Skift Take

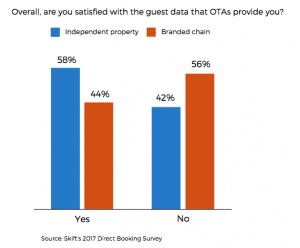

One of the biggest friction points between hotels and their distribution partners is access to customer data. 58% of independents said they were happy with the amount of data they get from their OTA partners. The chains were less happy. Over half said they were dissatisfied with their data sharing arrangement.

Today, Skift Research is publishing two derivative products, the Outlook On Hotel Direct Booking Data Sheet and Analyst Session. These products are available to subscribers only and accompany the 2017 Outlook On Hotel Direct Booking Report that was published earlier this year, providing new perspectives on the subject matter.

Hotel customer acquisition is a strategic exercise in budget allocation and partnership building. The myriad of options including various direct and indirect channels each have inherent advantages and disadvantages. Online Travel Agencies (OTAs) are a critical indirect channel for both branded and independent hotels – much more so for the independents.

Our survey data show that on average, independents generate around 40% of their bookings through OTAs. Branded properties are typically much less, about 13%. Generally, independent hotels also pay higher commissions than the branded properties. Collective bargaining helps but when it comes to data sharing, the branded chains are much less satisfied than the independents.

Customer data sharing is a big deal because both OTAs and hoteliers want to build and own direct relationships with the customer. OTAs spend a bundle on Google and Facebook ads to acquire them. Hotels pay OTAs a bundle in commissions to acquire them. Some would argue that both should have access to the data, especially email addresses, but it doesn’t always work out that way.

As the distribution landscape evolves, both OTAs and hoteliers will need to gain a better sense of how much that data is worth to them, in relation to the hard and soft costs that spoiled partnerships have on their longer-term business.

Our Data Sheet provides a deep dive into the results of our hotel-direct booking survey, which collected data from 375 hotel respondents. The respondents represent a variety of hotel types, both branded and independent. The survey’s results provide a picture of the differences in practices and preferences between these groups when it comes to distribution.

The Analyst Session provides further perspective and insight from Skift’s expert team members on this data and additional research on the current state of hotel distribution and where it is heading in coming years. In this podcast-style session, we dig deeper into the hotel distribution landscape, providing an overview of different booking channels, our estimates for customer acquisition costs across channels, and a summary of the current distribution of major hotel brands and a look at their advertising efforts to promote direct booking.

Subscribe to Skift Research Reports

This is the latest in a series of reports, data sheets, and analyst calls aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.