Report Overview

In the past few years, mobile commerce sales have amplified tremendously across all consumer product categories. Over 2017–2021, global retail m-commerce sales grew from $1.4 trillion to $3.6 trillion, a CAGR of 27%. Based on our analysis of available third-party data and our own estimates of the accommodation and airline sectors, we believe mobile travel sales account for about 30-40% of online travel sales and 15-25% of total travel sales globally.

Skift Research attempted to estimate the revenue share of hotel bookings made via mobile devices in top countries of APAC, Europe and North America along with the revenue share of online flight bookings made using mobile devices at a regional level. We also interviewed senior industry professionals to understand the status quo and expanse of m-commerce penetration in the hotel and airline industry to cover the two most important aspects of a traveller’s journey: transport and accommodation, and validate our estimates.

We found that mobile’s share of online bookings varies across regions. The disparity, to a degree, is linked to the demographic differences between the regions and is dependent primarily on the way consumers perform internet search and interact with their devices.

However, since booking travel is not a linear process and involves various touchpoints, travel companies should not only focus on bridging the gap between use of mobile devices and desktop, but have a multi-device strategy in place to engage with the customer at every point of his/her journey. Essentially, they should move from a mobile-first to an omni-channel approach to boost overall revenue.

What You'll Learn From This Report

- Mobile commerce sales and growth at a global level

- Share of hotel bookings by channel and device, breaking down by top countries and region

- Revenue share of mobile in online flight bookings by region

- Regional mobile usage behaviors and patterns that impact mobile bookings

- Other key factors that impact how and when mobile is used for booking

- Change in device usage patterns in light of COVID-19

- Challenges and opportunities of growing mobile channels

Executives Interviewed

- Alix Boulnois, Chief Digital Factory Officer, Accor

- Gary Yu, Senior Director of Product, Hilton

- Hugh Aitken, Vice President of Flights at Skyscanner

- Jolie Fleming, Senior Vice President, Guest Products and Platforms, IHG Hotels & Resorts

- Matthieu Dutter, Vice President Products, D-EDGE Hospitality Solutions

- Ronnie Jahraus, Chief Operating Officer, Myhotelshop

- Werner Kunz-Cho, Chief Executive Officer, Fareportal

Executive Summary

The use of mobile devices to make online transactions is increasing remarkably and mobile continues to have a growing influence on how consumers plan and book travel. Yet mobile conversions still lag behind desktop.

In this report we aim to estimate the size of mobile commerce globally as well as understand the regional variations in mobile commerce penetration in the travel industry. We focus on two travel sectors – hotels and flights – in North America, APAC, and Europe.

For hotel bookings, we tried to quantify the revenue that hotels made via mobile devices for the top countries in the above mentioned regions. We started by assessing the share of online mobile hotel bookings on both direct channels and online travel agencies (OTAs) at a country level, based on secondary research and our own estimates. We then calculated the hotel mobile revenue by applying the percentage share to the hotel industry revenue.

As per our analysis, China and Australia are leading the pack with approximately 35% of total hotel bookings revenue coming from mobile devices. However, only 44% hotel bookings are made online in China while the share of online bookings in Australia is as high as 80%, meaning that mobile is a much more dominant online channel in China than in Australia. U.S., Canada, India, and Japan are not too far behind, with mobile bookings accounting for approximately 20% of total hotel bookings. The average share of online bookings is around 45% for these countries.

We used a different approach to estimate mobile flight bookings. We deduced mobile booking shares from mobile traffic shares at a regional level, as that’s where we have the most solid available data. Through this exercise, we found that shares of mobile traffic as well as mobile bookings are the highest for APAC, followed by Europe, and North America.

We further delved into reasons for regional variations in m-commerce penetration, including the smartphone penetration and median age of smartphone users. At a more nuanced level, length of stay, average daily rate, and booking window also have a role to play in the type of device used for hotel and flight bookings.

With mobile usage continuing to grow, travel companies need to invest in mobile as a primary sales channel. To do so, they need to focus on providing a seamless user experience, detecting fraud and investing in fraud & security risk management, and accepting new payment methods.

However, the travel booking journey remains very much a multi-device journey. In recognition of consumer’s omnichannel mentality and behavior, travel organizations simply cannot afford to view their mobile and desktop channels as separate units. Instead, a broader approach is required that involves strategically engaging with the consumers through each stage of a fragmented online experience.

The M-Commerce Phenomenon

Simply put, mobile commerce, or m-commerce, includes any monetary transaction completed electronically via internet connection using a mobile device. It is typically considered as a subset of e-commerce, enabling people to buy and sell goods or services from almost anywhere, using a mobile phone or tablet device.

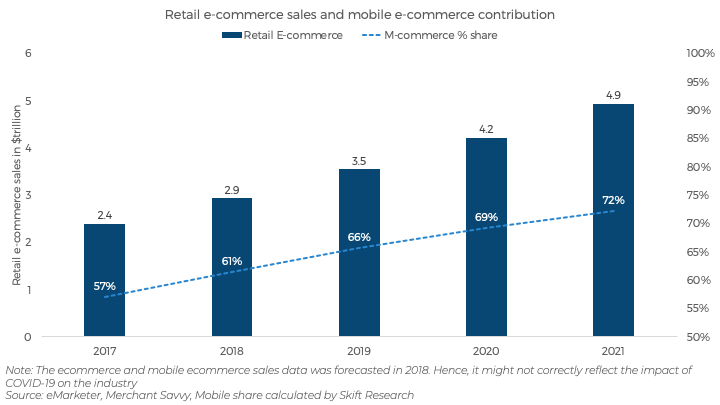

In the past few years, m-commerce sales have amplified tremendously. On the retail side, it’s estimated that over 2017–2021, global e-commerce sales increased from $2.4 trillion to $4.9 trillion, at a CAGR of 20%. For the same time period, m-commerce grew at a CAGR of 27%, increasing from $1.4 trillion to $3.6 trillion.

As a result, the contribution of mobile as a share of total retail e-commerce spend has expanded globally. While mobile sales accounted for approximately 57% of retail e-commerce sales in 2017, the contribution was forecasted to go up to around 72% in 2021 without taking into account the impact of COVID-19.

M-commerce has truly turned into a phenomenon with merchants directly benefiting from the increased usage of mobile devices as a shopping medium. The growth of the m-commerce market can be attributed to the increasing adoption of the smartphone across the globe. The number of smartphone users worldwide went up from 3.7 billion in 2016 to 6.4 billion in 2021 which means that, at present, 81% of the world population (7.9 billion) uses smartphones.

The increased usage is mainly driven by the decline in the price of the smartphones and increasing competition among the market players. Moreover, in emerging markets like China and India, internet penetration was very low before smartphones entered the market and now, smartphones are the most widely used internet device, driving both adoption and ecommerce sales.

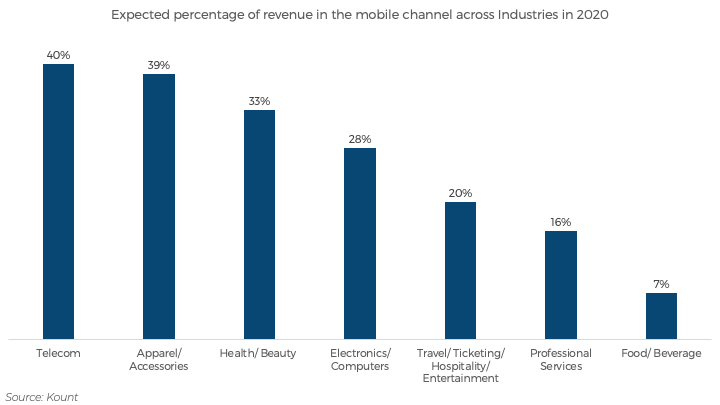

M-commerce sales growth and share vary across consumer product and service categories. According to a Kount 2018 Mobile Payments and Fraud Report surveying 600 merchants of all sizes across different channels and types of goods or services sold, merchants from the apparel, accessories, health, and beauty products which mainly sell low value products and categories like electronics, computers, and telecom which mainly sell standardised branded products reported that they expected a huge chunk of their sales to come through mobile channels. Merchants from industries like travel, ticketing, hospitality, and the ones rendering professional services which, in general, have higher price points and an array of personal filters to apply, expected to earn a relatively low revenue share from the mobile channel.

For instance, the average order value of travel products is 10x bigger than retail products while the mobile conversion rate for travel products is 7x smaller than retail products. Therefore, it is safe to say that, the higher the transaction value, subjectivity, and complexity involved, the lower is the chance of consumers using mobiles to transact online.

Exhibit 2: M-commerce share varies across product categories

M-Commerce in Travel

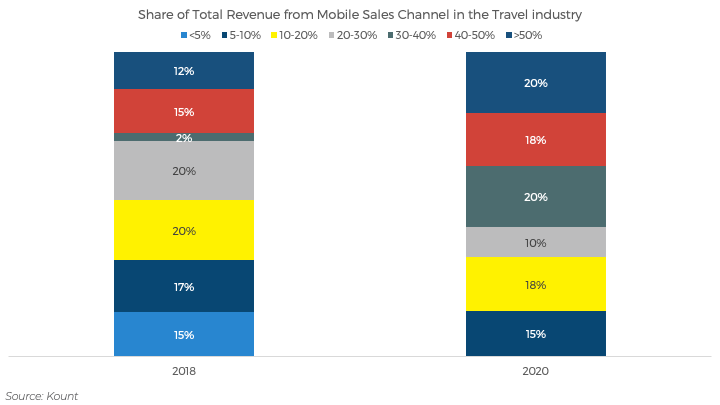

Narrowing down to the focal point of this report, the travel industry. Online booking became a reliable alternative to phone sales for travel agencies in the early 2000s and since early 2010, mobile websites and applications have become a standard in the travel industry. In general, the travel industry has kept pace with the growth trend of the broad m-commerce market. According to the above Mobile Payments and Fraud report, in 2020, the share of merchants earning more than 30% through mobile channels in the travel industry was expected to double as compared to the share in 2018.

Exhibit 3: Share of travel revenue from mobile channel increased rapidly in the last two years

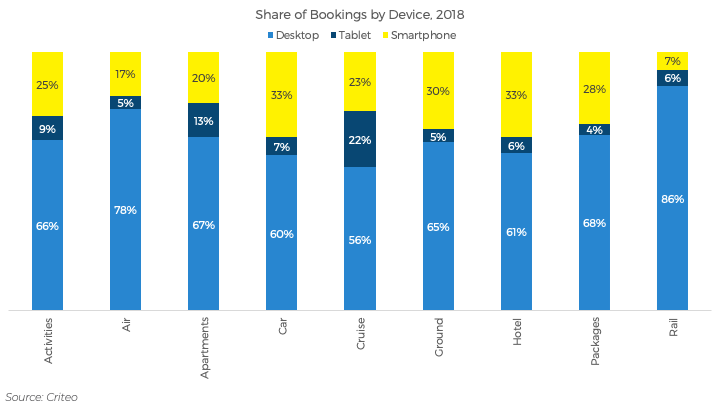

Another report by Criteo found that by 2018, most travel categories had already generated more than 30% of online bookings on mobile devices, with the highest bookings occurring in the car and hotel categories. Air and rail, the major transportation categories, received the lowest mobile booking shares.

Exhibit 4: Most travel categories generated more than 30% of online bookings on mobile devices by 2018

As far as the medium of mobile transactions is concerned, the majority of airlines, hotels, car rental companies, and taxi services have mobile applications and mobile compatible websites available for the travellers to book using their mobile devices. In addition, OTAs also provide good quality mobile applications to help them book and manage their trip on a mobile device. Travel searches that start on mobile metasearch engines are also ultimately directed to the vendors’ website or mobile application.

Hotels

Booking accommodation is generally a tedious and high-anxiety process as it involves an array of subjective, unique, and personal choices. To add to this, the increased digital presence of hotels and lucrative packages offered by them has made it even more difficult for travellers to make a decision when it comes to booking an accommodation.

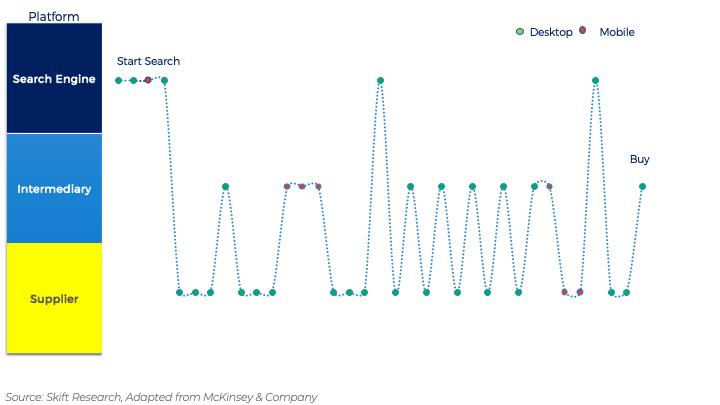

McKinsey in its recent analyses of cross-device clickstream data established that an average purchase journey for a single hotel room lasts 36 days and hits 35 touchpoints distributed among search engines and the sites of intermediaries/OTAs and suppliers, and involves multiple devices. The image below shows a typical accommodation-purchase journey by device and platform used.

On an average, a traveller starts on a search engine and ends up booking using an intermediary website/app. Mobile serves as a touchpoint 7 times in the process.

Exhibit 5: Hotel booking is not a linear process

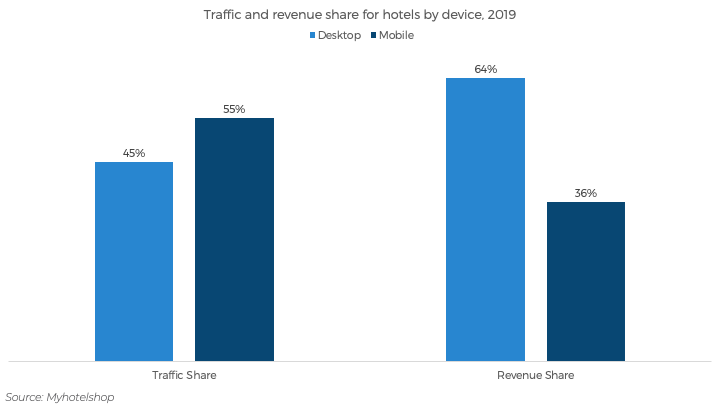

Mobile is the device used most in the ‘up in the funnel’ phase where the traveller is gathering information and is still far from a decision. As Ronnie Jahraus, Chief Operating Officer of Myhotelshop explained to us, 55% of traffic to their client hotel sites comes from mobile devices, but mobile accounts for only 36% of revenues.

Exhibit 6: Mobile is more of a research device

However, Jahraus also confirmed that mobile bookings have been increasing. He noted, “It was ten years ago mobile traffic was starting to begin, but nobody was booking. Over time transactions started to happen on mobile with one out of three bookings being made using mobile. The gap between desktop and mobile bookings is definitely narrowing. The usage of mobiles has doubled in the last five years, ballpark, from 15% to 30%.”

Airlines

As we have already observed in Exhibit 4, the majority of airline/flight bookings are made via desktop and m-commerce penetration for airlines is much lower as compared to other travel categories. Like in the case of hotel bookings, mobile is used as a search tool but majority transactions happen on a desktop in flight bookings as well. Hugh Aitken, Vice President of Flights at Skyscanner noted, “We see a general behaviour of travellers browsing on mobile, particularly mobile web, and completing larger transactions on desktop. So, while the volume comes from mobile users, a significant proportion of value comes from desktop. This has been consistent across regions over the past three years, but can vary by country.”

As per a report by SaleCycle, the average airline abandonment rate, i.e. the rate at which the customer leaves or quits before completing a booking online, was 87.9% for airlines, higher than the average for all travel sites (81.3%) and much more than retail ecommerce (74.6%).

This does not necessarily mean that airline websites or mobile applications are improperly designed or are difficult to use. Some could be improved of course, but the higher abandonment rates are mainly a result of the way people research flights, and the length of the booking process. Aitken described, “Travel planning is not a linear exercise – when you plot and track the user journey, people interact with lots of resources before they make a decision to book.”

Of all travel products, flights are the most complicated. Booking a hotel can be a relatively straightforward process, as is the case with other travel products like car rental. By contrast, booking flights requires much more work from users.

After selecting flights and times, travellers need to add passenger details, passport data, select seats, and in-flight meals, and much more. These are steps that cannot be avoided. For this reason, booking and payment often takes longer than for other travel products. As a general rule, the longer the purchase process, the more likely customers are to abandon.

Putting a Number to it – Market Estimation

While there is consensus that mobile accounts for a significant share of travel revenues and its share will continue to grow in the next few years, there is still a lack of industry-level estimates as to how big the travel mobile commerce market is. To fill the gap, we attempted to quantify m-commerce in travel with our own estimates. We focused on hotels and airlines, two of the largest travel sectors, for our estimates.

Hotels – Methodology and Results

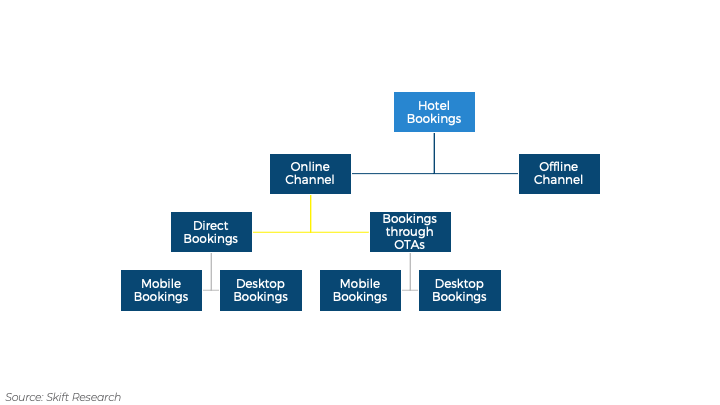

The data used for this exercise is for 2019, as 2020 and 2021 witnessed limited travel with probably stop-gap travel behaviour, the effect of which we will touch upon briefly later in the report. As a first step, we broke down the process of booking hotels by channel and further by the device used to access that channel as shown in the chart below.

Exhibit 7: Hotel bookings process

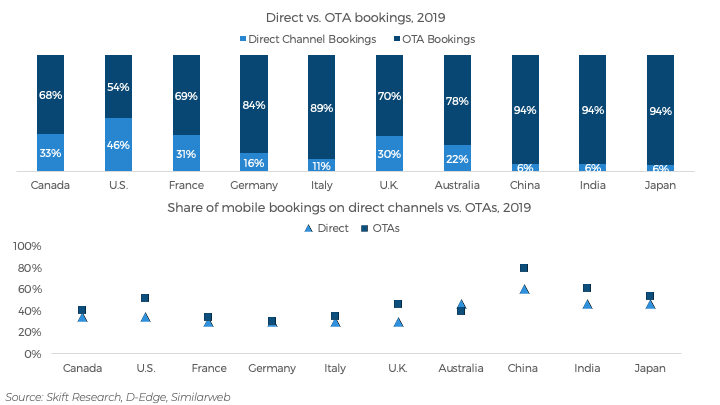

Next, we estimated the share of hotel bookings made online at a country level based on secondary research, company filings, and our own estimates. For the ensuing country-level as well as region-level splits by channel and device, we mainly used STR data for hotel industry revenues, Similarweb data for direct channel vs. OTA splits and OTA device splits, and D-edge data for direct channel device splits. Our final estimates are tweaked to reflect our analysis of other proxy data.

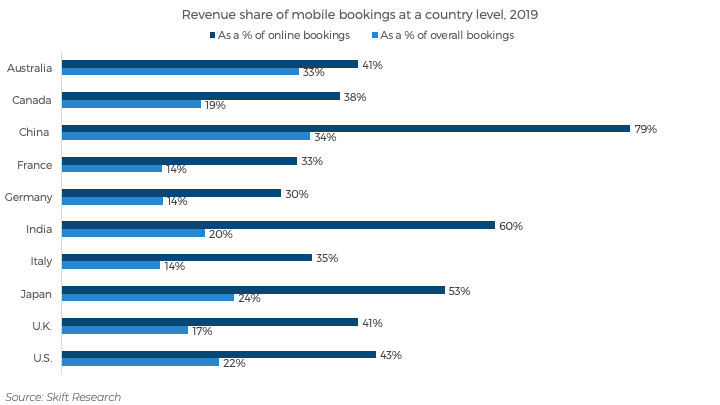

Exhibit 8: Hotel bookings by channel and device, 2019

As per our analysis, China and Australia are leading the pack with approximately 35% of total hotel bookings revenue coming from mobile devices. However, only 44% hotel bookings are made online in China while the share of online bookings in Australia is as high as 80%, meaning that China’s online commerce is much more skewed towards mobile than in Australia.

U.S., Canada, India, and Japan are not too far behind, with mobile bookings accounting for approximately 20% of total hotel bookings, or approximately 50% of online bookings.

Exhibit 9: Mobile hotel booking revenue share at a country level, 2019

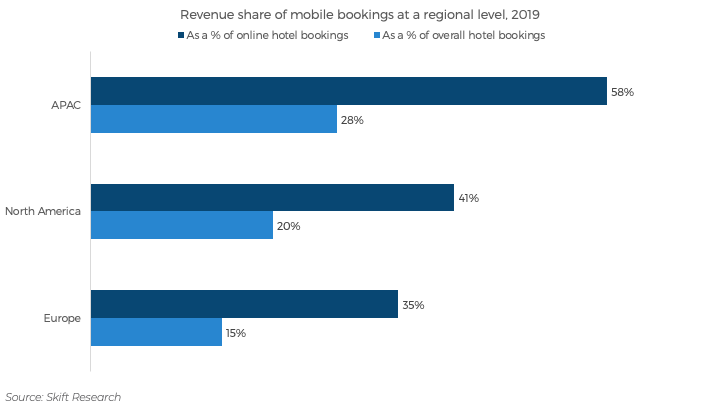

Our estimates for the regional level mobile bookings are based on the assumption that the countries under analysis represent the regional trends. So when rolling up, mobile accounts for the highest revenue share in Asia Pacific, followed by North America and Europe, reflecting the country-level trends.

Exhibit 10: Revenue share of mobile hotel bookings at a regional level, 2019

Another trend that is worth noting is how, in general, OTAs generate more mobile revenues than hotel direct channels. As shown in our estimate above, for instance, 80% of OTA revenues in China come from mobile devices and the number for direct channels is only 60%.

This disparity can primarily be attributed to a poor hotel mobile interface in comparison to an OTA’s and substandard consumer analytics at a supplier level which inhibits providing tailored services to the customers while OTAs immensely invest on customer analytics and provide very streamlined and intuitive filters to make the booking process super easy on mobile devices.

However, there is great regional variance in both OTA dominance and OTA vs. direct mobile booking differences. Based on the transcripts of earnings call of Expedia and Booking.com, the two biggest OTAs in North America and Europe – the regions which are relatively less dependent on OTAs, around 40-50% of room nights booked were via a mobile device in 2019. On the other hand, as per the earnings call of MakeMyTrip, the biggest OTA in India which is now growing its presence in the broader APAC region, mobile bookings reached 78% for total hotel bookings across all its brands in 2018. The regional variation is clear here.

Europe seems to be a bit of an outlier here. But it is noticeable that despite being OTA heavy, the overall mobile bookings share is low in the region, indicating an inherent consumer trend of travellers not being comfortable using mobile either on OTA or direct supplier websites and applications.

Exhibit 11: Direct and OTA hotel bookings via mobile, 2019

Airlines – Methodology and Results

For flight bookings, we mainly relied on our analysis of the difference between mobile traffic share and mobile booking share to arrive at mobile booking estimates. Because of limited data available on airline booking channels, unlike hotels, we are only able to offer ballpark estimates of mobile booking shares at a regional level.

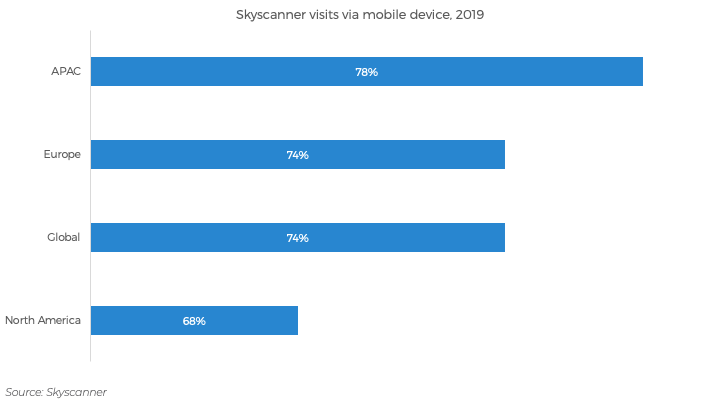

As a starting point, we used the visits data provided by Skyscanner. Aitken noted that “In 2019, globally, 74% of our users now come to Skyscanner via a mobile device. Over three quarters of APAC users (78%) visit Skyscanner platforms via a mobile device. Europe is in line with the global figure with 74% of users, while North America lags slightly at 68% of users.”

Exhibit 12: Percentage of users visiting Skyscanner via a mobile device, 2019

Aitken further elaborated that, “At a country level we see that in Japan and India over nearly 60% of users come to Skyscanner via mobile, whereas in markets such as the UK and Germany it is closer to 50%.”

While high in general, the range of mobile traffic might be big across different sites. For instance, Kunz-Cho from Fareportal (which is also the owner of online travel agencies CheapOAir and OneTravel), told us that “Around 50% of users in the United States and Canada come to our sites using mobile devices.”

Unlike hotels, airlines and OTAs mainly selling flight tickets have been notoriously secretive about anything related to revenues and there are very few public mentions on sales by channels or devices. So, to estimate revenues by device, we relied on traffic data that Skyscanner shared with us.

We started by using the traffic vs. booking data provided by MyHotelShop, presented in Exhibit 6. According to that data, mobile accounts for 55% of all hotel site traffic, but only 36% of all hotel bookings, which means mobile booking share makes up 65% of mobile traffic share. Various sources point to the fact that the conversion rate for mobile flight bookings are even lower than hotels. So we made the assumption that the traffic to revenue conversion for mobile flight bookings is 20% lower than mobile hotel bookings and applied a 52% booking to traffic ratio to the mobile traffic share data by Skyscanner.

What we found is that mobile traffic and bookings are both the highest in APAC, followed by Europe and North America. For APAC, mobile traffic accounts for 78% of all online traffic to flight sites, but mobile bookings only account for 41% of all online flight bookings.

Exhibit 13: Mobile traffic and revenue share of airline online bookings, 2019

Again, beneath these broad estimates are many nuanced variations among companies, countries, and regions. Take India’s MakeMyTrip (MMT), for instance. As per the 2018 earnings call transcript of MakeMyTrip, one of the biggest OTAs in APAC, mobile bookings reached over 59% for India’s domestic flight transactions booked online.

As we mentioned earlier, it was very hard to get information directly from airlines on their revenue split between channels and devices. However, we did get to speak with one executive from one of the biggest airlines (by fleet) in APAC, off the record. He told us that only 14-15% of their flight revenue was online direct, via their website and applications, around 40% was via OTAs and the remaining was all offline sales.

If this is the norm, this means that airlines are a little behind hotels in their digital as well as mobile adoption. The rough mobile booking estimates that we came up with also confirmed this lag.

Trends That Impact Mobile Booking Behavior

Regional differences are determined by demographics and smartphone adoptions

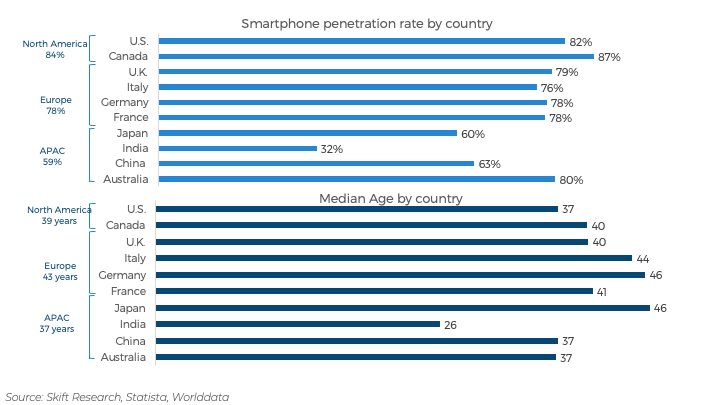

Part of the reason for the disparity in mobile bookings between countries and regions is the demographics. Time and again, surveys have proven that it is the youngest users who are the most likely to buy on smartphones, but as the ages of the people surveyed increases, purchases through smartphones plummet.

For instance, according to a recent survey by App Annie, on an average, approximately 80% of U.S. adults in the age bracket 18 to 44 years prefer to shop using their mobile phones vs. just 36% adults in the 45+ age bracket.

Correlating the output of our analysis with the median age at a regional level, an inverse relationship between the median age and m-commerce penetration in hotel and flight bookings can be found. The median age of the population in APAC is the lowest while the share of mobile hotel bookings and conversion rate for flight bookings is the highest in the region.

Exhibit 14: Demographic features of countries in focus

Another demographic feature we analysed was smartphone penetration. Europe and North America, the regions with higher smartphone penetration, were found to have a relatively lower percentage of hotel bookings via mobile. These are wealthier regions and hence more than 80% of their population has access to smartphones. But clearly, having access to smartphones does not explain the consumer behaviour and the consequent m-commerce trends directly.

In contrast to developed western markets where the general population was exposed to computers and dated infrastructure and later became familiar with a wide selection of applications, the emerging markets in APAC mostly skipped the offline era and began directly in the digital age through mobile phones. Hence, APAC has a greater mobile-first affinity. The start and rapid growth of superapps in the region further validates this phenomenon.

Furthermore, the Asian smartphone market is much cheaper than anywhere else in the world. Ravi Agarwal, Managing Editor of Foreign Policy and former CNN New Delhi bureau chief, in an interaction with the media said, “Most Indians can’t afford personal computers (PCs); most Indians will never, ever own a PC.” Many will never have landline telephones either. But with the smartphone, neither is necessary.

In addition to the demographics, certain trip characteristics also impact mobile usage for travel bookings.

Majority of last minute bookings are made on mobile devices

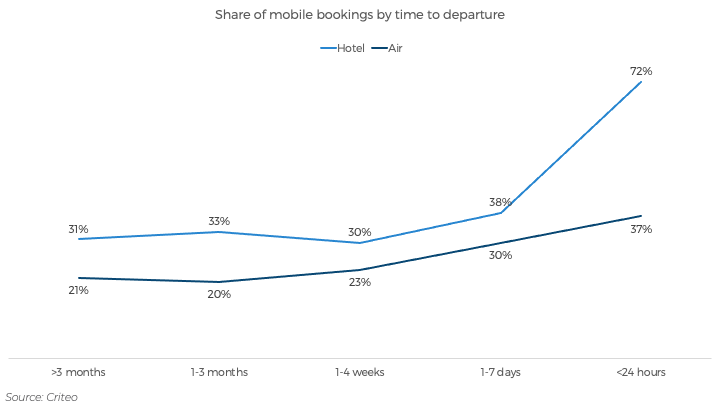

As per a study by Criteo, up to 70% of last-minute hotel bookings and 40% of last-minute flight bookings are made on mobile devices, much higher than the industry average that we’ve discussed earlier. For last-minute bookers, mobile phones have become a very handy device to finalise their trip arrangements.

There is a set of travellers who wait till the last-minute to avail themselves of lucrative mobile-only offers that OTAs, airlines and hotels roll out to use up their same-day inventory. On the other hand, this behaviour can be expected from business travellers as well who have a fixed company-paid hotel to stay in or need to fly out at a certain time for their last-minute meetings. They can just book the hotel or airline their organization has a tie up with on the go.

Jolie Fleming, Senior Vice President, Guest Products and Platforms, IHG Hotels & Resorts noted “The majority of bookings made in shorter windows are made through smartphones. Approximately 25% of mobile website bookings are for same-day, and 26% of same-day bookings are made through mobile apps. Mobile apps also make up the largest percentage of bookings made 1-7 days in advance. Desktop accounts for the largest percentage of bookings made 31 or more days in advance.”

However, this can be an induced behaviour too. In recent years, last-minute booking apps and OTAs have tailored their services to the specific needs of mobile users, fuelling an industry-wide trend that continues to grow. Household names in online travel, including Priceline, Booking.com, and Expedia, to name a few, all debuted same-day hotel booking features several years ago following the mobile-only HotelTonight, which pioneered same-day hotel bookings in a handful of taps. In case of flight bookings too, metasearch engines like Skyscanner provide easy-to-use search tools that can help users bag last-minute flights without going over budget.

Exhibit 15: Mobile bookings by time to departure

The conversion rate is higher on applications than on the mobile web

Criteo’s Travel Flash Report 2018 mentioned that travel advertisers see much higher conversion rate on mobile applications. The conversion rate on applications is around 5x higher than on mobile web and the difference has been growing year on year.

Kunz-Cho at Fareportal explained, “When travellers use a mobile application – they are going on a specific brand to book – your shopping experience is limited to a brand. Hence the conversion rate is higher. While mobile web is a mini version of the desktop as it is accessible from anywhere. When using mobile web or desktop you are still in the exploration phase, looking at options and deciding on a business partner. Conversion rate on mobile applications is between 6 to 8% while on mobile web is 2.5 to 4%.”

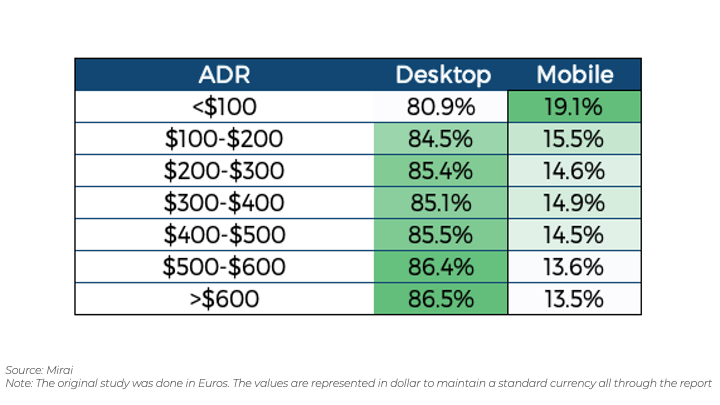

Average booked price or fares also plays an important role

Another very important factor is the price/average daily rate (ADR) of the room or fares of the flight to be booked. The lower the rate, the larger the use of the mobile phone to book. As the rate grows, the use of the mobile phone decreases in favour of the desktop.

Exhibit 16: Average daily rate differences in mobile vs. desktop bookings

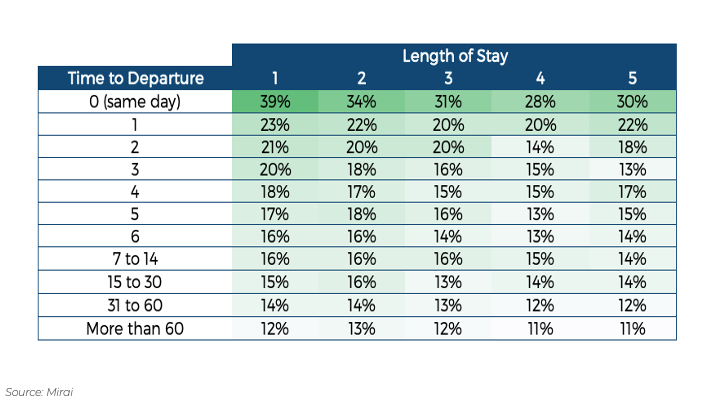

Length of stay is also an important determinant for hotel bookings

Mirai in its recent post noted that along with time to departure, length of stay is also an important determinant of device usage. As per their analysis, almost 40% of single-night bookings for the same day were done on mobile while mobile bookings of a 4-night stay for the same day dropped to 28%.

Exhibit 17: Mobile usage based on length of stay and time to departure

COVID Outlook

We have established in the initial sections that m-commerce in the travel industry, in general, has been on the rise. Discussions with industry experts during our research revealed that the onset of COVID-19 has accelerated an already existing trend.

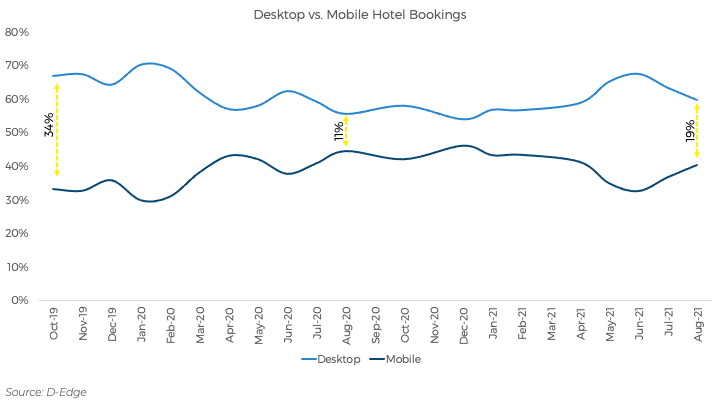

D-Edge shared with us the data for hotel bookings made via desktop vs. mobile between October 2019 and August 2021. The data clearly shows that the gap between mobile and desktop bookings has been narrowing.

Exhibit 18: Desktop vs. mobile bookings in the pandemic time

The South Asian airline’s executive we interviewed echoed this mobile boost during the pandemic, saying, “Bookings through mobiles hit as high as 25% during COVID as people did not have much confidence on OTAs and wanted to book directly through our mobile app.”

However, there is still a lot of unknown. The question now is how permanent this shift will be. Jahraus from MyHotelShop commented, “It is difficult to say anything for now. There is not enough data to support this hypothesis. We still have to see if business travel comes back through m-commerce. The trend is definitely continuing.” Kunz-Cho from Fareportal echoed, “Majority of the travellers during COVID were the younger generation. Hence, the blip can just be a temporary change.”

On the other hand, some shifts that happened during the pandemic might stay permanently and change people’s behavior, remote work being a major one. Alix Boulnois, the Chief Digital Factory Officer of Accor noted, “Remote work and a potential no desk policy going forward, is expected to definitely accelerate the mobile trend. Plus, more leisure travel and limited choices are also pushing users to use more mobile devices.”

In totality, a real trend can be determined only when the travel industry has completely recovered from the impact of COVID-19 and the traveler behavior has stabilized. However, we believe that COVID has definitely increased mobile usage in a lot of ways and people are getting more comfortable using mobile devices to complete online transactions. This is bound to give a boost to m-commerce sales in the future.

The Way Forward

Understanding m-commerce penetration in travel is not that straightforward. Booking travel is a journey in itself, right from the planning to experience stage. A survey conducted by Signal suggests that around 63% of consumers regularly use more than one device for planning and booking trips. Another survey by Criteo found that more than 30% of bookings via OTAs and direct suppliers were preceded by a click on another device, further confirming the trend of multiple device usage to make travel bookings.

Research on cross-device journeys indicates that travelers often start on one travel site and end up on another. The same thing happens with devices, travelers research on their phones and, later, finalize the booking on a desktop where you can have multiple tabs open and have all the available search tools at your disposal. This corroborates the statistics reported by Smart Insights that conversion rates on desktop for the travel industry are 2.4%, but just 0.7% on smartphone. It is important to know the difference between mobile usage for planning travel and mobile usage for making a booking transaction.

To further understand the possible touchpoints for mobile commerce in travel it is essential to map out a traveller’s journey. Google has identified the five stages of travel as:

- Dreaming: Here the user is thinking about traveling, but doesn’t know when or where. Simply he has the idea and starts to find out which destinations are in fashion or which are within his reach. At this point, the user simply looks for educational content.,

- Planning: Here the traveler already knows his destination and now he is planning the rest of his holidays: how to travel, the hotel, what to visit, restaurants to eat, etc.

- Booking: This is the most important step for the travel vendors. In this moment the user books, closes his vacations and he will become a client of the travel vendor if they are able to grab his attention in the first two stages.

- Experiencing: Here the user has embarked on the journey and is tangibly flying the airline and staying in the hotel he booked. Hence, in this stage the vendors and travelers interact to ensure quality customer service.

- Sharing: This stage is all about using social media and other channels to share the trip experiences.

Exhibit 19: Stages of travel

Travel companies’ mobile strategy should put mobile at the front and center of every stage in a consumer’s journey. Mobile should not be considered just as a channel, but as part of a seamless experience. Having a great mobile site or application is no longer just about making a few more sales. It’s become a critical component of building strong brands, nurturing lasting customer relationships, and making mobile work for you. It is a fundamental part of our lifestyle. It’s how we communicate, how we spend time and, more and more, how we transact.

Travel executives we interviewed echo the importance of focusing on experience, instead of distinctive devices. Aitken noted, “Travel planning is not a linear exercise – when you plot and track the user journey, people interact with lots of resources before they make a decision to book. Therefore, looking ahead, one of the key challenges to overcome is multi-touch attribution and a clear, consistent user experience, especially across multiple devices and desktop vs mobile.”

Similarly, when asked about Fareportal’s mobile strategy, Kunz-Cho said “We are channel agnostic. We want to give the customers a chance to reach out to us. We don’t push people to choose a certain channel.” Jolie Fleming from IHG Hotels & Resorts agreed, “Mobile is an important part of our cross-platform strategy. We want to meet guests wherever they are to support bookings, stay experiences and beyond. IHG engages guests on the go via a variety of platforms to make researching and booking a room as convenient as possible.”

As a vendor you cannot force someone to go down a path that they don’t want to go down. As much as brands want all of their customers to start at the top of the funnel and go neatly swirling down the stream into a conversion, that is just not how it works. Customer journeys are messy. They can start in unexpected places, take detours, speed up and slow down.

Yet, this doesn’t mean that there are no mobile unique challenges or opportunities. The 2018 Mobile Payments and Fraud Survey captured what challenges travel vendors face trying to reach and convert consumers in the mobile channel. The top three concerns for vendors are ease of use, detecting fraud and addressing mobile security, and fraud risk. Accepting new payments, cost of new technology, and lack of internal resources to boost mobile channel sales were ranked as low priority concerns.

We believe that concerns other than providing ease of use for consumers, like detecting fraud, managing fraud risk, and making relevant payment options available, can be tackled by tracking and analyzing user data and investing in the right technology. The discrepancy between mobile and desktop performance is not indicative of a problem with mobile devices, but rather stems from a transition period in the way consumers perform internet search and interact with their devices.

As per a recent Qubits survey, 47% of the respondents said they would complete more purchases via mobile if the browsing experience was easier or faster. Gary Yu, Senior Director of Product, Hilton, told Skift, “The key challenge is the nature of how people use their mobile is inherently different from a desktop. Desktop is more focused. While using a mobile, consumers are very distracted. Acknowledging how the behavior is different and building products to cater to that is of high importance.” Henceforth, it is a matter of user experience.

Overall, it is important for travel vendors to first understand their customer’s journey, how he/she searches online, connects with the brand, and the reasons why they book, or indeed, not book. This will allow them to identify the touchpoints to focus on, provide relevant and crisp content, adapt to pertinent payment options, create a well-designed and frictionless booking process and hence, boost mobile sales along with the other sales boosted by mobile discovery.