Skift Take

We continue to evolve and improve our product with the busy travel industry executive in mind. We’re digging deeper than ever before with more analyst perspective, and more data to support our forward-looking insights and conclusions. 2018 will be the year of the subscriber.

2017 was a pivotal growth year for Skift Research. We are thrilled with the growth in our subscriber base and the volume of content we’ve generated throughout the year. In January, we rebranded from Skift Trends to Skift Research, to reflect our deeper focus on primary industry and consumer data collection. We’ve since launched six major industry surveys covering hotel distribution, destination marketing, travel startups, and digital transformation in travel. We also fielded numerous consumer surveys looking at leisure, business and affluent traveler trends.

Our signature deep-dive reports merged traditional editorial reporting with rigorous financial and strategic analysis to evaluate travel’s big tech platforms including Ctrip, Expedia, Facebook, Google, Priceline and TripAdvisor. These enterprises are critical consumer channels across which the business of global travel is conducted.

We also analyzed the state of the vacation rental ecosystem, looking at the intermediaries, property management brands and technology providers now shaping the landscape. We explored budget dynamics and best practices in destination marketing. We analyzed business travel through the lens of conferences and events. We probed the implications of loyalty in hospitality, particularly as the big chain brands divest away from their real estate holdings.

The Year Ahead

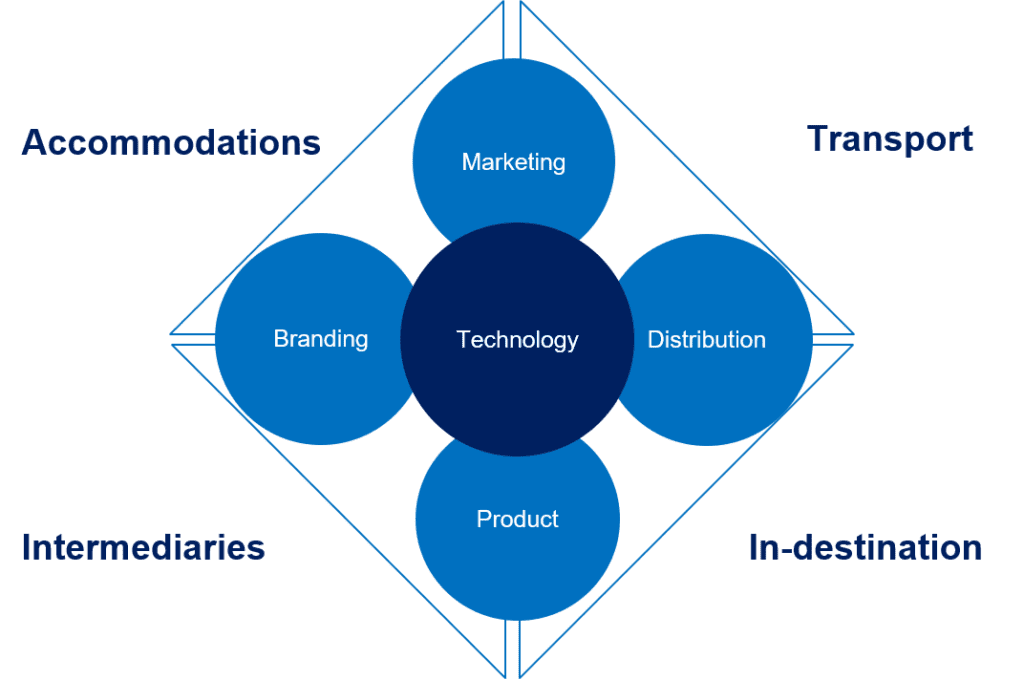

Next year, we will focus on delivering better analysis and better formats that help keep our community informed on the latest trends and developments in travel. Our deep dive series will focus on the big accommodations and airline brands. We’ll examine the hotel chains and their branding and marketing strategies, distribution, asset ownership, and the value-add that they bring to customers as well as hotel owners.

We will also cover airline distribution in greater depth, an area we barely touched in 2017. We anticipate a deeper transformation in the way that airlines interact with and sell to customers. Our June 2018 technology conference in Silicon Valley will highlight some of our research on retailing, merchandising and distribution. Airlines will look to build on their ecommerce and cross-marketing capabilities.

Our Reaction Reports series is a newer format that we’ve created to deliver more timely and topical analysis on the issues impacting travel. That includes earnings, acquisitions, major announcements, strategic initiatives, and other events that might have a significant impact on global travel.

The majority of our OTA coverage will become part of our Reaction Report series. We anticipate a busy and potentially turbulent year for the likes of Priceline, Expedia and TripAdvisor. Asia’s rise as a key outbound travel market will also play into our coverage of the online space. China’s domestic players including Ctrip, Fliggy and Meituan — backed by the likes of Priceline, Tencent and Alibaba — will become more visible on the global stage. Tech acquisitions abound, as travel’s incumbent players look to stay relevant in an age of platforms.

Alternative accommodations and the short-term rentals market will also play into our broader coverage. We are currently working with various partners to deliver detailed and interactive data on key market metrics. Here, we are staffing our research bench accordingly, bringing in lodging and hospitality experts from New York’s big financial investment firms to evaluate broader sectoral shifts and competitive faultlines.

Technology will return as the underlying theme, as we dig into the companies and platforms now shaping the industry. Company functions like data analytics and personalization, performance marketing, digital advertising, content management and distribution, API integrations, machine learning, voice and unstructured search, merchandising, and other tech-enabled business functions run core to every modern travel vertical. That includes hotels, airlines, tour operators, the big intermediaries but also destinations looking to attract and retain their most loyal customers.

Our Framework For Understanding The Industry

Source: Skift Research

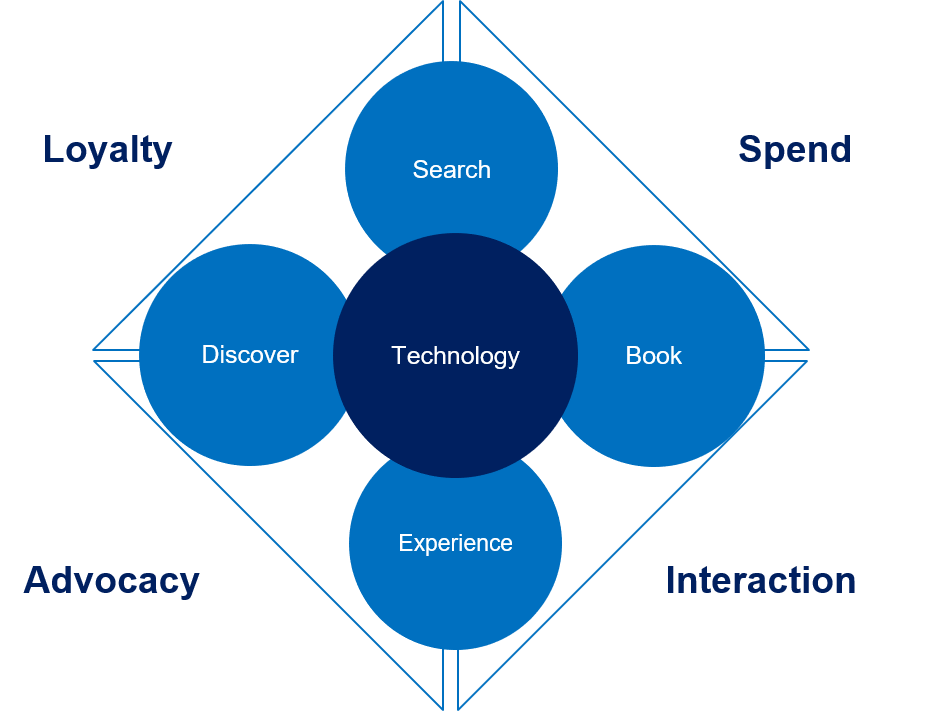

As we move into 2018, we also note the changing role of the travel consumer. Things like mobile computing, personalization, and prescriptive analytics mean that travelers now play a more active role in the brand design, marketing and product development process. Users are, in essence, part of the feedback loop that hoteliers and airlines use to perpetually improve the way brands create unique value. Developers and UX designers use traveler data collected at various points along the customer journey to streamline messaging and functionality. Customer centricity and maximizing customer lifetime value is the core objective.

Our Framework For Understanding the Consumer

Source: Skift Research

In 2018, we aim to shine a brighter light on how consumers want to interact with technology and brands, the advertising channels best suitable to engage across different parts of the customer journey, how brands leverage loyalty programs to build stronger relationships with their most valuable customers, and other elements tied to evolving consumer behavior. Our annual survey series and Data Sheets will strengthen our assumptions and outlook on travel with data points that our subscribers can use to build on their own initiatives.

Prevailing Trends Moving Into 2018

Our coverage will also align with certain overarching megatrends. Travel is a broad sector with numerous interconnected verticals. Some developments impact larger swaths of the travel ecosystem than others. Here are things we will be paying close attention to next year.

Platforms eat the world. Out of the big-five tech companies, Google and Facebook have the most direct impact on travel, mostly as advertising platforms but increasingly further down funnel with payments and content integration across their various consumer touch points. We will look closely at how the travel-specific brands — i.e. the OTAs, hospitality and airline players — plug into these big platforms. We’ll also keep an eye on other big players — e.g. Amazon, Apple and Microsoft — and their work in AI and voice search, interconnected devices (IoT), and augmented and virtual reality.

Economic tailwinds. We’re encouraged by the global economic outlook for 2018 and what that means for travel. The IMF raised its forecast for 2018 with more growth expected in mature and developing markets. In the U.S., better jobs growth, sustained low interest rates, and a potential infrastructure spend bill mixed with corporate tax cuts should keep companies investing. A rising middle class in Asia and greater stability in Latin America, will further push the needle for outbound travel demand to Europe. We worry about the “shock” potential of things like Brexit, terrorism and neo-isolationist tendencies, but overall the outlook for next year looks strong.

Everyone is a technology company. Travel companies are looking to invest in smarter operations, better marketing, better pricing, and better integration with their content partners. All of that, combined with strong global travel demand means more spend on technology solutions and services. Intermediaries and GDSs are stepping up to fill demand for better property management systems. We’ll be looking at how the big hotel groups and airlines transform their businesses.

Shake-up in digital advertising. Travel advertising dollars mostly help to feed Google’s and Facebook’s growth. The big online brands have recently de-emphasized performance marketing as part of their spend mix. While we do not expect digital to go away, we anticipate a bigger push on brand advertising and marketing. Offline channels could see a mild resurgence. We will keep tabs on how travel is allocating ad spend.

In total, we expect a very full publication schedule. We expect to add more than 30 new entries and reports to our subscriber vault. We will also look to our audience and subscribers for critical feedback on the market. Skift’s editorial and research teams interact with the industry on a daily basis. We are blessed with a loyal audience that sees the value in collaborating on our various initiatives, and we look forward to connecting with our peers in helping to create increasingly better products and services.

Tags: consumer research, market research, online travel, travel industry research