Report Overview

We check in on the current state of Expedia and Booking Holdings, the big two online travel agencies in the U.S. and Europe, as they recover from the COVID-19 pandemic.

In the short-term, Booking Holdings and Expedia Group are both recovering nicely from the depths of the COVID-19 pandemic. We look at how growth rates, regional strategies, and marketing efficiency are shaping up into year end.

We also take a long-term perspective on how the online travel business model is evolving and what changes Expedia and Booking are making in return. Expedia is focused on launching loyalty and B2B partnerships. Booking Holdings is investing in new tech, including apps and fintech, and in matching Expedia’s cross-sector offering.

What You'll Learn From This Report

- How Expedia and Booking’s Gross Bookings, Revenue, and Profits are recovering post-pandemic.

- Marketing efficiency for Expedia and Booking year-to-date including how web traffic is shifting and relative returns on investment.

- A look into the long-term dynamics that are redefining the online travel space.

- New initiatives that Expedia and Booking are investing in for 2023 and beyond.

Executive Summary

We check in on the current state of Expedia Group and Booking Holdings, the big two online travel agencies in the U.S. and Europe, as they recover from the COVID-19 pandemic.

In the short-term, Booking and Expedia are both recovering nicely from the depths of the COVID-19 pandemic. Booking is growing faster as Expedia’s airline exposure is a drag. Booking continues to make headway in the U.S. and saw notable progress during the pandemic though Expedia still holds the lead in North America.

Sales and Marketing spend continues to be a major expense and we see little signs that performance marketing efficiency is improving post-pandemic. However, both have invested heavily in brand marketing, loyalty, and new product offerings to drive customer interest and are seeing these initiatives pay dividends in the form of direct or organic search traffic.

We also take a long-term perspective on how the online travel business model is evolving and what changes Expedia and Booking are making in return. Expedia is focused on launching loyalty and B2B partnerships. Booking Holdings is investing in new tech, including apps and fintech, and in matching Expedia’s cross-sector offering.

The travel industry is shifting and Expedia and Booking are revamping their strategies, but both remain formidable travel competitors.

State of Recovery

Expedia Group and Booking Holdings as the big two online travel agencies in the U.S. and Europe are important bellwethers to understand how the online travel space is recovering from the COVID-19 pandemic. With third quarter 2022 earnings behind us, let’s check up on how these two businesses are performing.

Travel Industry Context

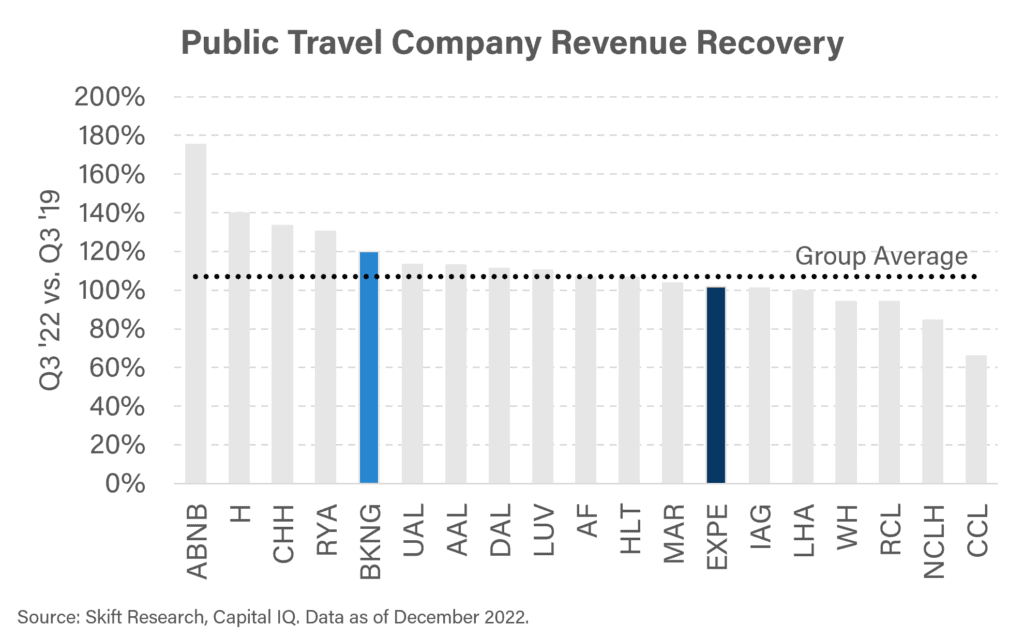

In terms of revenue recovery, online travel stacked up nicely compared to other travel public companies. Airbnb is the superstar leaving all others behind. Hyatt, Choice Hotels, and Ryanair outperformed Booking Holdings to round out the top five. Expedia is slower to recover, but still is above similar 2019 levels of revenue and is outperforming European airlines like IAG Group and Lufthansa, which were plagued by airport backups this summer. The worst ranking are, unsurprisingly, the cruise companies.

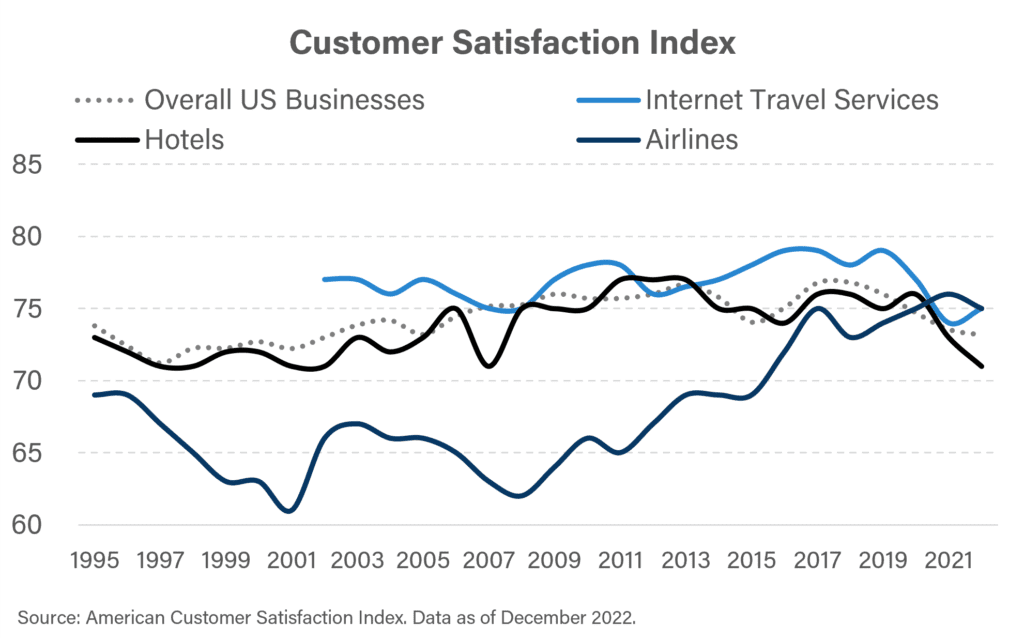

While we are comparing online travel agencies to other travel sectors, it is interesting to check in on customer satisfaction scores. The American Customer Satisfaction Index benchmarks how companies and sectors appeal to shoppers over time and relative to one another. Pre-pandemic, the online travel sector had higher satisfaction scores than the broader hotels or airline sector linked to value pricing, online convenience, and predictable experiences.

However, the pandemic appears to have plunged booking sites into a customer service crisis, with scores falling by four percentage points from 79 in 2019 to 75 today. In contrast the overall score for all U.S. businesses only fell by three points to 73. And surprisingly, airline scores grew by one point. Today for the first time ever, customers report the same level of satisfaction using an airline as they do using an OTA.

Online travel receives the lower satisfaction scores for their cancellation policies, promotions, and loyalty programs. We also think that a large part of the issue is that customers don’t trust online booking sites to deliver on complex itineraries when schedules break, as they so often have this summer and during the pandemic broadly.

On the plus side, OTA satisfaction was high with regards to mobile apps and ease of bookings. The ability to deliver a strong customer experience will become an increasingly important tool, in our mind, that booking sites will need to use to stand out from their competitors and peers.

Booking vs. Expedia Recovery

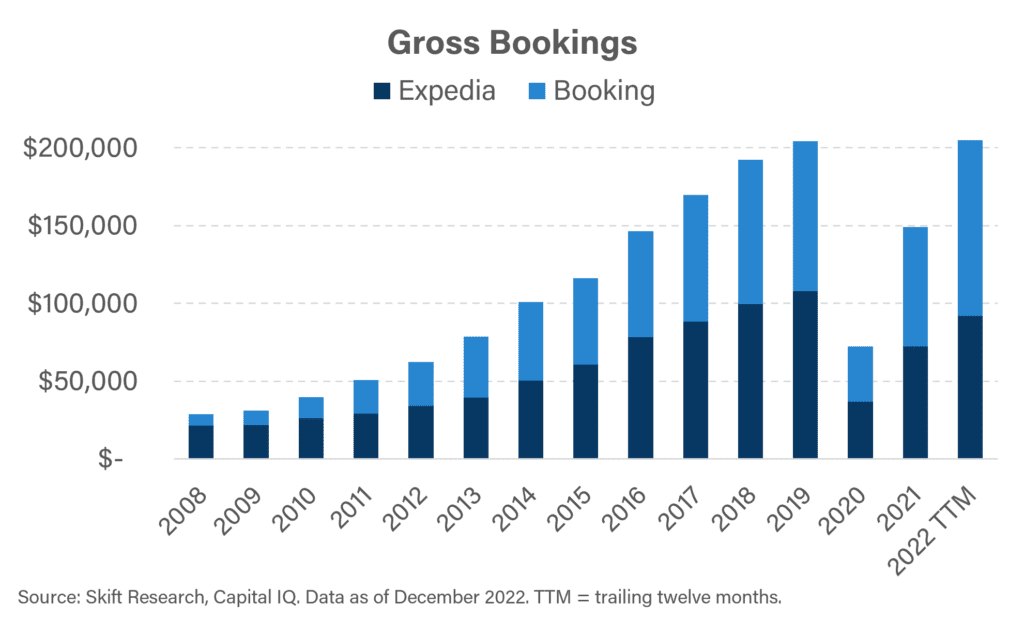

When looking at the big two in aggregate, we can see that the market for online travel gross bookings is reaching the point of full recovery. Together, Expedia Group and Booking Holdings drove $205 billion of gross bookings in the trailing twelve month period ended September 30, 2022. That puts the two just over their 2019 record of $204 billion gross bookings.

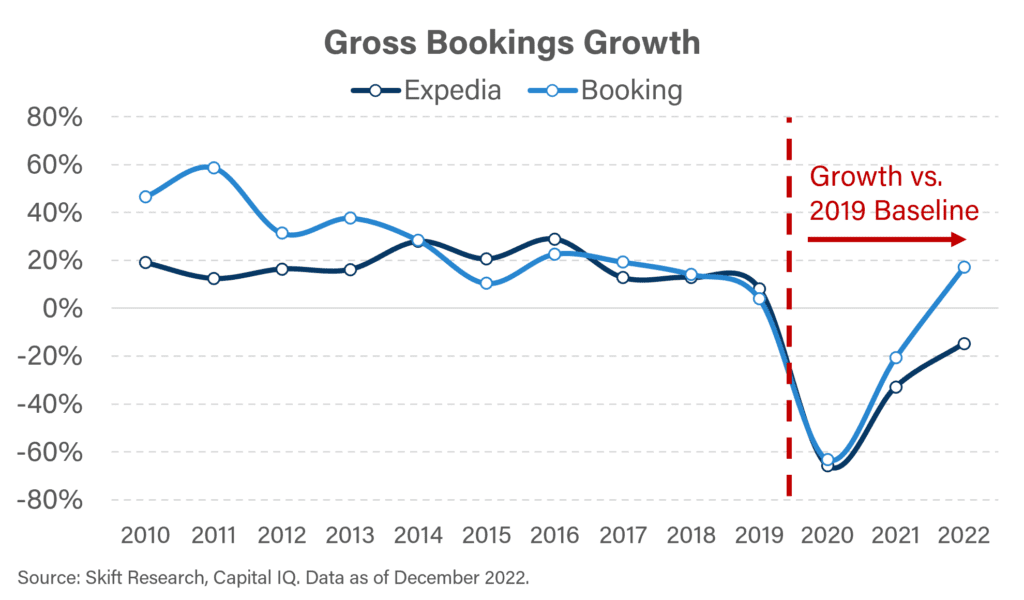

However, this top-level trend masks important company differentials. Expedia Group and Booking Holdings historically grew gross bookings at a very similar pace. Each grew at a mid-teens level before the pandemic and both fell by ~60% in 2020. Yet the two have performed quite differently to date with Booking Holdings achieving gross bookings 17% greater than in 2019 while Expedia Group is still 15% below that year.

We attribute this mainly to the different product mixes that each website offers. Booking.com’s inventory is almost entirely accommodations. Further bolstering Booking.com is that 30% of its room nights in Q3 ‘22 came from alternative accommodations – the hottest subsector in the entire travel industry (see Airbnb’s revenue recovery above). In contrast, Expedia has a larger mix of airline tickets in their bookings mix. Air was 6% of Expedia Group’s revenue in Q3 ‘2019 and that segment is still under heavy pressure.

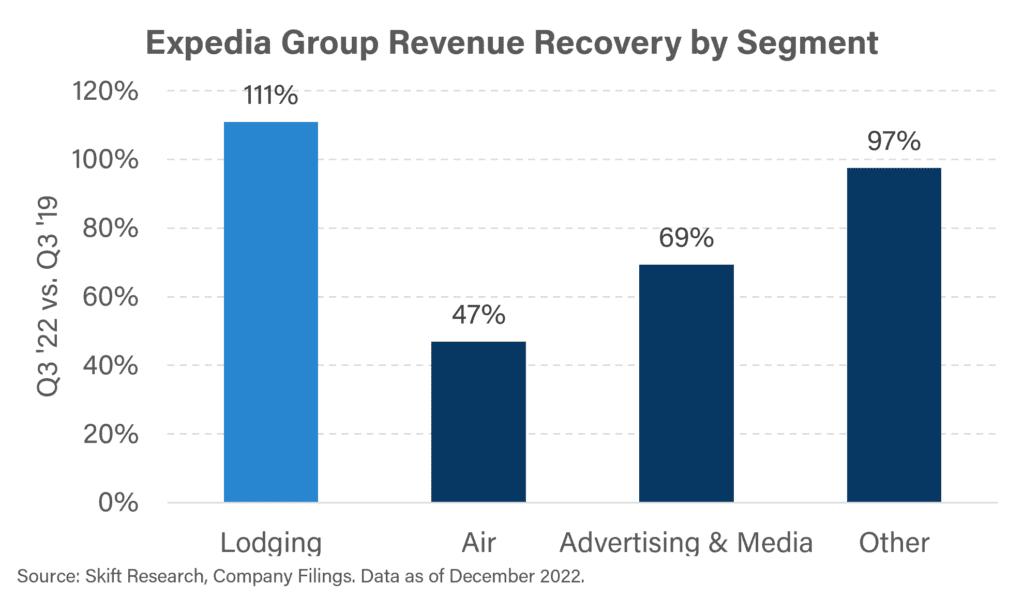

If we examine Expedia’s performance by segment we find that lodging revenue in Q3 2022 was 11% higher than in the same period in 2019, much closer to the performance that Booking Holdings is posting. But Air ticketing is not even half way back to equivalent 2019 levels. Advertising, primarily Trivago, is also holding back Expedia’s recovery.

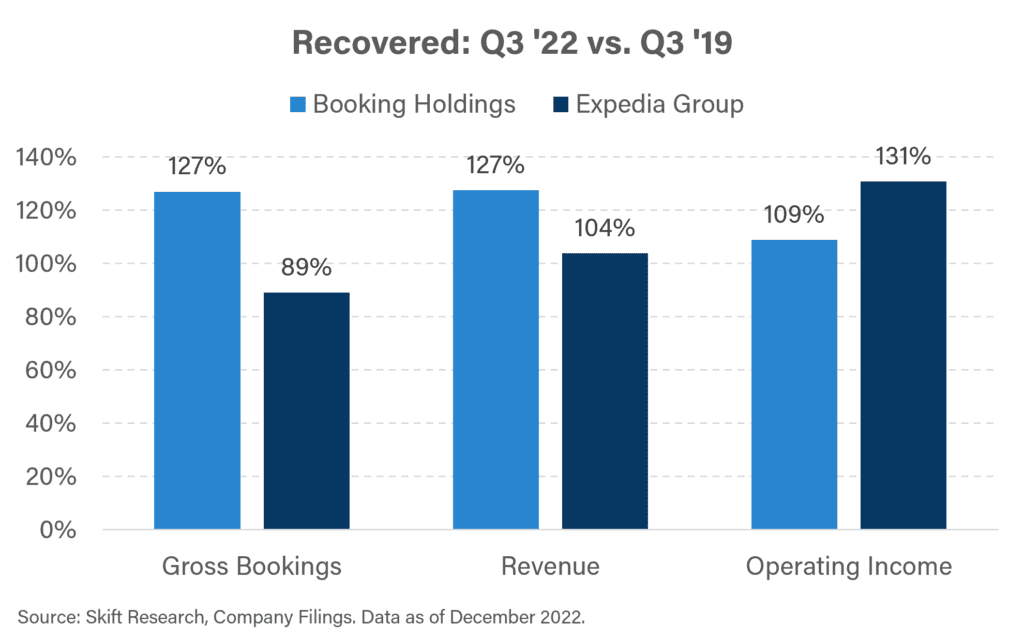

Let’s look at how other important financial measures stack up at Booking and Expedia in the third quarter of 2022 relative to 2019.

As discussed, Booking Holdings gross bookings are growing while Expedia lags, largely due to the lodging vs air mix. Despite this Expedia’s revenue has been made fully whole, because Lodging carries a significantly higher commission. And so while the shift away from lodging has held back Expedia’s Gross Bookings recovery, the mix has benefited its overall take rate and led to a much smaller differential between Expedia and Bookings on the basis of revenue recovery.

Interestingly, when it comes to operating profit, Expedia is actually outpacing its 2019 earnings by 31% while Booking is up 9%. Booking is still running a higher overall operating margin than Expedia, 42.6% vs. 22.1%, but Expedia was able to generate more incremental operating leverage through expense cuts over the last three years.

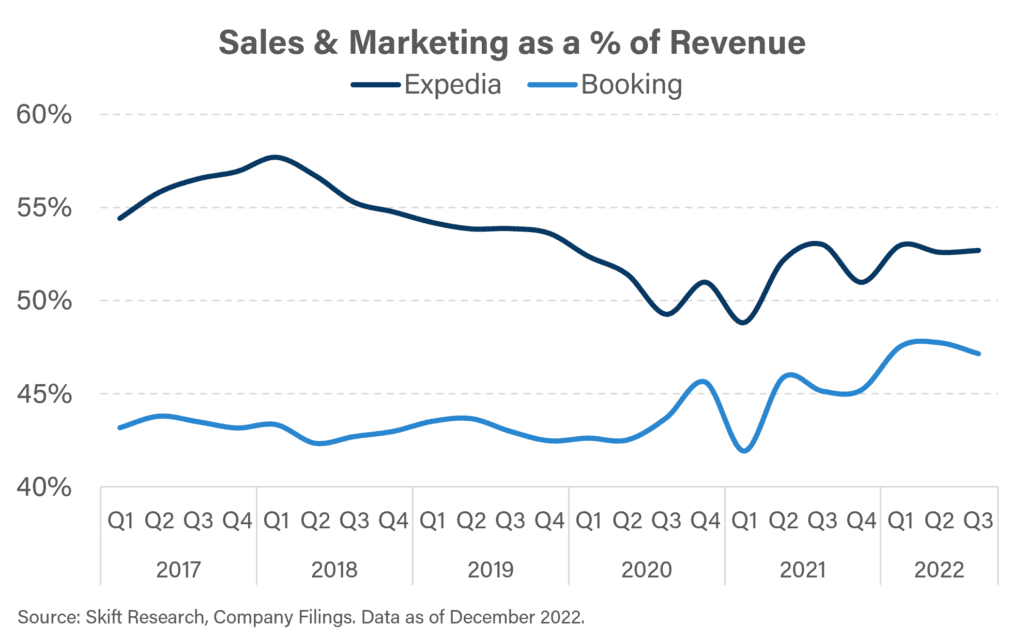

This trend of incremental operating leverage at Expedia while Booking retains an overall better margin, shows up clearly if we look at sales and marketing relative to revenue at each company. Sales and marketing is typically the single largest expense line item for an OTA and so examining it closely gives us a good understanding of overall margin.

Over the trailing twelve months leading up to September 2022, Expedia spent 53% of the revenue it earned on sales & marketing. That’s high. More than the equivalent invested by Booking Holdings. But in September of 2019, the same common size S&M metric for Expedia was 54% and in even earlier years like 2017 and 2018 that ratio could be as high as 55%+.

In contrast, Booking Holdings spent 47% of revenue on S&M in TTM Q3 ‘22, up from 43% in Q3 ‘19. Expedia saw a one point gain in S&M leverage while Booking experienced a four point decline – a net differential of 5 percentage points. These seem like small percentages but when multiplied by billions of revenue it adds up to major shifts in operating dollars. This explains why Expedia is at 131% of 2019 operating revenue while Booking is at 109% even as Booking saw a much faster recovery of Gross Bookings and a better overall operating margin.

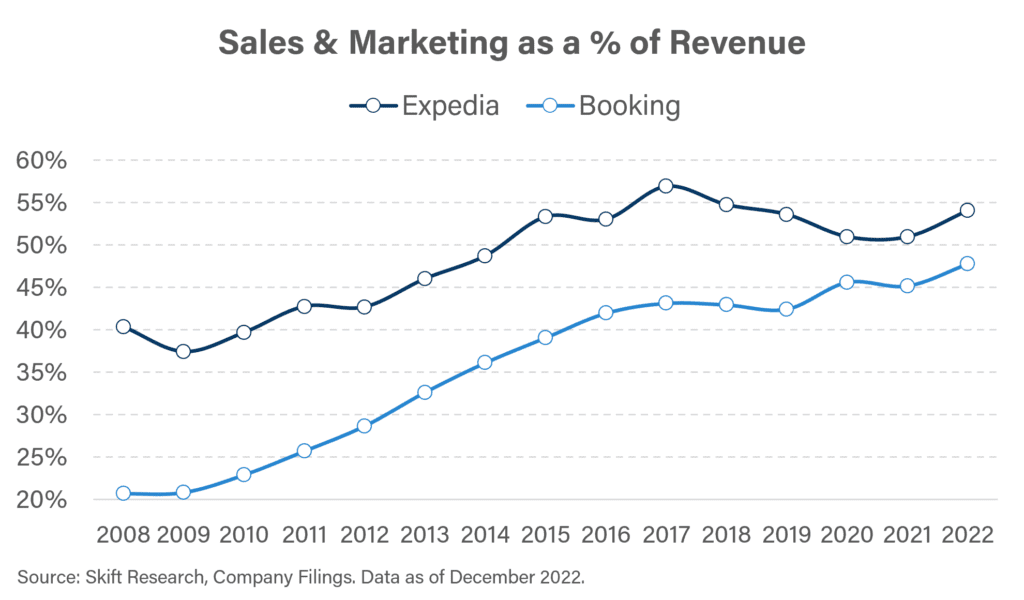

Common size sales and marketing dating back to 2008 shows a long-term trend of Expedia and Booking slowly converging towards parity on their marketing budgets but Booking still retains the overall edge.

Booking’s U.S. Expansion

Why is Booking stepping up its sales & marketing in relative terms faster than Expedia? One answer might be that Europe, Booking’s home base, has been slower to recover, thus creating a need for the company to invest in inorganic traffic to bolster sales. Another possibility is that Booking is investing heavily in expanding to the U.S. Booking has made clear it wants to expand even further into Expedia’s home turf but that won’t come fast or cheap.

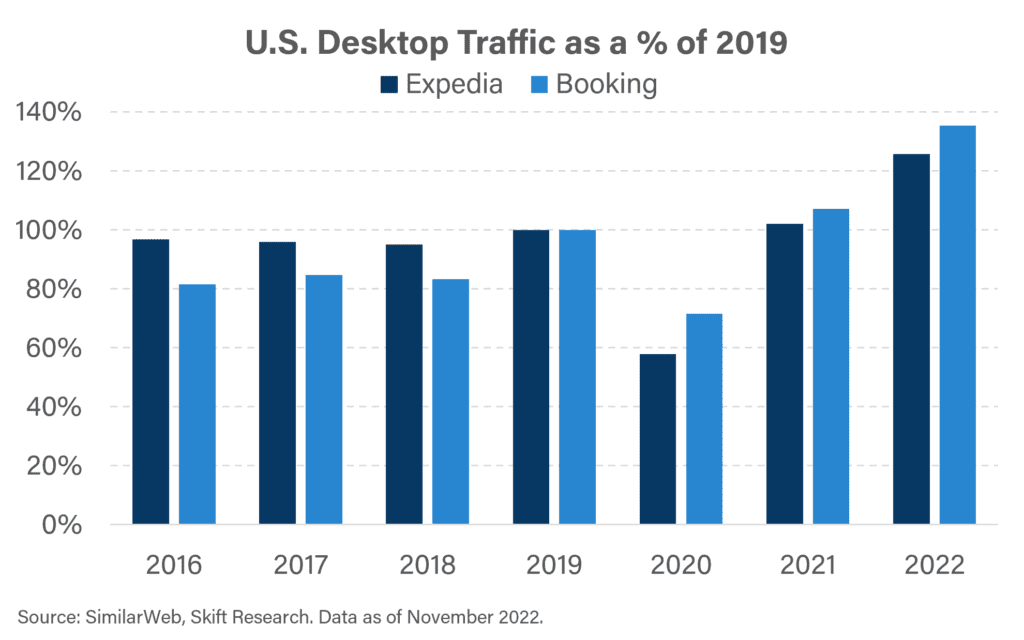

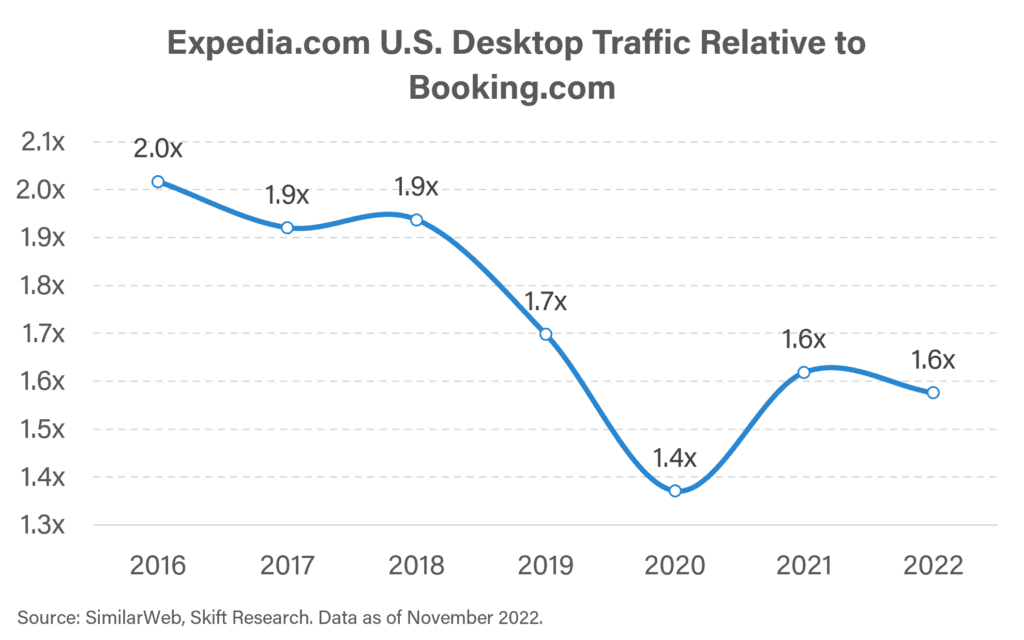

U.S. desktop traffic data from SimilarWeb suggests that booking.com is making headway against expedia.com. We started by aggregating average monthly U.S. desktop traffic volumes for each site by year. Benchmarked to a 2019 baseline booking.com’s traffic today is 35% higher than pre-pandemic while expedia.com grew by 26%.

To chart that more clearly, we directly compared traffic volumes between the two sites, from 2016 – 2018 expedia.com would regularly receive ~2x as much traffic as booking.com. That dominance fell to 1.7x traffic in 2019. Today expedia.com receives 1.6x more traffic than booking.com

This is a basic analysis and doesn’t include mobile traffic or other Expedia Group domains like hotels.com or Orbitz. However, the directional trend is clear to us that Booking is slowly gaining traffic share over its rival in the U.S. even as it remains quite clearly the second fiddle across the pond.

Web Traffic Trends

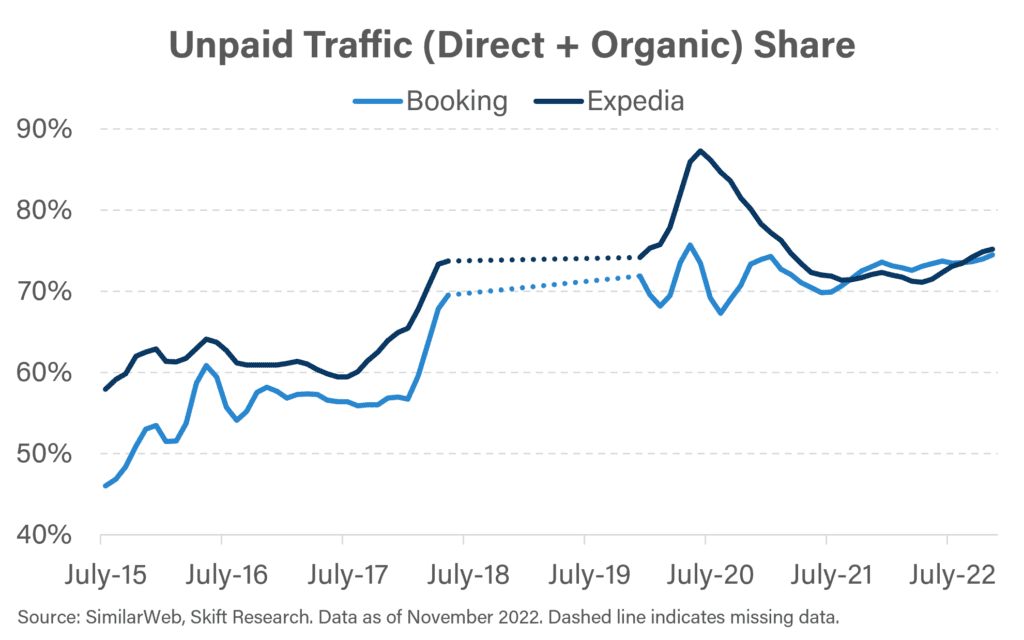

SimilarWeb is also able to give us a sense of web traffic sources for expedia.com and booking.com in the U.S. which we use as a proxy for their parent company performance.

Its data suggests that unpaid traffic, as a share of total U.S. desktop visits, has grown at both expedia.com and booking.com during the pandemic. Both seem to have reached a parity of ~75% unpaid traffic, a noticeable uptick from the 55-65% traffic share that was the norm pre-pandemic.

This is a positive development for both brands, but just because the traffic is not directly paid for doesn’t mean it has no cost. We combine both organic search engine results and direct brand.com web visits in this bucket. And although neither incur a direct advertising cost paid to Google or other metasearch sites, both can be influenced by brand marketing.

We know that Expedia and Booking have both been leaning heavily into brand marketing on TV, online, and print to drive mindshare amongst consumers. This helps square the circle for us of how sales & marketing spend does not seem to have fallen dramatically even as unpaid traffic sources saw a 10+ ppt share gain. It seems to us that brand awareness marketing campaigns in the U.S. are having their intended effect of driving traffic and searches to these online travel brands without incurring the Google ‘tax.’

Long-Term Business Trend Updates

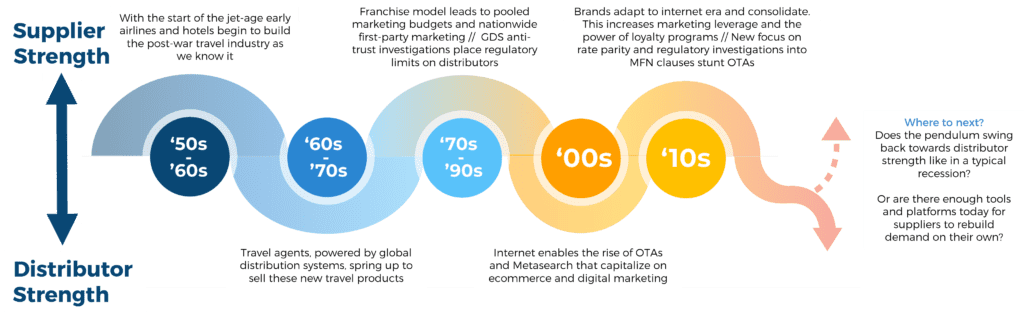

The travel industry has long been defined by a running series of channel wars between travel operators and their distribution partners. This balance of power is never static and swings back and forth between eras of relative advantages dating back to the start of the jet age.

Suppliers tend to do best in stable, growing economic environments while distributors are often the first to capitalize on disruption – both economic and technological. Distributors tend to move faster on changes in the tech landscape, with online travel agencies, as an example, early to capitalize on the long-term consumer shift to ecommerce. And in moments of economic disruption, recessions tend to make suppliers more willing to pay with margin for the ‘heads in beds’ that third-party channels can deliver.

We would argue that the pre-COVID period was an era of relative supplier strength as brands consolidated and launched book-direct campaigns based around loyalty. Our assumption heading into COVID was that, at a moment of extreme disruption for the travel industry, the pendulum would swing back in favor of third-party distributors.

But this initial assumption has not played out as expected. It is still very much up for debate whether the coming years will see a relative benefit for travel distributors. Brands are now skilled at online marketing. And long-tail platforms, like Google and soft-brand collections, are making it easier for suppliers to reach travelers without paying traditional commissions.

With this historical framework in mind, let’s examine the state of Expedia Group and Booking Holdings, the two largest online travel agencies and how their strategies are evolving to compete in a post-COVID travel world.

We believe Expedia and Booking have several sources of competitive advantage. Some of these sources of business edge are shrinking in the modern environment while new ones are being developed via growth experiments.

- Digital-Native // Status: The edge gained by being a digital-native business is shrinking as ecommerce becomes the norm.

- Discounting // Status: shrinking as operators drive enforcement of rate parity and incentivize direct booking.

- Wide Selection of Inventory // Status: growing as inventory continues to expand and as economic slowdown likely drives operator discounts.

- Marketing Economies of Scale // Status: shrinking as brands consolidate, driving ability to compete, and Google secures its place at the top of the funnel.

- New Technology and Product Offerings // Status: growing with investment in new technology, such as open APIs and fintech but facing competition from startups.

- Cross-Sector Offerings // Status: growing with new STR and tour operator inventory but needs investment and threatens margin dilution.

Digital-Native

There was a time when the raison d’etre of an online booking site was simple: bring the largely offline travel industry online. Beginning in the late ‘90s and running well into the 2000s and 2010s, OTAs spearheaded the push to digitize the hotel and airline industry.

Yet while some travel suppliers took embarrassingly long to embrace the web, all the major hotel and airline brands in the U.S. and Europe had done so by 2019. The pandemic forced a major digital upgrade for many remaining offline holdouts.

Bottom line: While there is still opportunity in driving online bookings to offline properties, especially outside of the U.S. and Europe, we think that the days of riding this secular trend to 20%+ gross bookings growth are behind us.

Discounting and Wide Selection of Inventory

The other classical driver of online travel bookings is the perception of value. Online travel agencies aggressively market their ability to offer discounted pricing. Big brand hotels and airlines have in the past decade invested significantly in pushing back against that perception. Hotels, for example, are getting better at enforcing parity and offering the same daily room rate on their website as is available on a booking site. Today, Expedia itself works with Marriott as an exclusive re-distributor of wholesale rates to stamp out non-parity rates. The two companies claim an 80 percent drop-off in Marriott ‘rogue’ rates appearing on metasearch sites. IHG just inked a similar agreement with Expedia.

In fact, in some cases hotels and airlines have managed to flip the script by building significant value into their loyalty programs. Because the hotel will add on free benefits to loyalty members that are charged as separate ancillary fees to third-party customers, some suppliers are effectively offering discounts below OTA pricing even while holding onto the façade of rate parity.

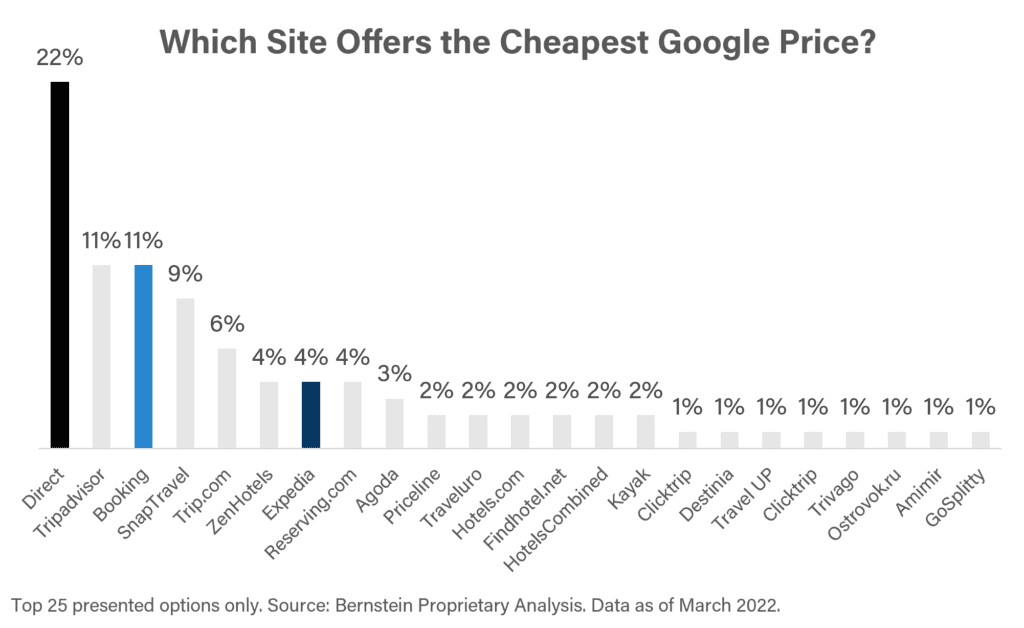

Recent research from Bernstein shows that when consumers search for hotels on Google metasearch that the direct website is most commonly the cheapest available option, in 22% of cases. Booking is tied for the second most common provider of cheapest rates, but that only occurs 11% of the time, a big step down from brand.com. Expedia.com is an even further step down at 4% of the time, but still in the top ten.

This speaks to the growing challenges that online travel agencies face in offering like-for-like discounts. But even if an OTA may not always offer a discount relative to brand.com on the same room at the same property, we need to bear in mind that Expedia and Booking offer comparison shopping tools that can often yield a cheaper rate at a similar property.

The largest hotel company in the world, Marriott, hosted nearly a million room nights in the most recent quarter; Expedia sold 93 million. The chain with the most hotels globally is OYO Rooms, with 15,000 properties; Booking Holdings offers more than 400,000. The scale comparisons are not even close.

This is an important point. The value proposition of an online booking site is increasingly not about providing a Marriott room at a cheaper price but in helping the consumer find a Marriott-like room from a different operator at a better rate.

From the perspective of a branded hotel revenue manager, they have managed to stem the bleeding caused by OTA discounting because perfect parity is maintained. But as far as the consumer is concerned, they still found a discount on the third-party site by booking with a different operator. As Expedia and Booking get bigger, their ability to offer pure discounting is diminishing but their power as comparison shopping platforms increases.

The main pushback against this that brands can offer is loyalty programs. These attempt to lock shoppers into the brands’ ecosystem and prevent cross-shopping. But these tactics are mainly available to branded rooms and independent properties still make up 30% of US and 60% of European rooms, leaving room for the booking sites to drive discounts in the independent space.

Whereas once consumers could reliably find like-for-like discounts on hotel rooms online, those deals are harder to come by today. It also makes it harder for Expedia and Booking to earn the initial click if they cannot offer the cheapest rate for a given property when it is searched.

But shoppers can still expect to save by comparison shopping hundreds, if not thousands, of similar rooms in a given destination. This value-add is not going away, and in fact becoming even larger as both bring alternative accommodations online.

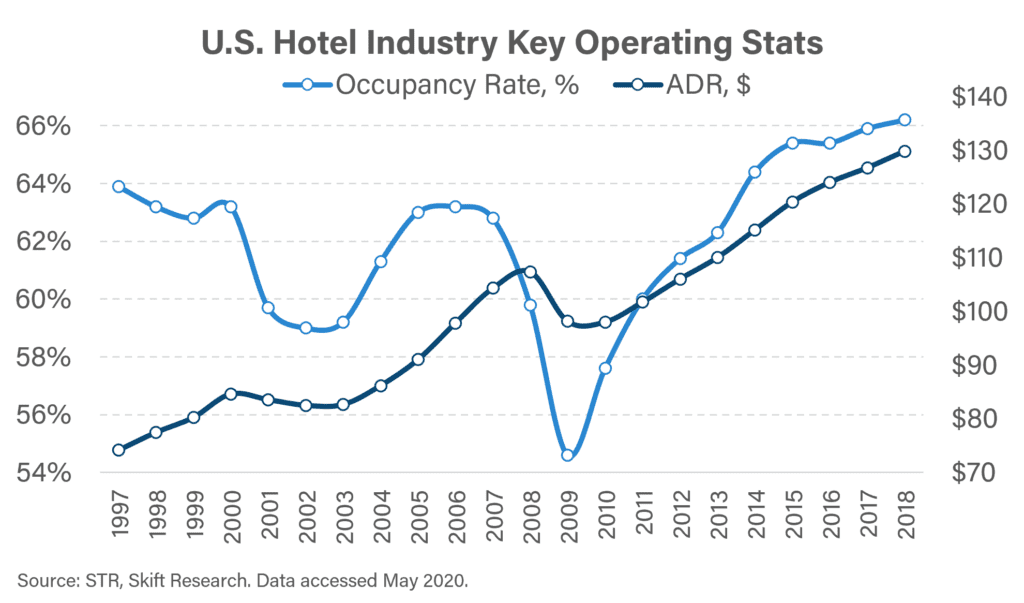

It will also be boosted in the case of an economic slowdown, which looks increasingly likely. The pandemic was a crisis of safety and trust, but not a financial crisis. Thus, hotel groups did an excellent job in maintaining pricing power. But consumer balance sheets are likely to deteriorate in coming years and we suspect that not all hotels will continue to hold the line so firmly on ADRs.

Properties lowering rates to drive ‘heads in beds’ plays nicely into the online travel agency’s strong suit as their price comparison tools can highlight these discounts via the prevailing market rate and drive a race to the bottom that benefits the distributors over suppliers akin to what we saw in 2001 and 2008.

Bottom line: we believe that Booking and Expedia are still able to offer travel savings as part of their value proposition, primarily from comparison shopping, but that their edge here is diminishing as rate parity enforcement is succeeding.

Marketing Economies of Scale

Expedia Group and Booking Holdings are likely the two largest advertisers in the entire travel industry. There was a time when this was a major competitive advantage and central to each companies’ strategy. However, we believe that dynamics are shifting and that returns from marketing economies of scale are diminishing at both.

Expedia and Booking were both some of the earliest businesses to embrace digital performance marketing. This channel is a powerful driver of demand that was initially not well understood and as a result these two OTAs saw outsized advertising return on investment.

Even as competitors wised up to the power of digital marketing, they found it hard to compete. Since performance advertising is sold via auction, having a large advertising budget was a competitive edge. Expedia and Booking built an advantage by leveraging marketing economies of scale. The two OTAs’ bigger budgets meant they were able to consistently outbid smaller hotel operators, driving bookings and margin to their sites, in turn funding larger ad budgets for the next quarter.

Two main factors came together to stop this virtuous cycle. The first was consolidation of travel suppliers. The biggest travel operators, in both hotels and airlines, had grown their market shares substantially by 2019 relative to 2009. This means that the consolidated marketing budgets for the largest brands – Marriott, Hilton, Delta, etc. – are now of the scale to effectively compete against Expedia and Booking. This drives up the cost of the performance ad, and all else being equal, drives down the return on advertising spend.

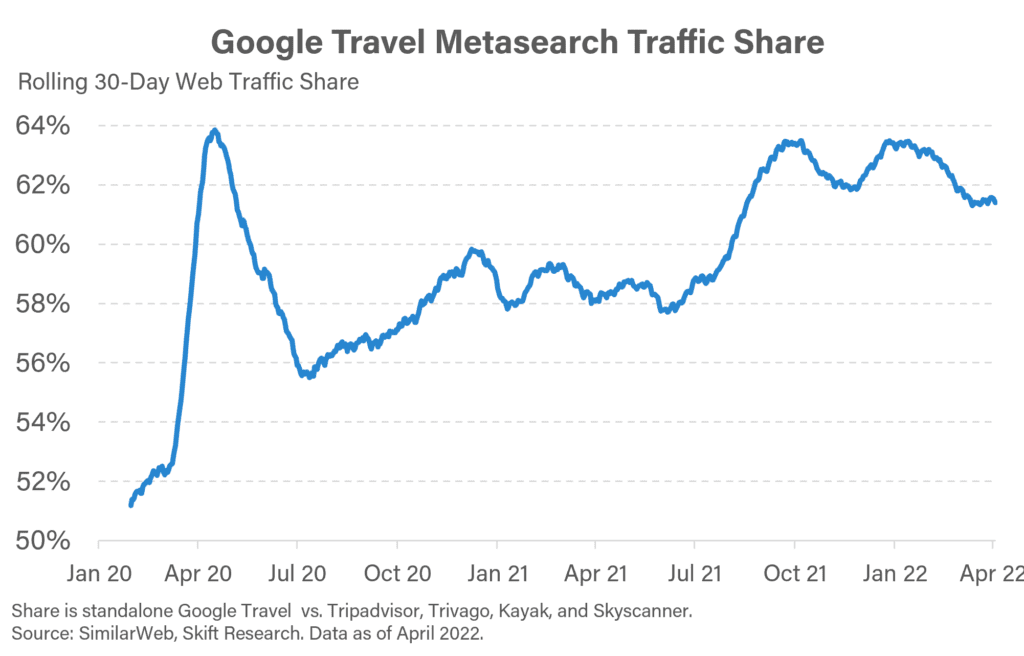

The second challenge for Expedia and Booking has been Google’s ability to cement itself at the top of the travel marketing funnel. In the past, OTAs had the ability to venue hop to drive up ROIs. If incoming bids from travel suppliers were driving up ad prices at one auction house, say TripAdvisor, an OTA could shift its spend to a more affordable venue, say Trivago.

However, we believe that these travel specific metasearch sites have been losing consumer traffic share to Google metasearch. Data from SimilarWeb backs this up and suggests that Google became even more dominant during the pandemic jumping from a ~51% traffic share in the U.S. to 62%.

It’s not effective to shift your marketing spend to a different venue if it does not receive enough shoppers to provide strong ROI. Following the eyeballs has resulted in most travel advertisers crowding into a single marketplace, namely Google.

This was a bad combination. Larger competitor advertising budgets chasings fewer venues meant that auction prices for clicks on Google had to rise – and ROIs had to fall.

This cost pressure had been building for years but perhaps Expedia and Booking would be able to use the pandemic as a reset and find a way to rebuild advertising ROIs? Our data suggests that, at least so far, this has not been the case.

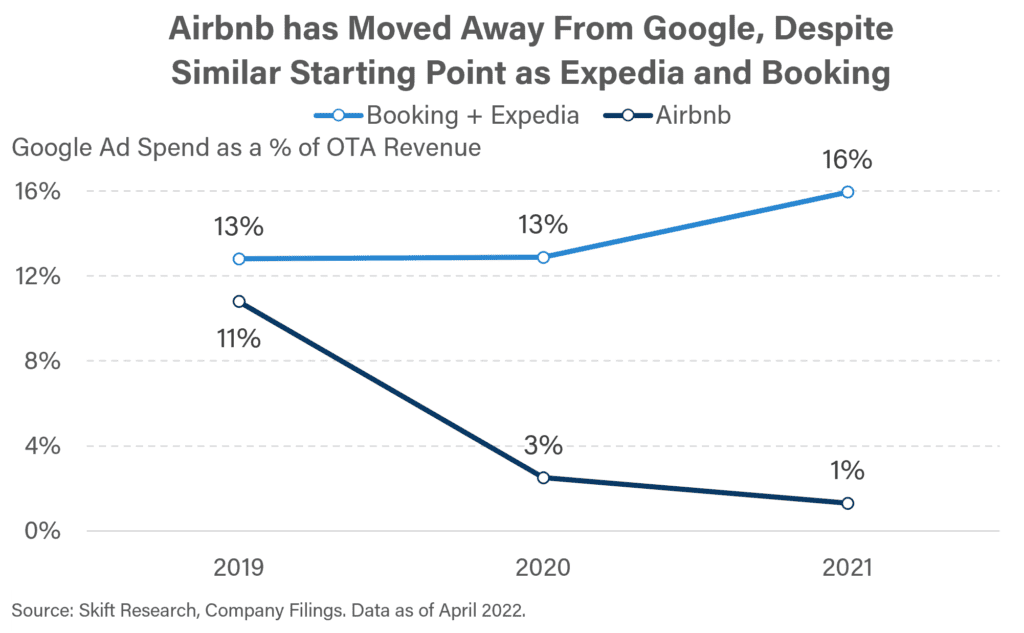

Both Expedia and Booking continue to rely heavily on Google for their performance marketing. Google ad spend, by our estimates, cost 13% of revenue at these two agencies in 2019. But by 2021, we estimate that figure to have grown to 16% of revenue.

This stands in contrast to Airbnb. Pre-pandemic, the short-term rental site had been investing a similar share of revenue in Google ads. During the pandemic Airbnb shut off much of its performance marketing and saw little impact to its bookings. Airbnb today spends 1% of revenue on Google, a dramatic implied improvement in marketing ROI relative to Expedia and Booking.

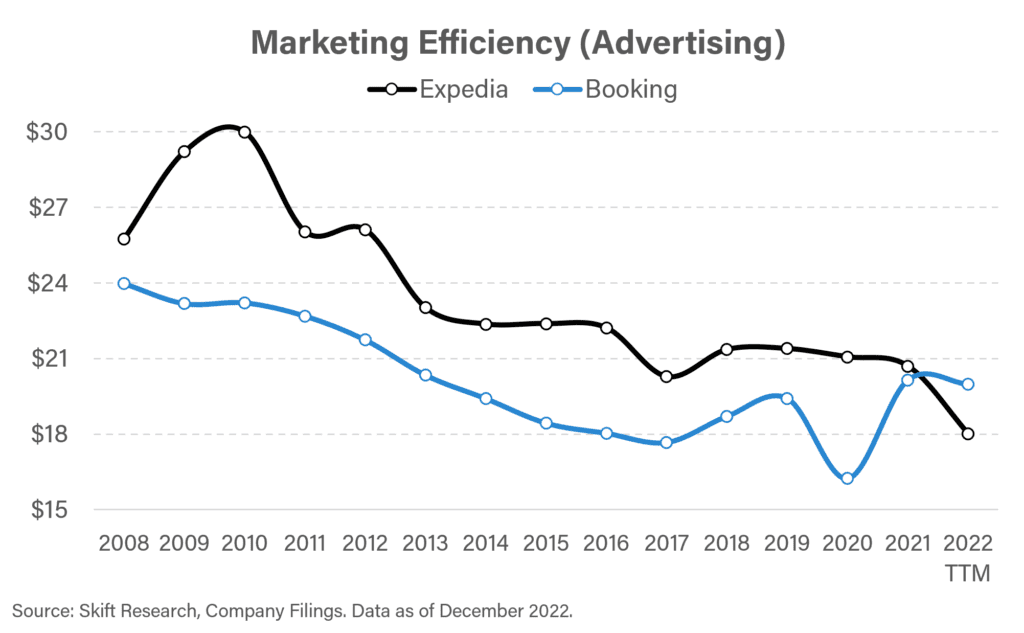

Bringing it all together, we have updated our dataset tracking the marketing efficiency of Expedia and Booking. This compares the gross bookings to estimated advertising spend at each company. In effect, we are measuring how many dollars of gross bookings can be bought for one dollar invested in advertising. This is not a perfect measure, for instance there may be timing mismatches or we may be off in our estimate of ad spending, but we believe it gives us a rough sense of how effective the marketing teams are at Booking and Expedia.

Given the discussion above, the updated trend is not surprising. Marketing efficiency has been on the decline for the last decade. In 2008 one dollar spent on ads at Expedia brought $26 of bookings in the door. By 2019, that dollar was 17% less effective, buying $21 of bookings. Similarly Booking Holdings saw its marketing efficiency fall 19% from 2008 to 2019.

Interestingly, we believe that YTD Expedia has seen its marketing efficiency decline even further while Booking has recovered from a COVID dip back to its pre-pandemic operating level.

Bottom line: Expedia and Booking are seeing their edge from marketing economies of scale erode as suppliers get better at performance marketing and Google’s metasearch share grows. The pandemic has not reversed this trend but rather seems to have amplified it. While Expedia and Booking remain powerful direct marketing machines this will need to be supplemented by new customer acquisition tactics.

New Technology and Product Offerings

The classic booking site model of online convenience, value pricing, and performance marketing is still powerful but doesn’t drive the results it once did. The key question for both Expedia Group and Booking Holdings today is how they can supplement this core with new tactics that drive customer acquisition and, perhaps even more importantly, customer retention.

Both of these groups are experimenting with new products and technologies to achieve this while minimizing the cost of their Google “tax” bill. Top areas being explored are loyalty, mobile, and B2B partnerships.

Loyalty

As the saying goes, if you can’t beat ‘em, join ‘em. Loyalty programs are huge drivers of business for travel companies. 50-60%+ of passengers on U.S. airlines are loyalty members and these programs contribute 40%+ of room revenue at major global hotel brands. Points programs keep otherwise fickle travelers true to a given brand family. Loyalty membership has been among the most successful tools that travel suppliers used to drive a wedge between customers and online booking sites.

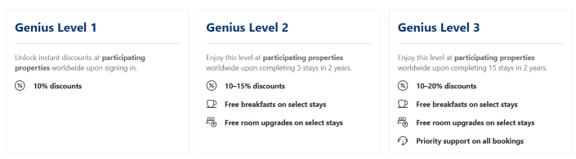

But no online travel agencies loyalty initiatives has yet risen to the level where they are a serious competitor against hotel or airline programs. Booking.com has offered its Genius program for several years now through various iterations, with the most recent update in May 2022.

The Genius program is simple. It is split into three tiers, each with escalating levels of discounts available, starting at 10% back and growing to 20% off. Any customer that creates a booking.com log-in is automatically enrolled in Genius Level 1 and the more hotel stays booking with the company, the higher the level you qualify for.

The primary goal of this program is to create a closed user group – a contractual loophole that allows properties to avoid rate parity clauses – by requiring a sign in. Hoteliers that want to drive business are then free to offer discounted rates to Booking.com shoppers. The majority of loyalty discounts are funded by the hotels themselves.

The simultaneous biggest strength and weakness of this loyalty effort is its simplicity. Allowing anyone to sign up and qualify makes it a savvy discounting tactic to drive near-term bookings. But the program is too simple for its own good in other ways. The offering is, in our opinion, not robust enough to attract and retain high value travelers – you know the type, credit card toting road warriors. These customers will prefer points based programs run by airlines and hotels that can provide significantly more than 10% savings when used effectively.

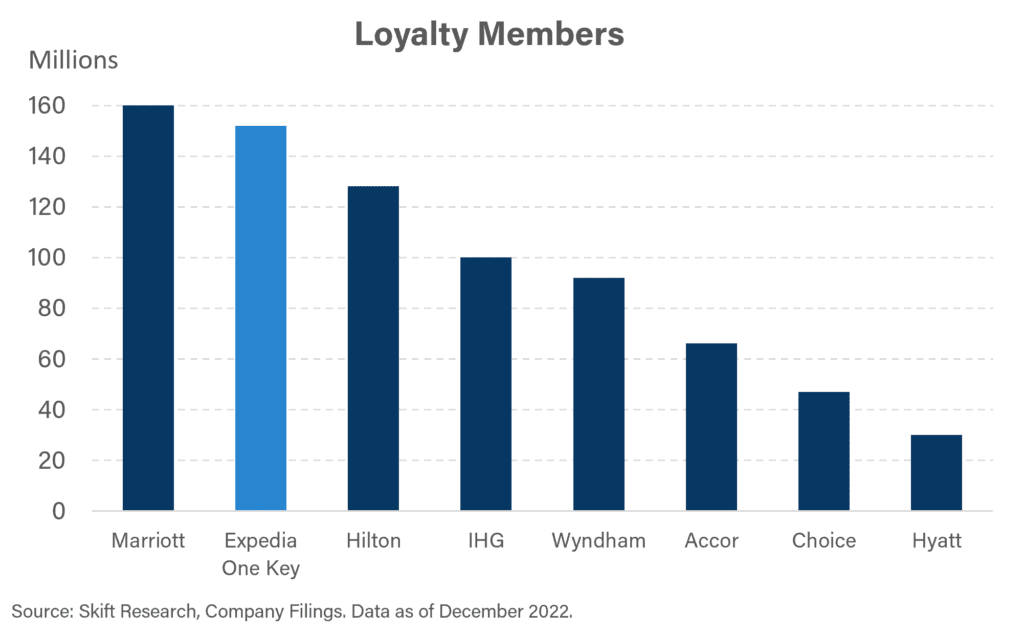

That’s what makes Expedia’s latest foray into loyalty so interesting. Expedia previously had four different loyalty programs split across its different brands with separate offerings from expedia.com, hotels.com, Orbitz, and Ebookers. This summer it announced plans to retire each of these plans and replace them with a new offering, called One Key. The new program will be points-based and allow guests to earn and burn across all Expedia Group brands, including Vrbo.

It’s been hard for Expedia to tie these all together because of different tech back-ends at each site. But as Expedia works to break down its internal tech silos, the program is expected to launch in 2023. Details are still scant but we know that it will port over 154 million members aggregated from across all of Expedia’s existing programs. For context, only Marriott would offer a larger loyalty program than Expedia.

Will consumers find this new loyalty to be a value add? It will likely offer less monetary value than a dedicated single-supplier loyalty program. But Expedia will attempt to make up for that by offering greater flexibility to redeem points across brands and product types (e.g. earn on flights and redeem on short-term rentals). It is also likely that Expedia points will let users double dip on earning airline miles, which can be a powerful perk (e.g. when redeeming Expedia points, the user still earns their airline miles for the flight).

Expedia CEO Peter Kern told Skift that this program will be targeted at the mid market of travelers who take several trips a year but not enough to earn top-tier hotel or airline status. “The real point is that most people don’t ever earn enough in rewards programs to get much reward out of it,” he said. “And for us, we have millions of members who can get a benefit, even if they’re traveling one, two, three times a year and … staying in different hotels and needing to take different airlines… So I think we serve a really important role there… and we want people to enjoy our brands as a family of brands and products as opposed to discrete things you just go into and think of as a single brand.”

Unlike the Genius program, Expedia will be funding a lot of these loyalty discounts itself. This should make the program more consistent, and perhaps even more valuable, but it will come with a greater cost than Booking.com pays. Loyalty driven promotions and discounts will likely show up on the income statement as a contrarevenue item, hiding not in the expense line items but as a reduction in Expedia’s take rate.

It’s far too early to judge the success or failure of Expedia’s loyalty initiatives but it speaks to the company’s need to close the back door on customer turnover. “There’s a mass of people that are up for grabs every day.”, Peter Kern, Expedia’s CEO explains. “The challenge hasn’t been buying them… The challenge has been keeping them.”

The new One Key is central to this strategy which in turn all ties back to online advertising return on investment. Lower turnover maximizes customer lifetime value (LTV) and allows Expedia to bid higher on online auctions and still maintain a profitable return on investment. Loyalty becomes the key to Expedia being able to compete effectively in a world of structurally higher online travel performance advertising costs.

Mobile

Mobile applications are another important strategy being pursued by Expedia and Booking. Shoppers are moving towards a mobile-first world and increasingly prefer the convenience of an app. Today we estimate that a third or more of all hotel and airline revenue is booked via mobile devices. There is even a higher rate of phone usage when browsing and searching for travel, with nearly 50%+ of hotel and airline traffic share coming via phones.

Even better for OTAs, mobile apps are by definition a form of direct traffic that avoids performance marketing costs. This makes apps an easy win-win for Expedia and Booking in that it drives customer satisfaction while avoiding expensive marketing costs.

Booking CEO Glenn Fogel said that, “about 45% of our room nights were booked through our apps in the third quarter [of 2022]”. That is up from ~35% of room nights in 3Q 2019. An even higher share, 60% of room nights sold were via mobile channels in 3Q 2022, with the differential mostly due to mobile web usage outside of the dedicated app. At Expedia Group, CEO Kern disclosed that, “app users drove over 2.5x the gross bookings per customer, 2.5x the gross profit per customer and 2.5x the repeat bookings versus non-app users.”

That’s not to say the mobile channel is completely free. There is still research and development costs that can add up to be quite substantial and both Expedia and Booking have been using direct performance ad campaigns to drive app downloads. Plus if you take bookings via iOS, Apple will take a cut. But even so, the development part of the expense equation still leans into the booking sites’ tech advantage. Their development teams are better positioned to launch and maintain apps than peers.

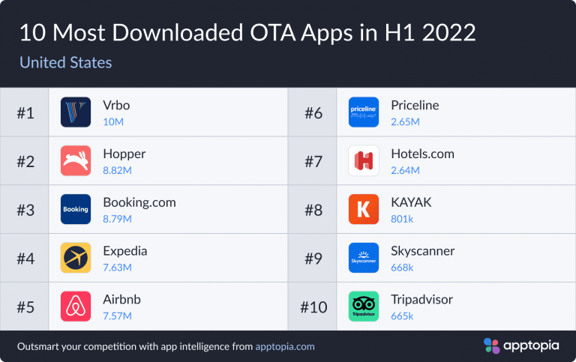

The most downloaded online travel agency app in the U.S. in the first half of 2022, according to Apptopia, was Vrbo. Booking.com was number three, while brand Expedia took fourth place. Booking.com’s app “was the only online travel agency app to consistently gain market share in the U.S. in 2022,” Apptopia said. Booking.com investing in Snapchat ads may have had a large role to play in driving downloads.

Mobile apps front-load a lot of customer acquisition expenses. You need to spend upfront in R&D and you still will pay via performance advertising to drive downloads. But the hope is that once the app is shipped and downloaded you will be left with a user base of direct shoppers driving repeat visits and bookings.

Partnerships

We have thus far assumed that there are only two options for travel bookings through an online travel agency or direct through a supplier. But the reality is far more complicated than that. Many airlines offer hotel bookings, hotels offer car rentals, and every combo in between.

But it is not just travel companies attempting to up their ancillary game. Travel has a strong lifestyle halo surrounding it that non-travel companies are looking to cash in on. These “non-endemic” businesses have a non-travel core product but want to affiliate their brands with the jetsetter lifestyle in shopper’s minds. Most obvious are credit cards that have built travel platforms but there are many others out there as well.

Online travel agencies have realized that partnering with businesses looking to merchandise travel presents a strong opportunity for a win-win by leaning into each platform’s comparative advantages. OTAs have a true comparative advantage in building travel inventory and online tech tools but their customer acquisition costs are rising. Meanwhile these third-party brands have direct traffic, since the prospective traveler has already landed on their ecommerce portal, but would find building out a wide selection of travel products cost prohibitive.

Both Booking and Expedia have been focused on building B2B solutions to take advantage of this opportunity. It’s true that there is a cost because the OTAs need to split their commission with a partner but on the flip side there is no need to spend any money on advertising since the marketing partner bears the full customer acquisition cost.

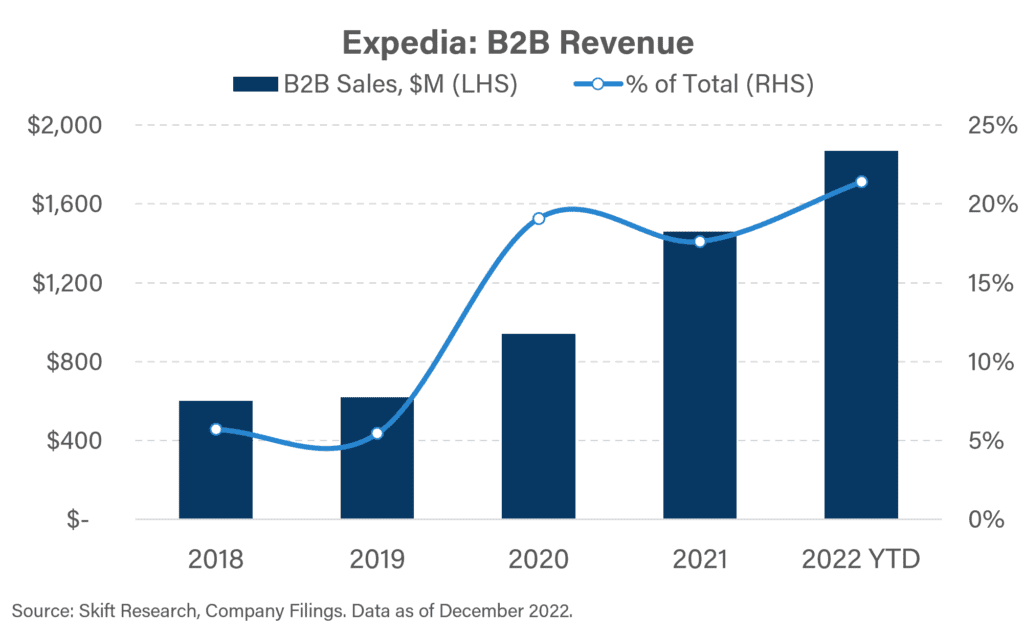

Booking doesn’t disclose B2B revenue but did spend $1.2 billion to acquire Getaroom in December 2021. Getaroom is a B2B distributor of hotels that signs wholesale deals for rooms and distributes them through its affiliate partners. Booking also runs Priceline Partner Solutions, an affiliate program, but out of the big two, Expedia has made the largest push into the B2B space. Expedia now generates 22% of revenue from B2B partnerships, nearly $2B YTD.

Expedia’s B2B sales are primarily driven by its partner solutions business which offers white label and co-branded solutions. The platform allows partners to sell Expedia travel products throughout their checkout process. When an airline offers ancillary sales of hotels or car rentals in a given destination after buying a ticket, the inventory is often offered by a white label third-party like Expedia. For instance, Expedia will partner with Jetblue to sell some hotel rooms.

Outside of travel suppliers, Expedia has also built white label relationships with corporate and offline travel agencies, credit card companies, AARP, and other similar platforms. It will even partner with other OTAs as in a recent deal to provide Vrbo short-term rental inventory to Hopper.

Expedia recently launched a new API platform, called Open World, to drive further bookings. This new API will be based around microservices to deliver “payments, fraud, conversations, and service, that anyone can use to accelerate, enhance, or even enter the travel business.” Rather than simply plugin in inventory as might be the case now, the goal is to offer more ecommerce building blocks to third-parties.

CEO Kern teased it as an entrance into the creator economy. He specifically highlighted the potential for a TikTok influencer to build an online travel booking platform customized to their audience to allow them to monetize travel content.

Kern wants Expedia to, “get to the point… where small entrepreneurs can use our technology to get into the travel business. So if you are an influencer, and let’s say you’ve got 100,000 followers because you write about travel for people with physical disabilities, we can power you to turn those ideas into trips… Not just a link, not just an affiliate deal, but a real ability to sell travel.”

While we suspect the majority of users will be banks, travel agents, loyalty programs, as is the case today, the possibility of building B2B partnerships far outside of typical use cases is intriguing.

It is also worth emphasizing that Partnerships are not a panacea. If Expedia or Booking are not careful they could wind up cannibalizing their own business, and customers that don’t have a direct relationship with a brand don’t repeat, and lower the overall OTA customer lifetime value. Expedia and Booking need to tread lightly to avoid finding themselves in the same situation, reliant on third-parties for bookings, that hotel brands found themselves in a decade ago.

However in the case where the customer was not going to shop via an online booking site in any case, then the B2B partnership is all upside, even if it comes at a lower take rate. A little cannibalization might be an acceptable price to pay for this new audience.

We suspect that, on balance, a large share of B2B2C customers are not being cannibalized since if they are airline or hotel loyalty members or if they are coming via a travel non-endemic then the odds of them booking via an OTA were slim to begin with. And the potential to crack the market for influencers and creators to sell travel via white label could drive major upside. Bottom line: Metasearch is consolidating and returns to scale from marketing are shrinking. Expedia and Booking are turning to innovation and new products to drive traffic and bookings that don’t require paying a performance advertising toll. We see growing potential for new loyalty programs, redesigned mobile apps, and B2B partnerships to drive incremental bookings.

Cross-Sector Offerings

How can online travel agencies drive customer acquisition in new ways that avoid incurring performance marketing costs such as the Google “Tax.” We looked above at new product launches and technology but there is another answer. Build a more holistic travel experience. If you have a genuinely more delightful booking experience than travelers will come to you direct.

Travel suppliers often see themselves in silos, providing just a single service. Airlines specialize in flights, hotels in rooms, and what about the actual day-to-day activities? Travel agencies are one of the few spaces that can see the forest for the trees and look at the whole trip. This is a huge built-in advantage since it aligns with the customers’ vision of the trip. Travelers are frustrated by needing to piece together multiple pieces of their trip from different suppliers. This is where OTAs can stand out by offering all-in-one convenience, like the offline travel agents of old used to do.

Expedia today offers a wide range of travel services including flights, hotels, accommodations, cruises, and day tours. We discussed earlier how that diversification away from hotels has been holding them back during the recovery, but long-term we see a benefit. Expedia’s challenge though has been integrating its many different product offerings across its many brands. Vrbo’s short-term rental inventory, for instance, was long siloed from Expedia’s other offerings.

Booking Holdings on the other hand, has long focused almost entirely on accommodations. At first that was just hotels, but over the last half-decade it has added a substantial amount of alternative accommodation. Today 30% of Booking’s room nights were from short-term rentals.

Booking has big ambitions to launch a more holistic product offering, with the objective of positioning itself as a one stop shop for consumers. They call it the Connected Trip. As early as 2019 CEO Fogel said that, “If you want to create this connected trip that makes [a trip] so much easier, you’ve got to do all parts of it.”

In November 2021, Booking Holdings entered into an agreement to buy flight provider eTraveli for $1.8 billion, although the deal is still under regulatory review. Offering flights seems to be gaining traction with the company reporting Airline ticket sales up 235% in Q3 2022 over 2019 levels and up 45% compared to 2021.

Booking sees flights as an important tool to drive new customers into their ecosystem, especially since so many trips start with purchasing a flight first. Seeming to underscore that it’s strategy is working, 20% of all flight bookings in Q3 2022 were from customers new to booking.com.

Booking is also working to launch a number of other connected trip initiatives such as better integrated ground transport and standing up a fintech unit to allow more suppliers and more sectors to accept customers via booking.com, as well as to upsell products like travel insurance.

Bottom Line: Consumers don’t view the travel industry as divided into the slices that travel insiders carve out. Having a delightful and holistic travel booking experience is a major differentiator and if done successfully can drive direct traffic and repeat business. Ironically, in building out multisector convenience, online travel agencies are following the path of their offline travel agent ancestors. We see both Expedia and Booking investing in building their multi-sector product offerings and driving growth through cross-selling.

Conclusion

Booking and Expedia are both recovering nicely from the depths of the COVID-19 pandemic. Booking Holdings is recovering faster due to its tilt towards hotels while Expedia’s airline exposure is a drag. Expedia has done a better job deleveraging than Booking, though the latter still holds the overall margin advantage.

Booking Holdings continues to make headway in the U.S. and saw notable progress during the pandemic, but Expedia still holds the lead in North America. Sales and Marketing spend continues to be a major expense and we see little signs that performance marketing efficiency is improving post-pandemic. However, both have invested heavily in brand marketing, loyalty, and new product offerings to drive customer interest and are seeing these initiatives pay dividends in the form of direct or organic search traffic.

From a long-term perspective Expedia and Booking are seeing two of their largest tailwinds deteriorate as ecommerce becomes the norm and as suppliers get more savvy about online marketing and rate parity. Instead they will need to invest in driving broader inventory, innovative technology, partnerships, and holistic travel offerings.

Expedia Group and Booking Holdings have invested heavily in many of these initiatives. Expedia is focused on launching loyalty and B2B partnerships. Booking Holdings is investing in new tech, including apps and fintech, and in matching Expedia’s cross-sector offering.

The travel industry is shifting and Expedia and Booking are revamping their strategies, but both remain formidable travel competitors.