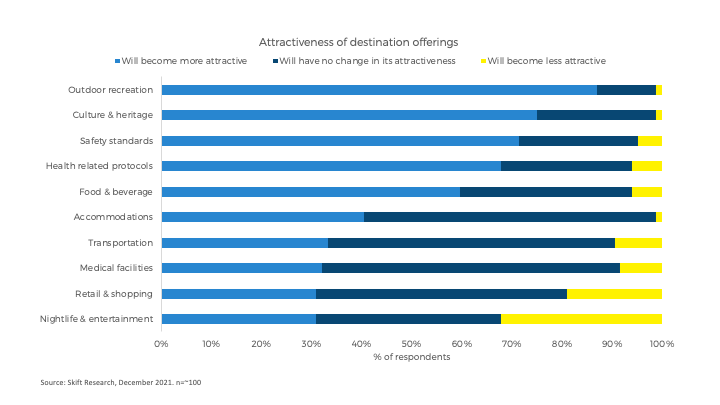

83% of the survey respondents believe that marketing messages will have to be changed once their destination has fully recovered from the impact of Covid.

Attractiveness of the facets/offerings of the destination will also change in line with evolved traveler preferences. Results suggested that outdoor recreation and cultural heritage become key products to be marketed post Covid. In addition, undoubtedly, health related protocols and safety standards are bound to become important factors to attract tourists in 2022.

Under its It’s Time for New York City campaign, NYC & Company shows how they used the culture and heritage facet to invite visitors right when the U.S. international borders were reopening. Right before the start of the holiday season, the DMO invited locals and visitors to enjoy holiday traditions and cultural experiences across the five boroughs, many of which are in person for the first time in two years.

Keeping the need for health and safety, destinations are opening their borders cautiously. As Chee Pey at the Singapore Tourism Board told Skift: “In recent months, Singapore launched Vaccinated Travel Lane (VTLs) with over 20 markets, allowing fully vaccinated travellers to travel without quarantine after closely monitoring source markets and ascertaining travel demand. STB also partnered with ClassPass to jointly promote Singapore’s wellness offerings and enhance the city’s attractiveness as an urban wellness destination.”

Other facets which are set to become very important once destinations recover from the pandemic are accommodations and food & beverage outlets.

Exhibit 24: Attractiveness of destination offerings is expected to change in line with changing traveler preferences

However, the post-Covid phase will bring its own share of struggles for the DMOs. In order to eliminate the risk of virus transmission yet again, DMOs will have to be extra careful in which source markets to target and when. Heywood at NYC & Company discussed, “Now international has reopened. It is getting much better – we need to understand that the vaccination situation is different in each country and everyone might not be able to follow the requirements to enter our country.”

Marketing channels to maintain balance but few innovative approaches expected to transpire

In the near term, digital marketing channels are expected to maintain their supremacy as post advent of the pandemic. However, partnership marketing, community building, and cross-DMO collaborations are expected to gain importance in the coming years as compared to the pre-Covid setup (refer exhibit 13).

Partnership marketing to pick up

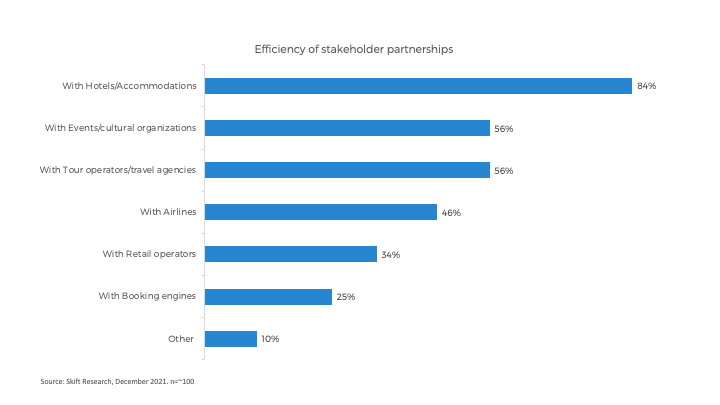

Eighty-six percent of the survey respondents said that their organization is actively partnering with tourism stakeholders, like airlines and hotels, to work towards the common goal of bringing back travelers. The results further suggest that 84% of the respondents believe that partnership with hotels turn out to be the most fruitful and efficient.

It is important to mention that based on the survey results, we believe that DMOs have a natural tendency to favour hotels over other travel partners (later in the report we will see that DMOs vote eco-conscious products and services of hotels as the most attractive tourist offering). This bias can be attributed to the fact that hotel transient tax was a major funding source pre-Covid and the trend is expected to continue and hotels are much more closely tied with the local economy that destinations represent than other travel segments (refer exhibit 19).

Exhibit 25: DMOs believe that partnership with hotels turn out to be the most fruitful and efficient

NYC & Company’s It’s Time for New York City tourism campaign that we mentioned earlier is a good example of partnership marketing. As part of this campaign, the DMO formed a partnership with British Airways with billboards installed in the UK to promote eight daily flights to Gotham.

They also collaborated with Virgin Atlantic along with British Airways, and hosted an event to commemorate the opening of U.S. borders to vaccinated travellers with the aim of creating a buzz and attracting more British travellers. Heywood from NYC & Company in an interaction with PR Week said, “The thing that equates to success is having the power of partnership and having different people bring their strengths to the table was what really propelled this event from being something that could have just been a run-of-the-mill reception to something that garnered a lot of media attention.”

Similarly, Tourism Australia launched the National Experience Content Initiative, a new $12 million media creation program aimed at supporting tourism businesses across the country in their recovery and driving increased visitation by helping them to better market their experiences and attractions.

Cross-DMO collaborations on the rise

About 60% of the respondents said that their organization is exploring cross-DMO collaborations to rationalize costs and standardize basic functions.

Destinations Put Aside Old Rivalries With New Combined Marketing, a recent article by Skift, talks about how the new ‘friends not rivals’ approach to marketing destinations might just get more traction from today’s changed traveler.

One good example to showcase such partnerships is the #ThroughMyWindow campaign put together by the Los Angeles Tourism & Convention Board, NYC & Company and San Francisco Travel in April 2020. Through this campaign the DMOs encouraged those who live in their cities to share their views with the hashtag #LAThroughMyWindow, #NYCThroughMyWindow, and #SFThroughMyWindow. The idea was to provide a virtual window into each other’s cities, a sign of unity and support.

However, we believe that this is an interim strategy, as navigating joint messaging amid varied target markets across destinations will be a challenging task once they have fully recovered from the pandemic.

Community engagement to grow

Around 90% of the survey respondents said that their organization has started focusing more on building local/community partnerships.

Over the last few years, destination marketing has broadened and shifted to a more cohesive community outlook. Locals have a direct influence on the visitor experience, from being welcoming, sharing their culture, creating safe and secure environments, to spreading positive stories about the destination. On top of that, destination organizations have increasingly realized that bringing in tourism should be integrated into building local community and culture and improving the quality of life for the local residents.

Denaye Hinds, managing director of JustaTaad, a sustainability consultancy firm and a board member for the Center for Responsible Travel, during the Skift Destination and Sustainability Summit held in July 2021 discussed: “Tourism starts before getting on the plane and taking that trip, and getting that responsible message across to future visitors is where the opportunity also lies as far as including communities in marketing messaging.”

A recent article by Skift, Lebawit Lily Girma mentions, “As tourism returned, doubts lingered as to whether tourism boards would keep prioritizing their residents and continue to market to them. At Skift Global Forum, leaders of California and Florida tourism indicated that the shift was here to stay, and that they would continue to market to their insiders as local marketing campaigns had been well received with pent up desire from locals to explore their backyard and support their homegrown businesses.”

DMO roles on the backburner come to the forefront

DMOs will continue to find their footing in the new travel landscape. The chart below shows how some of the DMO functions are expected to broaden massively to keep up with the changing trends and patterns owing to the pandemic.

Exhibit 26: DMOs continue to find their footing in the new travel landscape

Increased emphasis on Sustainability initiatives

In the post-Covid world, we found that sustainability initiatives are at the top of destination professionals’ minds. While only 34% stated their organizations worked on sustainability initiatives in 2019, 74% said their organizations will work on them post-Covid.

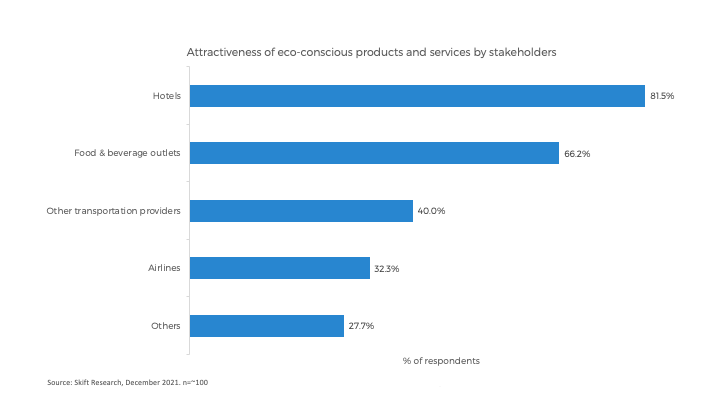

Eighty-three percent of the respondents feel that there is a need to provide eco-conscious travel options given the focus on climate change and sustainability issues post Covid. And among the travel products offered by various travel providers, destination professionals believe eco-conscious products and services offered by hotels and food & beverage outlets will be the most attractive to travelers.

Exhibit 27: Destination professionals believe eco-conscious products and services offered by hotels will be the most attractive to travelers

Furthermore, 50% of the respondents said that their organization started working on developing methods and advocating for regulations that can prevent over-tourism and/or managing its negative multi-facet effects for the purposes of advanced sustainable development as a result of Covid. As one respondent shared, “Emphasis will be on sustainable practices with dispersal of tourists so that the threshold hold capacity of a tourist destination does not cross its limit.”

However, industry experts believe that although sustainability practices are being included in their strategic agenda on a theoretical basis, for now it has been put on the backburner as the need of the hour is to get tourism going by any means possible. Dougan from Tourism Australia commented, “Undoubtedly, sustainability and tourism go hand in hand, however, currently we need cash in the industry to survive and to remain competitive. Labour shortage and the ability to service demand are the things the industry should be much worried about.”

Airport route development and overall stakeholder engagement resurge as key DMO functions

While only 25% said that their organization focused on airport route development in 2019, 40% said that their organization will focus on it going forward.

Dougan at Tourism Australia, told Skift: “We will have to focus on more support areas – from our core function of marketing to a much higher degree of aviation engagement, distribution engagement, industry engagement as well. We have set up programs to help the industry become more competitive, to help industry stakeholders do the right marketing. We also have been very active in talking to airlines in keeping them informed of what is happening in Australia. Trade and Aviation are crucial to keep it going.”

Increased emphasis on economic development, and crisis management is expected to continue. Over and above the functions mentioned in the chart above, respondents listed policy development, political advocacy, increased accessibility with round the clock communication options for visitors and residents as other functions that are expected to become important post Covid.

Heavy investment in Data

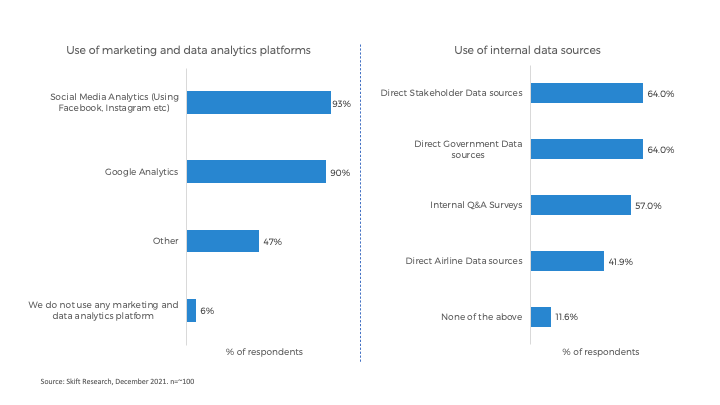

Tourism research and data was already of significant importance to DMOs before the pandemic, with 80% respondents mentioning it as a key function of their organization. In the post-pandemic phase, 90% of the respondents voted it as a key function. As we have already mentioned above, budget restraints due to Covid have made it essential for DMOs to take a more targeted approach with respect to internal business practices and their overall strategy to efficiently utilise the budgets available. As Heywood at NYC and Company said, “We are as good as our data.”

Survey results show that Google and social media analytics are used ubiquitously by DMOs. At the same time, internal data sources from stakeholders and the government are also being used to make informed decisions.

The Roadmap for Tourism’s Reimagining and Recovery document published by NYC & Company in July 2020 shows how they track essential data to define their success metrics. A few of the metrics tracked by them are measuring changes in search terms, site traffic, social media engagement, social listening, custom/proprietary traveler sentiment surveys. The DMO even tracks indices like the performance of hotels, shopping trends and regional mobility.

Exhibit 28: Google and social media analytics are used ubiquitously by DMOs along with direct stakeholder data sources

To conclude, the overall objective of creating demand, boosting visitor numbers and spending will require all facets of the DMOs to function in perfect harmony in 2022. We believe that 2022 will be a pivotal year of laying the groundwork for the DMOs to build back better in a real sense. Identification of new revenue and funding opportunities, streamlined internal operations, implementation of performance measurement metrics, use of sophisticated data and analytics and targeted marketing along with significant focus on health & safety, sustainability, partnerships and community building are some of the interesting changes that the DMO landscape will entail in 2022.

We’ve received many uplifting comments from our surveyed destination management professionals that echo the above message. We will end the report with messages from a couple of respondents that capture the essence of the work that many DMOs are planning to do:

“In 2022, we will focus more on the health and safety aspects of our industry partners – and promote the Safe Travel Stamp and all businesses that are certified. We will also feature the outdoor attractions more than we have in the past. We will also focus more on the sustainability message across all markets – travel trade, business events and leisure. We will ensure that all of our messaging demonstrates that our destination is welcoming and inclusive to all.”

“Our offer will develop considering the wants and needs of our target groups putting them in accord with those of our residents and stakeholders. We aim to become a safe and friendly destination for them offering a better quality of life, products and services, making our destination a nice and interactive place for all our long or short-stay residents and visitors. In addition to the safety messaging, we’re talking about increasing awareness around sustainability and environmentally friendly ways to travel.”

“More than ever we’ve seen the importance of being nimble so will be much more flexible with our messaging and advertising placement. There will be new customers’ needs to be answered in our marketing communication, it will focus more on safe travelling, health information, new digital services – and we will continue to be a home-away-from-home and will welcome visitors to take part in the locals‘ life.”