Report Overview

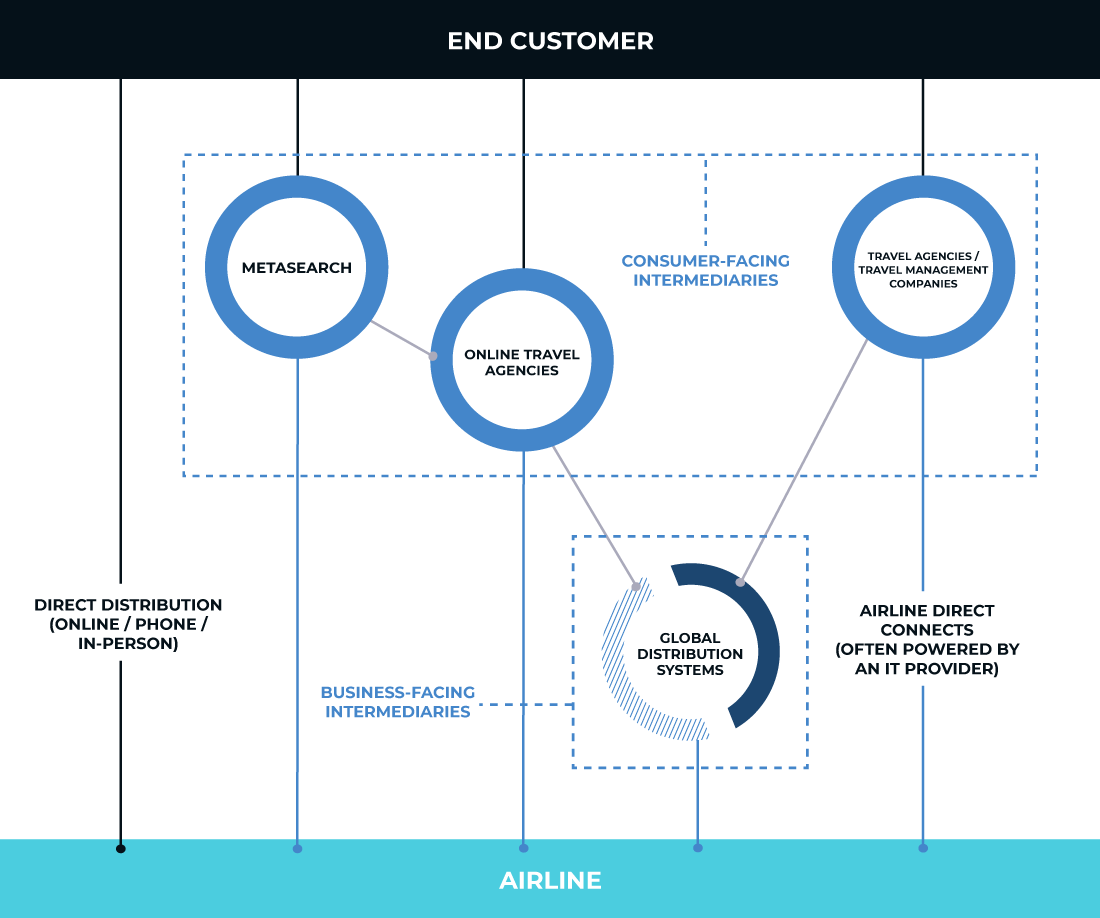

Airlines need to send travelers to and from all corners of the world. That requires casting a wide net to reach all of those customers, and in doing so, they have built a complex web of distribution intermediaries.

Outside of the direct sales channel, each intermediary has evolved to best service its niche of customers. This broad distribution network includes online travel agencies, metasearch sites, traditional offline travel agencies, and travel management companies.

In addition to customer-facing intermediaries, global distribution systems (GDS) are back-end aggregators of inventory and play a large ‘behind-the-scenes’ role in enabling the inventory of travel agencies (offline and online) and travel management companies.

The global distribution systems are critical to the airline ecosystem, yet because we do not interact with them as consumers, they are cryptic and intimidating to many. We devote a number of pages in this report toward contextualizing the long, and at times contentious, relationship they have had with the airlines they serve.

Then, looking forward, we define four key questions through which we can better understand the future of airline distribution: 1) Does the world still need the Global Distribution Systems? 2) What is the New Distribution Capability and how will it impact air travel? 3) Can airlines really de-commoditize bookings? and 4) Does Silicon Valley have a role to play in airline distribution?

What You'll Learn From This Report

- How to untangle the complex and interlocking airline distribution landscape

- A history of the global distribution systems and their relationship with the airlines

- A study of GDS market dynamics, including customer fragmentation, technical integrations, and booking fees

- How we expect airline direct connects to evolve

- An overview of the New Distribution Capability: what it is, why it is needed, and an update on its adoption by the industry

- Why airline ancillaries are so important to industry toplines and why they have become a sticking point with distributors

- Our take on the potential for new airline retailing strategies to de-commoditize bookings

- A view into potential disruption that could come out of Silicon Valley

Executive summary

Airlines are a crucial part of our global transportation infrastructure, with 4.1 billion passengers in 2017. Airlines need to send those travelers to and from all corners of the world and acquire customers across specialized buying behaviors including business versus leisure on one axis, and budget versus luxury on the other.

Airlines cast a wide net to reach all of those customers, and in doing so, they have built a complex web of distribution intermediaries. As a result, though sources vary on the exact number, it is likely that anywhere from half to two-thirds of all airline bookings come from an intermediary. Understanding this complex ecosystem is challenging, even for seasoned industry insiders.

Outside of the direct sales channel, each intermediary has evolved to best service its niche of customers. Online travel agencies are large aggregators that serve primarily leisure travelers, but increasingly also work with businesses. Metasearch sites serve as feeders that funnel traffic to either online travel agencies (OTAs) or direct airline booking sites.

On the offline side, traditional travel agencies are still kicking and continue to play a large role in emerging markets, while travel management companies serve large corporate travel accounts.

In addition to customer-facing intermediaries, global distribution systems (GDS[1]) are back-end aggregators of inventory and play a large ‘behind-the-scenes’ role in enabling the inventory of travel agencies (offline and online) and travel management companies. Originally developed as in-house computer reservation systems, the airlines spun off the GDS as stand-alone businesses decades ago.

The global distribution systems are critical to the airline ecosystem, yet because we do not interact with them as consumers, they are cryptic and intimidating to many. We devote a number of pages in this report toward contextualizing the long, and at times contentious, relationship they have had with the airlines they serve.

Looking forward, we define four key questions through which we can better understand the future of airline distribution:

- Does the world still need the Global Distribution Systems?

- What is the New Distribution Capability and how will it impact air travel?

- Can airlines really de-commoditize bookings?

- Does Silicon Valley have a role to play in airline distribution?

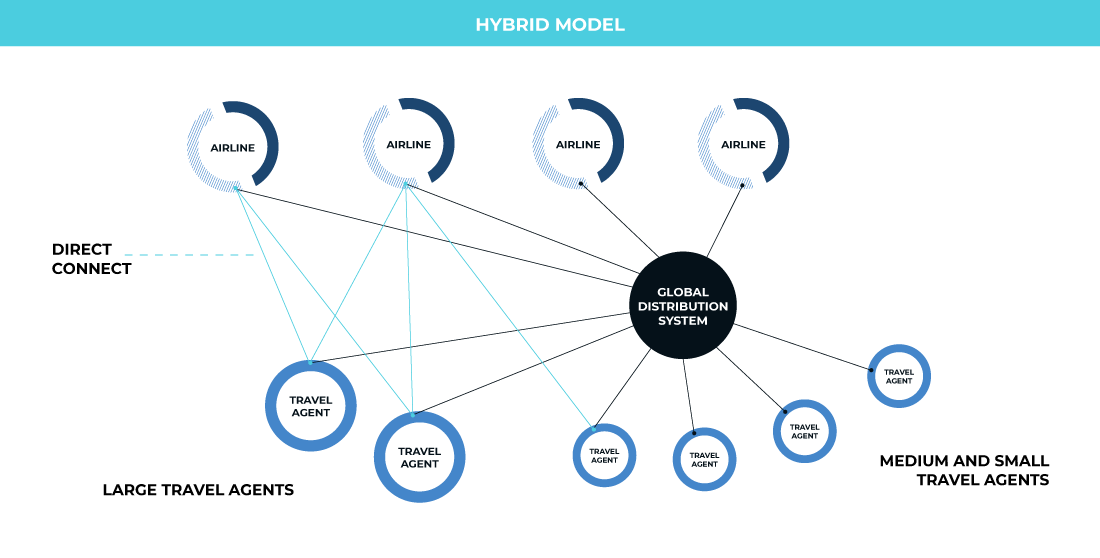

We begin with one of the most frequent questions we receive: Does the industry even still need the global distribution systems? Our answer is that we expect the GDS to remain large and important players in airline distribution. That’s because the travel market remains highly fragmented, giving rise to a need for central clearinghouses. Additionally, the distribution systems are well entrenched within travel management companies that provide high value bookings, which airlines cannot forgo. We expect to see a hybrid model of connectivity and distribution where the world’s largest agencies and airlines talk to each other directly but remain connected to core global distribution systems to access the long tail of travel agents and international airlines.

Next we turn to what has been a key fault line in the airline space for many years, the New Distribution Capability (NDC). The New Distribution Capability creates a common tech standard that allows global distribution systems, and in fact all airlines, intermediaries, and sellers, to seamlessly display and sell a richer array of products and services. While seen by some as a threat to the GDS, we mostly disagree. In our view, NDC in its current iteration is less about how the pipes are laid out, and more about what content flows through them. NDC has been such a priority for the airlines because it will better enable the selling and marketing of branded fares and ancillaries through all sales channels.

The airlines see branded fares and ancillaries as part of a new way of retailing that will be the key to de-commoditizing their products and services. They feel so strongly about this, that they have rewired the entire distribution system (via NDC) to accommodate this approach. That makes it relevant to ask if airlines really can de-commoditize bookings. Our answer is, partly. There will always be some segment of the consumer population that is price sensitive above all else. We are also skeptical that certain branded fares are truly differentiated from competitors’ commoditized offers. They have certainly raised extra revenue, but that is not quite the same thing as a de-commoditization. That said, we see a path forward through personalization. Being able to offer the right choice-based ancillaries (e.g. priority check-in) to the right customer at the right time creates a transaction based on perceived value rather than strictly price and route alone.

Lastly, after playing several rounds of inside baseball, we shift to an outside view of airline distribution and consider what role Silicon Valley might have to play in airline distribution. Google is already a large player in the metasearch space. We expect it will continue to grow there, but we do not foresee it tackling other parts of the distribution ecosystem in a big way just yet. Amazon could enter travel, but faces several hurdles to adoption. We also look at blockchain, technically a protocol, not a company. Blockchain is an interesting technology that we continue to monitor, but we remain skeptical and see a de minimis role for it in the immediate future.

Airline distribution landscape overview

Airlines are a crucial part of our global transportation infrastructure, with 4.1 billion passengers in 2017. Airlines need to send those travelers to and from all corners of the world.

Airlines can go direct to the customer in a variety of ways. Today, a large share of these direct sales come from online websites. But the direct channel can also include call centers, physical ticket offices, or airport kiosks.

Outside of the direct sales channel is a large web of intermediaries, each adopted to best service a niche of customers. For instance, online travel agencies are large aggregators that serve primarily leisure travelers, but increasingly also work with businesses. Metasearch sites serve as feeders that funnel traffic to either online travel agencies (OTAs) or direct airline booking sites.

On the offline side, traditional travel agencies are still kicking and continue to play a large role in emerging markets, while travel management companies serve large corporate travel accounts.

Each of these channels targets customers across specialized buying behaviors including business versus leisure on one axis, and budget versus luxury on the other.

In addition to customer-facing intermediaries, global distribution systems are back-end aggregators of inventory and play a large ‘behind-the-scenes’ role in enabling the inventory of travel agencies (offline and online) and travel management companies.

Below, we present a simplified diagram of the major players in airline distribution and the behind-the-scenes ‘pipes’ that they use to connect with each other.

Metasearch

Description: Aggregates the aggregators and airlines. Metasearch sites display airfares from across a variety of different online travel agencies and airlines. Metasearch works on an advertising model and simply refers customers to another site to complete the booking.

- Primary type of customer: Leisure

- Price sensitivity: High

- Level of consolidation: Medium

- Importance to airlines: Low

- Sample players: Google Flights, Kayak, TripAdvisor, Qunar, Skyscanner

Online Travel Agencies

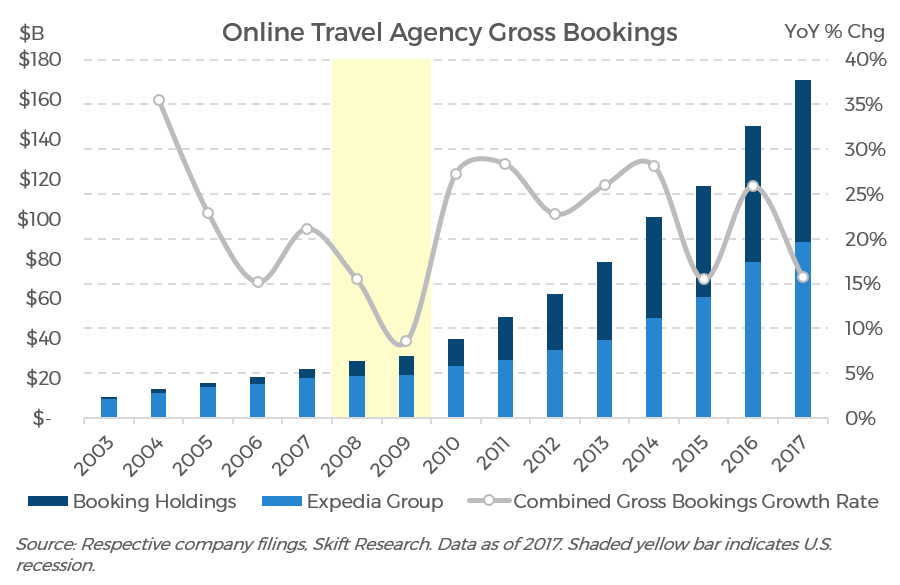

Description: Prominent online aggregators of airfares. Online travel agencies (OTAs) often include user reviews and offer a full suite of travel products including hotels and car rentals. In the last two decades, these booking sites have become very popular among leisure travelers and have, at least in the U.S. and Europe, captured a significant amount of market share that used to go to traditional, leisure-focused, travel agents.

The move to online travel is secular in nature and in 2017, collective gross bookings at the two leading online travel organizations, Expedia Group and Booking Holdings, were $170 billion. That is more than 10x, those two companies’ 2004 bookings of $15 billion, a 21% compound annual growth rate. Admittedly, some of these increases were fueled by M&A, such as the 2015 acquisition of Orbitz by Expedia, but the growth still remains impressive.

- Primary type of customer: Leisure

- Price sensitivity: Medium-to-High

- Level of consolidation: High in U.S./Europe, Medium in RoW

- Importance to airlines: Medium

- Sample players: Expedia, Booking.com, Priceline, Ctrip, Kiwi.com

Traditional Travel Agencies

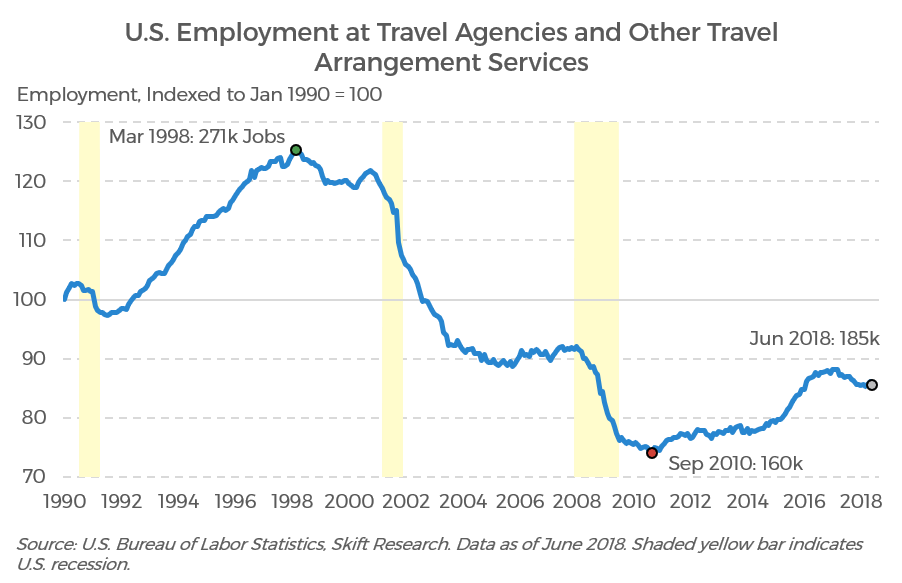

Description: Sell airfare and other travel products through a mix of offline and online channels with a high level of customer service. Some may even operate a series of retail storefronts. In the U.S. and Europe, traditional travel agents have declined under pressure from online sites.

Offline travel agents have borne the brunt of the impact of travel e-commerce, and it is no coincidence that sector-wide employment has been in structural decline in the U.S., down 32% since its peak in the mid-90s.

That said, ‘the death of the travel agent’ in the U.S. has been greatly exaggerated. Most now mainly deal in complex itineraries, such as luxury leisure travel. Agents remain valuable as luxury travel is a high-margin, stable niche. Accordingly, U.S. employment in the sector has been fairly stable and actually added 15,000 jobs from post-recession lows.

One should also not overlook rapidly growing emerging markets where brick-and-mortar storefronts still have a large role to play in the distribution landscape. Offline agents are so important to this market that, for instance, MakeMyTrip, a leading Indian OTA, operates 34 branded travel stores and has a network of more than 3,200 travel agents.

- Primary type of customer: Leisure

- Price sensitivity: Low

- Level of consolidation: Low

- Importance to airlines: Medium

- Sample players: Valerie Wilson Travel, Liberty Travel, Avoya Travel

Travel Management Companies

Description: Provide a full range of business travel services to corporate clients. Beyond simply booking air tickets, travel management companies provide clients with a suite of tools such as online booking tools, reporting functionality, travel policy consulting, and employee safety tracking (duty of care). In practice, in the U.S. and Europe, traditional travel agencies and travel management companies are often sister divisions of the same parent corporation.

- Primary Type of customer: Business

- Price sensitivity: Very low

- Level of consolidation: Medium

- Importance to airlines: High

- Sample players: BCD Travel, Carlson Wagonlit Travel, American Express Global Business Travel, Higgs Robinson

Global Distribution Systems

Description: Business-facing electronic aggregators of airfares. These platforms act as a clearinghouse between airlines and customer-facing distributors. Global distribution systems (GDS) have access to the internal fares and schedules of hundreds of airlines worldwide. Many travel agencies (both online and traditional) and travel management companies use a GDS on the back-end to source air inventory and increasingly, as IT infrastructure. In turn, the GDS connect individual airlines to a long tail of customers across the globe, that in many cases would otherwise be difficult, if not impossible, to acquire.

- Primary type of customer: Business and leisure

- Price sensitivity: Low-to-Medium

- Level of consolidation: Very High

- Importance to airlines: High

- Sample players: Sabre, Amadeus, Travelport, Travelsky

Airline Direct

Description: A direct booking made through airline.com, the airline call center, or ticketing office. This is the airlines’ preferred way for customers to book as they pay no commission and are better able to offer ancillary products, such as premium seating. Even though direct channels bypass distribution cost, airlines might need to invest more in marketing and IT to drive direct bookings.

- Primary type of customer: Leisure

- Price sensitivity: Low-to-Medium

- Level of consolidation: High-to-Medium in U.S. / Low in Rest of World

- Importance to airlines: High

- Sample players: Southwest, JetBlue, Delta, Lufthansa, Cathay Pacific, Air Canada

Why it Is Important to Understand the Global Distribution Systems?

Targeting such a large number and variety of air travel customers necessitates a robust and multipronged distribution network. Sources vary on the exact number, but it is likely that anywhere from half to two-thirds of all airline bookings come from an intermediary.

For instance, Euromonitor International, a market research provider, estimates that in the U.S., 45% of the value of all air transactions in 2017 came from online intermediaries.[2] A further 19.5% of all bookings were made through offline channels like brick-and-mortar travel agents, call centers, or similar.[3] Euromonitor does not differentiate between first- and third- party offline; however, though airlines do operate their own call centers, presumably a large share of these transactions are via intermediaries. This implies that combined offline and online intermediaries likely represent over 50%, and perhaps as much as 60% of all air bookings.

Other sources are in agreement. For instance, Credit Suisse estimates 70% of air bookings come from global distribution systems (GDS), travel agents, and other third parties.[4] Similarly, Bank of America Merrill Lynch estimates that full-service carriers sell 66% of their tickets through third parties, though in contrast, low-cost carriers do 90%+ of their bookings direct.[5] These two figures blend to a global share for intermediaries of 48%.[6]

As consumers, we are most familiar with the intermediaries that sell to us on a regular basis. Perhaps we search for flights on a metasearch site like Kayak or an online travel agency like Expedia. For business travel, we may work with an agency like BCD Travel or Carlson Wagonlit. These sales channels each have unique business models tailored to the kinds of customers they work with.

For instance, the online travel agencies run sophisticated marketing campaigns with massive budgets — Expedia and Booking spent a combined $7.8 billion in advertising over the last 12 months — that makes them the largest advertisers in travel. Travel management companies win business by delivering extra services like duty of care and financial management services to their corporate clients, and are refocusing on the needs of the traveler. Offline travel agents have been working hard to remake themselves with new branding and a new marketing campaign.

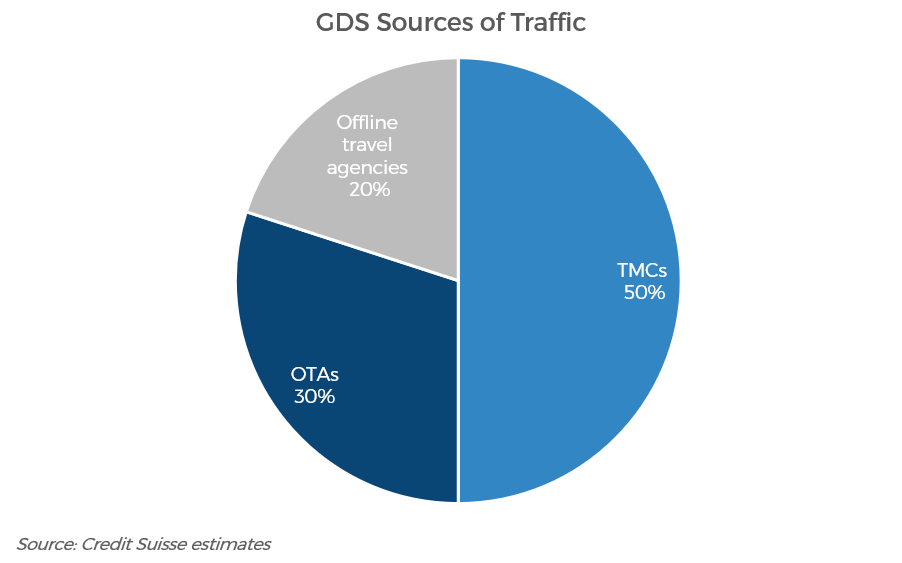

These businesses come in all shapes and sizes, with many varying customer acquisition strategies, but all have one thing in common: global distribution systems. These customer-facing intermediates all book a major share of air tickets that they sell through a GDS. From the airlines’ perspective, this makes the GDS one of the single largest buyers of air tickets.

The global distribution systems are critical to the airline ecosystem, yet because we do not interact with them as consumers, they are cryptic and intimidating to many. We believe it is important to make the role of the GDS more approachable to those seeking to understand this market. As we seek to untangle the web of airline distribution, we will continuously be returning to the GDS, as they are enmeshed at the heart of this world.

Therefore, before we address our four key questions on airline distribution, it is useful to briefly study how the current system evolved, with a focus on the origins of the GDS. This history is important because it helps explain the prominence of the GDS to nearly every sales channel and gives context to the love-hate relationship those firms currently have with the airlines.

History of the Airlines and the Global Distribution Systems

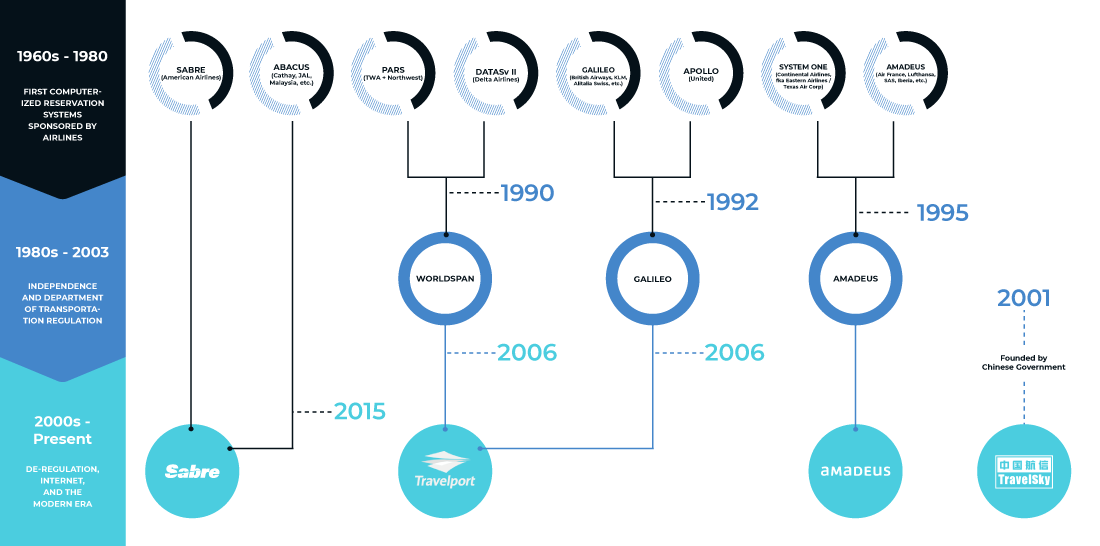

The first computer reservation systems (CRS) were developed by airlines in the 1960s and would later evolve into the global distribution systems (GDS) that we know today. In the beginning, each airline developed its own internal systems, such as the Semi-Automatic Business Research Environment (later SABRE) developed by American Airlines and IBM. These mainframe systems were cutting edge for their time and automated the previous time-consuming, manual process.

These computer systems were soon rolled out to wide networks of travel agents to build booking scale and airlines paid out commissions to the agents for each segment sold.

Most travel agents used only a single computer reservation platform, typically the one provided by their local hub carrier. And so airlines would have to participate in competing networks to grow their geographic footprints. In exchange for access to the reservation system, non-owner airlines paid a booking fee to the owner airline, who naturally, paid no booking fee within its own systems. Owner airlines would also display fares from themselves and select partners, first on their computer display screens in an attempt to bias travel agents toward booking their fares over competitors.

As the airlines grew in the 1970s and 1980s, so did the power and size of their CRS distribution networks. This vertical integration roused antitrust concerns and, in the mid-1980s through early-1990s, the Department of Transportation (DoT) and its predecessor agencies stepped in to pass consumer protection regulations.

The most important rules prohibited flight information displayed to travel agents from favoring one airline over another (“unbiased display screens”) and required that booking fees charged for access to the computer systems must be consistent across all airlines for the same level of service (“price nondiscrimination”). The rules also effectively required every airline to participate in every computer reservation system and to offer the same inventory across all platforms (“mandatory participation”).[7]

Under this regulatory regime, many airlines spun off their computer reservation systems. After all, why continue to outlay huge sums of capital expenditures on undifferentiated IT infrastructure? These spin transactions also raised capital and allowed airline executives to refocus on their core flight operations.

But these deals also turned the GDS sales channel, once a profit center, into a cost center for the — effectively GDS fees became a recurring tax paid on nearly every ticket sold by the airline.

Meanwhile, as the airlines evolved, so too did their former distribution arms. These newly independent distribution companies, now known as global distribution systems (GDS), added additional business lines, such as hotel distribution and airline IT systems. The GDS companies also went on an M&A shopping spree, and, with consolidation, found they could effectively control airlines’ access to most major markets. With broad market access and little competition came pricing power with which the GDS were able to capture a significant share of total value in the air travel ecosystem.

The new millennium brought with it several challenges for the global distribution systems including the end of DoT regulation, the emergence of low-cost carriers which refused to list fares with the GDS, and the rise of the internet as a direct channel.

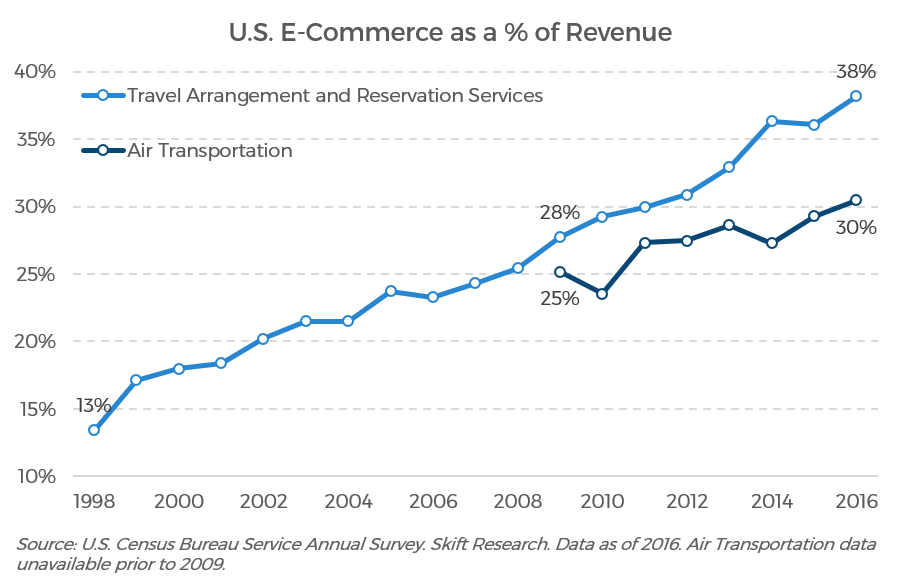

Importantly, e-commerce led to the rise of the online travel agencies, which while still powered by GDS on the back-end, nonetheless significantly disrupted the GDS’ core customer base of offline travel agents. The internet also gave airlines the chance to cut out the middlemen and drive greater direct sales.

The e-commerce shift had a massive impact on the aviation industry — both first-party airline direct and third-party agencies — which has one of the highest rates of e-commerce penetration among all sectors of the U.S. economy. Changes driven by the shift to an online economy are still playing out today.

Yet, in spite of these shocks, deregulation did not immediately change airline power dynamics as old contracts were replaced with similar clauses guaranteeing the GDS “full access” to airline fares. Early proponents of the internet imagined it would upend the old order of airline distribution, but little initially changed in the GDS-airline relationship. At the time, airlines were in no position to risk war with the GDS by contesting market terms due to their anemic financial positions; airlines were further cowed by allegedly anti-competitive behavior from the distribution networks.

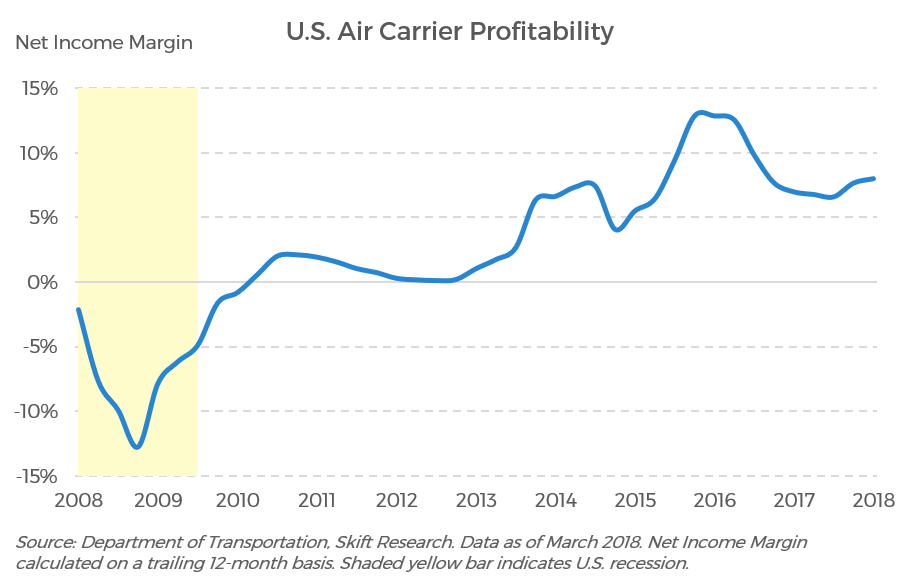

However, in the last half-decade some large airlines have nursed their profits back to health and now feel more comfortable with pushing back on the GDS. E-commerce is more important than ever and continues to exert pressure on offline players. Plus, airline consolidation, a series of antitrust lawsuits, and a new focus on personalization and retailing have all conspired to shift the airline-GDS power dynamic yet again.

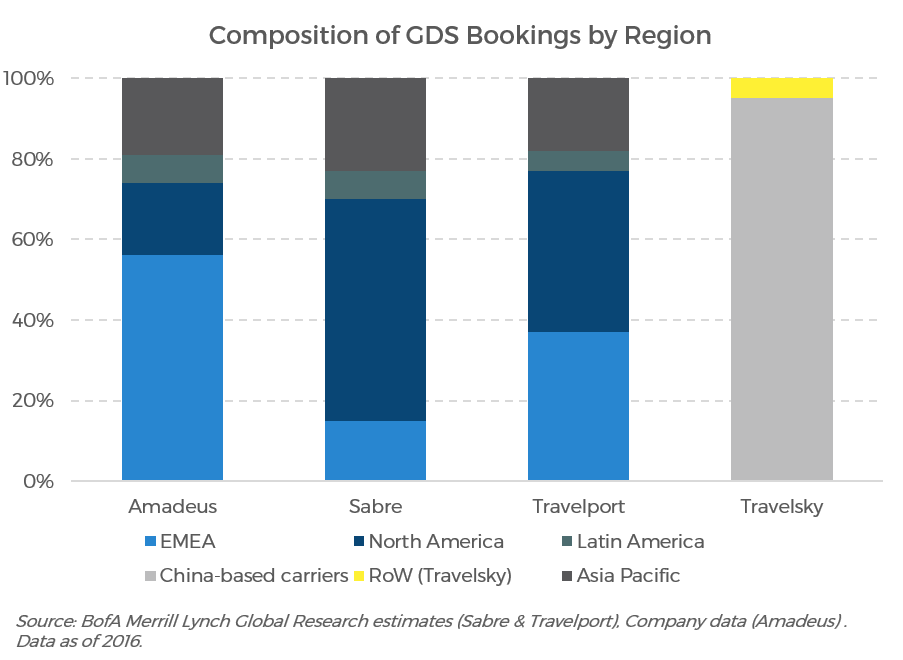

Presently, the global distribution industry is highly consolidated with just four major players, three of which operate in open markets and can trace their heritage back to an airline parent company.

Of these, Amadeus, headquartered in Spain, is the largest global distribution system in the world. Next is Texas-based Sabre which, although smaller than Amadeus overall, is the largest distributor in the United States. Rival Travelport from the U.K. is the smallest of the open market competitors but is developing a strong foothold in emerging markets like India.

The fourth major distribution system is Travelsky, a Chinese state-owned enterprise. It has long had monopoly-like power because Chinese regulations require Chinese travel agents to use the Travelsky GDS for most bookings, though these rules are slowly being eased.

Key Question One: Does the world still need the Global Distribution Systems?

Global distribution systems (GDS) are one of the largest pieces of the overall airline distribution puzzle. But does modern aviation still need these back-end aggregators? Our desk view is that there remains a strong need for the GDS in airline distribution for the foreseeable future.

But why can’t an airline just interface directly with its sales agents? Well, some are trying, running experiments with such “direct connections.”

In 2015, Lufthansa added a surcharge on all GDS bookings to encourage travel agents to book directly. British Airways’ parent company, International Consolidated Airlines Group (IAG), imposed a similar fee in May of 2017 and Air France-KLM joined the bandwagon a few months later in November 2017.

American Airlines tried the carrot rather than the stick, but with the same end goal in August 2017. It announced an incentive fee for travel agents that book using the new distribution capability (NDC) standard — which, especially at the time of the announcement, implied more direct bookings.

But the bark for many of these announcements has been worse than their bite.

For instance, British Airways has said that its sales have not suffered unduly, but at the same time, Amadeus,claimed that it was also not impacted by these fees. How can they both be right? One possible explanation is that, according to The Company Dime, British Airways agreed to let at least some franchise partners of American Express Global Business Travel, Carlson Wagonlit, and HRG avoid paying surcharges on bookings made through Amadeus. BCD Travel also reached a similar agreement with both British Airways and Air France-KLM to waive GDS surcharges. These side agreements effectively defang direct-connect initiatives by letting the most valuable distributors off the hook.

Across the pond, American Airlines has called its new distribution capability incentive fee a success, pointing to the fact that more than 5% of all global tickets booked on American via nearly 200 travel agencies now go through American’s direct connections. However, we note that the American incentive fee will also apply to any GDS bookings made through the NDC tech standard, just as they do for direct connect NDC bookings. Effectively, as long as the GDS are willing to adopt NDC,[8] the American incentive fee does not discriminate between direct and indirect channels. Short-term success notwithstanding, that hardly strikes us as an effective long-term driver of direct connections.

We see several reasons why direct connect results have been disappointing so far, and why we expect the global distribution systems to remain large and important players in airline distribution:

- The travel market (mostly travel agencies, but also airlines to a lesser degree) remains fragmented, creating strong network effects and, correspondingly, high barriers to new entry.

- The distribution systems, in many cases, have entrenched themselves within travel management companies by effectively acting as their back-end software providers and main source of revenue. There is no easy replacement for these travel management companies and most airlines cannot forgo the high-value bookings that these travel management businesses provide.

- Airline distribution costs have been falling over time, changing the risk/reward equation for any airline considering ripping up the old pipes.

Global Distribution Systems Still Provide Value as the Travel Agency Market Is Highly Fragmented

Today, airlines primarily use the global distribution systems to access travel agencies, both online and offline, and travel management companies. These, as we describe above, are crucial sources of ticket sales, and for some airlines 50% or more of bookings. So why not just connect directly to these important channels rather than through a GDS?

After all, low-cost carriers have been selling direct for years and shouldn’t modern tech enable us to cut out the middleman? Other sectors have seen no shortage of emerging brands that trade on the idea of going straight to consumers — Warby Parker and Allbirds quickly come to mind.

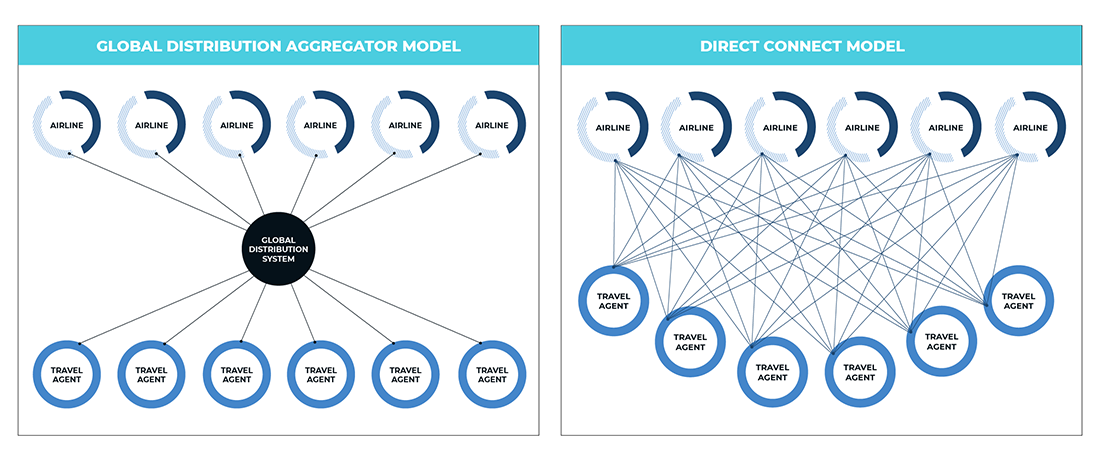

However, we believe the most apt analog is not to direct-to-consumer retail brands, but rather to the handful of clearinghouses that underpin the financial system. It’s not that the technology to go direct to consumers doesn’t exist, it clearly does. The real challenge, in our view, is not one of technology, but simply of getting so many small players to sign onto a single platform.

As the below diagrams illustrate, the benefit of aggregation through a global distribution system is immense, allowing the industry to cut through the tangled gordian knot of direct connections that would otherwise exist.

Aggregators can have incredibly sticky business models as the need for a central platform is more often a function of the size and structure of the market than the technological environment (within reason, of course). Stock exchanges still play the same fundamental role today as they did 100 years ago, although the technology that traders use to communicate with each other has changed dramatically. Similarly, Visa and Mastercard are in many ways operating the same network-driven business model that they did 50 years ago, though today the underlying tech has changed.

When we analyze the structure of the travel agency market, we find it remains highly fragmented, which leads us to believe that the GDS continue to have strong staying power, even as the tech backdrop evolves.

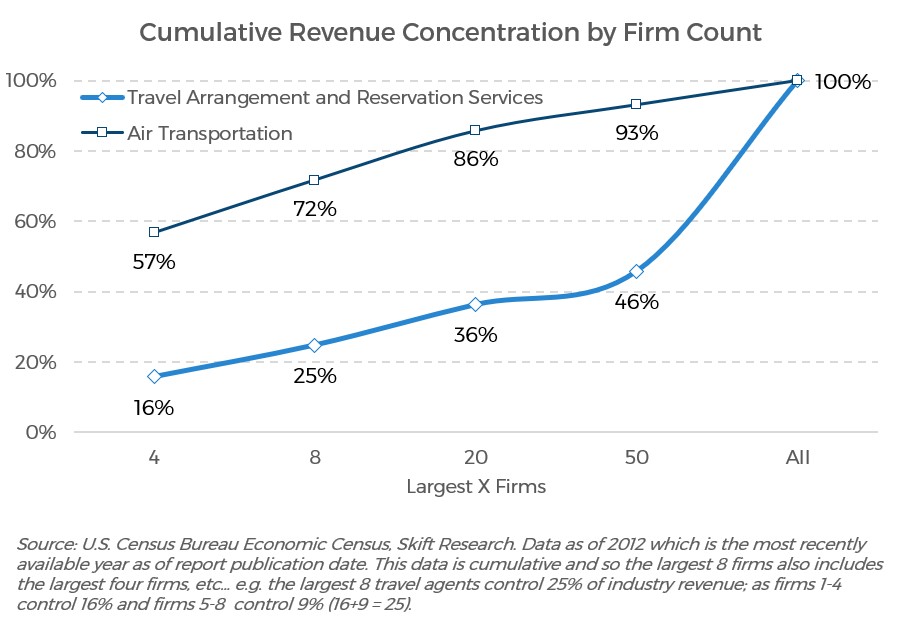

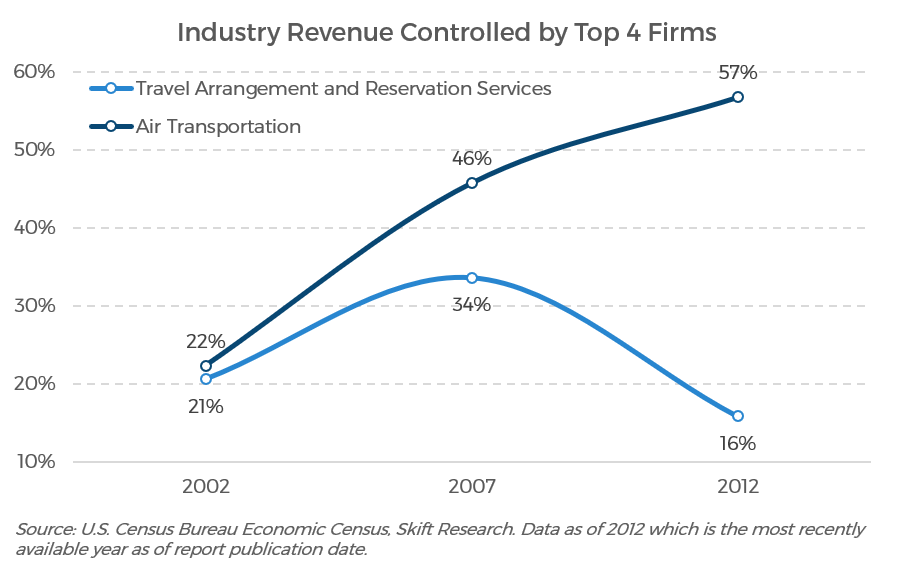

According to data from the U.S. Census Bureau, the U.S. had just over 20,000 unique firms providing travel arrangement and reservation services[9] in 2012.[10] In one measure of sector concentration, the four largest firms in this group generate 16% of U.S. industry-wide revenue. The 50 largest firms generate 46% of U.S. industry-wide revenue. For comparison’s sake, the same metrics for the average sector of the U.S. economy are 9% and 31%.

On the other hand, the U.S. air transportation industry is more highly concentrated, with the top four firms controlling 57% of revenue and the top 50 controlling 93%. Clearly, in the U.S., travel agents are fragmented while airlines are more concentrated, but interestingly this was not always the dynamic. According to the 2002 Economic Census, the four largest airline and travel agency firms at the time controlled about a fifth of their respective industry’s revenue.

This divergence in industry consolidation over the last 15 years helps explain why the late-‘90s / early-00s were so good for the GDS. Back then, both markets on their two-sided platforms were fragmented. We would emphasize that our above analysis is solely focused on the U.S.; though Europe has followed a similar path, with the top five air carriers there now in control of 56% of the market versus 38% in 2007.[11]

However, we do not believe that the many airline mergers of the last decade will spell the end of the GDS. For starters, our view is that central aggregators can still provide value even when one side of their platform is more diffuse than the other.

And secondly, while airlines are more consolidated than they were in past eras, and more so than travel agents are today, we do not want to overstate our case — the aviation market is still very diverse. This is especially true when one looks on a global basis. On this scale especially, airlines remain quite fragmented.

The International Civil Aviation Organization (ICAO), a U.N. agency, tracks over 1,400 scheduled airlines worldwide.[12] This fragmentation of global routes may not matter much to a short-haul tourist (from the U.S. or Europe), but it is of high importance to an international business traveler. Business travel is of high value and so the GDS also continue to play an important role in facilitating these complex, often interline, bookings.

Further, while the number of airlines in the U.S. and Europe may be shrinking, lock-in on the airline side of the marketplace is still reinforced by alliance partnerships which prefer to be on the same platform. Coordination within an airline alliance is tough in any situation, but a switch of GDS would be a special type of headache, as most individual carriers are on staggered 5-10 year contract renewal terms.

Global Distribution Systems Deeply Embedded into the Business Travel Management Ecosystem

Another key reason for the survival of the global distribution systems is their tight links to travel management companies (TMCs). The GDS will be difficult to disintermediate because in many cases they serve as critical back-end tech for travel management companies. They also serve as a large source of revenue for most travel management companies, who are loath to risk shaking up their business models by removing the GDS.

Travel management companies are one of the most important sales channels for an airline, because they in turn deliver business travelers. Business travelers are among the most profitable for a myriad of reasons: they upgrade to business class over coach, book complex international routes, tend to be frequent fliers, and their employers are mostly price insensitive.

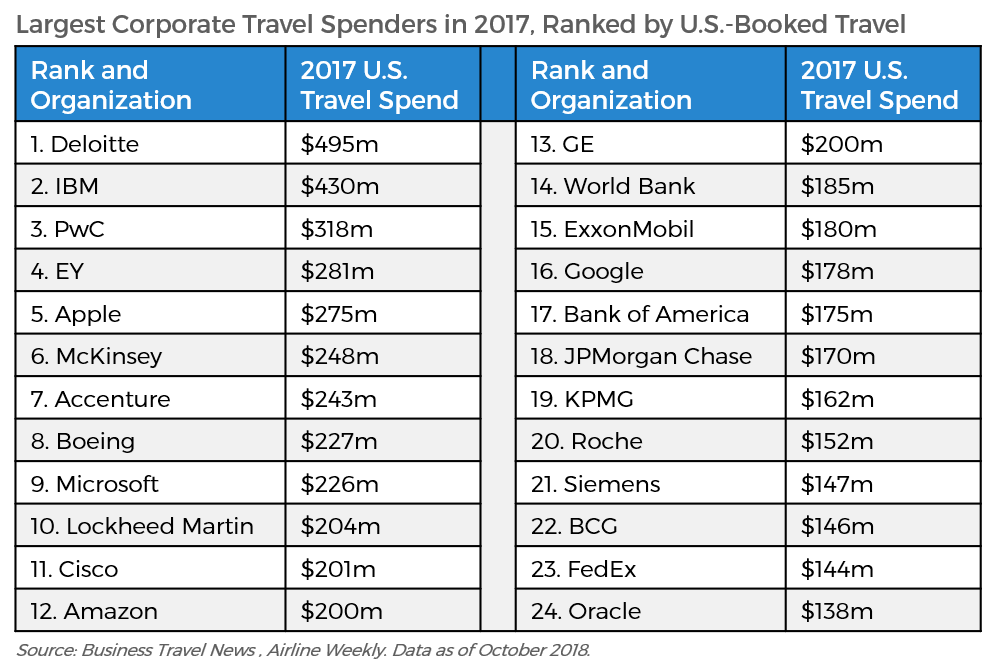

Worldwide spending on business travel grew 6% in 2017, according to the Global Business Travel Association. The 24 largest U.S. corporate travel clients were responsible for more than $5 billion of U.S. domestic travel spend alone.

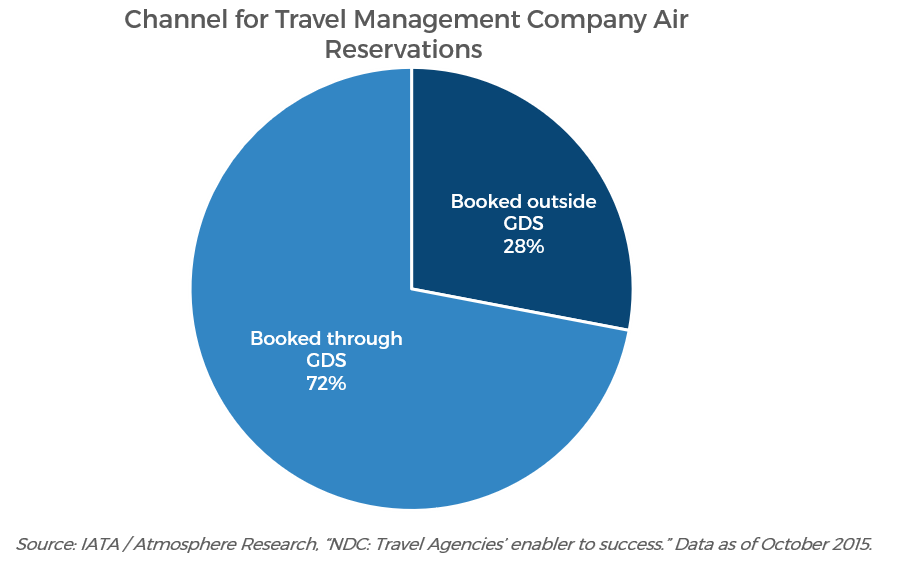

For all of these reasons, airlines surveyed by Atmosphere Research in 2016 said that TMCs were their highest margin channel, generating yields 16% greater than sales on their own direct websites.[13] And the global distribution systems go hand in glove with the travel management companies. One study by Atmosphere Research found that 72% of all air bookings made by travel management companies were done through a GDS.[14]

Part of the reason for this tight relationship is because of the complexity of corporate travel policy requirements. Unlike leisure travelers who want a plain old ticket, GDS also provide corporate travel buyers with extra services such as travel risk management and expense management.

Consider the case of Deloitte, which controls $619 million of business travel spend globally in 2017. Of that sum, $495 million was spent in the U.S., making it the largest U.S. corporate spender. According to Business Travel News, Deloitte used at least four major business travel vendors: Sabre for its booking tool, SAP to help manage expenses, American Express for payments, and BCD Travel as its principal U.S. corporate travel manager. The GDS are not just integrated with end clients such as Deloitte, but they serve as the technical back end for the travel management companies, such as BCD Travel in the above example.

Driving this point home, Corey Garner, vice president, sales and distribution strategy at American Airlines, told Skift that he often “hear[s] from many travel agencies that GDS are the center of their architecture.” The travel agencies often “rely on [GDS] too much to abandon [them].”

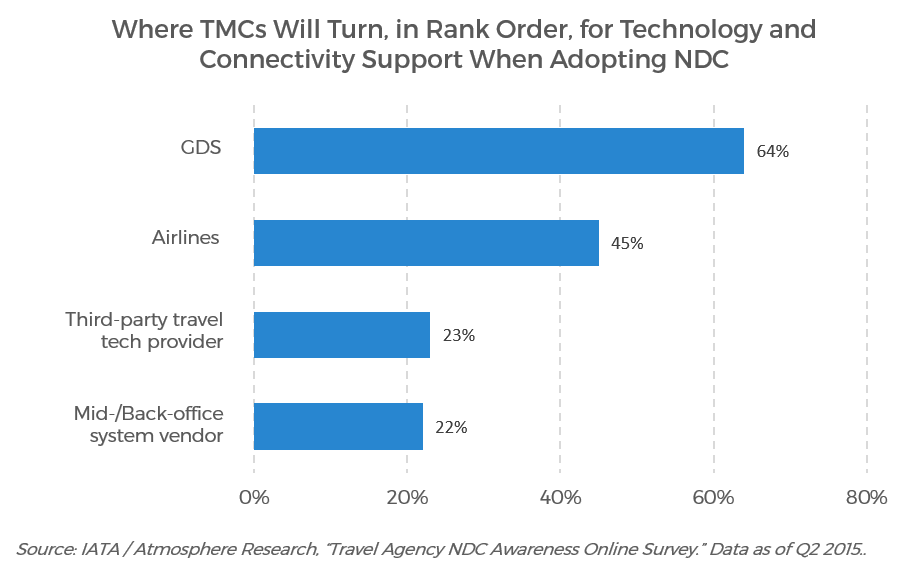

Or in another example, travel management companies were asked where they will turn for technological and connectivity support when upgrading systems for NDC. The overwhelming majority said that they would rely on the GDS for help, emphasizing how close the technical ties between these two parties are.

This multilayered web of technical integrations would be very hard to disentangle, even if all parties wanted to start anew. But here’s the kicker: travel management companies have very little incentive to cut out the global distribution systems.

Global distribution systems send incentive payments to the travel management companies in exchange for air bookings. These payments are likely the largest source of revenue for travel management companies.

To get a sense of the size of these payments, court documents in an antitrust lawsuit brought by U.S. Airways against Sabre indicate that from 2006 to 2012, Sabre paid more than $1.2 billion in incentive payments to the top four brick-and-mortar travel agencies, which were responsible for almost 89% of air travel bookings for the top 100 corporate travel accounts.[15] That is just one of the big-four GDS. Without these incentive payments, the document alleges, most traditional travel agencies would be unprofitable.

Deep technical integrations and revenue incentives would seem to give the airlines little opportunity to dislodge the global distribution systems. That will not stop the world’s largest airlines from pursuing direct connects with the world’s largest travel management companies, but on the whole, we believe that airlines have learned to accept the status quo.

Garner now says of American’s direct connect initiatives that, “what we have learned, as a fundamental truth over time, is that it’s hard to get someone to do something that they don’t want to do.”

Airline Distribution Costs Are No Longer a Cause for Panic

There is one final factor that has contributed to the recent détente between airlines and their global distribution partners. It is the simple fact that overall airline distribution costs, despite all the rhetoric, have fallen in recent years.

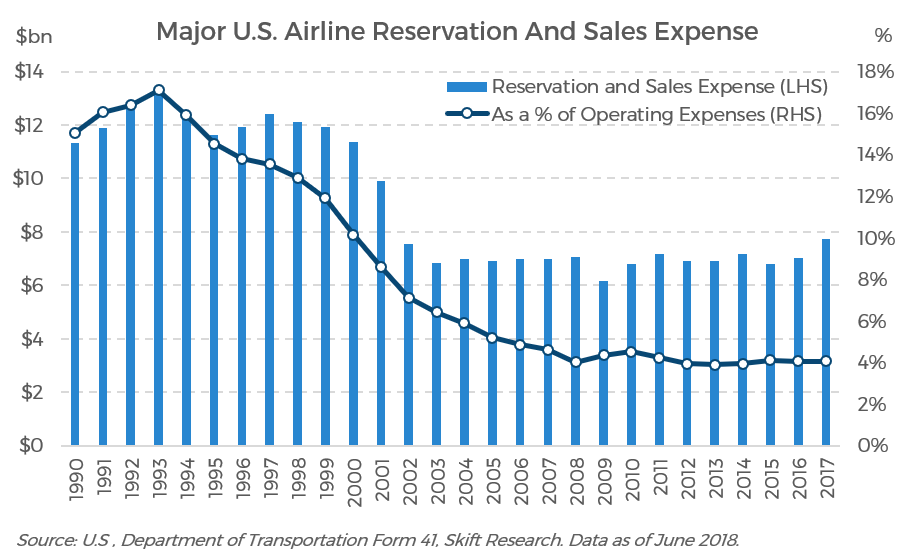

In the U.S., where the Department of Transportation collects detailed statistics on airline operating performance, the peak year for distribution expense was 1993. In that year, major U.S. airlines spent $13.2 billion on reservation and sales expenses, representing 17% of industry operating expenses.

But the last two decades have ushered in a dramatic improvement in distribution costs. Reservation and sales expenses at major airlines now consistently make up 4% of operating expenses; the absolute dollar figure fluctuates between $6–8 billion a year.

Looking at this data, one might assume that the transition to direct channels would simply shift costs from one expense line item to another. Yet, in 1993 airlines spent 2% of operating expenses on advertising budgets, and today that figure is 1%. That advertising expenses have not risen despite the move toward more direct distribution has been a net windfall for the airlines. This means that airlines are holistically finding it cheaper to acquire customers today, making GDS costs less of a sticking point in the big picture.[16]

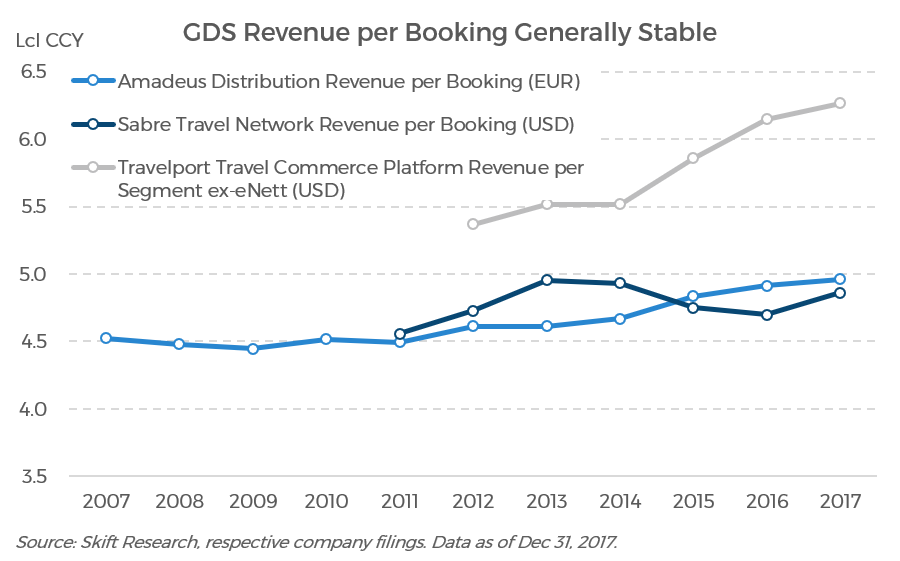

Further, average GDS fees run from $4-6 per booking, and the latest DoT data tells us that average domestic airfares are $350. That implies GDS fees represent between 1–2% of that ticket price. When looking at the effective average fee an airline pays, this figure could be even lower. That’s because we did a back-of-the-envelope calculation based off of domestic airfares whereas GDS are in practice likely to be booking higher value international and business class fares (then again, the spread could be higher than 1-2% in cases were a single transaction contains multiple segments as most GDS charge per segment, not per ticket).

In this light, GDS commissions are in line with charges by similar interchange networks like Visa and Mastercard which charge from 1–3% depending on the customer. And GDS even compare favorably with certain marketplace platforms such as online travel agencies’ hotel room listings (10–25%), ridehailing apps (20–25%), food delivery sites (15–30%), or the Amazon sellers’ marketplace (6–20%).

Taking a broader view, airlines are feeling healthier for a whole host of additional reasons including consolidation, a record number of U.S. airline passengers, rationalized capacity, lower cost structures, and (until recently) benign oil prices. The net result is record high levels of industry profitability.

These newly found profits substantially alter the risk-reward equation for an airline looking to confront the global distribution systems. When the airlines were losing money, management was desperate for cost savings and it was a lot easier to view the distribution game as zero-sum.

But today, when the sun is shining, the focus is less on cost reductions and more on revenue growth and optimization. Is it really worth it to go to war with global distribution systems and risk losing market share in that environment?

Hybrid Model

Overall, our view is for the global distribution systems to remain a critical part of the airline distribution landscape. The industry remains fragmented, giving substantial power to intermediary aggregators. Plus, the global distribution systems are tightly aligned with corporate travel accounts which the airlines simply cannot afford to lose. Further, with airlines no longer fighting for survival and distribution costs manageable, we suspect management teams see little reason to risk stirring the pot.

That said, we cannot ignore mergers in recent years that have created dominant organizations in all parts of the aviation value chain — including among the airlines (e.g. American Airlines), online travel agencies (e.g. Expedia), and travel management companies (e.g. BCD Travel).

It would be naïve to assume that these supersized giants could not simply speak to each other without the need of a third party. To that end, we already see, and expect to see even more, direct connect experiments among this rarefied group.

Ultimately, our view is for a hybrid model of connectivity and distribution. In this model, the world’s largest agencies and airlines talk to each other directly but remain connected to core global distribution systems to access the long tail of travel agents and international airlines. The GDS will also continue to play an important role in facilitating complex and interline bookings.

Key Question Two: What is the New Distribution Capability and how will it impact air travel?

Thus far we have discussed how the plumbing of the air travel ecosystem has been laid out. In this section, we turn to what is actually flowing through those pipes from the airline to the consumer.

Historically, the global distribution systems only carried limited airline information — namely fares, schedules, and inventory. Henry H. Harteveldt of Atmosphere Research Group writes that, “within the GDS ‘native’ or ‘cryptic’ displays, (the so-called ‘green screens’), all airlines look alike.”[17] This frustrated airline executives to no end, as it undermined billions of dollars of investment in distinct brand identities and value propositions.

In response, the New Distribution Capability creates a new common tech standard that allows global distribution systems, and in fact all airlines, intermediaries, and sellers, to seamlessly display and sell a richer array of products and services.

The Importance of Airline Ancillaries and Fare Unbundling

The New Distribution Capability is all about airline ancillaries, branded fares, and the next generation of airline retailing. Broadly speaking, ancillary revenues are any sales generated by airline passengers from products or services other than tickets. While there is not a standard definition of what exactly is included as an ancillary, IdeaWorksCompany, a leading expert on airline ancillaries, breaks out the following categories:[18]

- Frequent Flyer Activities: This revenue mostly comes from the sale of miles or points to partners such as hotels, co-branded credit cards, and other retailers. This category also includes miles sold directly to loyalty program members.

- A la Carte Features: These are amenities that customers can choose to add to their air travel experience. There is no standard menu, but common a la carte items include 1) the onboard sale of food and beverage, 2) checked/excess bag fees, 3) assigned seats, 4) priority check-in, 5) early boarding, 6) onboard entertainment, and/or 7) inflight internet access.

- Commission-Based Products: These are commissions earned by airlines on the sale of hotel rooms, rental cars, travel insurance, and other similar products.

- Advertising Sold by the Airline: Airlines sell ads in their inflight magazines or in physical areas such as loading bridges and airport lounges.

- Fare or Product Bundles: Some airlines may include a portion of the price associated with a fare bundle in their ancillary revenue, though some simply count these fares as ticket revenue. Whether or not fare bundles are ancillary revenue is a grey area. For the avoidance of doubt, we will discuss this specific category in more depth below.

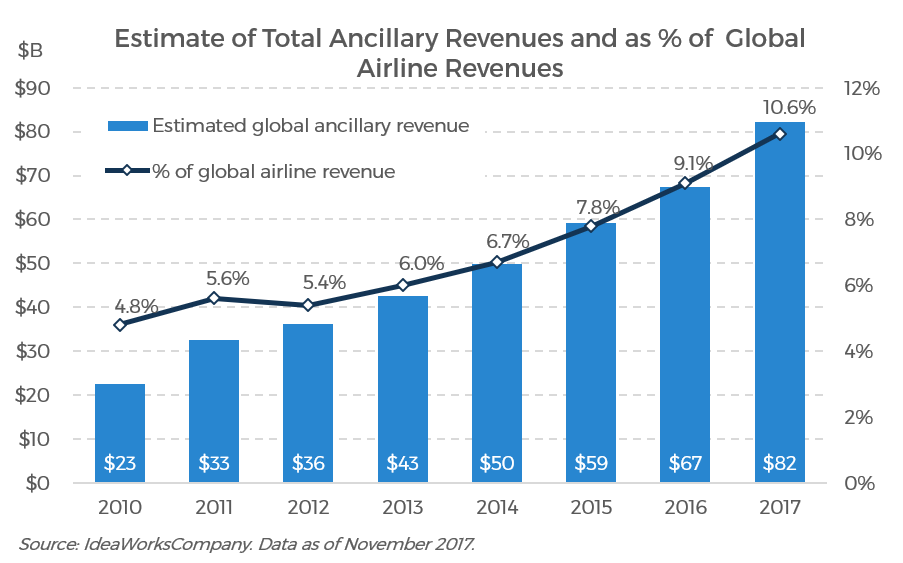

Ancillary revenue is big business for airlines. A global study by IdeaWorksCompany found that ancillaries generated $82.2 billion of revenue in 2017, representing 10.6% of total sales.[19]

United, Delta, and American Airlines now each individually sell well over $5 billion of ancillaries a year. But despite these large dollar figures at the legacy carriers, the true kings of ancillary sales are the low-cost carriers. Spirit (47% of revenue comes from ancillaries), Frontier (42%), and Wizz Air (42%) are all rapidly approaching a revenue mix where ancillaries will account for fully half of their businesses. Ancillaries likely already make up a majority of profits at these carriers as the incremental margin on ancillaries is typically quite high (i.e., priority check-in and seat selection all effectively have 100% incremental margins).

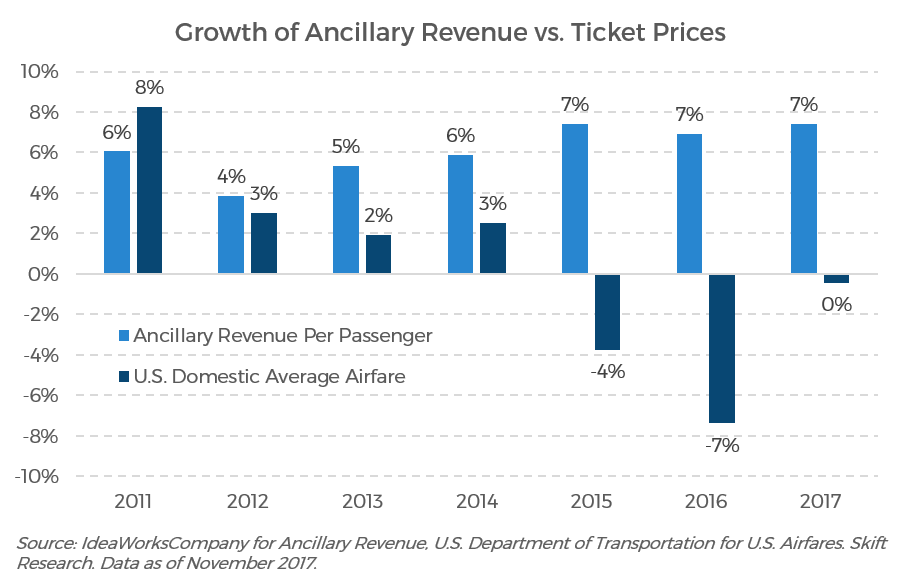

Ancillary revenues have been growing at double-digit annual rates for the past five years. This has been a crucial support for airline toplines which helped offset what has otherwise been a flat to deflationary ticket pricing environment.

A closely related development in airline sales has been fare unbundling and the segmentation of the cabin with the development of new fare classes. Many of us are familiar with this process: carriers introduced basic economy fares which strip out or unbundle all additional costs including most baggage allowances as well as seat assignments. The more expensive counterpart of this strategy is premium economy which offers more comfortable seats and extra legroom for a higher fee.

It is not always clear if fare class upgrades within the same cabin are considered ancillary sales or not as there is no standard accounting definition. But regardless of the label, cabin segmentation strategies are key drivers of airline performance in the modern era.

Take Delta Air Lines as an example. In the third quarter of 2018, it began breaking down its passenger revenue by ticket class, subdividing out main cabin fares from the business cabin and premium products. These business and premium products include: Delta One, Delta Premium Select, First Class, and Comfort+ seats.[20]

In the first nine months of 2018, Delta sold $10.4 billion of business and premium products, 34% of its overall revenue. These premium products grew 20% over the same time period last year versus main cabin revenue which only grew 2%. Perhaps more importantly, premium seat capacity only increased at a low-to-mid single-digit rate, meaning that most of the revenue growth came from upsells and pricing power. The ability to take price increases is invaluable in this current environment where airlines are trying to pass on rising fuel prices.

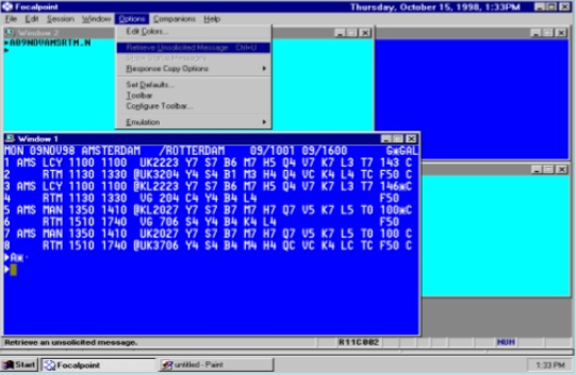

Here then lies the problem, because the prior generation of global distribution system technology was based on legacy mainframes that did not have built-in capabilities to support the vast majority of ancillary and branded fares. This older generation of mainframes could only retrieve and display data based on a cryptic series of codes and text command prompts — when they were built the system envisioned a code for a generic economy ticket at any airline but not how to prompt for an in-flight Wi-Fi upgrade or a branded fare.

Source: Magiel Venema of Edutour via Slideshare

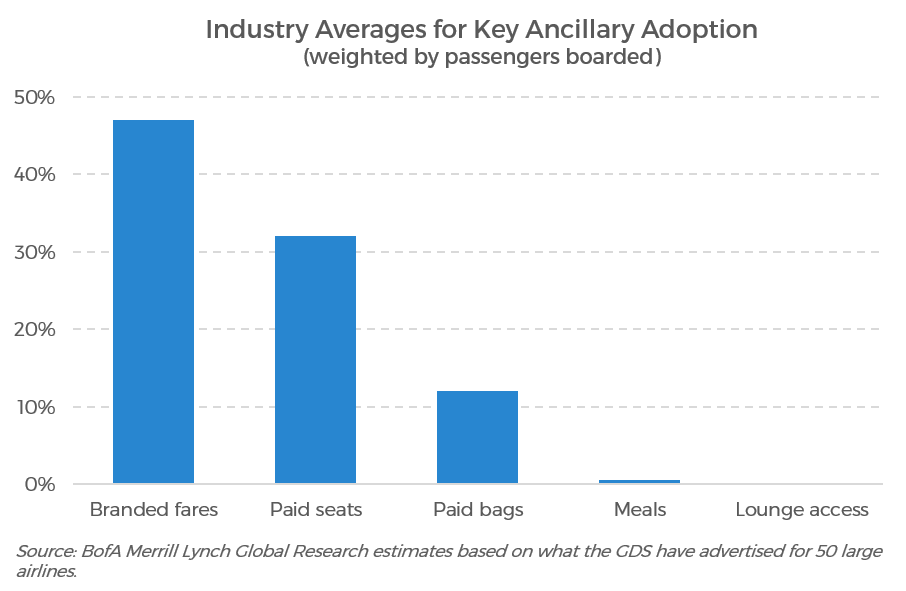

Research by Bank of America in September of 2017 emphasizes the scope of the issue. It aggregated information on the types of ancillaries supported for 50 of the world’s biggest airlines, across the three major GDS. The results are mixed, but not encouraging overall. The GDS have made an effort to support branded fares, but paid seat selection and paid bag fees lag behind. Some ancillaries, like meals and lounge access, are not offered at all.

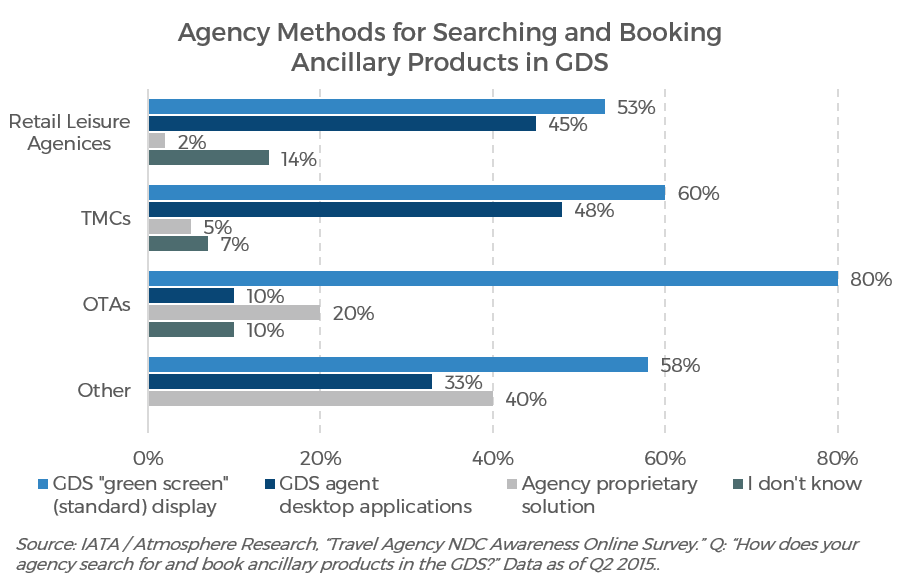

The Pace of New Distribution Capability Adoption

However you slice the above data, it is clear that the airlines’ retailing ambitions had outstripped the global distribution systems’ tech capabilities. The airlines pushed ahead on their own by implementing new ancillary offers on their website but eventually they ran into a wall. Intermediaries either could not, or would not, sell enough ancillaries. Part of the roadblock is that the vast majority of airline ancillaries sold via an intermediary are booked through GDS ‘green screens’ or desktop applications. This is true across all sales channels — travel management companies, retail agencies, and online agencies. Without the GDS onboard, the airlines were stuck. Enter the New Distribution Capability (NDC). But the adoption of the NDC has been slow for several reasons.

At its core, NDC is a tech standard that makes it easier to break an air travel transaction into its component elements, each of which can then be individually added to a customer’s shopping cart, allowing more seamless ancillary sales.

However, GDS complained that because each airline’s ancillary programs are individualized — branding, pricing, and included services vary greatly — NDC would make apples-to-apples comparisons across carriers nearly impossible. This opacity, they argued, would be a mental tax on travel agents and reduce customer choice.

Another main component of the NDC is that it will give individual airlines the capability to tailor the offers they make to their end customers.

Prior to NDC, the GDS connected to airline databases and ‘pulled’ ticketing availability into their own GDS systems. The GDS effectively stocked their own shelves with the airlines’ inventory. When a customer of the GDS — a travel management company or online booking site — came into the store to make a purchase, the GDS had full discretion to pick from their inventory and choose what price to charge.

Under the new system, offers will be made by the airlines and not the distribution systems. The airlines will ‘push’ offers through the GDS pipes and on to the end customer. In theory, this should eventually enable the airlines to create personalized offers — John and Jane could perhaps be offered different products and prices based on their past buying history, even if they are both flying the same route and booking through the same TMC.

But this upstream shift in where the offer will be calculated chips away at some of the value provided by the global distribution systems, and unsurprisingly, they reacted defensively.

Finally, the shift to the New Distribution Capability will in many cases require a wholesale rebuilding of legacy code bases. Who pays for these major tech initiatives was no small question. Travel agents and travel management companies were hesitant to pony up, preferring to rely on the GDS instead, which as discussed, already provided much of their back-end infrastructure. Plus, TMCs were already under pressure from technological shifts and had little margin to spare on IT upgrades.

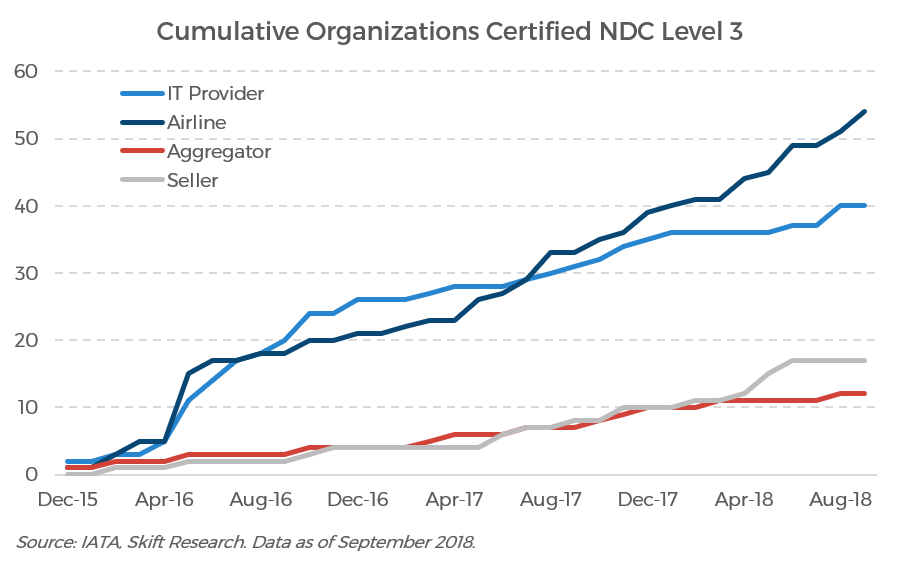

Perhaps it is no surprise then that as recently as December 2015, uptake of the new standard was poor. At that time, the International Air Transport Association (IATA) had certified just four organizations as NDC level 3 capable (Level 3 is the highest level of NDC functionality). But after years of acrimony, today, IATA has certified 124 organizations as level 3 capable. In a big win for the standard, these level 3 adopters include Amadeus, Sabre, and Travelport.

Ultimately, the GDS seem to have come to embrace the new distribution standard as beneficial to the entire ecosystem. Jose-Luis Aragon, regional vice president airline distribution sales Americas at Amadeus, said that his company company, “want[s] to change things. We want to make sure that our customers get the right solutions to ensure the right products are offered to the right traveler.” In his view, NDC is not bringing a “destruction” of value provided by Amadeus but a “transformation.” We are committed to providing the best solutions for our Airline and Travel seller customers in any retail environment. As to the costs related to implementation and adoption, everyone will need to put “skin in the game”, he insists, but the project should bring “a return for every player.”

Though perhaps only a single-digit share of transactions are booked through the standard currently, with many major players onboard, we expect this will rise.

Can New Distribution Capability Tech Standards Remain Relevant in a Fast-Moving World?

Despite what its name implies, the New Distribution Capability is not so new anymore. Early development dates to the early 2010s, it was officially ratified by the International Air Transport Association (IATA), a major airline trade association, in 2012, and DoT approval came in 2014. It’s only in the last two years that commercial adoption has really begun to take off.

That raises the question: with tech evolving so fast nowadays, how will NDC remain consistently relevant? To wit, Skift’s internal development team reacted in horror when this analyst asked them their thoughts on the XML (eXtensible Markup Language) programming[21] language that NDC is built upon. Quick checks confirm that, indeed, JSON (JavaScript Object Notation), another data standard for application programing interfaces (APIs), surpassed XML in popularity in 2013.

Will NDC be outmoded before it is even fully implemented? Our answer is a definitive ‘no.’ We believe that NDC is, and will remain, a highly relevant standard for many years to come.

That is because NDC represents a generational shift in the language that companies in the travel industry use to speak with one another. It is a shift to rich content, communicated through APIs, away from the spartan, commoditized messages of the prior format (known as EDIFACT).

Marshall McLuhan famously wrote that “the medium is the message.” He was suggesting that the medium itself, not just the content it carries, influences how we understand the ultimate message and perceive the world. The way that we send and receive information can be just as, or even more important than the information itself.

In that sense, NDC is the new medium through which everyone, including sellers, intermediaries, and suppliers, understands their world. It is building a lingua franca that gives the air travel ecosystem the vocabulary to describe ancillary products and branded airfares in the same way.

Ian Ryder, vice president business transformations and partnerships at SITA, who is working on its NDC Exchange Joint Project with ATPCO (the Airline Tariff Publishing Company), makes a similar point. He says that the greatest difficulty of NDC adoption has been getting sellers and intermediaries to adjust to the standard from an organizational and business process perspective. With those changes now underway, he believes that as long as the airlines and sellers have solved the fundamental issues that NDC addresses, “then changing to [a] new technology wrapper is not going to be an issue.”

In other words, the fundamental shift in airline retailing mindset that NDC represents at its core is here to stay. The difference between XML, JSON, or whatever comes next, is merely window dressing — just the difference between two dialects of the same common tongue.

Oh, and on a purely technical note, IATA has already begun to implement XML-to-JSON compatibility.

Key Question Three: Can airlines really de-commoditize bookings?

It is an axiom that air tickets are a commoditized product; one whose price is strictly a function of supply and demand for a given route and timeslot. The airlines allege that the old GDS systems were in large part responsible for this dynamic as they could only store price and schedule information. In response, they have pushed forward the NDC standard that will allow for the unbundling and retailing of goods and services.

Though they sound similar, unbundling fares is not the same thing as de-commoditizing them. The tech is in place to unbundle fares, but will the market truly support an offer where a differentiated airline brand determines value, i.e. de-commoditization?

Price Is Not Everything, but Unbundling Is not the Same as De-commoditization

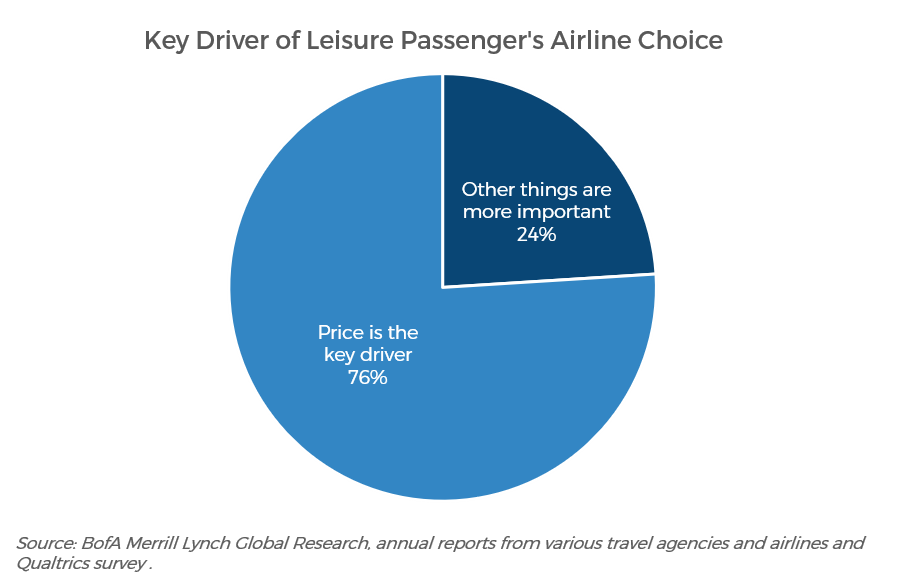

There can be no doubt that price is one of the most important factors for customers looking to book a flight. To point to just one of many examples, Bank of America found in a recent survey that price is the key driver of airline choice for 76% of leisure passengers.

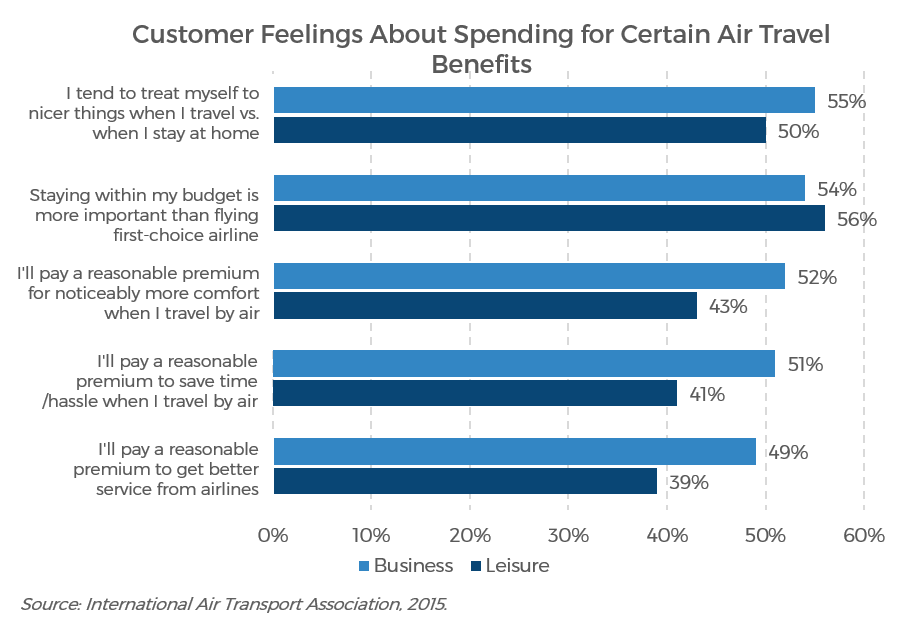

But while Airlines can never disregard price, there is significant room for nuance in this conversation. For instance, a majority share of both leisure and business travelers say that they treat themselves to nicer things when traveling. A substantial chunk of travelers too, are willing to pay a premium for more comfort or better service when flying.

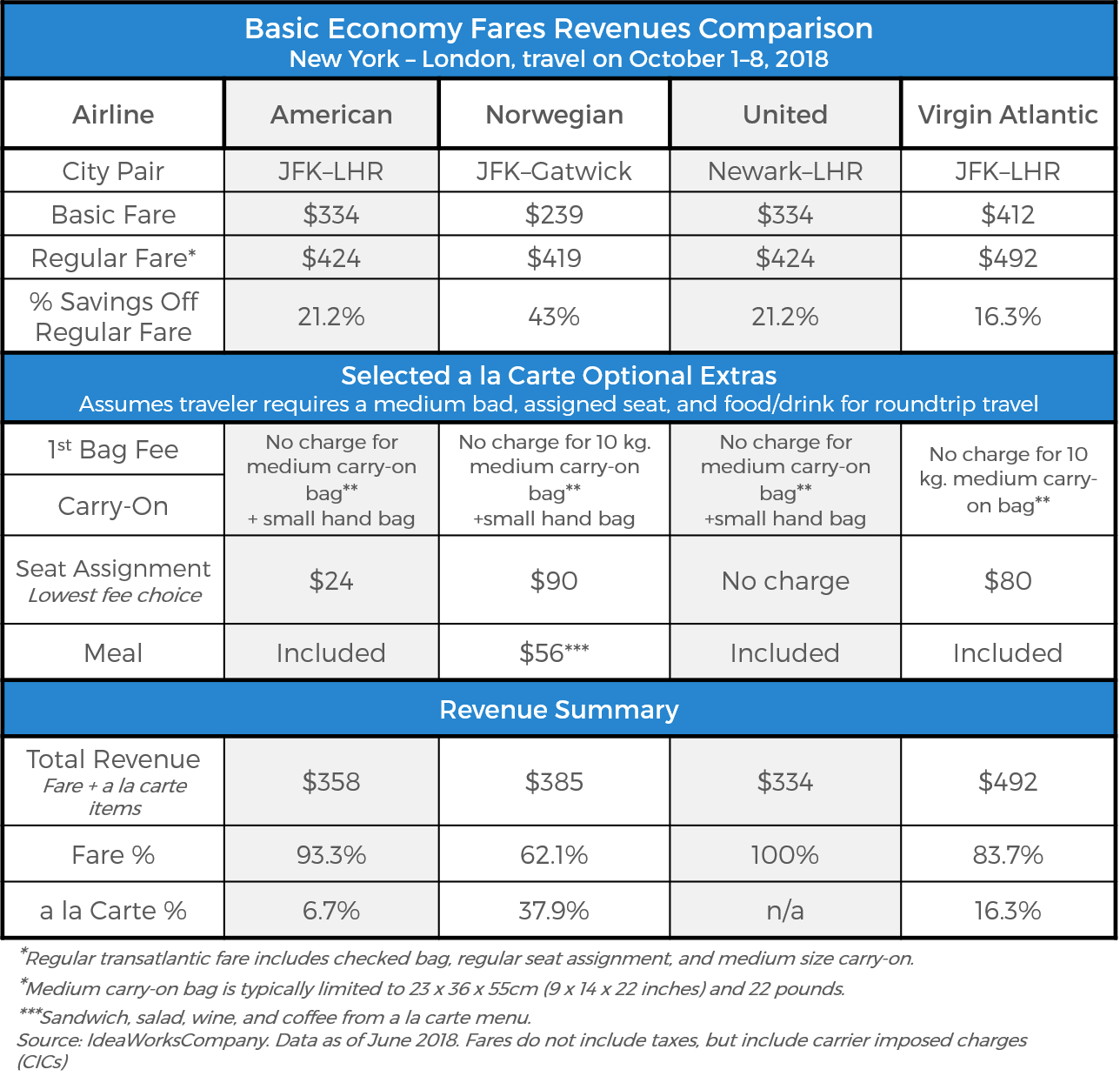

Cabin segmentation and unbundling (e.g. separating out checked bags from the price of the ticket) has been a great solution for the fickle preferences of the traveling public. Bare-bone basic economy fares can capture the budget traveler and give legacy carriers a product with which to fight back against the low-cost carriers. Premium economy products and a la carte ancillaries let travelers treat themselves to extra comforts as much as their budgets will allow.

Theses strategies have been excellent tools for airlines to optimize revenue (i.e. luxury travelers can spend more via a la carte ancillaries) without sacrificing passenger yield (i.e. a budget traveler can book a basic fare and use up a seat that would have otherwise flown empty).

Air carriers can now mix and match from these underlying components to re-bundle new branded fares. Delta’s Comfort+, for instance, combines the individual ancillaries of 3–4” of extra legroom, priority boarding, and complimentary snacks, among others. JetBlue’s Blue, Blue Plus, Blue Flex and Mint options are other good examples of offering branded fare classes made up of ancillary building blocks.

But will consumers one day ask for a Comfort+ or Blue Flex ticket by name in the same way they order a Coke or pick up a pack of Kleenex? Here we caution, that unbundling fares is not the same thing as de-commoditizing them.

The challenge, in our view, is that though the airfare has been deconstructed, the underlying components still have very little differentiation. Accordingly, when branded fares are reconstituted from similar components, they still wind up feeling very similar across carriers.

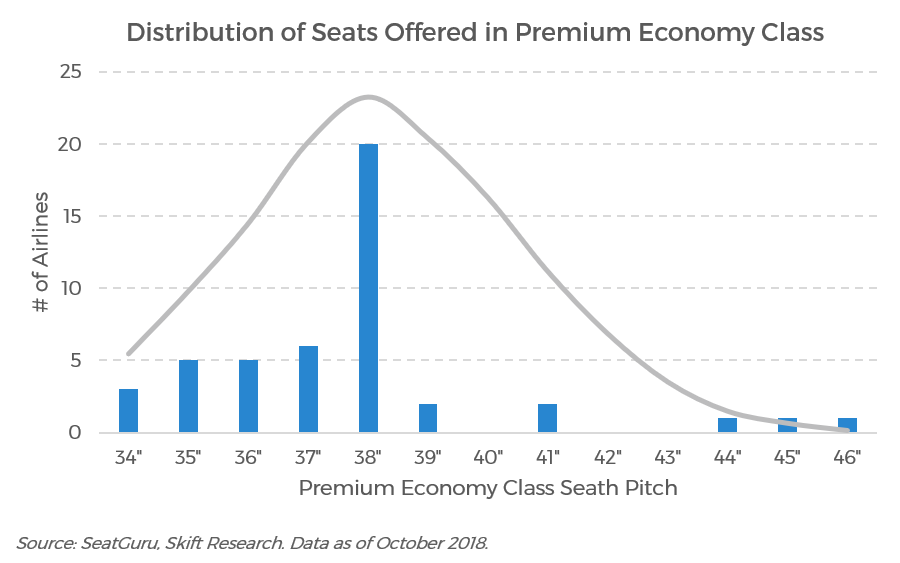

SeatGuru, for instance, offers an analysis of premium economy seat configurations across 46 airlines. When we compared these offerings, we found many offered the same package of ancillaries. A vast majority of airlines for instance, offer the same 38” seat pitch. IdeaWorks too, compared basic economy fares of four carriers on the same route, and their analysis shows that the offering tends to be similar, though not identical.

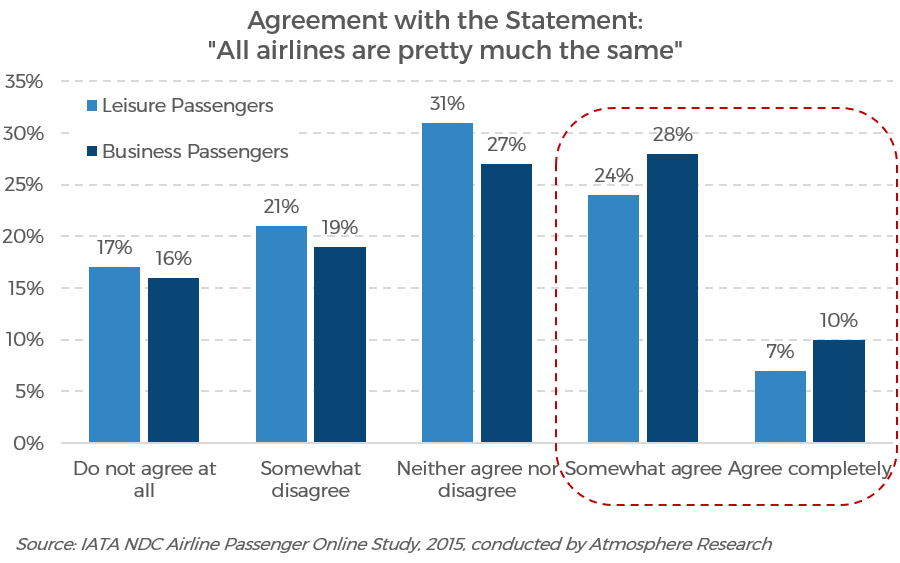

There is, for instance, still substantial room for further differentiation in airline branding when just 38% of leisure passengers and 35% of business passengers somewhat or strongly disagree with the statement that “all airlines are the same.”

From Re-Bundling to Retailing

President and CEO of Farelogix, a leading airline technology provide, Jim Davidson, says that when the airline industry started to unbundle, “it was done for financial-driven purposes. There was no consumer experience.” Branded fares created granularity in the pricing of a ticket, but this came at the cost of added complexity and confusion for customers. While branded fares may have begun to also build some differentiation across carriers they have been less successful in this respect relative to the former, financial, objective.

Davidson differentiates between necessary ancillaries and choice-based ancillaries. A necessary ancillary is one a passenger cannot go without, perhaps checked bags for a family of four traveling on vacation. These ancillaries are drivers of financial results. A choice-based ancillary on the other hand, will not be the difference between the customer choosing to take the trip or not. This could be a solo traveler springing for extra legroom or priority boarding. In this case, savvy customers are making value-based purchase decisions.

Choice-based ancillaries, Davison says, “[are] the real opportunity … for airlines to shift from unbundling for the sake of unbundling and recharging, to the point of unbundling and re-crafting products or fare families that match the desires and values of the consumer.”

Offering the right selection of air products at the right time to maximize value is much easier said than done. There was a time when an airline might simply delineate its fare pricing along simple dimensions like distribution channel or business versus leisure. But to really take advantage of unbundling and ancillaries, airline sales will have to integrate a much more sophisticated set of customer data to make relevant offers. The same individual traveler will have a different set of value preferences on a business trip versus a solo trip versus a family trip. An international business trip is different from a domestic business trip. The individual’s past buying behavior and loyalty affiliations also matter.

To facilitate this shift toward a retailing mentality, Ornagh Hoban, VP marketing and strategy at Datalex, sees a “significant investment in digital platforms, where airlines are really taking ownership of their distribution.” “Whether you're Airbnb, Uber, Amazon, JetBlue, whoever,” she continues, “we're all trying to build platform businesses … focused on delivering products and services with exceptional precision.”

These sophisticated data-driven offers will have to be optimized for the individual, but also will have to be distributed across what Hoban calls a “multi-sided and increasingly complex digital marketplace.”

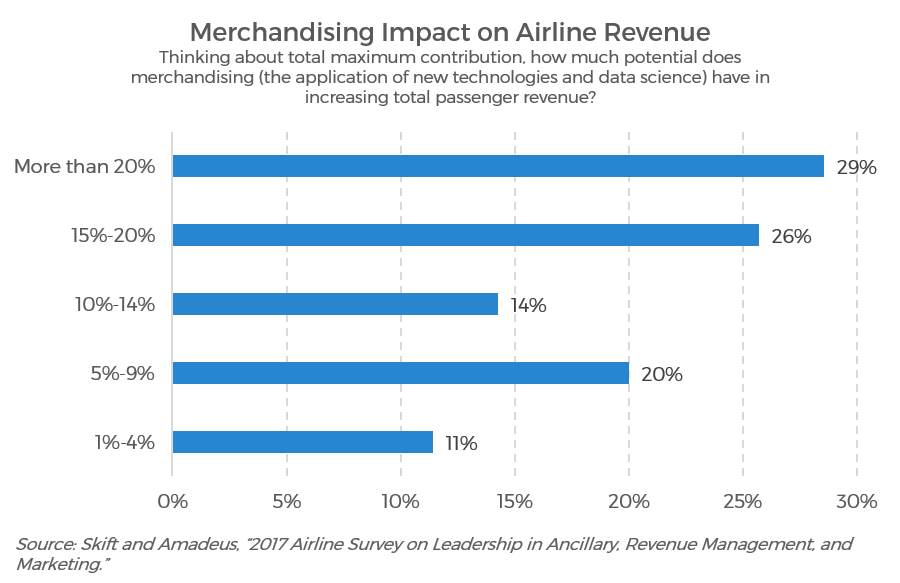

Airlines see real value in these solutions and, in a Skift survey, most saw these new retail initiatives as potentially driving a significant uplift in sales.

There is much excitement about the possibility of differentiated and personalized airline retailing, but Skift Research cautions that there is much work left to be done. We are not alone, with nearly half of all airlines polled in the same survey as above saying it would take at least two years to implement many of these changes.

These dynamics, in our view, are likely to drive a convergence between a number of technologies that were previously separate, including revenue management, distribution tools, customer relationship management, and more.

The New Distribution Capability lays a good foundation for these changes, but we also believe that mainstream adoption of these technology will require solutions that provide a single source of truth regarding an individual’s identity and shopping history. After all, how could you make a personalized offer to a customer, or group of customers, without understanding their demographics and past buying behavior? If consistent personalized offers are to be made to this same customer across multiple sales channels, there must be a way for the whole ecosystem to share and use these profiles.[22]

IATA’s One Order initiative seeks to solve these challenges. It is a data communication standard, like NDC, that hopes to be able to consolidate many different pieces of customer data, such as order items, payment and billing information, and fulfilment data and status, into a single order record. Currently all of these various pieces of data about the customer transaction journey are housed in separate digital records such as the Passenger Name Record (PNR), Electronic Ticket (ETKT) and Electronic Miscellaneous Document (EMD). One Order is still in the early stages of development and it could take up to a decade to see significant progress. Or perhaps other technology solutions could drive progress in the identification space even sooner.

Key Question Four: Does Silicon Valley have a role to play in airline distribution?

Thus far, this report has focused on how the many players in the air travel ecosystem have built, and plan to develop, airline distribution. But despite the best laid plans of the industry, could disruption come from the outside? Could big tech companies disrupt airline distribution, for instance? It seems plausible as, after all, outside disruptors like Airbnb and Uber shook up hospitality and ground transportation respectively.

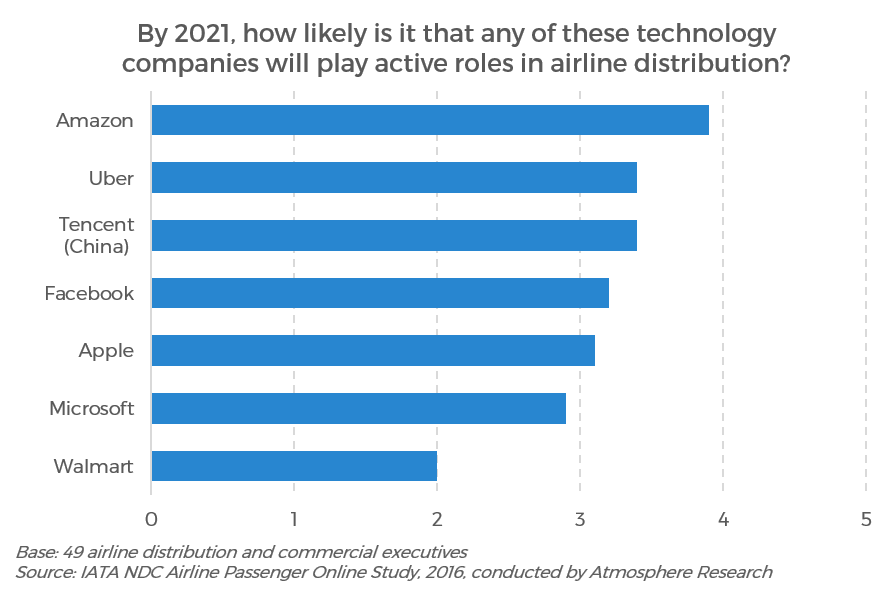

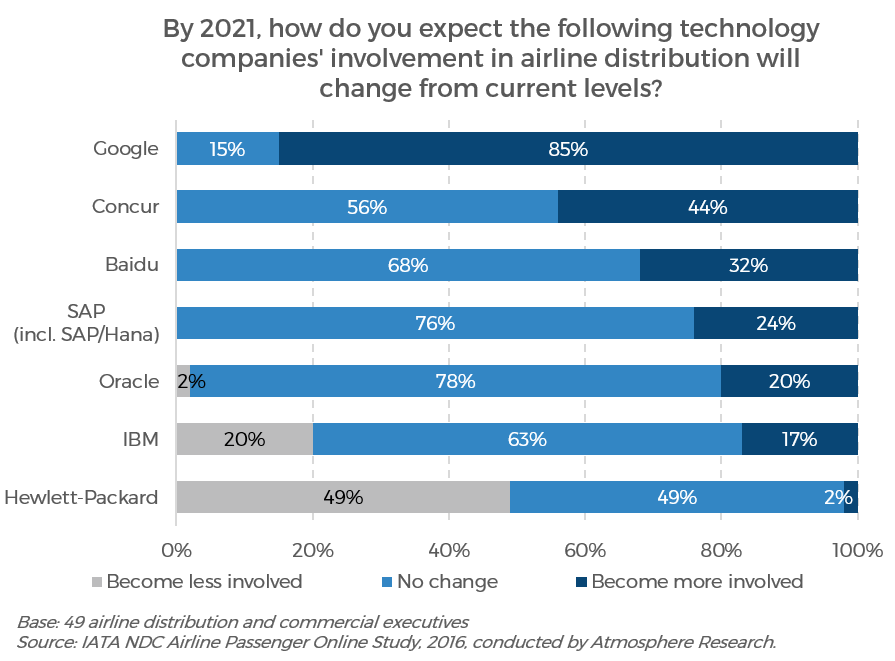

Certainly, polls of executives betray a sense of anxiety, with many seeing it likely that companies such as Amazon or Uber could play a more active role in airline distribution. The entrance of these companies would be more likely to hurt the consumer-facing intermediaries. An Amazon travel offering is more of a threat to Expedia than to Sabre, as Amazon would likely have to acquire supply from a GDS all the same. Most of these companies would have more of a negative impact on consumer-facing intermediaries rather than the business-facing ones.

But then again, tech could come for the global distribution systems as well. For instance, we would be remiss if we did not address the possibility of blockchain in any discussion about the future of airline technology. A distributed blockchain would support a network connecting sellers to suppliers without a centralized middleman, an existential threat to the global distribution systems. Blockchain though, is not a company, but rather a network protocol, like email. It would require a company to take up the mantle of designing a user experience to make this technology usable (i.e. play the role that AOL/Outlook the businesses did relative to the email protocol).

Google is, of course, already a large player in the travel ecosystem. It has been involved in airline distribution since its 2010 acquisition of ITA Software, a faring engine, which then became the backbone of Google Flights in 2011. Google is primarily a metasearch platform that aggregates many fares across various airlines and platforms. Metasearch is popular among travelers for its ability to cut through a crowded market of vertical search engines. Various research studies estimate that somewhere between 25–40% of travelers do some trip research on a metasearch platform.

Google has a crucial advantage over other business in gaining customer eyeballs as its platform extends well beyond travel and interacts with individuals on a daily basis. Google’s ecosystem offers apps that span hotel and air search, activities, itinerary management, person-to-person communications, payments, voice search, and other features.

We expect Google to continue to grab hotel and air business market share away from other aggregators, though we note it poses the most immediate threat to travel-specific metasearch sites like Trivago, TripAdvisor, and Kayak. These platforms will need to stay price-competitive on traffic acquisition. While always a possibility, we see a much lower chance of Google offering its own OTA product, due to the complexity of distribution channels, which we discussed in depth above.

Amazon

If the future of travel distribution is to be built around modern e-commerce platforms, then surely Amazon has a role to play. Amazon arguably operates the best retail platform in the world, and so at a minimum, there are lessons to be learned from studying its business.

What about the threat of direct competition? Amazon did launch a destinations site in 2015, but that offering was mainly focused on booking local hotel getaways. It shut down that business fairly quickly, likely due to struggles with the complexity of hotel distribution. Hotels are higher margin than air tickets, and so if Amazon struggled with that product, airline distribution would seem to be safe for now.

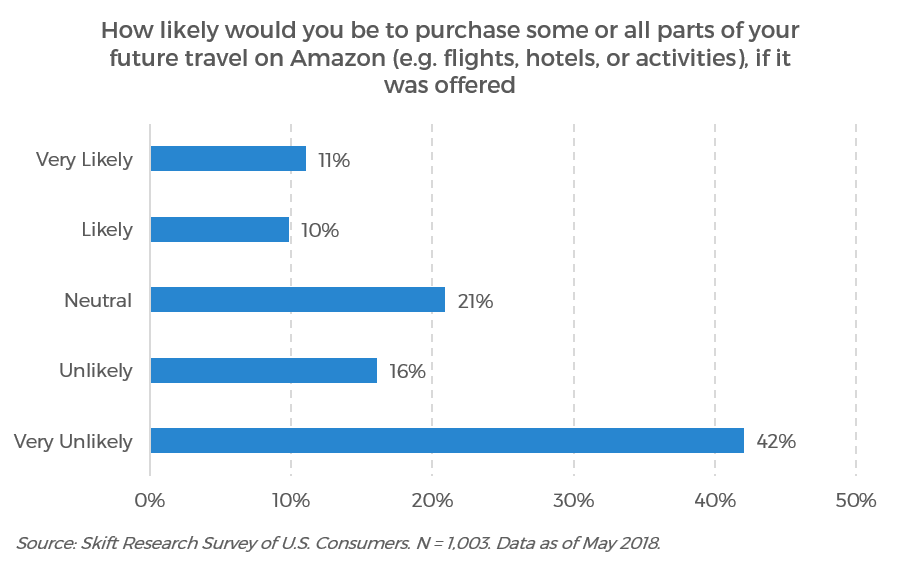

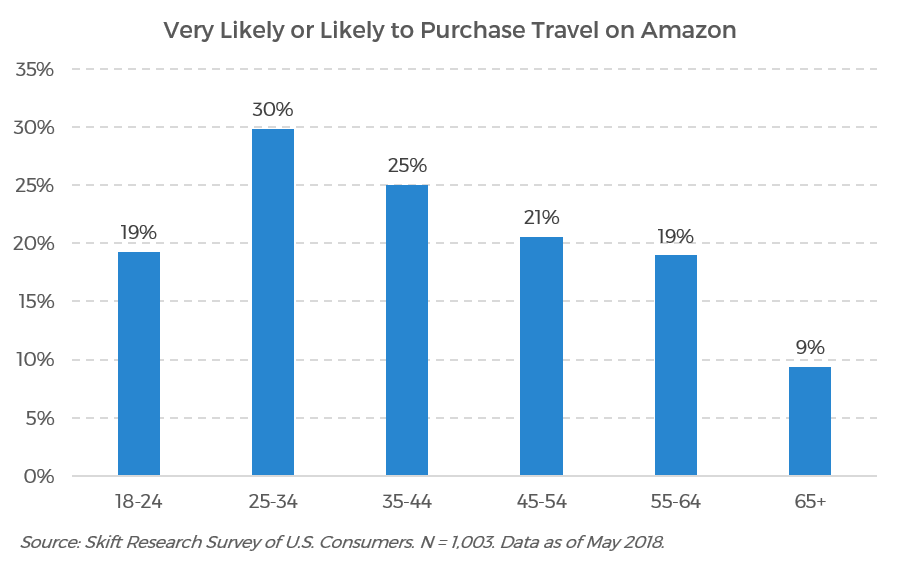

Further, Skift Research polled a representative U.S. audience and found that Amazon still faces many challenges in developing trust as a consumer travel brand. 42% of U.S. adults considered themselves “very unlikely” to make future travel purchases on Amazon if it were offered and just 11% were “very likely” to consider the idea.

But airline distribution stakeholders should remain wary of Amazon as a threat. Those aged 25–34 and 35–44 showed significantly more favorability toward booking travel on Amazon

Despite early failures, travel is a lucrative market and Amazon is an iterative company. That makes it likely that some new travel experiment could be in the works for a future date. It’s worth preparing for that possibility alone, but even if it never comes to pass, the company could well influence airline distribution through other channels such as its growing advertising business or leading position in voice-enabled smart devices.

Blockchain

No doubt blockchain advocates are salivating at the thought of running airline distribution on the technology. Blockchain is able to replace centralized intermediaries with a distributed network of peers interacting with one another. A distributed blockchain would support a network connecting sellers to suppliers without a centralized middleman, so maybe airline distribution is in fact a good use case for this tech. We remain skeptical.

From a technical perspective, we suspect many underestimate the size of the airline market and overestimate the capabilities of blockchain.

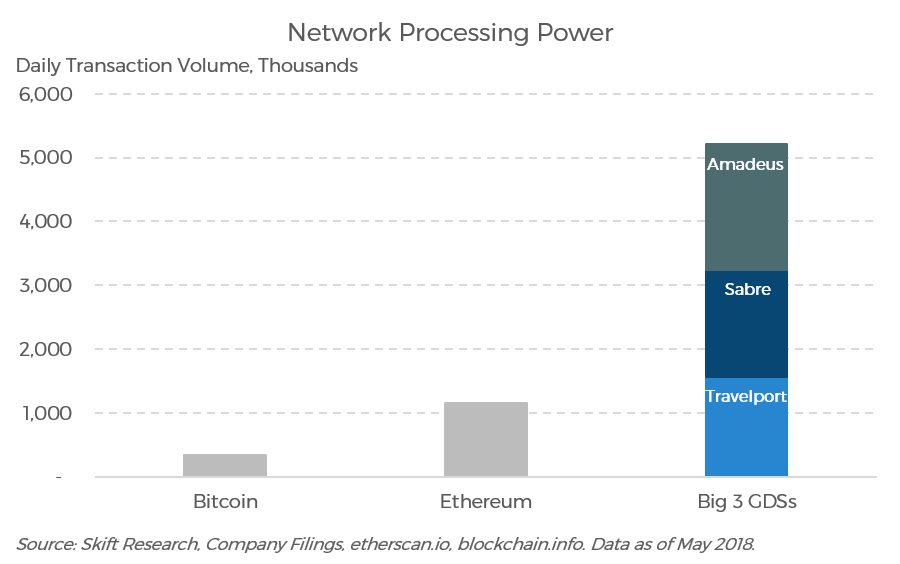

Amadeus, Sabre, and Travelport combined, process over 5.2 million transactions a day. In contrast, Bitcoin posts only 343,000 transactions. Ethereum, a modified blockchain protocol that forms the basis for many commercial blockchain initiatives is a three-fold improvement over blockchain, handing 1.2 million transactions a day. But still, Ethereum falls short of the transaction volume of even the smallest GDS, Travelport. Bear in mind that GDS still only handle a portion of the overall burden of airline distribution and it becomes clear to us that the technology is not yet ready for the main stage.

Ryder, of SITA, says blockchain is probably not helpful to an area like NDC. Instead he says that there could be potential for integrating blockchain into IATA’s One Order program, or a similar initiative, which as we briefly mentioned earlier, is focused on problems of passenger identity. To that end, Ryder says, “you [can] imagine that something like blockchain could be a very valuable technology for distributing that verified version of what somebody has purchased, what they've paid, who's responsible for delivering what, etc…” As we discussed in an earlier section, building a verified personal identity is key to making a personalized offer.

We also note that blockchain is not a company, but rather a network protocol. It is useless without a company or team of developers to put a software and a user experience around it. The comparison is email, which is a generic, freely available protocol. In the case of email, it was developers of software like AOL, Outlook, and Gmail, that made the protocol usable for all intents and purposes. What company could develop this technology and then sign up all of the many individual airline sellers and suppliers onto its network? Ironically, a GDS would be best positioned to implement such an approach, but they are clearly not going to disintermediate themselves.

We remain open to the possibility of blockchain being integrated into the future of airline distribution. It could well serve as an important source of buyer identity that empowers the future of airline retailing and customized offers. On the other hand, a centralized set of data and software could achieve similar results without blockchain.

We are highly interested in blockchain and continue to closely monitor developments. The technology could have potential, but for now, we see it playing a de minimis role in the immediate future for airline distribution.

Conclusion

Airline distribution is undoubtedly a complex and, at times, intimidating topic. It is easily overlooked or dismissed as archaic by those new to, or on the outside of, the travel industry. Our deep dive into the space left us with a newfound sense of respect for the system and the businesses built within it. Yes, there are parts of the system that are outmoded, but our overall sense is that it is slowly reinventing itself one piece at a time. It takes a long time to turn around a big ship, and this one is truly titanic with with 4.1 billion passengers globally in 2017.

On the GDS front, we expect to see a hybrid model of connectivity and distribution where the world’s largest agencies and airlines talk to each other directly, but remain connected to core global distribution systems to access the long tail of travel agents and international airlines. The GDS will also continue to play an important role in facilitating complex and interline bookings.

The entire ecosystem seems to have come to embrace the New Distribution Capability and we expect to see further acceleration in its adoption rate. NDC will better enable the selling and marketing of branded fares and ancillaries by allowing all channels to communicate with rich content through APIs. In that sense, NDC is a the fundamental shift in airline retailing mindset that we believe is here to stay.

The NDC push is part of an effort by airlines to drive a new way of retailing that they believe will be the key to de-commoditizing their products and services. Branded fares and ancillaries will help with this in some regards. But there will always be some segment of the consumer population that is price sensitive above all else. We are also skeptical that certain branded fares are truly differentiated from competitors’ commoditized offers. In our mind, the path forward to de-commoditization is through personalization. These techniques are still in the early stage and will rely on being able to build an accurate profile of the consumer.

Disruption out of Silicon Valley may also play some role in the future of distribution, but it will be hard for these tech companies and protocols to rewire the system wholesale. Google will maintain its large role in travel and Amazon may enter the space, but the latter faces several hurdles to customer acceptance. Blockchain is an interesting technology that we continue to monitor, but we remain skeptical and see a de minimis role for it in the immediate future.

Footnotes

1. We use GDS as both a singular and a plural to avoid the awkward, though more technically correct, GDSs.↩

2. Euromonitor International. “Passport: Airlines in the U.S.” September 2018.↩

3. Ibid.↩

4. Credit Suisse. “Amadeus Initiation: Disintermediation momentum to accelerate.” April 2017.↩

5. Bank of America Merrill Lynch. “Selling ancillaries indirectly: How the Global Distribution Systems are doing Industry.” October 2017.↩

6. Ibid.↩

7. Under mandatory participation, airlines could still withdraw fares from the distribution systems as long as they did so equally across the board. This is subtly, but importantly, different from later “full content agreements” that required airlines to provide the GDS with full access to all fare information.↩

8. At present, all of the GDS have committed to NDC, though this was not always a given. None have gone live with AA’s specific NDC connection yet, but some have promised to do so.↩

9. This category (NAICS:5615) includes online and offline travel agency companies among others.↩

10. As of this report publication in October 2018, these are the latest available figures. Data on the 2017 Economic Census will become available starting in 2019.↩

11. Source: Credit Suisse Research, Dio Mi 2016 Data. Published in: Credit Suisse. “Amadeus Initiation: Disintermediation momentum to accelerate.” April 2017.↩

12. International Civil Aviation Organization. “Aviation Benefits.” 2017.↩

13.Atmosphere Research and IATA. “The Future of Airline Distribution, 2016-2021.” 2016↩

14. Atmosphere Research and IATA. “NDC: Travel Agencies’ Enabler to Success.” October 2015.↩

15. United States District Court Southern District of New York. Case Civ. A. No. 1:11-cv-02725-LGS. “US AIRWAYS’ MEMORANDUM OF LAW IN SUPPORT OF MOTION FOR PARTIAL RECONSIDERATION.” Filed 3/30/2015.↩

16. That said, ask any airline if they would rather pay less and the answer is going to be “yes.” But it changes the rank priority of which costs need to be tackled and when.↩

17. Atmosphere Research and IATA. “The Future of Airline Distribution, 2016-2021.” 2016↩

18. Jay Sorensen. “The 2018 CarTrawler Yearbook of Ancillary Revenue by IdeaWorksCompany.” September 2018.↩

19. IdeaWorksCompany. “Airline ancillary revenue projected to be $82.2 billion worldwide in 2017.” November 2017.↩

20. Note that Delta still classifies premium tickets at passenger revenue, not ancillary revenue, speaking to the technical difficulties of such a delineation.↩

21. Technically, XML is a markup language, which is to say, it’s a language for holding data structures that programs output.↩

22. Of course, to the extent possible while protecting consumer privacy.↩

Further Reading

- Skift, "Channel Shock: The Future of Travel Distribution." August 2017

- Skift, "American Airlines Feels Vindicated in Its Second Try at Direct Distribution." October 2018

- Skift, "American Airlines Revives Direct-Connect Moves While Sabre Questions Feasibility." August 2017

- Atmosphere Research and IATA, "The Future of Airline Distribution, 2016-2021." 2016

- IdeaWorksCompany, "Airline ancillary revenue projected to be $82.2 billion worldwide in 2017." November 2017

- U.S. General Accounting Office, "Airline Ticketing: Impact of Changes in the Airline Ticket Distribution Industry." July 2003