Report Overview

Skift Research’s Global Travel Outlook 2024 gives a closer look into global travel performance and the key regions fueling growth. Transitioning into 2024, we forecast Europe will normalize to stable growth levels while the Asia-Pacific region positions itself as the primary growth driver.

The Skift Travel Health Index reveals recovery across all regions. Europe's growth, impacted by multiple economic and geopolitical factors, has been sluggish. Asia-Pacific’s resurgence, driven by China's reopening and strong domestic travel, has driven the global travel average to surpass pre-pandemic levels.

Asia’s revenge travel moment has just arrived, now that the complete impact of open borders is realized. The region has significant room to recover and, after that, grow further. Europe’s revenge travel boom has stabilized, and we believe that persistent geopolitical instability, the economy, and extreme weather conditions will potentially impact travel numbers in the region. We anticipate growth across all regions, but Asia Pacific will be more robust than slower Europe.

See our Global Travel Outlook 2024 for further global and regional insights.

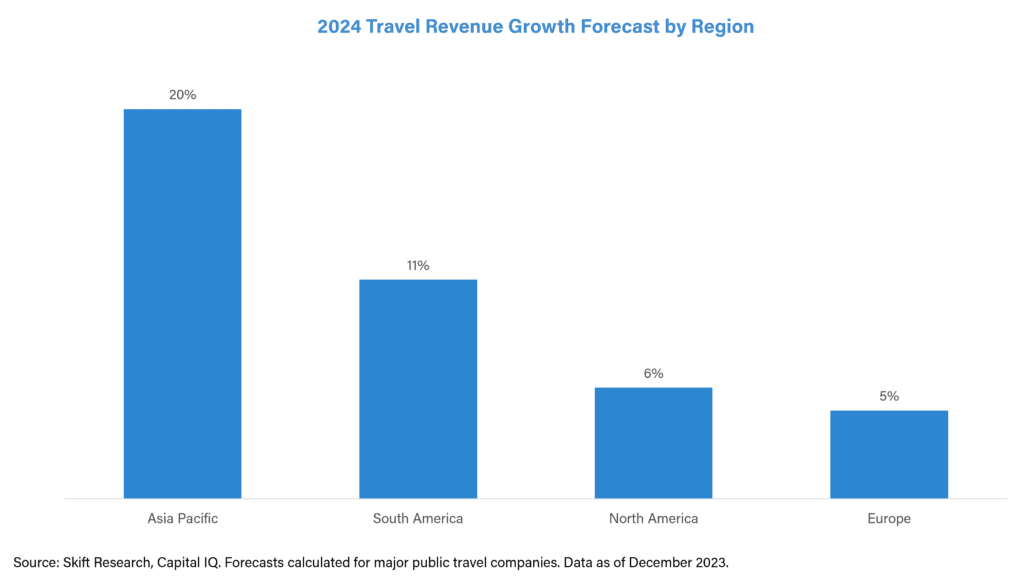

Asia Pacific to Drive Growth in 2024

The global travel industry faces shifting dynamics in 2024. Travel revenue projections for the top 200 tourism companies show that Europe, the most popular tourism hotspot in the world, is slowing down as the Asia-Pacific region is set to be the primary driver of travel growth. The forecast shows Asia Pacific in the lead, growing 20% over 2023. Europe’s gains are expected to be more modest, at 5% year-on-year.

Sluggish Growth in Europe

The Skift Travel Health Index monitors travel indicators across 22 countries, benchmarking monthly performance to 2019. The analysis reveals a recovery in Europe, but growth in the region is held back by Russia, which is stuck at 65% of pre-pandemic levels, and the economic conditions, which are leading to sluggish growth levels.

Asia Pacific, a laggard since 2021, made slow progress in travel recovery from the pandemic. However, early 2023 was a game-changer. As soon as China reopened borders and travel from the country resumed, the region made rapid progress, surpassing pre-pandemic performance by 2% in April 2023. This trend has continued. The strong growth in the region pushed the global travel average to overcome 2019 performance levels.

Europe's Modest Travel Forecast

As of the end of 2023, inbound travel to Europe was only 6% short of 2019 levels. Intra-European travel and favorable exchange rates attracting Americans helped the region’s travel rebound. High prices have fueled the recovery, mainly driven by rising inflation. After the revenge travel boom and a strong summer, European travel patterns are normalizing.

While the region has been resilient, persistent geopolitical instability could hurt further growth. According to the European Travel Commission’s Trends and Prospects (Q3 2023) Report, the ongoing war in Ukraine continues to affect arrival figures in Eastern Europe, and the developing conflict in Israel poses risks to destinations such as France, Turkey, and Romania, which are popular with Israeli travelers.

The report also revealed that 24% of European travelers are concerned about rising trip costs, and 17% expressed concerns about the economic situation and personal finances in the upcoming months. Additionally, extreme climate conditions may further impact tourism.

Having said that, Paris is gearing up to host the 2024 Olympics. Hotel rates in the city have surged, 24% higher than during the same period in 2023. This uptick shows the impact of increased demand associated with hosting major global events.

Developments are on the horizon in Eastern Europe, too. Romania and Bulgaria are expected to join the Schengen area in March 2024. This move will give a boost to travel in these countries.

We expect the region to grow, but more slowly than others. Globally, Europe has the highest volume of international travelers, twice the travel volumes seen in Asia Pacific in 2023. These numbers are too large to grow at double-digit growth rates. So, single-digit growth levels should not be viewed negatively; instead, they indicate the normalization of travel in the region. The Global Travel Outlook 2024 forecast shows that international travel volumes from Europe will almost return to pre-pandemic levels by 2024 and further grow by around 3% in 2025.

Dynamic Growth in Asia

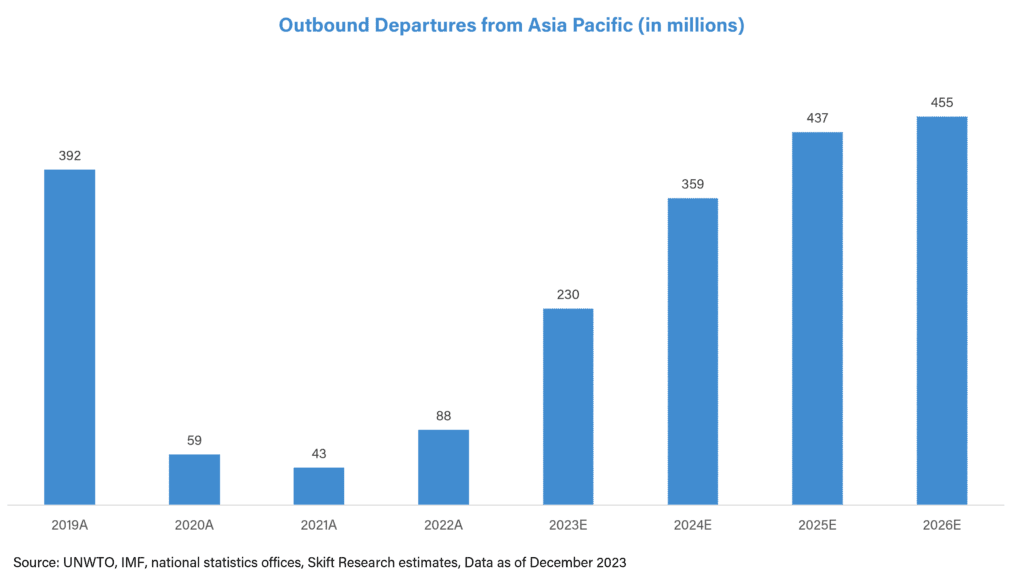

Asia has made significant strides toward recovery, particularly following the reopening of China. Despite the travel boom in India, travel performance had only recovered to 72% of 2019 levels by 2022. This changed when China’s borders re-opened for travel. However, travel volumes from China did not bounce back as quickly as was expected. Countries such as Thailand, Indonesia, and Hong Kong, which are dependent on Chinese travelers, have struggled as a result.

China is the most significant contributor to international travel in Asia Pacific, accounting for around 13% of total outbound departures in the region in 2019. While international travel from other countries in the region has grown, it is not enough to make up for the void left by China. Our Global Travel Outlook 2024 report shares a forecast of 80% growth in Chinese outbound departures in 2024 and a further 46% in 2025. As a result, we anticipate international travel volumes in the Asia Pacific to recover in 2025 as Chinese outbound travel returns completely.

Led by strong domestic travel and the thriving Indian travel industry, Asia substantially recovered in 2023. The gradual easing of border closures in Asian countries, which were among the slowest to do so, has led to a release of pent-up demand to visit Asian countries.

According to Bernstein, India is expected to become the third-largest domestic and fifth-largest outbound travel market by 2027. Hopper revealed that Tokyo and Seoul have emerged as the top two trending international hotspots for U.S.-based travelers in 2024. Similar trends are observed in Kayak's data, which highlights Hong Kong, Shanghai, Taipei City, Tokyo, and Osaka as the topmost popular destinations for the year. On average, airfare prices on Hopper for a flight to Asia are 45% higher than in 2019. Hayley Berg, the lead economist at Hopper, also claimed that tourists may pay a hefty premium to fly to Asia in 2024.

OAG data shows that China’s international airline seat capacity has improved. As of December 2023, it is 38% lower than 2019 levels but increased by 497% year-on-year. The positive trend in seat capacity indicates potential improvements in both Chinese outbound and inbound tourism in 2024.

China has introduced a visa-free policy for nationals from France, Germany, Italy, Malaysia, the Netherlands, and Spain from December 2023 until November 2024, facilitating more accessible travel.

Thailand's strategic move to temporarily waive visas for travelers from China, Kazakhstan, Russia, India, and Taiwan is proving effective. Although visitor arrival volumes remain below 2019 levels, the slow rebound in Chinese inbound tourism is offset by increased arrivals from Malaysia, which have doubled. Other source markets include South Korea and India, each contributing 1.5 million visitors. The Tourism Authority of Thailand (TAT) is actively exploring measures such as extending visa durations for certain nationalities, introducing multiple entry visas, and considering an extension of the visa exemption for Chinese tourists, which is currently set to expire at the end of February 2024.

Indian travelers visiting Vietnam have significantly grown, making India one of the top 10 inbound markets for Vietnam. The country is improving direct connectivity to key cities in India to promote tourism further.

All these factors point to significant room for recovery and further growth in Asia as the impact of lifted lockdowns and open boundaries is fully realized. Therefore, the Asia Pacific region will drive travel growth in 2024.

Conclusion

In conclusion, the travel industry's trajectory for 2024 reflects a tale of two regions. Asia Pacific is poised to be a driving force, fueled by China's resurgence, pent-up demand to visit Asian countries, and robust domestic travel. In contrast, Europe, the most popular tourist hotspot, is now stabilizing and also faces challenges tied to geopolitical uncertainties, inflation, and climate-related concerns, contributing to a more modest growth forecast.

Read our Global Travel Outlook 2024 for further global and regional insights.