Executive Summary

Loyalty marketing is a multi-billion dollar revenue stream for the travel industry and the programs, as measured in terms of total number of enrollments, are more popular than ever. But changes to the industry landscape and changes in consumer behavior have many observers questioning if they still serve their original purpose: building connections with customers. This question is all the more urgent as new technology tools give travelers access to better information about their travel experience, opening up more information about everything from prices to customer reviews than ever before. This information is also creating new learnings for travel marketers as well, who are gaining more ability to selectively personalize the travel experience and identify pain points as they happen.

While the “points for rewards” loyalty paradigm still rules, there are plenty of new loyalty strategies that are challenging this model. A tidal wave of data, coming from customer mobile phones, social media and digital behavior on booking websites offers new opportunities to better personalize services, surprise and satisfy customers. Meanwhile, this huge wealth of information is also forcing many companies to rethink how and why they are deliver rewards to loyal customers, becoming more transparent and responsive in the process. Those companies that manage to incorporate this wealth of travel data into their loyalty offering stand to reap significant rewards, both in terms of customer perception, but also in terms of their bottom line.

Introduction

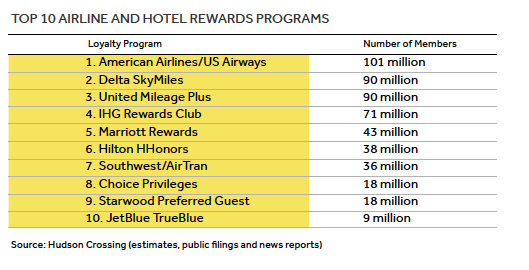

Travel loyalty programs. A simple idea to create product differentiation following airline industry deregulation in the late 1970s has morphed into a global marketing juggernaut adopted by virtually every corner of the travel industry, from airlines to hotels to rental car companies and beyond. The amount of money at stake is immense: COLLOQUY, a marketing and consulting research firm, recently found consumers had amassed more than $48 Billion dollars worth of rewards.1

Yet despite this wild success, there is a growing sense among both travelers and marketers that the programs are flawed. A system that was designed to create stronger bonds between travel customers and travel businesses has turned into something else entirely—a massive revenue stream. The program revenue generated via alliances with credit card issuers and consumer businesses that profit off loyalty programs are making travel businesses rich, but the original goal — forming an emotional bond with the customer—has been lost, with potential long term consequences. In fact, the changes are already happening: a recent survey of traveler perception of loyalty programs by Deloitte found that just 14 percent of respondents always fly the same airline, while just eight percent always stay at the same brand of hotel.2

According to travel industry analyst Henry Harteveldt, the entire concept of loyalty marketing needs a complete overhaul. “If I were running loyalty at a travel company, I’d probably want to see how quickly can I end my current program, and how do I ‘green field’ something new that reflects the new competitive dynamic of my industry and what are my real objectives. These loyalty programs have stopped being about customer loyalty and they’ve turned into cash cows for their sponsors.” As hotel and airline loyalty programs become less important in purchase decisions, they’re simultaneously being disrupted by several changes to the industry landscape:

- Continued industry changes in how rewards programs are structured and how the rewards are earned and redeemed

- Increased transparency of program value due to technological innovation, decreasing brand competitive advantage

- Shifting preferences among travelers’ for finding, booking and taking advantage of rewards while traveling

- New and more types of traveler data that help travel businesses better respond to and personalize the travel experience before, during and after it happens.

Behind the trend

The birth of loyalty: creating the rules of the game

American Airlines didn’t set out to invent the loyalty marketing playbook when they launched the AAdvantage program in 1981, but the decision still reverberates across the industry landscape. Government deregulation of airlines in 1978 had exposed the lack of product differentiation among key players like United and TWA, leading American’s advertising agency, Doyle Dane Bernbach, to propose a marketing concept that had long been embraced by other customer-centric companies such as banks and grocery stores—the customer loyalty program.

The scheme was simple—after experimenting with few other incentive structures (special fares for loyal customers was one idea that was scrapped —they were too easily matched by competitors) American’s AAdvantage program settled on a system pegging rewards to the amount of mileage flown. The program proved an immediate success and key competitors, including United, TWA, British Airways, quickly followed suit with similarly structured programs.

The rapid customer adoption of AAdvantage and its swift duplication by airline competitors soon caught the attention of hotel marketers. Executives at Holiday Inn and Marriott launched their own hotel-focused loyalty programs in 1983. Piggy-backing off the attractive value of free travel, these hotel programs aligned themselves with airline programs, offering free plane tickets as a core selling point, along with free hotel stays and free rental cars.

While seemingly inconsequential at the time, the decision to structure loyalty rewards around the volume of product consumed rather than dollars spent had lasting consequences for a variety of woes currently plaguing not only how travelers make use of loyalty programs, but also the companies’ bottom lines. However, recent industry moves suggest the long-held dogma surrounding the miles for rewards structure may be on its way out as loyalty programs seek new opportunities innovate and drive revenue.

Credit card co-brands surge

The loyalty program surge didn’t end with airlines and hotels. Diners’ Club became the first credit card to link customer spending to travel rewards in 1985 and other banks quickly developed their own offerings. Today, almost every major hotel and airline brand has its own co-branded card and there are literally thousands of such cards on the market. According to a recent co-brand credit card report by industry researcher David Morris, “It is estimated that for every 100 people using a credit card branded with the American Express, Discover, Visa or MasterCard logo, there are 58 co-brand/affinity card users.”3

With the nearly ubiquitous nature of co-brand cards and their related loyalty partners, travelers have become more cynical (and more selective) about the perceived value of these cards, gravitating towards loyalty programs that offer the best mix of flexibility and desirable redemption awards. But playing the partner game is a tricky proposition for travel businesses as relationships come and go. “In many ways, depending on a card’s partners is a bigger risk to the consumer because you rarely get advance notice when those partnerships are changing,” notes industry observer and writer Seth Miller of travel website Wandering Aramean. In addition, many co-brand partners have designed reward systems that are difficult to understand and rigid in when and how cardholders can redeem. Because of this, many consumers are increasingly gravitating towards cards that are not only flexible but that offer simplified redemption systems.

An example of an card issuer that has thrived among more savvy point hunters is Capital One, whose co-brand reward offerings like Venture, offer a proprietary point system that can be transferred across multiple airline loyalty programs, with no blackout dates on usage and no expiration dates. Issuers like Capital One that offer high-value, high-flexibility, program agnostic rewards have put many airline and hotel loyalty offerings on the defensive.

One airline that has managed to use this massive co-brand card arms race to its advantage is Southwest Airlines. In addition to structuring their rewards program around consumer dollars spent per flight (rather than miles flown), Southwest Airlines Rapid Rewards card allows consumers to book using their points at any time with no seat restrictions or blackout dates. Travelers can earn further reward incentives by booking on Southwest.com.

While there’s no magic formula to co-brand program success, Southwest’s focus on reward flexibility and transparent reward redemption offers a model that an increasing number of industry players are likely to move towards in the future. Further, those players that are able to provide co-brand card holders with one-of-a-kind rewards, such as concierge service or access to special “experiential” events, are likely to be more successful and well-received than simple “miles for flights” or “stays for rooms” systems.

Increased transparency and mile hacking

For as long as loyalty reward programs have been in place, travelers have been creating ever-more-clever tactics to exploit them to their advantage. It wasn’t until the late 90s that the numerous “mileage hacking” tricks began to formalize via online forums like the ever-popular Flyertalk, which helps travelers share deals and loyalty program knowledge. In the last 10 years, a number of travel media sites have come into existence that focus specifically on loyalty deals. Two well-known examples are The Points Guy and Airfarewatchdog, which help consumers track and decipher the marketing double-speak behind the latest loyalty offers. While Flyertalk may not have been the first mileage running forum, it is arguably the web’s most influential community many of the websites that focus on finding and publishing loyalty program deals gain their insight and insider deal knowledge tips primarily from Flyertalk’s forums.

Types of Programs

Airlines

∙ Southwest Rapid-Rewards

∙ AAdvantageHotels

∙ Starwood Preferred Guest

∙ Kimpton InTouchCo-brand credit cards

∙ American Express JetBlue

∙ Fairmont Visa Signature CardProprietary point systems

∙ Capital One Venture

∙ Chase Sapphire

Whatever the preferred site for loyalty deals, the impact of these websites on customer perception of loyalty programs is clear. They’ve created transparency and sameness among the various loyalty offerings, leading to a degree of parity the travel brands created loyalty programs specifically to avoid. To combat the trend, some airlines are partnering with online communities like Flyertalk to build listening posts for planned loyalty program changes and float new deals, generating advance word of mouth.

KLM’s proprietary In Touch Community, for instance, was specially developed by the airline to gauge the impact of potential loyalty program changes on elite customers.4 United Airlines as well as British Airways’ Open Skies program have long-courted the Flyertalk community to gain an increased understanding of their loyalty programs’ perception among travelers, solicit advice on potential changes and test out new program rewards. Participation and response is a key component of these types of outreach efforts, as there is a high-degree of suspicion among community members. “The problem [loyalty marketers] run into…is they go from being someone who interacts with the community to someone who is simply an offshoot of the marketing department,” notes Miller.

As the increasing knowledge sharing by these communities creates transparency and parity among travel companies, marketers must take it for granted that special “insider deals” are going to be circulated much more widely than originally planned and act accordingly. There’s no such thing as a “members only” discount when it gets shared with everyone. The challenge then is to design loyalty programs that don’t simply push the latest offer to these communities, but genuinely engage the community in such a way to listen to key requests and offer one-of-a-kind rewards that are not easily replicated.

Metasearch and new digital comparison tools

Soon after Flyertalk arrived on the loyalty scene, a new type of travel search tool was coming of age: the metasearch, a hybrid search tool as demonstrated by sites like Kayak.com that “skim” the publicly available HTML price data from industry approved websites and filter/recombine it in user-friendly ways. Other digital services offer additional user-friendly features to travelers interested in booking, monitoring and optimizing their loyalty experience. For hotels, sites like Room77 give travelers micro-specific insight into the best rooms within specific properties. For loyalty program users, tools like TripIt and AwardWallet make it possible to aggregate and track most, if not all, of a customer’s frequent flier and hotel loyalty information in one place. These tools are frequently viewed as threats by loyalty program marketers: many of the airlines, including United, Delta, Southwest and American, now prevent travelers from accessing their account details within Award Wallet.5 In addition, the relentless focus on price in metasearch rankings strips away many details used by airlines to inspire loyalty in the first place —details such as which planes have in-flight Wi-Fi, along with amenities like optional legroom and new aircraft are typically left out of search results.

While metasearch may have leveled the playing field for price, loyalty marketers should investigate the work of newer metasearch players like Routehappy and Hipmunk that are helping integrate key details about the flight experience back into consumer searches. Rather than simply ranking itineraries based on price alone, Hipmunk lets users filter their flight search criteria by key factors like “level of agony,” and Routehappy helps searchers find planes using factors like Wi-Fi service and additional legroom.6 Although getting a traveler to book on a company website remains the ultimate objective from a loyalty perspective, partnering and/or promoting these types of amenity-focused metasearch tools as superior alternatives is a good option to reinforce the value of loyalty to more sophisticated travelers.

Another opportunity for loyalty marketers takes the traditional saying, “If you can’t beat them, join them” to heart. Considering the transparency caused by these tools is not likely to disappear, travel companies would be wise to develop strategies to take metasearch and comparison shopping into account in their pricing, booking and differentiation strategies. Taking a page from the auto insurance industry, where companies like Progressive Insurance share price quotes for competitors along with their own insurance prices, one potential approach would be to embrace this transparency by showing competitive prices, loyalty program benefits and room availability on official booking websites. While this may seem counter-intuitive, this transparent approach could benefit a travel company with a strongly differentiated product offering by creating a perception they are more customer-friendly.

Devaluation hits the industry

Perhaps the clearest sign that loyalty programs are not sustainable as they are currently structured is the trend of loyalty award devaluation. In February 2014, both Delta and United announced plans to increase the number of miles needed to upgrade to business class on longer flights. American and US Airways, likely preoccupied with their current merger, seem likely to follow suit. In the hotel realm, most of the major chains, including Starwood, Hilton, Marriott, have announced similar increases in the number of points need to redeem for free hotel stays and upgrades.7 In other words, as rewards become easier than ever to earn, they’re also becoming harder and more expensive to use.

As their loyalty points become worth less, programs will need to adapt to offer travelers more unique benefits and more personalized experiences in order to keep travelers engaged.8 A great example of a company working to offer unique, personalized benefits is Kimpton Hotel’s InTouch program, which offers free Wi-Fi, on-site guest recognition and member-only events as a way to distinguish the program from others. Similarly, IHG’s Rewards Club offers loyalty members a dedicated concierge service as well as merchandise catalog where points can be redeemed for a variety non-travel related goods. Wyndham Hotels Group follows a loyalty redemption structure similar to IHG, allowing members to cash in points for gift cards and other rewards after as little participation as a single night’s stay. While many reward redemptions cost more than ever, many travel brands like Starwood are winning praise simply by being more transparent.

“Starwood does a pretty good job when they release their updated charts of mentioning these are the properties where the award cost went down” notes Seth Miller. While none of these offerings may be the silver bullet, travel companies who are able to offer members unique benefits beyond the typical “points for flights/rooms” paradigm are likely to vault ahead of the competition. At many boutique hotels for instance, this takes the form of insider-access to hotel amenities. A recent study for the Cornell University School of Hospitality Management found that independent hotels have loyalty program success rates high above average9, with the number of annual room-nights for hotel guests enrolled in the hotels’ loyalty programs increasing by as many as 50 percent annually. The key for hotel and airlines is identifying these points of difference with their competitors and integrating them in an enticing way in loyalty offerings.

The rise of online influence and loyalty consequences

Loyalty programs have long focused on tiered levels of status for customers. Whereas this system was traditionally based upon the number of miles flown or nights stayed, social media has created a new of layer of data for travel marketers to use in evaluating and servicing their most valuable (and vocal) customers. As travelers take to Twitter and Facebook to complain (and praise) travel companies for their customer experience, marketers are finding power in building stronger relationships with social media users to encourage sharing of branded content and offer assistance when the travel experience goes awry. Travel companies that successfully use travelers’ social media profiles in a responsible way also gain the added benefit of further personalizing in their loyalty program offering.

One of best-known examples of how online influence has impacted travel industry loyalty programs is the social media measurement service called Klout. Klout gathers a social media user’s various profiles, assigning an aggregate score based upon various factors such as the user’s level of social media activity, total followers and the degree to which content they share is picked up by other users. Several airlines have partnered with Klout to offer special perks to influential social media users.

Virgin America used Klout to award free seats to social media users on its inaugural flight from Los Angeles to Toronto.10 Las Vegas hotels like The Palms have experimented with Klout to decide which hotel guests receive additional perks and freebies during their visit.11 Airlines including American Airlines and Cathay Pacific have offered one-time elite airport lounge access for Klout users whose scores exceed a specific threshold.12 Despite the positive buzz, critics of Klout-focused programs complain that there is no established link between those with online influence and the high-spending customers loyalty programs were designed to court. Travel marketers need to keep their loyalty business goals in mind when considering initiatives like Klout. Whether the objective is building emotional connections, building awareness or driving more sales, social media can be an effective loyalty tool as long as these goals are well-established at the outset.

Another way travel brands are using social media is to personalize their loyalty offerings using the vast wealth of public data consumers already share online. A 2010 campaign by KLM called “Surprise” used traveler check-ins at Amsterdam’s Schipol airport on Foursquare to deliver real-life gifts to customers.13 Travel industry analyst Henry Harteveldt also cites Delta for doing a good job with personalization, noting “they now have a space in your profile on Delta.com where if you want you can enter your Twitter handle [which] gives them a way to…reach out if there’s an operational problem. Frankly, that’s where an airline can earn its customers’ loyalty, by sending a proactive message [when things go wrong]…” Some travel companies like British Airways, however, may have taken social media personalization too far. The news in 2012 that the airline had pulled Google Images of top elite fliers to better recognize them at the airport sparked a furor among privacy advocates.14 Another particularly egregious incident involved the hotel staff at the Westin in Edina, Minnesota, which used the Linkedin profiles of guests booking corporate rates to confirm their eligibility for discounts.15

Whatever the tactic, the opportunity to increase personalization and exceed traveler expectations using social media is there if travel companies use it wisely. Given the increasing industry-wide parity and online transparency in loyalty program perks, it is exactly this type of personalization and “surprise and delight” via social that offers savvy marketers the chance to truly differentiate their loyalty offerings. Yet the tactic is not without its pitfalls—marketers would be wise to clearly outline when and why their company will use social data to personalize and ensure there are ample opportunities for travelers to opt-out if they don’t wish to participate. Still, companies that can put in place nimble systems and a CRM strategy to utilize social data stand to benefit greatly in the loyalty landscape of the coming years.

Experiential loyalty marketing

While it’s no secret that a loyalty program is a “must-have” for any travel business, the prevailing mentality is that these programs must focus on boosting revenue by driving repeat customers. Yet as the industry trade publication Hotel Business Review has noted, “…this focus on revenue, however, [has] lost focus of the real purpose of loyalty programs: creating a meaningful, interactive dialogue that helps build and maintain strong brand/customer relationships.”16

A growing indicator that many travel marketers are re-thinking the purpose of their loyalty programs is the growing shift towards awards built around “experiential rewards,” a category of experience-focused redemptions that give insider access to “once-in-a-lifetime” events and travel activities. Examples of these type of rewards include offers like tickets to marquee events like Fashion Week or the Super Bowl, 1:1 meet and greets with celebrities and destination-specific experiences led by local experts.

A good example of this new experiential loyalty trend is the program by the Global Hotel Alliance (GHA), a worldwide alliance of independent luxury hotels. Hotel Business Review mentions GHA’s Discovery Program is “…not a points-based program, but rather an innovative one that rewards travelers with “Local Experiences” that have been designed by local experts offering members access to a large selection of adventures, exclusive experiences and off-the-beaten path activities that are not easily available or accessible to the general public.”17 Example rewards in this category include a full-day boutique shopping experience in São Paulo with a personal shopper, night-fishing with local boatmen in Portugal or private lessons with a Tai Chi master in China. The program has proven a business success for GHA. After the first 9 months of the Discovery program, GHA recorded over 1.6 Million new loyalty program signups and over $300 Million in net room revenue. GHA is not alone in this “experiential” approach to loyalty rewards—other hotel chains like Ritz Carlton’s Rewards and Hilton’s HHonors Program are taking a similar approach.18

Similar to the changes happening in loyalty marketing with online-influence and social media, travel marketers need to evolve their loyalty programs so they are positioned as opportunities to build stronger relationships with customers, not simply as transaction opportunities to give away freebies. The more loyalty members feel that a program’s rewards are personalized and offer unique experiences, the more likely they are to repay the brand with future business.

Smartphones, data and loyalty

The proliferation of powerful smartphones is not only changing the way travelers search, discover and book their trips, it also represents an untapped opportunity for travel loyalty programs to gather key insights on traveler preferences and use that info to better personalize the travel experience. Traditionally, loyalty programs were designed to track customer participation at the time of purchase (during booking you enter your frequent flier or hotel rewards number) and at the start of travel (when you scan your boarding pass or check-in). Travelers engage with mobile in real-time during travel offering an entirely new layer of activity data that can be tracked and used to better personalize that experience.

The savviest loyalty marketers in the travel space are using the highly personal nature of mobile to help bring a new level of customization to loyalty offerings. A great example of a brand that uses mobile to better personalize the traveler experience is Starwood, whose iOS app uses the smartphone user’s location to personalize local weather, hotel information and local activities.19 Mobile offers further opportunities to simplify and improve the travel experience. Starwood’s Aloft brand recently announced that customers could use their mobile app as a room key at 14 select U.S. properties, with plans to expand the program in the future.20

Yet as analyst Henry Harteveldt notes, a huge opportunity remains for travel brands to better use mobile to build loyalty with customers, noting only a tiny portion of travel companies “…are taking advantage of their customers’ mobile phones…travelers are very open to receiving text alerts of offers or discounts or information from a travel company while they’re in the destination.” It’s easy to see how travel brands could increase loyalty program value and member signups simply by adding these types of convenience boosting features to their mobile products in the future.

Another area of keen interest for travel companies is mobile booking. Although many travelers still don’t use mobile as the primary channel for purchasing hotels and flights, there are signs that frequent business travelers are increasingly using mobile as a quick-booking channel. Choice Hotels has recognized this trend in the RapidBook feature integrated with their mobile app, allowing frequent travelers to store hotel booking preferences and payment information for quick access.21

While Starwood and Choice Hotels have been able to add significant value and personalization to their loyalty experience via mobile, building custom branded apps is not always necessary. Contrary to the industry consensus, tying loyalty to a branded mobile app experience can be a costly (and often unnecessary) approach. As a recent report on mobile apps by Tripadvisor revealed, the sky-high development and marketing costs associated with mobile apps is often unnecessary, especially for a customer experience that can happen via a mobile-optimized website.22 Despite the huge potential of mobile to increase the value of loyalty offerings, travel companies need to be smart in approaching the channel not simply as the “next great thing.” Instead travel companies would be wise to design mobile loyalty tools so that they help personalize and simplify the travel experience for their most valuable customers.

Digital case studies

Kimpton InTouch Rewards

Shirley King, an associate at Kimpton’s San Francisco-based Hotel Palomar, was looking for a way to help the property better track and recognize frequent guests. Her creation of a series of index cards, populated with guest details like birthdays and preferences like favorite candy bars, might not seem like the beginnings of one of the hotel industry’s best known loyalty programs, but it was this simple commitment to personalized, simple to memorize guest details that has remained core to Kimpton’s award-winning InTouch loyalty strategy to this day.

From the beginning, the Kimpton marketing team has acknowledged that offering a points-based reward program was a race to the bottom. Rather than trying to compete on a points system, Kimpton has built InTouch around the concept of simple personal touches tailored to each customer, along with small, easy-to-earn “perks” as key points of differentiation.23

The strategy plays out in several ways: at the base level, anyone who joins InTouch gets immediate access to free Wi-Fi, a chance to “raid the minibar” in their room and a $30 spa credit. Other perks include a free snack upon arrival, complimentary room upgrades when possible and a VIP reservation line. Furthermore, Kimpton uses InTouch as an opportunity to satisfy to the needs of specific traveler segments like female business travelers.

Kimpton’s decision to offer upscale versions of amenities frequently requested by women such as hair-dryers and nail-polish remover has been so successful that the practice has been adopted across the chain’s 60 hotel properties. Mike Depatie, CEO of Kimpton acknowledges the hotel’s personalized offerings for women, noting “You’ve got a fairly male-dominated industry: it’s amazing how we forget some of the things that are important to women.”24

Perhaps more interesting, the strategy has resulted in plenty of industry-wide accolades. According to a recent article by Retail Wire, Kimpton has the best customer satisfaction scores (+93 percent) and emotional attachment scores (+89 percent) of any hotel company operating in the U.S. Retail Wire points out that the secret to these impressive customer perception rankings is Kimpton’s ability to focus on “providing care and comfort for guests, rather than viewing them on a transactional basis.25 Kimpton zeroes in on “little data” and singular experiences, using data to inform strategies, while giving associates the power to get creative in connecting with guests.” These types of tactics may seem counter-intuitive at first —they do not immediately improve the bottom line and require the creation of a company culture that empowers employees to put guests first. But as the Kimpton executive team and customer surveys confirm, their loyalty strategy is focused on long-term results.

KLM Surprise

KLM Airlines isn’t a brand traditionally known for social media savvy. But in 2010, marketing executives at the airline knew they needed to be more active in social and were looking for opportunities to form more personal connections with travelers. Realizing that travelers spend massive amounts of time on their mobile devices (tablets, smartphones and laptops) in flight departure lounges, they created a special social media campaign to engage customers, build awareness and strengthen traveler loyalty with the KLM brand. It was the inception for a campaign called KLM Surprise.26

The program involved some simple digital legwork by the KLM team. After reviewing social channels including Twitter mentions of KLM and Foursquare check-ins at Amsterdam’s Schipol aiport, the team did some sleuthing of public social info connected to the users’ profiles to discover their interests, locate them in-person at the airport and deliver a customized surprise. As an example, a woman flying KLM to Rome listed she was a passionate runner in her Twitter profile, so the KLM team brought her a surprise Nike running watch to help her track miles during her trip. Not only did the unexpected gesture earn plenty of social media buzz, the video of the program on YouTube has been viewed over 340,000 times and re-shared by many more.

KLM Surprise not only provided the immediate “surprise and delight” factor so often missing from more transactional loyalty programs, it also resulted in meaningful new digital connections for the KLM brand, garnering 1,000,000 Twitter impressions and plenty of online media coverage. Most importantly in the context of loyalty, KLM reported over 5,000 new fans on its Facebook presence immediately following the stunt.27

Strategies to increase the value of loyalty offerings

Creating and sustaining meaningful relationships with travelers is no easy task. But with a variety of industry trends, from technology to loyalty program changes, conspiring to put continued downward pressure on loyalty program points and rewards, it’s the only clear path to success. In examining the trends reviewed in this article, we recommend anyone involved in managing or creating a travel industry loyalty program consider the following tactics:

- Personalize your offering — use the wealth of customer data available from social and mobile, combined with a strong digital strategy, to personalize loyalty offerings for all customers, from frequent travelers down to the “newbies.” This includes everything from using the location data of a customer’s smartphone to understanding the topics they care about in social media to better integrating their social media profiles into existing loyalty database information. Best-in-class personalization should also allow consumers to opt-in to this tracking (rather than opt-out) and should be clear about how and when it might be used, as unprompted tracking of traveler behavior may be perceived by many as unwanted.

- Be transparent — the “points for rewards” paradigm will never completely disappear, but travel brands must strive to distinguish their offerings from a slew of similarly structured loyalty programs. A range of online tools, from metasearches, to point tracking apps to mileage communities already reinforce the relative sameness of most rewards programs. Rather than fighting this trend, use that relative uniformity to differentiate via transparency. A key first step in differentiation is clear communication to members and a straightforward system to accrue and use points. To accomplish this, travel businesses should strive to make redemptions as easy to understand and transparent as possible. It shouldn’t require a guidebook to figure out how to redeem them.

- Make rewards attainable — High-end rewards are great, but don’t forget to make all travelers feel like they can earn something of value after just a few flights or hotel stays. This doesn’t always need to be a free room or flight —consider new types of rewards and new opportunities for travelers to redeem them.

- Surprise and delight — perhaps the best way to avoid the parity caused by “points for rewards” is avoid it altogether. Consider unexpected ways to deliver personalized rewards and one-of-a-kind experiences that can’t be bought. Experiential rewards are certainly enticing for some groups of consumers, but not everyone is willing or interested in spending the time to accrue the necessary points. In keeping with the trend towards attainable and personalized rewards, think about how to provide entry-level reward surprises to first-time customers.

Further Reading

- http://www.colloquy.com/press_release_view.asp?xd=95

- http://skift.com/2013/01/23/the-inexorable-decline-of-loyalty-in-travel/

- http://cdn2.hubspot.net/hub/209482/file-279056053-pdf/docs/White+Papers/Widening_the_Net_Co-Brand_Credit_Car d_Growth_Opportunities.pdf

- http://www.communispace.com/uploadedfiles/clients_section/clients/case_studies/casestudy_klm_expandedinfluence.pdf

- http://thepointsguy.com/2012/12/united-blocks-awardwallet-access-to-mileage-accounts/

- http://www.eyefortravel.com/revenue-and-data-management/when-big-data-meets-flight-meta-search-it%E2%80%99s-happy-routing-passengers

- http://thepointsguy.com/2013/02/the-state-of-hotel-loyalty-programs-a-devaluation-story/

- http://www.hotelnewsnow.com/Article/11029

- http://www.hotelschool.cornell.edu/research/chr/pubs/reports/abstract-17604.html

- http://www.tnooz.com/article/virgin-america-partners-with-klout-to-influence-social-media-influencers/

- http://adage.com/article/digitalnext/marketing-las-vegas-palms-hotel-klout-scores/146189/

- http://www.psfk.com/2013/05/klout-score-american-airlines-vip.html

- http://thenextweb.com/socialmedia/2010/11/12/royal-dutch-airline-gives-passengers-a-surprise/

- http://techcrunch.com/2012/07/05/british-airways-borders-on-creepy-with-know-me-google-identity-check/

- http://thepointsguy.com/2012/05/are-hotels-taking-social-media-too-far/

- http://hotelexecutive.com/business_review/2812/why-guest-programs-dont-work-and-how-to-make-them-better

- http://hotelexecutive.com/business_review/2812/why-guest-programs-dont-work-and-how-to-make-them-better

- http://www.travelandleisure.com/articles/hottest-hotel-loyalty-programs

- http://www.forbes.com/sites/traceygreenstein/2012/03/27/the-newest-travel-must-have-starwoods-spg-app/

- http://skift.com/2014/01/27/smartphones-to-replace-room-keys-at-some-starwood-hotels/

- http://www.hotelnewsnow.com/Article/11179/Technology-helps-drive-loyalty-programS

- http://skift.com/2013/05/11/tripadvisor-advises-against-mobile-apps-for-its-hotel-customers/

- http://www.hotelnewsnow.com/Article/11030

- http://marketresearch.about.com/od/market.research.segmentation/fl/Refining-Consumer-Profiles-for-Maximum-Relevance.htm

- http://www.retailwire.com/discussion/16662/is-little-data-the-key-to-making-loyalty-programs-work

- http://www.youtube.com/watch?v=pqHWAE8GDEk

- http://stuffworthsharing.com/klm-surprise/