Report Overview

Skift Research has gained unprecedented access to one of the fastest growing online travel agencies (OTAs) in North America – Hopper. We interviewed senior executives across each of Hopper’s verticals, as well as speaking to their co-founder and to their CFO in order to produce a deep dive analysis of Hopper’s rise in travel. Since being founded in 2007, Hopper has become a formidable disruptor of the OTA market, which for so long has been dominated by the duopoly of the legacy players. It has leveraged big data, machine learning algorithms and predictive analysis to launch an array of unique fintech products which have been fundamental in helping it become the third largest OTA in North America.

In this report, we take a deeper look into how exactly Hopper differentiates itself from its competitors and what has fuelled its tremendous growth. Based on our conversations with senior executives, we have also estimated Hopper’s key financial and performance indicators, such as total gross bookings, revenue and marketing spend, as well as modeling its future growth trajectory. Hopper is a private company and much of the data and analysis presented in this report is not publicly available, nor has it been published in such detail before – making this a truly differentiated piece of work.

What You'll Learn From This Report

- The evolution of Hopper’s business strategy and how that has influenced top-line growth and market share gains

- Hopper’s key metrics such as gross bookings, revenue, take rate and segment mix, as estimated by Skift Research

- Hopper’s key growth drivers, such as the launch of its fintech products and Hopper Cloud (its B2B arm)

- Skift Research’s projections for Hopper’s growth trajectory

- Hopper’s unique user acquisition and marketing strategy within the travel industry, specifically its vision of utilizing social commerce as inspired by Chinese app Pinduoduo

Executives Interviewed

- Dakota Smith, Co-Founder & President of Hopper

- Daniel Calderon, Chief Financial Officer of Hopper

- Ella Alkalay Schreiber, General Manager of Fintech at Hopper

- Makoto Rheault-Kihara, Head of Hopper User Acquisition

- Kiera Haining, General Manager of Hopper Flights

- Lexi Caron, Head of Hopper Hotels Marketplace

- Ani Malkani, Head of Hopper Ground Transport

- Susan Ho, Head of Hopper Homes

- Hayley Berg, Lead Economist at Hopper

Executive Summary

Hopper was founded in 2007. It spent nearly a decade building out a structured database of travel information and price prediction algorithms advising users on when to book flight tickets. In 2016, it changed its business model, deciding to utilize its data-driven approach to not only advise customers on when to buy flight tickets, but also allow them to book on Hopper’s own app.

In early 2019, Hopper launched its first fintech product called ‘prize freeze’ which allows customers to lock in flight prices based on advice from Hopper’s price prediction models. Since then it has launched a whole fintech suite which has materially contributed to top line growth.

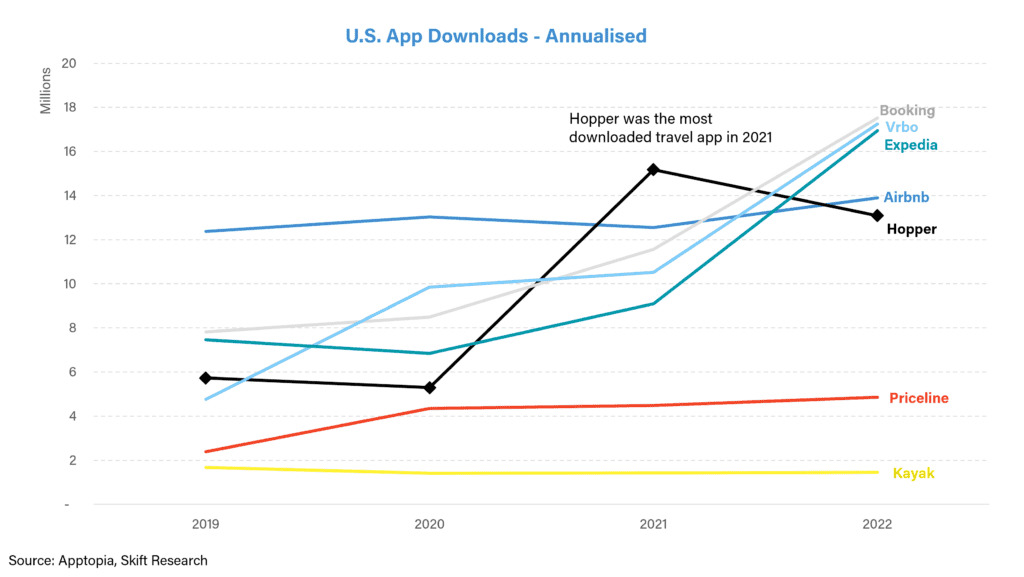

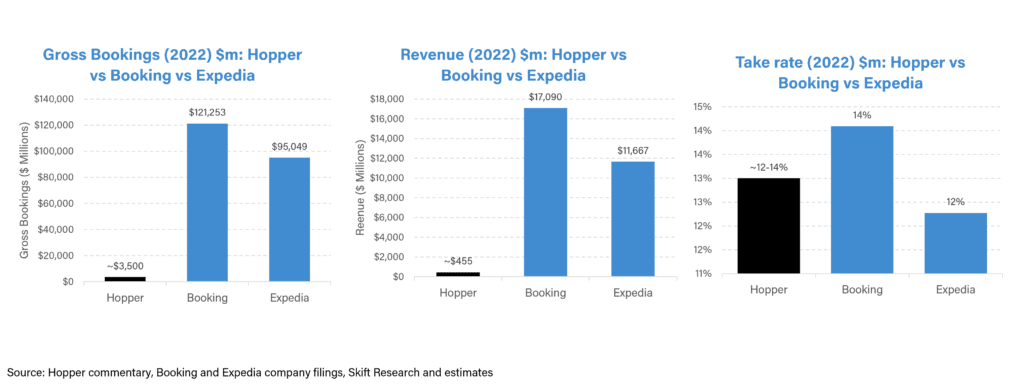

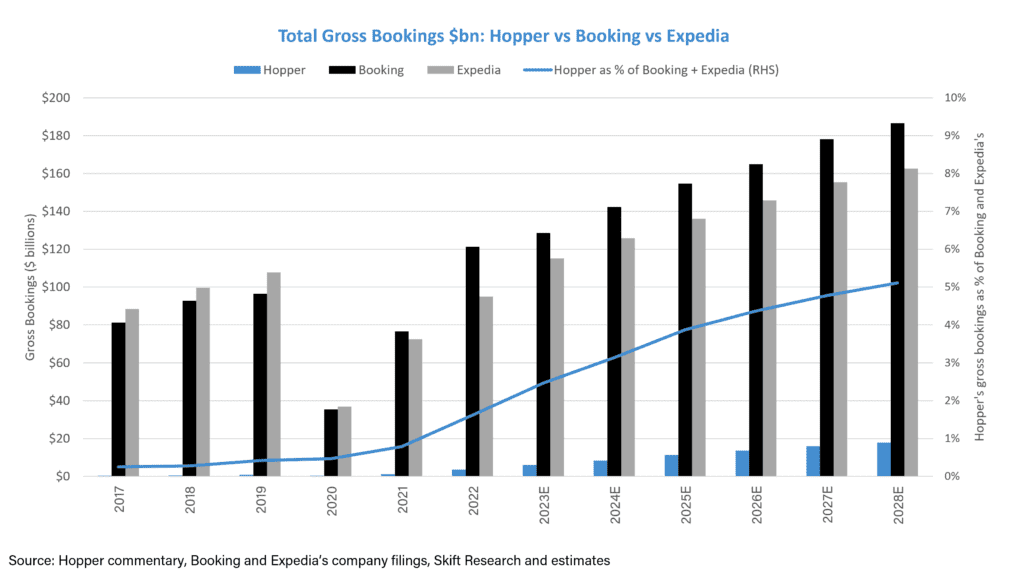

For instance, as of 2022, we estimate that Hopper’s total gross bookings are around $3.5 billion which places it at only 3% to 4% that of Booking and Expedia’s respectively – but despite Hopper’s relatively smaller size and the fact that it’s not yet fully at scale, its take rate of around 12-14% (Skift Research estimate) is in line with Booking’s 14% and Expedia’s 12%, largely thanks to the expansion of its fintech products. In the last few years, Hopper has gained significant market share, and in 2021 it was the most downloaded travel app in the U.S. Today, it is the third largest OTA in North America.

What has fuelled such rapid growth at Hopper and what differentiates it from its peers? There’s certainly a sense that Hopper’s success is comeuppance for the legacy travel industry which in many ways has been held back by outmoded ways of working. Hopper, with its first-principles thinking and desire to address pain points in the industry has allowed it to leapfrog other OTAs through its fast adoption of new systems such as NDCs (New Distribution Capabilities) in the flights business and its differentiated offering of anxiety-alleviating fintech products.

Hopper, not held back by legacy tech systems and contracts, is simply capitalizing on what the long-established players have been too slow to implement. Perhaps even more ironic is that through its fintech suite, Hopper’s monetization of traveler anxiety is in fact a direct product of the unfriendly selling practices, such as “hate-selling”, long perpetuated by the traditional OTAs themselves.

Hopper’s customer-led strategy is an overarching theme that has powered growth drivers for the company, from the launch of its fintech suite which have significantly boosted top line growth and take rates to its social commerce inspired marketing strategy which hopes to increase user engagement and life-time value of customers. Hopper is clearly not afraid to innovate and pivot strategy, as dictated by the needs of its users – and this unique characteristic makes it a formidable competitor in today’s distribution landscape.

An Overview and History of Hopper

Hopper is an online travel agency (OTA), co-founded in Montreal, Canada in 2007 by Frederic Lalonde (who is the current CEO) and Joost Ouwerkerk, both formerly Expedia executives.

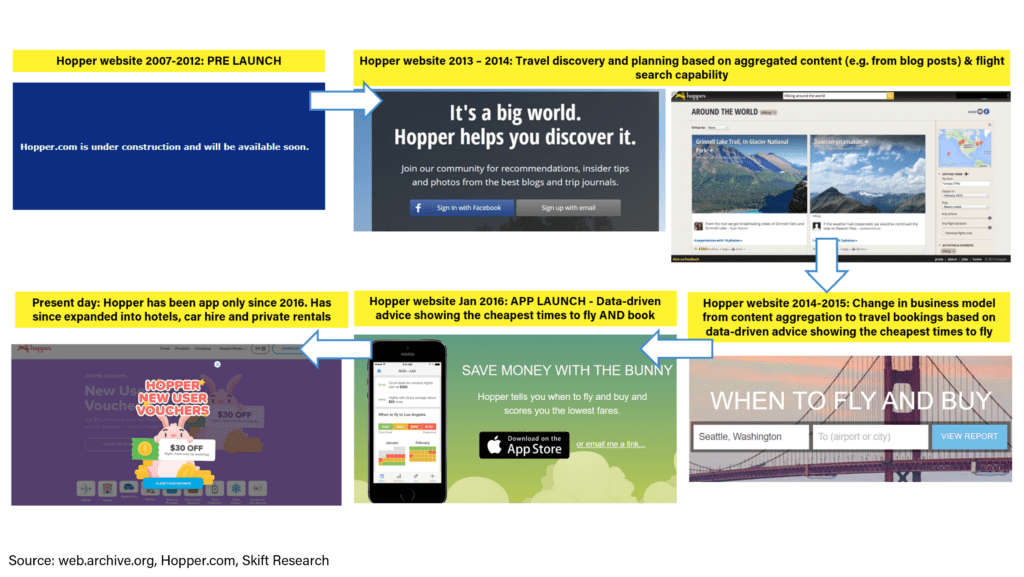

Prior to launching their website in 2013, Hopper spent several years building out a database of travel information, with its original value proposition being to harness a data-driven approach in allowing better travel inspiration and planning, based on aggregated content from sources such as blog posts and travel reviews.

In 2014, Hopper changed its business model from content aggregation to flight bookings, utilizing its structured database of travel information and price prediction algorithms to advise users on when to book flight tickets, launching an app based around this in 2015. In 2016, it officially launched as a travel agency, allowing consumers for the first time to use Hopper as a channel to book flights.

However, whilst Hopper is well known for its data capabilities and utilizing that data to optimize savings for flight bookings, the company’s management, such as co-founder Dakota Smith, quickly realized that “you don’t make a lot of money when you sell air travel alone. The average airline pays a 1.5% to 2% commission and that’s not really enough to even cover the cost of payment processing or customer service.”

Therefore in attempts to expand margins and better monetize its price prediction tools, Hopper expanded its scope from standalone air travel to other verticals within travel such as hotels in 2017, car hire in 2019, and private rentals in 2022, as well as launching an array of fintech products which aid in mitigating consumer anxiety around price volatility and cancellations.

In 2021, Hopper expanded into the business-to-business (B2B) space with the launch of Hopper Cloud, powering the travel capabilities of keynote partners such as Capital One (which also led Hopper’s latest funding round), Uber, and most recently Australian bank CommBank. Hopper Cloud also provides Hopper’s suite of fintech products to partners already within the travel ecosystem, such as Agoda and Kayak, amongst others. Through its acquisition of tours, activities and experiences provider PlacePass in 2021, Hopper also powers the experiences arm of Marriott’s Bonvoy loyalty program.

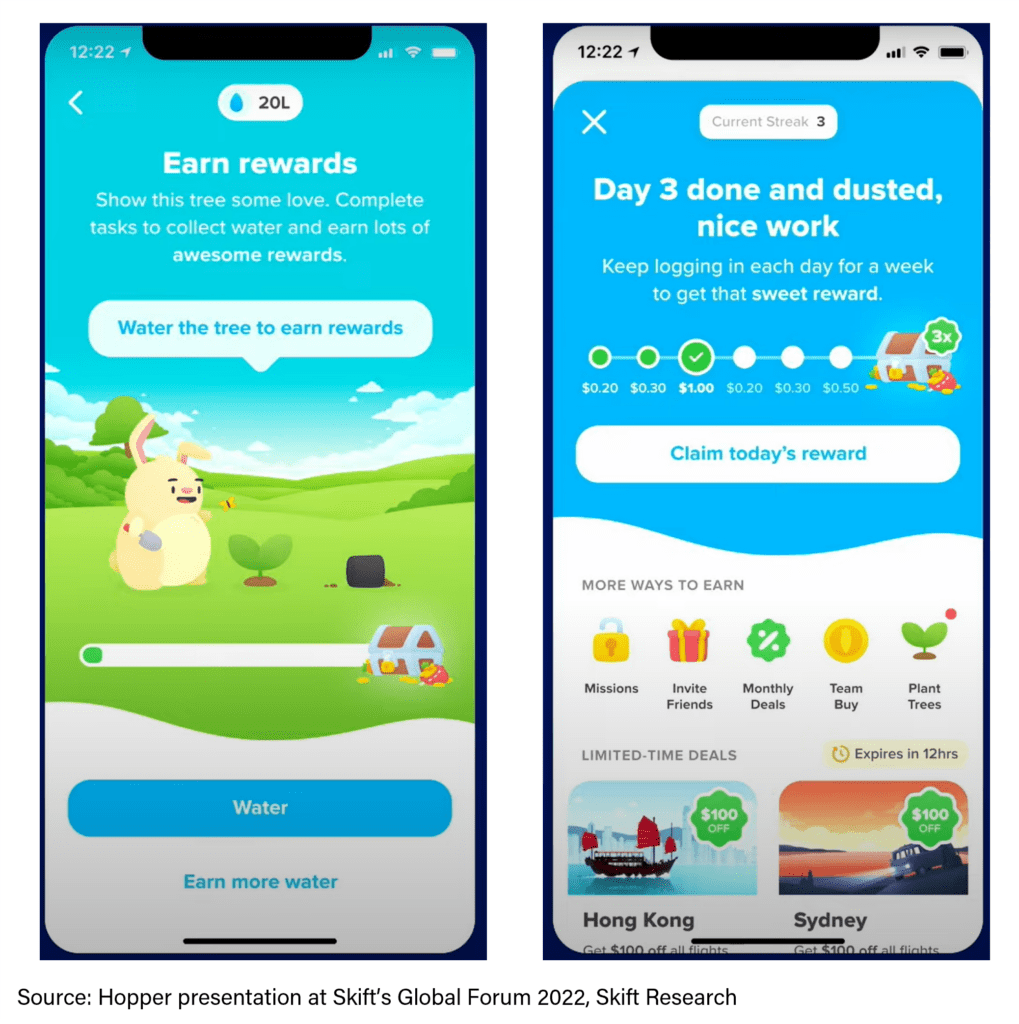

Hopper is also well known for its desire to evolve into a social ecommerce platform and become a travel super app, with its CEO often citing Chinese app Pinduoduo as an inspiration behind this vision. Hopper intends to introduce a gamification element to the app which allows users to collect and spend ‘carrot cash’ – Hopper’s currency for its loyalty program – as a means to bypass traditional marketing spend on search engine marketing, as well as increase retention and the lifetime value of users. This strategy plays to its primarily Gen-Z and Millennial customer base, with 80% of bookers aged 18-35, with an average of 25.

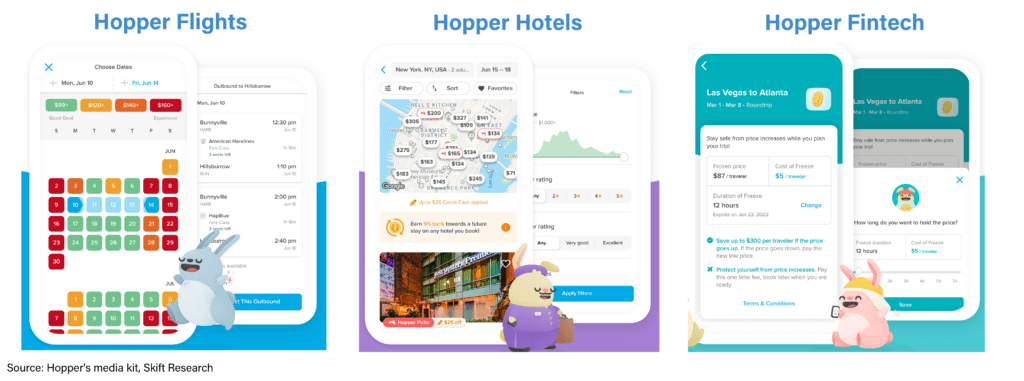

Hopper is also an app-only platform. Hopper does have a desktop presence, but the website doesn’t allow bookings, instead leading customers to download and use the app. Below we present some screenshots of some of Hopper’s products, such as Hopper flights, Hopper hotels and its price freeze product.

The app is clearly built to appeal to its target audience of Gen-Z and Millennials, with Dakota Smith, co-founder of Hopper saying “We would like to become the defining travel brand for Gen-Zs. And the app has fully embraced that, with the whimsical tone of bunnies and bears, elements of gamification, social commerce, carrot cash as well as our marketing channels of TikTok, Instagram and Snapchat all really leaning into that image.”

Hopper Has Gained Market Share

Since launching as a travel agency in 2016, Hopper has firmly established itself as a popular app for flight and hotel bookings, becoming well known for its price prediction tools and fare alerts. In 2021, it became the most downloaded travel app in the U.S., as shown in the chart below.

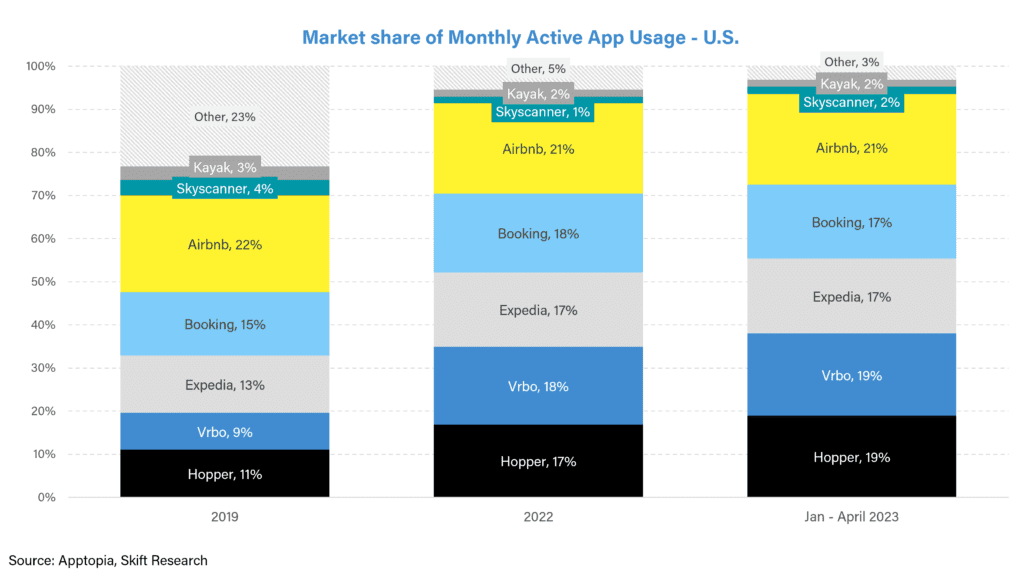

Hopper has materially grown its market share of total app usage, from 11% of the U.S. market in 2019 to 19% today, as shown in the chart below.

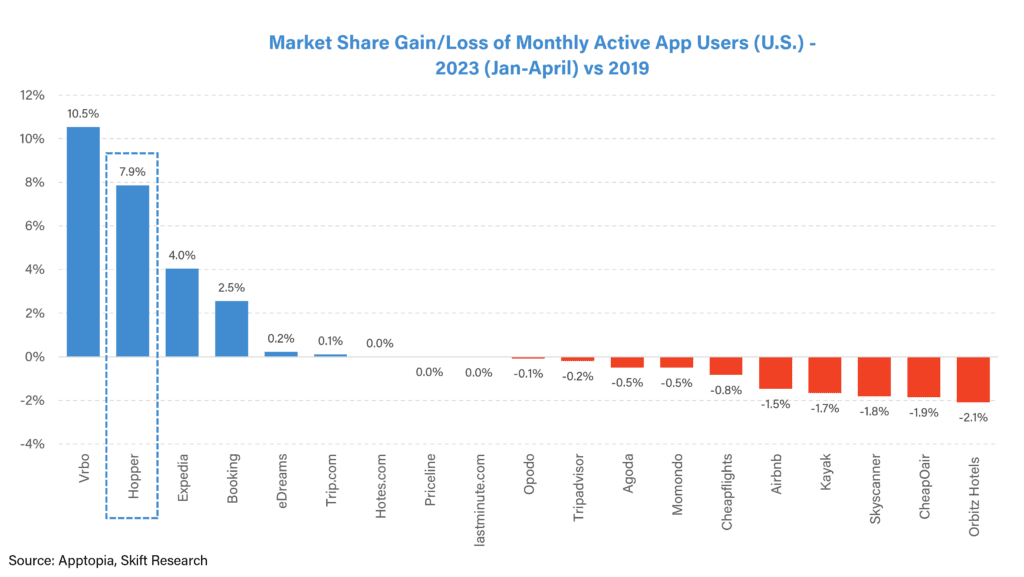

Hopper’s +8% share gain since 2019 places it as the second fastest gainer of market share, behind Vrbo’s +11%, as shown in the chart below. Vrbo, which is Expedia’s vacation rental brand, likely benefited from the surge in demand for private homes throughout the Covid pandemic, especially for whole accommodations in non-urban destinations which is where the majority of Vrbo’s supply sits.

The fact that Hopper — which didn’t benefit from the same demand for vacation rentals (having only expanded into Hopper Homes in 2022) — has gained share faster than giants Booking Holdings (which is aggressively expanding into the U.S.) and Expedia (which is likely closest to Hopper in terms of revenue mix out of the major OTAs) goes to show the level of traction it has garnered over the last few years.

Hopper’s Key Financial Metrics

Top Line Growth and Segment Mix

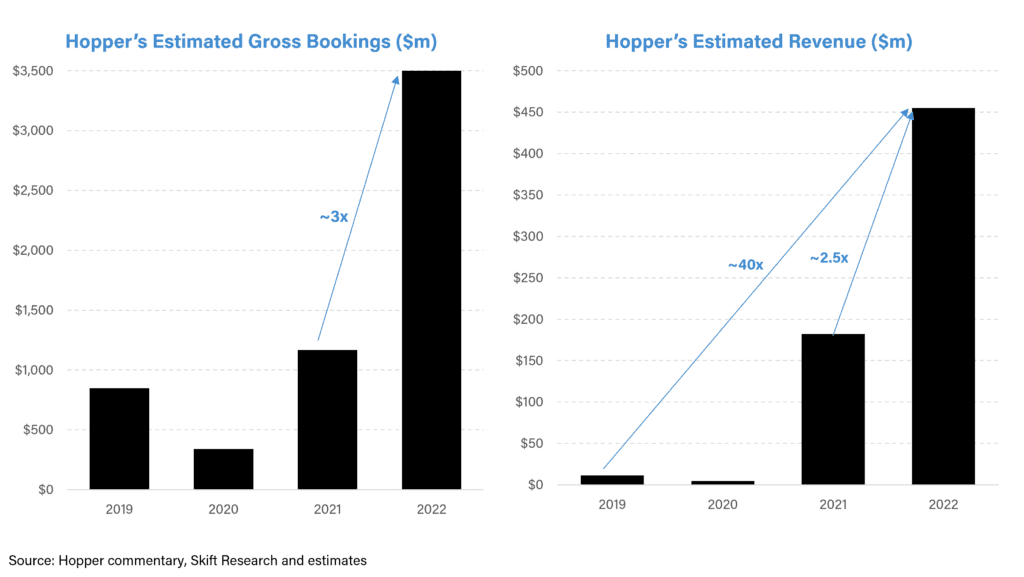

Over the last few years Hopper has seen enormous expansion, growing its revenue 40x since 2019 – largely due to its evolution from selling solely flight tickets into higher revenue generating streams such as hotels, fintech and Hopper Cloud. In 2022 Hopper made roughly $3.5bn of gross bookings and revenues of around $455m (as estimated by Skift Research, and shown in the charts below).

Though Hopper is primarily a U.S. focused company, it is quickly expanding internationally, with international users comprising more than 20% of their sales today, versus about 5% the prior year. However, globally, as of 2022, we estimate that Hopper’s gross bookings are only 3% to 4% that of Booking and Expedia’s respectively. Despite Hopper’s relatively smaller size and the fact that it’s not yet fully at scale, its take rate of around 12-14% (Skift Research estimate) is in line with Booking’s 14% and Expedia’s 12% – largely thanks to its fintech offerings.

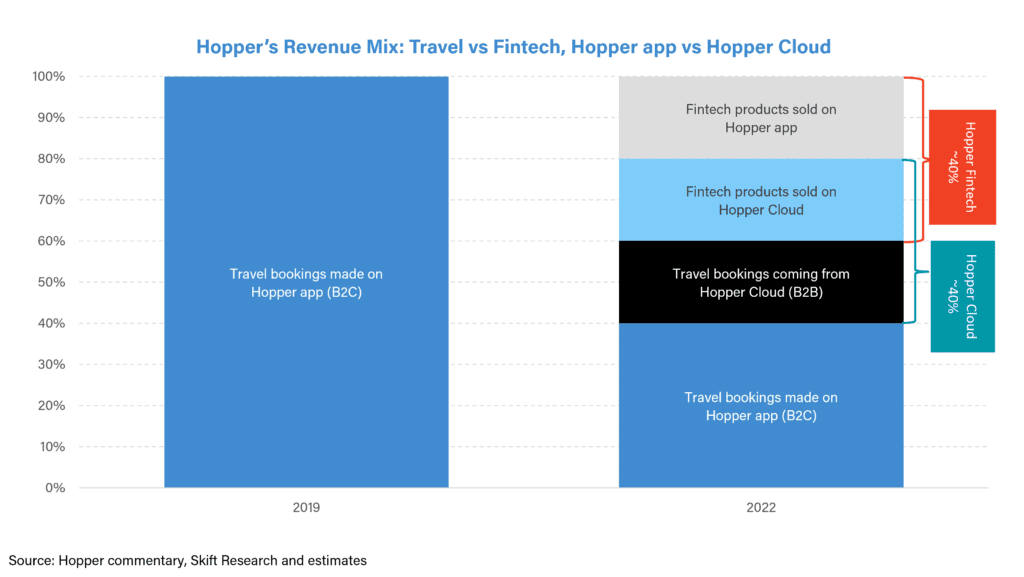

Much of Hopper’s growth can be attributed to its expansion of fintech products (rolled out early 2019), as well as the launch of its B2B business Hopper Cloud (launched in 2021)– each making up close to 40% of Hopper’s total revenue today.

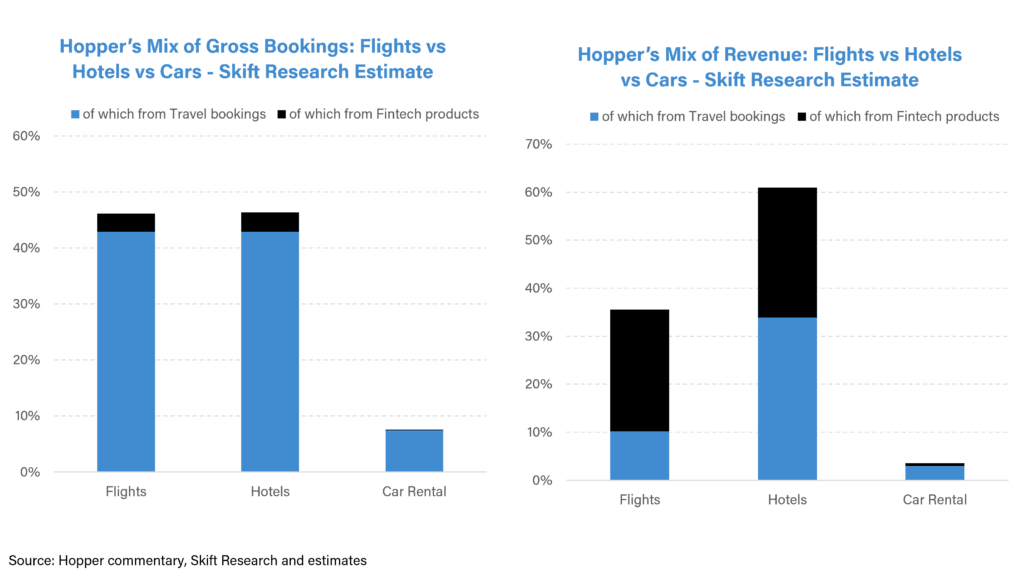

Despite being best known for selling flight tickets, today Hopper’s hotel gross bookings roughly match that of flights (with Hopper reporting that hotel bookings have grown 100x since 2019, selling roughly 2 million hotel room nights annually), as shown in the chart below. Whilst flights and hotels make up a similar share of Hopper’s total gross bookings, as a percentage of revenue, hotels have the larger share due to the much higher take rate available for hotel bookings versus flight bookings.

Additionally, since launching fintech products in early 2019, fintech has grown to become a significant source of revenue for Hopper, and we estimate that it makes up around 70% of flights revenue and around 45% of hotels revenue.

This goes to show how Hopper’s expansion into both hotel bookings and fintech has helped fuel growth at the company, with co-founder Dakota Smith saying that “the most profitable segments are fintech and hotel bookings. This isn’t a secret, right? The existence of fintech turns air travel from what is generally a loss maker at other travel agencies into a small profit center for Hopper. That said, people are just as likely to buy fintech on hotel bookings [which offers a much higher take rate than air tickets]. So we still would rather sell you a hotel booking.”

Profitability and Cost Base

Hopper likely has negative EBITDA margins today, with focus being on market share growth rather than bottom line profitability. Though it is “gross profit positive on every product” it sells (with fintech products having higher gross profits than travel bookings), Hopper re-invests much of its free cash flow into research and development (R&D) as well as marketing in order to spur growth on the top line and continue gaining market share. Hopper’s co-founder Dakota Smith said to us that, “Hopper has been growing really fast; over the last seven years, we saw a 100% compound annual growth rate (CAGR). That said, we are investing a lot of money into research and development. We have a big team made up of about 500 software engineers. We are letting the products re-invest all of their gross profit back into market share growth, and that is still the priority.”

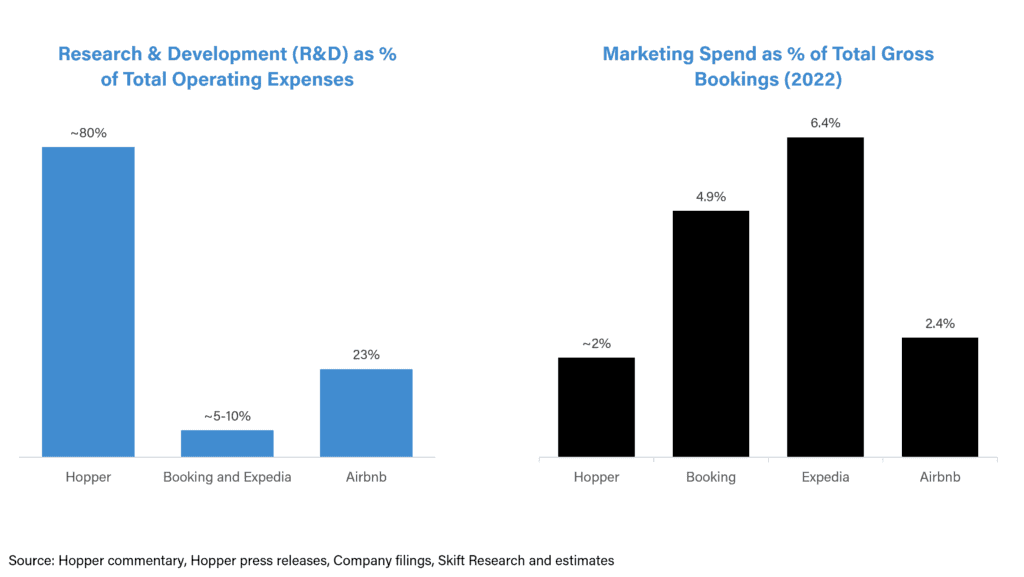

According to Smith, R&D is about 80% of Hopper’s operational expenses, with half of their team working on new initiatives that have yet to generate material revenue. Smith explains that “that’s why you see us able to do things like launch new fintech products, but also the entire Hopper Cloud business unit out of thin air in 18 months because we were already positioned with the kind of cost structure to support that kind of innovation. In contrast, at a more mature company that you might see in the travel industry, less than 10% of their operating expenses would be spent on developing and launching new initiatives.”

Whilst Smith expects R&D spend as a percent of operating expenses to decrease to 30% over the next few years as new initiatives get rolled out, even this level of spend on R&D is non- traditional for an OTA, which would typically invest the majority of its operating expenses in sales & marketing, rather than technology advancement; Hopper’s edge on tech development is a clear differentiator between it and its peers.

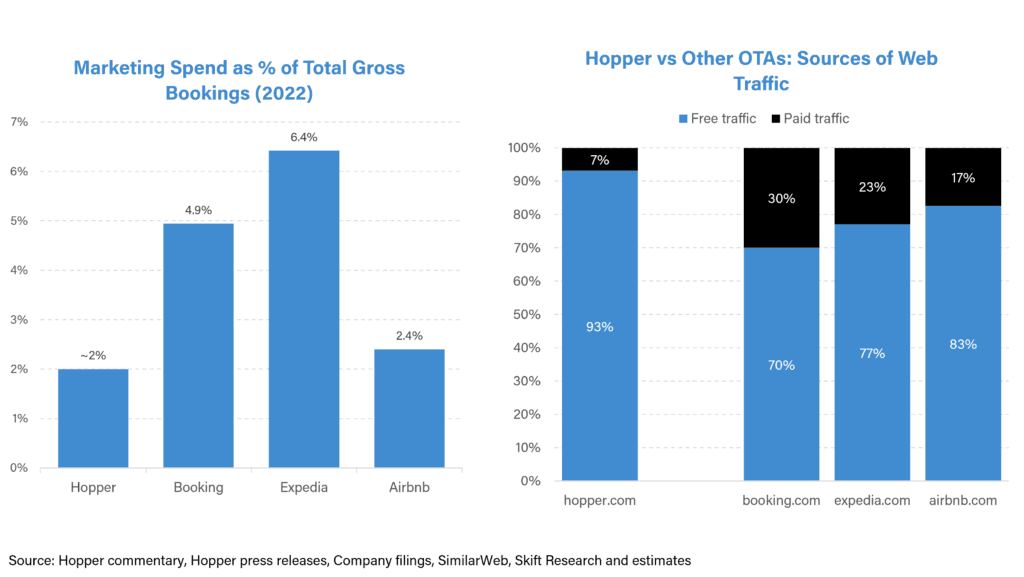

Another differentiator is its strategy around marketing spend. Despite being a young company which is not yet fully at scale, we estimate that Hopper’s marketing spend is only around 2% of its gross bookings, versus 4.9% and 6.4% at Booking and Expedia respectively and 2.4% at Airbnb.

Unlike Booking and Expedia, that continue to spend performance marketing dollars to acquire traffic from Google – not daring bite the hand that feeds them – Hopper doesn’t list on Google or any other metasearch platform and also gets more of its customers through direct channels (with Hopper receiving 100% of its bookings from its app – having no booking presence on desktop web, for its non-B2B business at least). Hopper instead focuses the majority of its performance marketing spend on social media (appealing to its mainly Gen-Z and Millennial consumer base).

Hopper is also significantly investing into building out a social commerce platform with a gamification aspect that allows users to collect carrot cash (Hopper’s currency for their loyalty program) on a daily basis such that the app retains consumers until they’re ready to book a trip. This differs from the broad strategy used at Booking and Expedia, which are “buying high intent users ready to book today, and are deep in the funnel of Google search or metasearch.”

Daniel Calderon, Hopper’s CFO, compared Hopper to Airbnb – which also rarely lists on Google – explaining that “you can think of us long term more like Airbnb – the only other travel app that is single brand and is focusing on demographics also. We should be like Airbnb in terms of sales and marketing.”

We go deeper into Hopper’s user acquisition and social commerce strategy in a later section of this report.

What Fuels Hopper’s Growth?

We identify 5 key drivers behind Hopper’s growth trajectory. They are:

- First Principles Thinking

- Fintech

- Hopper Cloud

- Differentiated Marketing Strategy

- Super App Ambitions

Growth Driver 1: First Principles Thinking

From our discussions with executives across the various verticals at Hopper, one thing which stood out was the data-driven, first principles thinking utilized by Hopper to offer its services. Unlike legacy travel companies which have long been held back by outdated modes of working, Hopper has been able to quickly capitalize on opportunities and technologies which the long-established players have been too slow to implement. Hopper heavily relies on data analysis to address pain points in the industry and respond to consumer desires, such as launching fintech products which help mitigate consumer anxiety and launching Hopper Homes upon realizing that 40% of their customers prefer a private rental over a hotel (with Homes having growing to over 4 million properties since being launched in 2022 – and is in the process of expanding supply).

Hopper has also been addressing a key pain point in the flight business in particular. It has been heavily investing in first party NDC connectivity (New Distribution Capability, which allows upselling of ancillaries such as seat selection and class upgrades) through direct partnerships with airline providers, which – as we have written in The State of Airline Distribution 2018 – is an area traditional OTAs and corporate travel agents have been slow to implement. For instance, many traditional OTAs still heavily rely on decades old Global Distribution Systems (GDSs), which are based on legacy mainframes that do not have built-in capability to support the vast majority of ancillary and branded fares.

We spoke with Kiera Haining, General Manager of Hopper Flights, who said that “one of the primary goals of Hopper is to make sure we’re able to offer all of that ancillary content, which NDC unlocks for us. We are actually able to drive market leading ancillary attach rates for seat selection for our airline partners and is something we work very closely with airlines in order to achieve, and make sure we’re able to offer, promote and merchandise that content to customers effectively.”

Hopper’s first-principles thinking and customer-led strategy is an overarching theme that has powered key growth drivers for the company, as discussed in detail in the sections below, from the launch of its fintech suite which have significantly boosted top line growth and take rates to its social commerce inspired marketing strategy which hopes to increase user engagement and life-time value of customers. Hopper with its data driven strategy and technology capability also allows it to be differentiated from the older, more traditional OTAs. This coupled with Hopper’s fintech offering layered across all of its products provides partners and suppliers an alternate avenue to diversify their source traffic and revenue streams, allowing Hopper to be a very real competitor to the giants of Booking and Expedia.

Growth Driver 2: Fintech

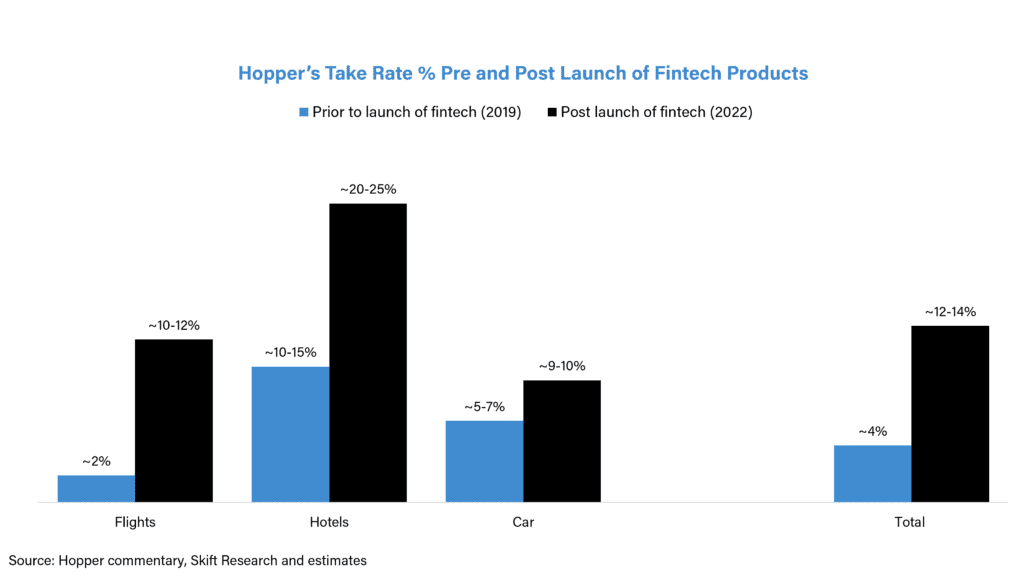

Before Covid and before the launch of fintech products, the majority of how Hopper made money was similar to that of traditional OTAs – Hopper received a commission per travel booking, with “take rates” ranging from 2% for flight bookings to 5-7% for car hires and 10-15% for hotel bookings.

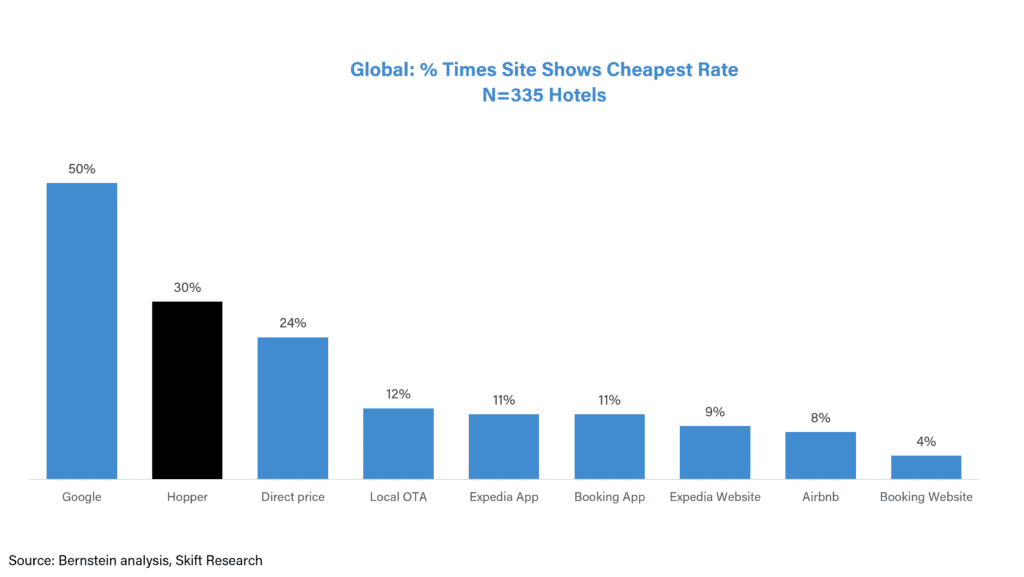

In order to lead peers on price – a key reason why Hopper’s mainly Millenial and Gen Z consumers use the Hopper app – Hopper regularly discounts prices and offers the savings back to users in the form of ‘carrot cash’ (Hopper’s loyalty scheme). Hopper’s lead on hotel prices is shown in the chart below, with Hopper likely to be the cheapest option 30% of the time versus only 11% of the time for Booking and Expedia’s app, according to Bernstein.

By funding these discounted prices Hopper gives up a share of its take rate and we estimate that Hopper’s take rate in 2018/9 was only around 4% – due to both its skew to low take-rate flights bookings and its discounting practices.

While Hopper still offers discounted prices which carve into its take rate, it has also significantly grown its fintech business — which offers higher take rates than just standalone flight or hotel bookings – and we estimate that Hopper has expanded its take rate from around 4% pre Covid to about 12-14% in 2022.

We spoke with Hopper’s co-founder Dakota Smith and CFO Daniel Calderon who provided a breakdown of take rate by travel segment, explaining that before launching their fintech offering, the take rate from flights was only 2%, but has since grown to 10-12%; similarly for hotels, with hotels take rates expanding from about 10-15% pre-fintech to 20-25% today.

Hopper’s launch of fintech products has clearly aided in their goal of optimizing long-term value and revenue gains. Its suite of fintech rivals traditional travel insurance – something which has been a standard for decades – but the new offering has innovated on product types and has resonated with Hopper’s consumers. According to Hopper, 50% of their app bookers are attaching a fintech product to their travel bookings, with an average of 1.4 fintech products per travel booking, paying an extra 10% per booking.

Hopper’s novel fintech offering is helping boost top line growth and market share gains, even if it is less margin accretive than traditional insurance, all in the name of easing consumer anxiety and acquiring high lifetime value users. For example, Ella Alkalay Schreiber, General Manager (GM) of Fintech at Hopper explained that “though we might work on less than half the margin of a traditional insurance fee, we also provide high utility to our customers and make sure that we are building products that our customers love. For example, only about 2% of users would exercise their travel insurance, but about 10% or even higher of customers would exercise on our fintech portfolio. Additionally, traditional insurance comes with a lot of friction – there’s claims portals and a high rejection rate. Our [Hopper’s] acceptance rate is 100%. And it’s all automated. This suggests a new level of service and different level of protection in the travel space – selling products that add real value and that are working with less friction.”

Whilst Hopper’s launch of fintech products have significantly boosted both growth and take rates, it is worth noting the risks that Hopper takes on its balance sheet whenever a consumer exercises the option associated with the various fintech offerings. (See the appendix for a full explanation of Hopper’s fintech products – such as ‘prize freeze’, ‘leave (a hotel) for any reason’ or ‘change or cancel (flight bookings) for any reason’ – and how Hopper utilizes and monetizes its data through fintech). For example, if a consumer decides to buy the ‘leave for any reason’ fintech product when booking their hotel, and upon checking in realizes that the hotel isn’t up to their expectation, they can exercise their option to ‘leave for any reason’. This would see Hopper reimburse the hotel for the original booking, at no extra cost to the customer. Hopper’s ‘leave for any reason’ product differs from the cancellation policy offered by other OTAs in that Hopper enters an obligation to fully reimburse the hotel if the customer decides to leave, whilst cancellation policies place no such obligation for Expedia or Booking to pay out the hotel.

Though Hopper claims its price prediction tools are 95% accurate, and that they dynamically price their fintech products and have sophisticated risk management strategies in place, if there is another black swan event like the Covid pandemic this could potentially place significant pressure on Hopper’s balance sheet.

However, Hopper’s CFO is not worried. Calderon claims that “today the risk that we assess is 10 times smaller than the cash that I have in the bank account”, and he sees the fintech products as having a “healthy risk to margin ratio”. The fintech offerings are also fairly diversified and have natural hedges in place, with Schreiber, Hopper’s GM of fintech, explaining that “it’s really hard to think about a time when everyone would want to ‘cancel for any reason’ and at the same time everyone would also want to exercise their ‘price freeze’.” This effectively shows the negative correlation in play between their fintech products, such that by underwriting some products, Hopper can help hedge the risk on others – meaning that whilst the margins of one product might decrease, margins of others will increase.

There are, however, additional risks on the horizon. Other major players such as Google Flights and Expedia are also launching their own price prediction tools in competition with Hopper, as is Booking which has established its own fintech division. The travel industry is no stranger to highly competitive dynamics, and with new players launching their own fintech products – which, unlike Hopper, are for the most part free, but not yet as sophisticated – we expect Hopper to further invest into fintech and price discounting in order for it to remain price competitive, likely biting into margins and delaying their route to company-wide profitability.

Growth Driver 3: Hopper Cloud

In 2021 Hopper launched Hopper Cloud, its B2B offering, where it powers the travel booking platforms and fintech capabilities of various partners, such as Capital One, Uber, and Agoda, amongst others. Half of Hopper Cloud’s clients are those already in the travel industry looking to expand the scope of their travel platform or launch a fintech offering, with the other half not in travel currently but looking to become a travel booking platform, such as Capital One.

According to Hopper’s co-founder Dakota Smith, there are “really active pipelines for both, with two teams internally pursuing the opportunity in both segments.” For example, in the last couple of years we have seen a flurry of activity from financial institutions such as JPMorgan Chase, Revolut, and American Express partnering with OTAs such as Expedia through B2B deals as a means to tap into the aspirational appeal of travel to their customer base.

Hopper Cloud’s partners tap into Hopper’s inventory through a white label site, utilizing Hopper’s Application Programming Interface (API) to power their own booking products. We estimate that these partners likely take 25-40% of commission earned on each travel booking, with the rest going to Hopper. For partners utilizing Hopper’s fintech products, there are likely various contracts in place, with Hopper managing the pricing and fulfillment of exercised fintech products (i.e. Hopper takes the risk of a fintech product being exercised on its own balance sheet, even if it is through a B2B partnership) as part of the service they offer to their clients.

For Hopper, B2B partnerships allow it to capitalize on the value of its existing inventory and scale its operations with minimal additional costs. Additionally, whilst Hopper’s B2C app mainly targets Millennial and Gen Z consumers, Hopper Cloud allows the distribution of Hopper’s travel agency and fintech products to other demographics, with co-founder Dakota Smith saying “We need to grow up with our user base and retain them through their lifetime as they grow in purchasing power. Along the way, some will drop out, some will become loyal members of other travel programs. Some will go from brand neutral to brand loyal, others will graduate from the mass market and qualify for some of these premier travel credit cards. The strategic idea is that we will be there to meet them because of the loyalty programs or credit cards that they graduate into, hopefully many of them will be Hopper Cloud clients.”

Growth Driver 4: Differentiated Marketing Strategy

We have talked at length about Hopper’s key growth drivers of fintech and B2B. The fourth arrow in the quiver is its unique strategy around marketing and user acquisition, namely its investment into building out a social commerce platform and becoming a travel super app.

Not Playing the Search Engine Marketing Game

Hopper spends much less on marketing than peers Booking and Expedia despite being much younger and not yet fully at scale – in 2022, we estimate that Hopper’s marketing spend was under 2% of its total gross booking, versus 5-6% at Booking and Expedia respectively. This is largely due to Hopper spending none of its marketing dollars on Google advertising or metasearch services, which at Booking and Expedia makes up an estimated 60-70% of their marketing budgets. As a result, Hopper receives more of its web traffic organically (as shown in the chart below), and is further helped by the fact that it is an app-only booking platform, receiving 100% of its B2C bookings on the app, versus roughly 45-50% of bookings coming from app at Booking and Expedia.

We spoke with Makoto Rheault-Kihara, Head of User Acquisition at Hopper, who explained that “One of the reasons we’ve been able to keep our costs a lot lower than our competitors is that we don’t compete at all on search engine marketing (SEM). The traditional travel companies’ growth models are based on bidding on Google for really high intent keywords, trying to convert them on the spot and extract as much revenue from that transaction and then the next time around go through the process again. At Hopper we decided not to compete in that game at all. Instead Hopper has a lot of features like price freeze and flight watches that are meant more for users that are a little bit lower intent but higher in the funnel. We also acquire all of our app installs on channels like Facebook, TikTok, Snapchat, and YouTube, as well as through partnerships with influencers, which are channels that are much lower cost than a pay per click on traditional SEM.”

Investing in Product-Led Growth

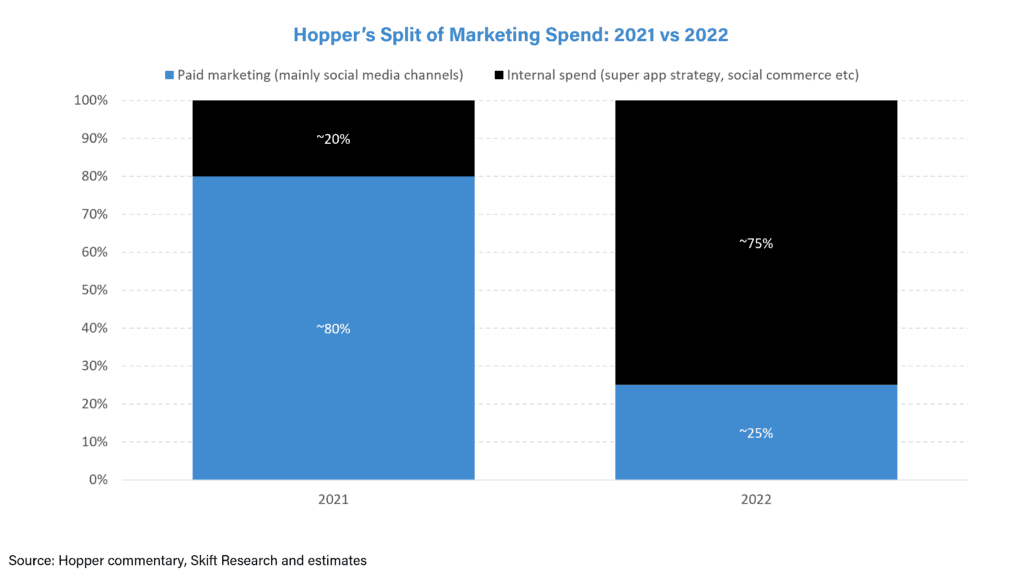

Hopper was already ahead of peers in terms of marketing efficiency in 2021 – and Hopper continues to innovate, moving away from social media advertising and instead investing its marketing dollars towards product-led growth and the development of a social commerce platform and super app.

Whilst paid marketing channels through social media allowed Hopper to quickly grow its app downloads, the focus is now on retaining those customers rather than continuing to attract more downloads. Hopper’s app has been downloaded more than a 100 million times, with Hopper being the most downloaded travel app in 2021, growing app installs near 200% year-on-year from 2020. However it will be difficult to keep up this growth momentum – the U.S has a population of about 330 million, meaning that at 100 million app downloads, a certain saturation level gets hit. Continued paid marketing will not see the same level of returns as before.

Rheault-Kihara explains that “In 2021 we got a really good amount of installs and we lead travel pretty consistently in terms of the number of app installs that we get. [However], now it’s less of growing installs because we’re up there with Uber and Amazon in terms of total install volume. The next opportunity isn’t in increasing installs by 2x or 3x every year. So we started to look a lot more inwards towards product led growth.”

According to Rheault-Kihara, marketing spend on paid marketing external to the app (i.e. through social media channels) was 80% of Hopper’s marketing spend in 2021, and has today dropped to 25%, as shown in the chart below.

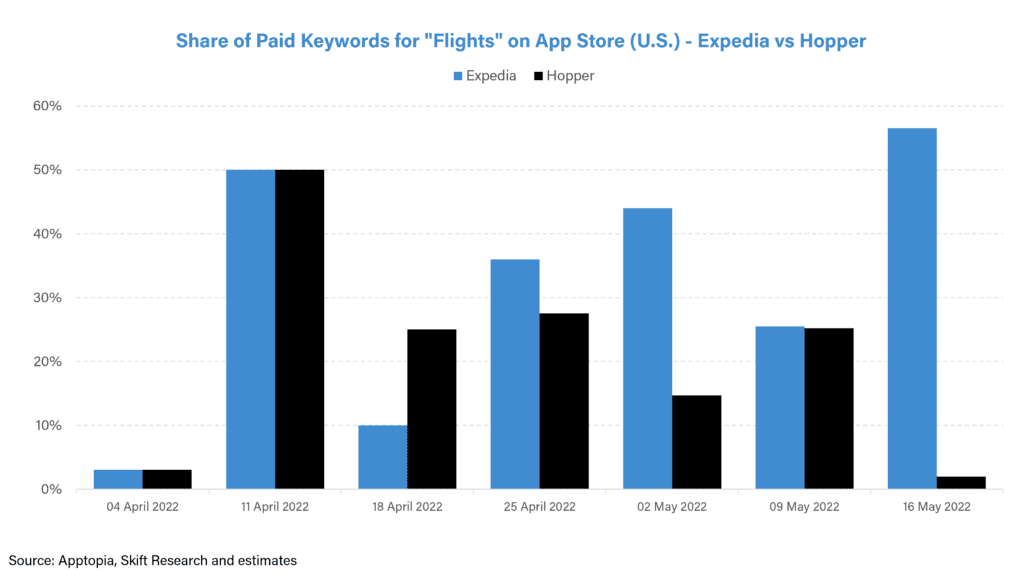

For example, since April 2021, Hopper has been spending less on buying keywords such as “flights” or “cheap flights” in the app store, giving up these keywords mainly to Expedia, which launched its own flight prediction capabilities in April 2021, as shown in the chart below. Hopper clearly realizes that OTAs such as Expedia are far more experienced in search engine marketing and it would rather not compete head on with companies with much larger performance marketing budgets. Rheault-Kihara says, “We don’t really do that much Apple search; as a percentage of our spend, it’s really low. What we see is there’s not that much search volume and again, it’s usually being stuck to competing head on with our competitors, which we just want to avoid.”

By investing in product-led growth such as its social commerce mechanisms (explained in the next section) and referral programs, Hopper is hoping that users specifically download the Hopper app looking to use these discount-offering products and for these to become a key value proposition and a core part of the product provided by Hopper, rather than just a marketing tool.

Interestingly, Rheault-Kihara sees Hopper’s retention focussed marketing strategy as being cheaper on a per customer basis than the in-the-moment conversion approach deployed by the traditional OTAs. For Booking and Expedia, marketing spend correlates fairly linearly with gross bookings (i.e. it costs a certain amount to get every single booking) – instead Hopper is hoping to “get long term conversions, not instant bookings”, which in theory can stretch the initial marketing spend to attract a user over several bookings, extending the life-time value of a customer.

Growth Driver 5: Super App Ambitions

Hopper has long talked about its ambitions to become a super app in travel, which it hopes to do through its strategy shift towards social commerce.

Rheault-Kihara explains that “What we’re trying to do is build a super app for travel and we definitely have consumer demand for that. Every time we launch new products, users want to do their entire trip in one app and have rewards that encompass their flights, hotels, car rentals, etc. One of the most interesting examples that we wanted to follow was around these super apps in Asia that figured out how to use the product itself as a main growth lever, instead of external marketing, by giving customers discounts and rewards which incentivizes users to convert and be retained over a longer life cycle.”

Hopper’s CEO particularly cites Chinese company Pinduoduo as inspiration behind this vision.

What is Pinduoduo?

Pinduoduo, which in Chinese translates to “together, more savings, more fun”, is a Chinese e-commerce platform which offers customers discounts on a huge range of everyday products from groceries to home appliances. Its core value proposition is to allow users to experience a shared shopping trip with their friends and in turn receive group savings – with the app showing incremental discounts with each additional buyer added to a group purchase. This engineers the sharing of deals on social media, mainly WeChat.

The app also heavily utilizes gamification such as spinning wheels which give out coupons and leaderboards showing which users have had the most number of friends sign up to the app. Additionally, unlike shopping apps such as Amazon, Pinduoduo’s app is built for browsing deals, rather than searching for a particular product, which increases consumer engagement.

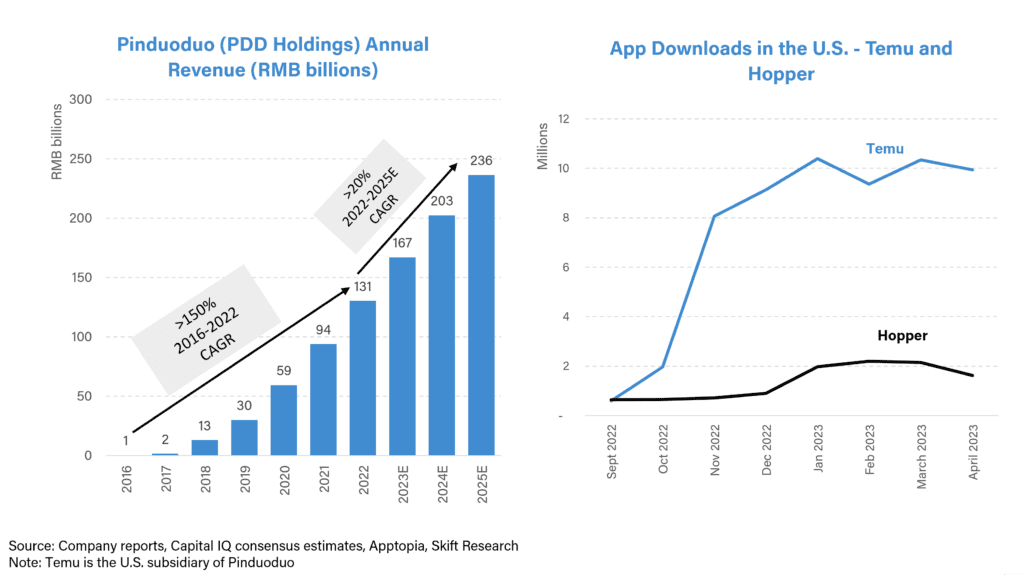

Pinduoduo has seen incredible growth since being founded in 2015. As shown in the charts below, Pinduoduo has grown its revenue at an enormous >150% CAGR from 2016-2022 to become one of China’s largest e-commerce platforms. In September 2022, Pinduoduo launched its U.S. subsidiary Temu, which quickly became the most downloaded shopping app in the U.S.

Introduction Gamification Elements

Hopper has clearly been inspired by Pinduoduo’s huge success, and hopes to implement some of Pinduoduo’s key characteristics such as social sharing, gamification, and viral app design as a means to drive repeat bookings and increase customer retention.

For example, Hopper is currently working on introducing a gamification component to its app which, similar to apps such as Duolingo, incentivize users to log onto the app every day in order to collect discounts or ‘carrot cash’ which they can use towards an eventual booking. At Skift’s Global Forum 2022, Fred Lalonde, CEO of Hopper, explained: “So the idea is you come in and you do something repetitive in what Google calls micro-moments like waiting for your latte at Starbucks and you press that Claim Today’s Reward button. And if you miss a day, you lose the $10 discount. But if you do it a couple of days straight, in this case a week [as shown in the screenshot below], you get $10 of future booking credit. Duolingo is the only real example of this in the West. Fundamentally this is called engage-to-earn. So you come in and you do something that you would do anyway, so you water this tree and it grows and then there’s a secret chest that opens up and it contains vouchers and coupons. And this is actually what will replace the established eCommerce players in travel, in my opinion.”

Rheault-Kihara sees this marketing strategy as being more akin to a gaming company rather than a travel company. In our interview with him, he said “We look at an LTV (Long Term Value) to CAC (Customer Acquisition Cost) ratio, instead of ROAS (Return On Advertising Spend) like a travel company would, that is more of what we’re interested in because we’re playing that long term game in the same way that a mobile app or a meditation app or an Uber would do.”

Additionally, the introduction of social commerce and gamification also allows Hopper to hark back to its original value proposition from 2007, of harnessing a data-driven approach in allowing better travel inspiration and planning. Rheault-Kihara explains that “[Social commerce and travel inspiration] are pretty intertwined. When a customer comes onto the Hopper app, unlike a SEM [search engine marketing] customer, they’re not looking for a specific trip or a specific date yet, they’re still pretty high in the funnel in terms of deciding where to go. So a lot of the gamification elements around giving you specific discounts for specific destinations help you choose a place and aids in travel discovery. So [travel discovery] would be a pretty natural extension of the gamification product.”

Is Hopper’s Super App Vision Achievable?

Whilst we applaud Hopper’s differentiated marketing approach around gamification, social commerce, and travel inspiration, we expect Hopper will have to go through several iterations before perfecting their product-led growth strategy. For example, recently Hopper has had to answer to concerns that the various add-ons (such as fintech products, controversial opt-out tips, paid VIP customer support – and now a gamification element) are adding unnecessary friction to the booking process. These products can complicate and distract from Hopper’s core value proposition of being the most price competitive OTA on the market and we believe that Hopper has to strike a balance between efficiently monetizing its products whilst also offering a streamlined user experience.

Additionally, we believe that Hopper faces tough competition in its ambition of being the one-stop-shop for travel bookings. This is a dream shared by many of its peers, with Booking in particular regularly citing its ‘connected trip’ vision. Players outside of travel are also looking to enter the sphere of super app-dom, notably Uber which has forged a B2B partnership with Hopper in order to sell flights and fintech within its own app. The emergence of new players in travel will likely only make the competitive dynamics more fragmented. Whilst Hopper doesn’t intend to sell products outside of travel, it might in fact see the most competition from the likes of Uber (which is primarily known for ride-hailing and food delivery, not travel) rather than pure-play travel companies such as Booking or Expedia.

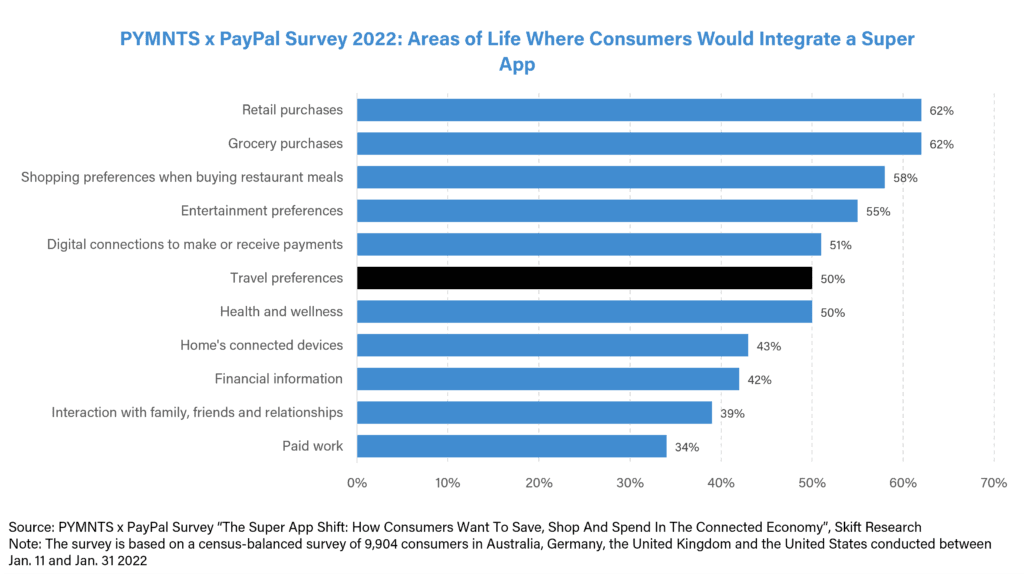

Consumer survey data conducted by PYMNTS and PayPal (as shown in the chart below) shows that there is higher demand for a super app in areas of life which sees higher frequency purchases such as retail or groceries, with fewer consumers intending to use a super app for travel purchases.

On stage at Skift’s Global Forum 2022, we asked Hopper’s CEO about how he looks at the issue of travel being a low-frequency travel purchase. He sees their social commerce initiative as the key behind increasing user engagement on the app, explaining “Everyone knows what their next trip is, so instead of scrolling on Instagram when you are waiting in line for a latte at Starbucks – from which you gain nothing– log onto the Hopper app, come water a tree [i.e. engage in its gamification elements], and collect discounts and coupons towards that next trip.” After completing ‘streaks’ (i.e. by logging onto the app every day and ‘watering a tree’ for example), Lalonde expects users to start browsing deals, which due to the discounts collected, are now cheaper than they were before.

Though we applaud this strategy, we are still wary of how successful Hopper’s – or any travel company’s – implementation of it can be. One reason behind social commerce company Pinduoduo’s immense success is that it sells everyday, high-frequency purchase items such as groceries, meaning that users naturally log on to the app more regularly – and also get addicted quicker – than they would for buying low-frequency purchases such as travel bookings.

Companies whose main offering is high frequency purchases such as retail, ride-hailing, or banking services might end up being a more formidable competitor to Hopper’s super app dream than one might expect, with the irony being that Hopper itself is helping power the travel platforms of these companies through B2B partnerships. Clearly the dynamics at play are complex, with many stakeholders involved, and we at Skift Research eagerly look forward to seeing how Hopper’s super app dream pans out.

Modeling Future Growth Trajectory

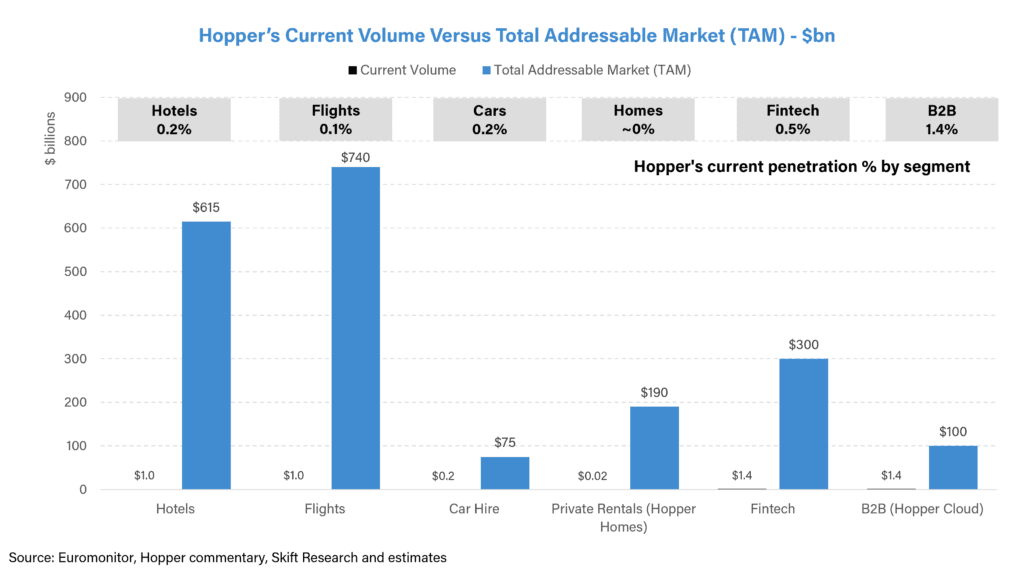

Hopper made roughly $3.5bn of gross bookings in 2022. Though it has grown substantially since launching as an official travel agency in 2016 – we estimate at a CAGR of near 50% – it is barely scratching the surface of what it could achieve given its current penetration of the TAM (Total Addressable Market) available by travel vertical.

Hopper is best known for being a flight OTA, but today it has only 0.1% share of the flights market globally. In 2017, Hopper started selling hotels, but at about $1bn of hotel gross bookings, it has only a 0.2% share of the total hotels market. Similarly for car hire and private rentals, where it again has less than 1% market share.

Hopper’s expansion into fintech and B2B have been key growth drivers for the business, as we have discussed in detail throughout this report, and both segments offer a long runway for growth, with its CEO identifying a $200-400bn TAM available for travel fintech, of which Hopper currently only has 0.5% share, and a TAM of $100bn for Hopper Cloud, of which it has only single digit percentage share.

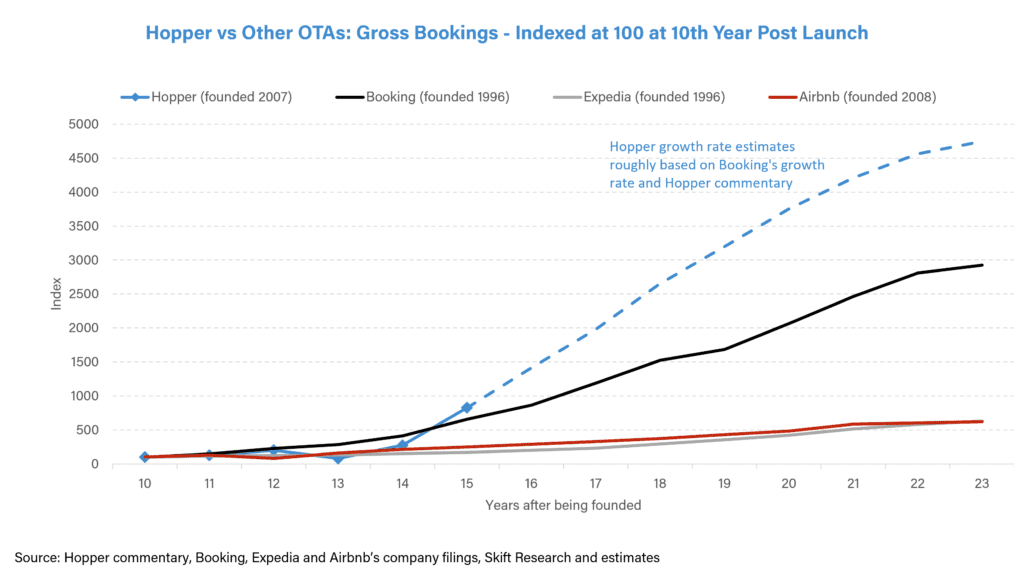

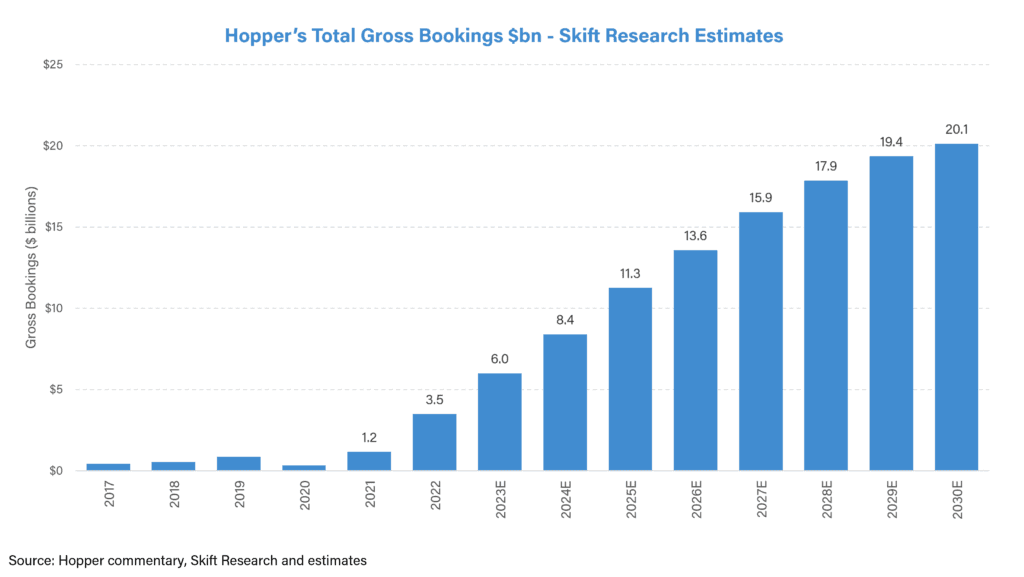

In the charts below, we model Hopper’s gross bookings growth trajectory, benchmarking its performance to that of Booking, Expedia and Airbnb 10 years after their respective launches. In 2022 (i.e. in the 15th year post Hopper’s founding in 2007), Hopper overtook Booking in terms of year-on-year gross bookings growth, largely fuelled by its launch of Hopper Cloud and expansion of fintech products. Based roughly on Booking’s growth pattern and our conversations with executives, we model that Hopper can reach more than $10bn of gross bookings by 2025 and $20bn by 2030.

We model that Hopper can grow its gross bookings from about 1.5% of Booking and Expedia’s combined gross bookings in 2022 to more than 5% by 2030.

Conclusion

Hopper has seen immense success in just a few short years, from selling its first flight booking in 2016 to becoming the third largest player in North America today. This growth has been fuelled by its approach around fintech, B2B partnerships, and a differentiated marketing strategy.

Hopper is still a young and burgeoning company, not yet fully at scale, meaning that the company is likely to see several iterations before undergoing a potential IPO, such as learning to strike a balance between efficiently monetizing its products whilst also offering a streamlined user experience.

However, regardless of whatever doubts someone might have, one thing for sure is that Hopper has been a redoubtable disrupter of the OTA market, unafraid to pivot strategy and innovate – a unique characteristic in today’s landscape which for so long was dominated by the duopoly of legacy players.

Appendix: How Do Hopper’s Fintech Products Work?

Price Prediction

Since being founded in 2007, Hopper has been building a database of travel and flights information by archiving receipts, or “echo traffic”, sourced from global distribution systems (GDS) and using this data to feed their price prediction tools.

Hopper’s lead economist, Hayley Berg, explains that “anytime an online travel agency sends out a ping to the GDS, looking for all the flights available to be booked at that moment, the various itineraries, the prices, etc. – it’s called an echo event – and we have been archiving these events since 2007 to create a database that is made up of about 80 trillion historical prices and itineraries. And every single day we get the previous day’s itineraries, which we call shadow traffic, and this is the data that feeds into our machine learning models and is what fuels the price prediction in the app.”

Hopper claims that their price prediction tools are 95% accurate. For hotel prices, due to the fragmented nature of the hotel industry, and a lack of a centralized database, Hopper bases its pricing estimates on what’s already available to book in the app.

Fintech Products

Through Covid, Hopper expanded its price prediction tool into a price freeze fintech product, as well as launching an array of other fintech offerings (explained below), and today fintech sales make up about 70% of flight bookings, 45% of hotel bookings and 15% of car bookings.

Hopper has 5 key fintech products:

Price Freeze – Price Freeze protects customers from pricing volatility by enabling them to freeze prices. For an upfront fee, the Price Freeze product will protect you against price increases, up to a specified amount, for a flight for a set time. It allows customers to take more time to finalize their plans before they book. We do note that sometimes Hopper will pay the customer out in the form of ‘carrot cash’ – the currency for its loyalty program – rather than an actual cash refund. Price Freeze is available for flight, hotel and car bookings.

Change for Any Reason – This plan gives you the power to change your flight, including date, time, and airline, for any reason up until the time of your scheduled departure with no added fees. If a traveler ends up utilizing this plan, Hopper pays any fees due to the airline.

Cancel for Any Reason – Available on flights and hotels, this plan gives you the power to instantly cancel your flight for any reason up until the time of your scheduled departure and receive at least 80% your ticket cost back. If a traveler ends up utilizing this plan, Hopper pays any fees due to the airline or hotel.

Flight Disruption Guarantee – If your trip is delayed or you miss your connection, you can instantly rebook the next flight to their destination in the app – no matter the airline – at no additional cost.

Leave for Any Reason – With this product, you can leave your hotel for any reason at or after check-in and book a new hotel of the same star category at no cost (with 100% of the rebooking costs covered by Hopper).