Report Overview

There is perhaps no bigger trend in the travel industry today than wellness. Given the wellness boom outside of the travel industry, it only makes sense that it would eventually become a hot topic within it as well. Even though it’s gained new found attention, wellness has long been a key motivator for travel and an important part of the travel experience. Today, however, wellness travel is manifesting in new and different ways than in the past, driven by the demands of increasingly well-being minded travelers.

In this report, we focus on addressing four questions about wellness tourism: How big and important is the wellness tourism market? What are the trends that define the new era of wellness travel? What sectors are impacted by wellness tourism? What are the best practices for various stakeholders looking to attract consumers with wellness in mind?

We attempt to answer these questions drawing from Skift Research’s proprietary survey data, third-party data, and a number of in-depth interviews with industry stakeholders and experts. Using these perspectives, we synthesize five components that make up the new definition of wellness tourism, and end the report by laying out nine best practices for wellness tourism stakeholders.

What You'll Learn From This Report

- What wellness tourism means today and how it has evolved over time

- Who wellness tourists are, how they behave, and what they prefer

- How to categorize wellness tourists based on their wellness-oriented travel motivations

- Who the stakeholders are in wellness tourism and how potential stakeholders can play a role

- The size of the wellness tourism market

- The kinds of wellness travel experiences tourists are interested in

- A five-part breakdown of the new definition of wellness tourism

- Nine best practices for wellness tourism stakeholders

Executives Interviewed

- Aleena Abrahamian - Head of Strategic Partnerships, Calm

- Anna Bjurstam - Wellness Pioneer, Six Senses

- Anne Dimon - President, Wellness Tourism Association and Founder/Editor, TravelToWellness.com

- Beth McGroarty - Director of Research and PR, Global Wellness Institute

- Betty Wong - Divisional Vice President, Inflight Services and Design, Singapore Airlines

- Brian Badura - Director of Global Public Relations & Strategic Initiatives, Seabourn

- Brian Povinelli - SVP, Global Brand Leader for Westin, Le Méridien, Renaissance, Autograph, Tribute, & Design Hotels

- Cassandra Bianco - Founder of WELLBEINGS and Global Wellness Consultant for Selina

- Emlyn Brown - VP of Well-Being, Accor, Luxury & Premium Brands

- Mia Kyricos - SVP, Global Head of Wellbeing, Hyatt

- Phil Auerbach - Chief Commercial Officer, Lindblad Expeditions

- Vivienne Tang - Founder & Editor-In-Chief, Destination Deluxe

Wellness Tourism Demystified and Defined

Terminology

When it comes to wellness in travel, there are a few terms that are commonly used, and while they may seem self-explanatory, their definitions have subtle nuances that are important to bear in mind. Those who work within the industry are especially likely to use these terms, and even they might define them slightly differently from one another.

- Wellness vs. Well-being (sometimes written as “wellbeing” or “well being”): These terms are often used interchangeably, but some stakeholders claim there is an important difference in their meanings. Emlyn Brown, VP of Well-Being at Accor, and Mia Kyricos, SVP of Wellbeing at Hyatt, fall into this group. For both, “wellness” is more active, made up of the specific activities one does to take care of themselves, while well-being is the result of those activities.According to Kyricos, “At Hyatt, we see … well-being as a destination, that place you’re always trying to get to but don’t get to stay for long.”

- Wellness travel: The Global Wellness Institute (GWI) and the Wellness Tourism Association (WTA), both authorities in this area, offer similar definitions of this term. We use these definitions as a foundation, but will later add more nuance to the term, including how it may differ for various segments of the travel industry.

- The GWI definition: “Travel associated with the pursuit of maintaining or enhancing one’s personal wellbeing.”

- The WTA definition: “Travel that allows the traveler to maintain, enhance or kick-start a healthy lifestyle, and support or increase one’s sense of wellbeing.”

- Wellness tourism: Often used interchangeably with “wellness travel.” The only difference between the two terms has to do with the context in which they are used. As Beth McGroarty, director of research and PR for GWI explained, wellness tourism, “is just more of an industry term that refers to the category as a travel segment. Wellness travel is what people do.”

- The WTA defines wellness tourism in a similarly industry-facing context: “A specific division of the global tourism industry that is defined by the common goal of marketing natural assets and activities primarily focused on serving the wellness-minded consumer and those who want to be.”

- In this report, because we are speaking within and to the travel industry, we will be using these terms interchangeably.

- Medical tourism: This type of tourism involves people who travel to a different place to receive treatments for a disease or condition that is either offered more affordably or at a higher quality than is available to them at home. It also includes international travel for cosmetic procedures.Even though they are both spurred by personal well-being and they may overlap to a small extent, medical tourism and wellness tourism lay in different spheres. While wellness tourism tends to focus on maintaining or improving well-being and is more preventive or proactive, medical tourism tends to be more reactive. Some argue that medical tourism is broader than how we have defined it here, and there will likely be more overlap between these categories as wellness becomes more high tech and utilizes tests and technology that were once reserved for the medical world, and medical tourism incorporates more general wellness components. For now, however, it is important that travel brands and destinations understand the distinction between the two. Medical tourism, while lucrative in its own right, heavily relies on government policy. It can also be controversial, and at times, dangerous. For these reasons, this report focuses only on wellness travel.

Scope

So what really counts as wellness travel? This can be difficult to pinpoint. Clearly, based on the definitions given above, the umbrella of wellness travel is quite broad. It seems like almost any travel experience that isn’t completely gluttonous or debaucherous could fall under it. To an extent, this is true. To understand the different scopes of wellness travel, it is often necessary to understand the intent of the traveler. McGroarty of GWI emphasized this: “I think the intention is what makes the term operant, which is, ‘What I want to achieve from this has to do with some kind of either full transformation in my health or I just want to come back feeling better.’”

Anne Dimon, president of the WTA, echoed the subjective, personal nature of defining what wellness travel really is:

“This gets complicated. By our definition Wellness Travel ‘allows the traveler to maintain, enhance or kick-start a healthy lifestyle.’ So the ‘maintain’ allows a traditional vacation to fall under the umbrella of wellness travel. Take someone who lives a healthy lifestyle but whose prime goal of the vacation is just to be with family, but they still want to ‘maintain’ their healthy habits … Travel for business or pleasure, can also apply to the ‘enhance’ part of the definition, as can taking a trip with the specific intention of bettering one’s health.”

She explained that even the same activity may be a “wellness activity” for one traveler, but something else to another: “Hiking for one traveler may be an adventure, for another it’s just a fitness activity … And, while ‘hiking’ and ‘kayaking’ can be classed as ‘adventure’ they can also be classed as ‘fitness activities.’ It’s just depends on who is doing the classifying.”

Since it can be difficult to know a traveler’s intention, wellness travel is typically broken into two main categories to make it easier to understand and classify types of trips or experiences. These categories are primary wellness travel and secondary wellness travel. As the terms suggest, primary wellness travel is travel that is motivated mostly or entirely by wellness, while secondary wellness travel incorporates aspects of wellness, but it is not the main purpose of the trip.

Each of the above is a valid way to describe wellness travel. Even when breaking it into these smaller categories, it still encompasses a huge amount of activity types, many of which are common parts of most people’s travels. Wellness itself is incredibly multifaceted today. It’s more than just about physical health. It also encompasses mental wellness, social wellness, and the wellness of the community. Adding that to the intentionality part of the equation, and it all makes wellness travel a difficult segment of the travel industry to picture in a quantifiable way. We will present some data to quantify these different scopes of tourism a bit later.

Stakeholders

Wellness tourism is often discussed in the context of the hospitality sector, whether it’s hotels, resorts, or wellness retreat providers. It is also commonly associated with luxury travel. This report, however, will emphasize that there are a variety of stakeholders that can find a place in the wellness tourism space. It’s simply a matter of determining what kind of wellness experiences customers want, or expect, different travel brands to offer.

For example, a tour provider can appeal to primary wellness travelers through a wellness-focused tour offering. An airline or airport, on the other hand, should seek to incorporate wellness in less direct ways, like by offering nutritious food, facilitating opportunities for physical activity, or even by taking effort to curb jet lag through lighting that can help travelers adjust to time changes (known as circadian lighting).

This report will help build a more detailed picture of what wellness tourism is today, including how different types of travel brands can play a role and meet the needs of an increasingly well-being focused traveler. As you will see throughout the report, “wellness” is not new, and neither is “wellness travel.” The way they are understood and manifest today, however, is quite different from 10 or 20 years ago. These concepts continue to evolve along with consumer demands and advancements in science. Later in this report, we will examine more specifically what defines wellness tourism today. First, we will take a look at the current state of wellness tourism for context.

The State of Wellness Tourism Today

Sizing the Market

As mentioned earlier, there are a number of factors that make it difficult to accurately size the overall “wellness tourism” market. If a traveler utilizes the fitness center at the hotel, does that make them a wellness traveler? Or if they make an effort to select healthy menu items? Should travelers who make choices like this be counted among those who go on week-long wellness retreats?

In this section, we will provide data — both our own and from other sources — that will help give an idea of the size of the wellness travel market.

Any discussion about the size of the wellness tourism segment needs to include the estimations by the Global Wellness Institute (GWI). GWI published its first Global Wellness Tourism Economy report in 2013, and an updated version in 2018. This most recent version estimates that wellness tourism was a $639 billion global market in 2017. The report claims that this segment showed an annualized growth rate of 6.5% between 2015 and 2017, more than double that of general tourism in that time period. To put this another way, travelers around the world made 830 million wellness trips in 2017, which was 139 million more than in 2015.

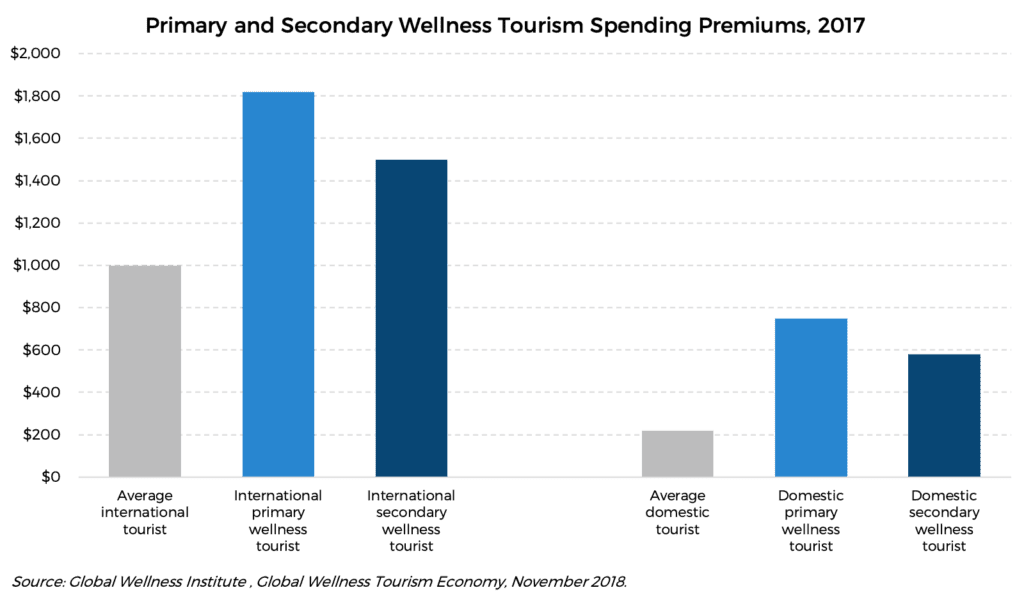

In addition to this overall sizing estimation, GWI also provides estimations for trip expenditures per traveler for wellness travelers and non-wellness travelers. With these estimations, it claims that international wellness travelers spent an average of $1,528 per trip in 2017, which is 53% more than typical, non-wellness, international tourists spent per trip that year. Domestic wellness tourists spent less per trip overall in 2017, at $609 average, but according to GWI, this is 178% more than the non-wellness, domestic tourists that year.

It’s important to note, however, that these estimates include both primary and secondary wellness trips, and so they size the segment with the broadest scope of it in mind. Trips taken by travelers who prioritize healthy eating, utilize the hotel gym, or book a spa treatment are taken into account, for example. And according to GWI, secondary wellness travelers accounted for 89% of all wellness trips in 2017 and 86% of expenditures. Further, when it comes to spending, purchases of wellness-based activities are considered, as well as “generic” spending on things like all the transportation, food, lodging, and buying souvenirs that is involved in a trip.

The GWI’s sizing estimates are helpful in showing how large the overall wellness travel segment may be and how it is growing, but it’s necessary to keep its broad scope in mind when interpreting the overall size of the wellness tourism opportunity.

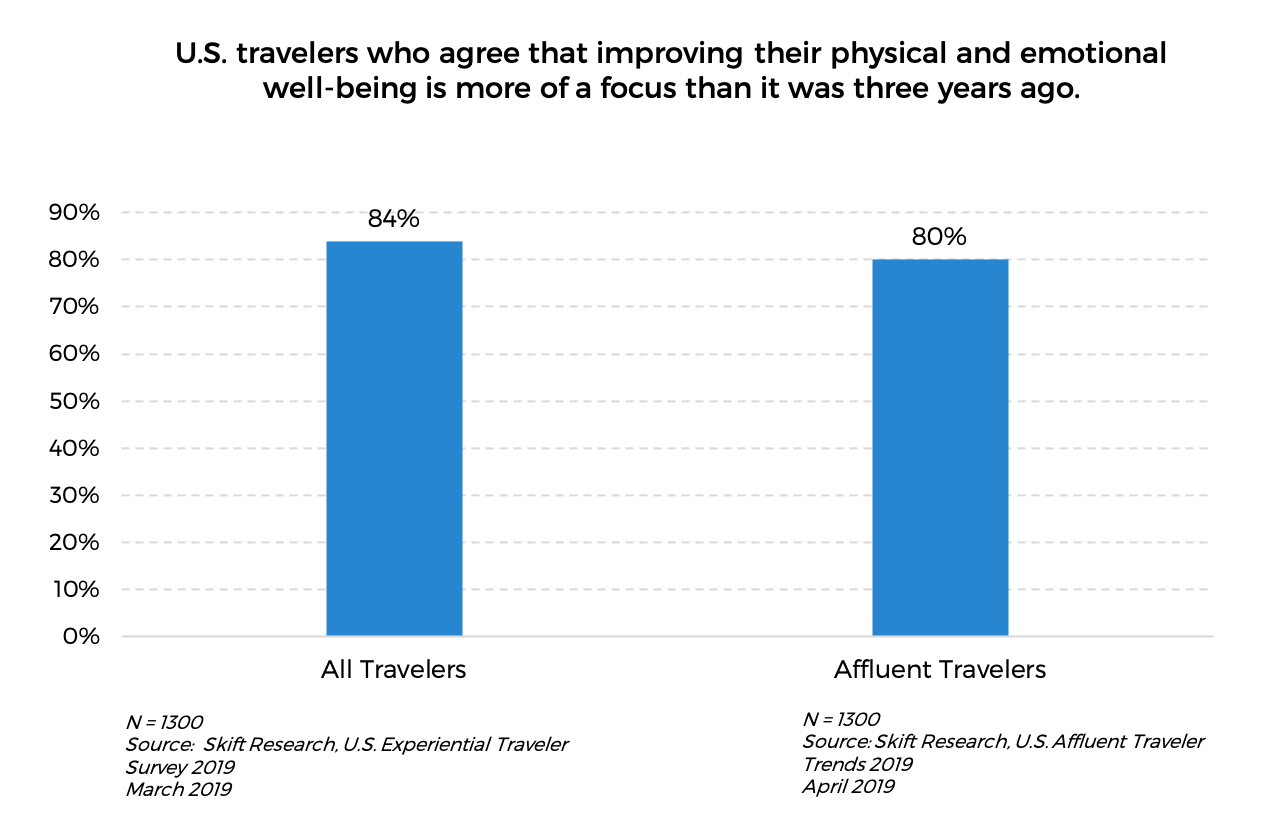

We looked at some data from Skift Research traveler surveys to help estimate the size of the wellness tourism segment in different ways. Following the broad definition used by the GWI, we looked at the proportion of travelers who are broadly interested in improving their well-being, who, we would argue, are highly likely to engage in secondary wellness tourism, if not primary at some point as well.

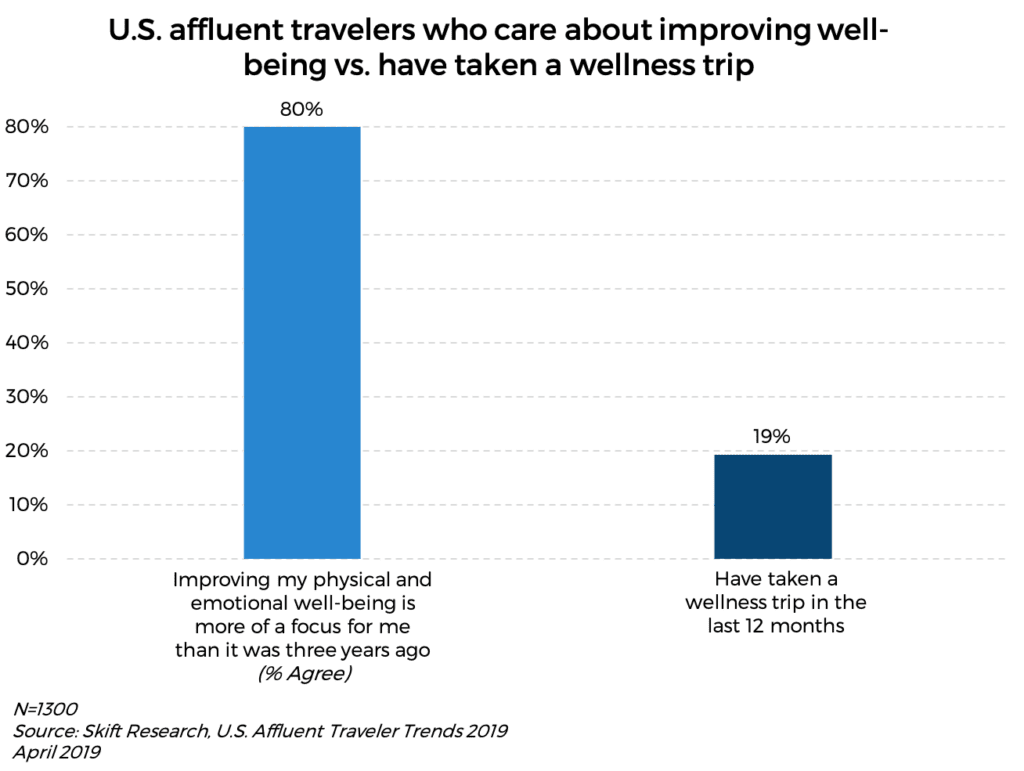

Two of our recent surveys of U.S. travelers allow us to see the size of the segment when defined in this way. Among respondents of our U.S. Experiential Traveler Survey 2019, who had gone on a leisure trip in the last year, 84% reported that improving their physical and emotional well-being is more of a focus than it was three years ago. A similarly large proportion of high-income travelers (with combined household incomes of $100,000 or more) who were surveyed for our U.S. Affluent Traveler Survey 2019 reported the same, with 80% in agreement.

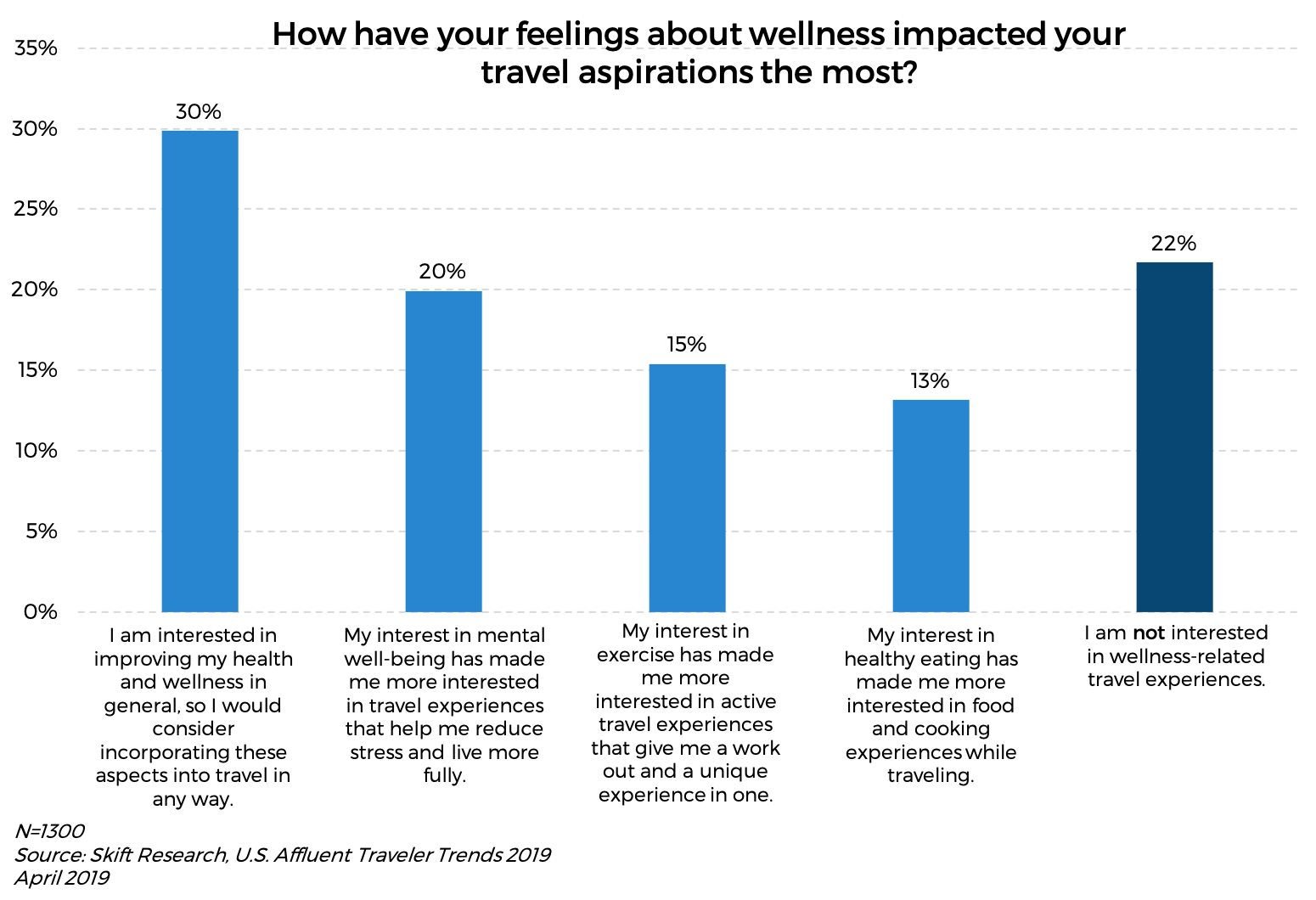

We see a similarly high majority of U.S. affluent travelers who reported that they are interested in incorporating wellness into their travels in some way. Only 22% said they are not interested in wellness-related travel experiences.

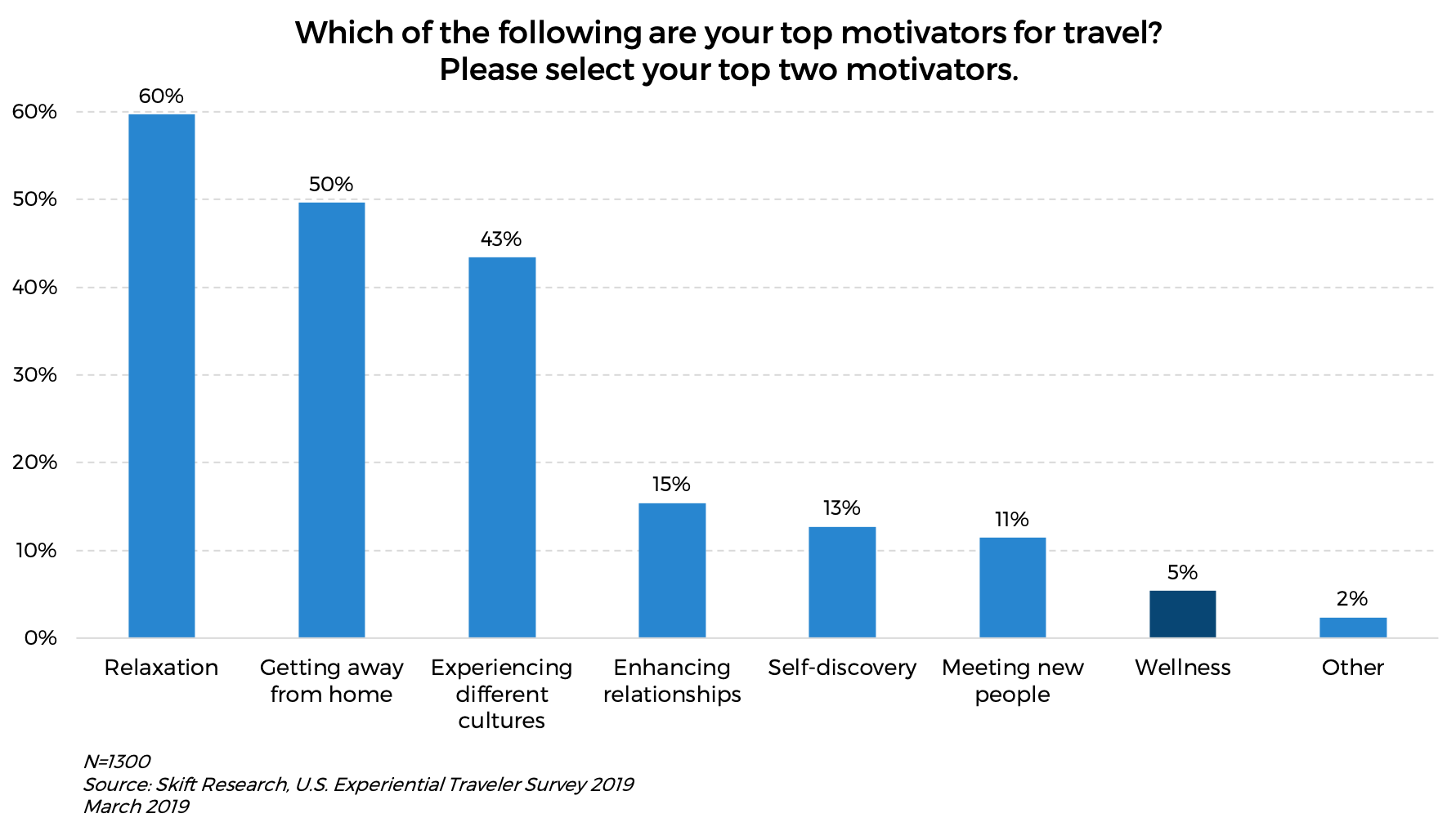

Next, we narrowed our scope down to primary wellness travel. Despite the large majority of respondents who reported that they are more focused on improving their physical and emotional well-being than they were three years ago, our U.S. Experiential Traveler Survey 2019 also showed that this mindset is not a huge motivator for travel for most travelers. When asked to select their top two motivators to travel, wellness was selected by only 5% of respondents.

These travelers might not identify wellness as a key motivator for their travels, however, many of the motivators that they are more likely to identify are strongly related to wellness. Relaxation, experiencing different cultures, enhancing relationships, self-discovery, and meeting new people can all be vital to mental, social, and community wellness, which many experts would argue are key pillars of holistic well-being. This is another place where the intentionality aspect of the definition of wellness tourism makes the broad scope definition difficult to quantify.

The most straightforward and quantifiable scope of wellness tourism is primary wellness tourism, or trips that are motivated mostly or entirely by wellness. Yoga, meditation, or spa retreats are clear examples of this type of wellness tourism. While 80% of respondents to our U.S. Affluent Traveler Trends 2019 survey are likely secondary wellness tourists, just 19% reported that they have gone on a primary wellness trip in the last year. This might be a small subsection of the total pool of potential wellness travelers, but one out of five respondents reporting primary wellness trips in the past year is not an insignificant amount.

Consumer Demand for Wellness and Travel Combine to Fuel Wellness Tourism Growth

Equally important to the current size of the wellness tourism sector is its growth, and all signs indicate that this is a quickly growing sector that is poised to continue that trajectory. There are a number of factors that are driving the growth of wellness travel globally. At the most macro level, the expansion of the global middle class has given individuals the means to not only take leisure trips, but also to invest in their personal well-being.

There is also a clear trend of an increased consumer desire for wellness-related services and activities overall. This likely stems from an increased awareness of the negative health impacts of the largely sedentary, always-on lifestyles that have permeated developed countries, including chronic physical and mental health issues. As a result, the proactive, preventive mindset is becoming more common, especially among younger generations. There are a few ways this trend is being observed:

- According to research by the International Health, Racquet & Sportsclub Association (IHRSA), membership in boutique fitness studios in the U.S. increased 121% from 2012 to 2015, and gym memberships increased 18% in that period.

- A study by the Centers for Disease Control found that participation rates in yoga and meditation among U.S. adults has been steadily increasing. While just 9.5% of those 18 and over participated in yoga in 2012, 14.3% reported doing so in 2017. Meditation saw an even greater jump in participation during this period, rising from 4.1% to 14.2%.

- Estimates by Technavio predict that the global spa market will have a compound annual growth rate of almost 6% by 2023.

Aside from these wellness-specific trends that are contributing to the growth of wellness travel, there are also travel trends that are playing a role. The continuing popularity of experiential travel, which has been on the minds of travel industry players for years now, plays into the growing interest in wellness-based travel experiences. More specifically, the rise of wellness travel coincides with the rise of transformative travel, which Skift wrote about in 2018 as the evolutionary successor of experiential travel. In transformative travel, the value of a travel experience is beyond the experience itself, and instead “lies in the transformational value of the experience and how it helps travelers become the person they aspire to be.”

On a more specific level, wellness tourism’s popularity is also closely connected with the rise of adventure travel. According to a 2018 survey by Travel Leaders Group and the Adventure Travel Trade Association, 86% of travel agents who sell leisure travel reported that they’ve witnessed growth in adventure travel sales during the previous three years.

Given all of these emerging and intermingling trends, it makes sense that wellness tourism is having such a moment in the spotlight right now, and it doesn’t seem like it will be going away anytime soon. Forecasts by GWI estimate that wellness tourism overall will grow an average of 7.5% per year through 2022, putting it ahead of the estimated growth rate of 6.4% for global tourism in general.

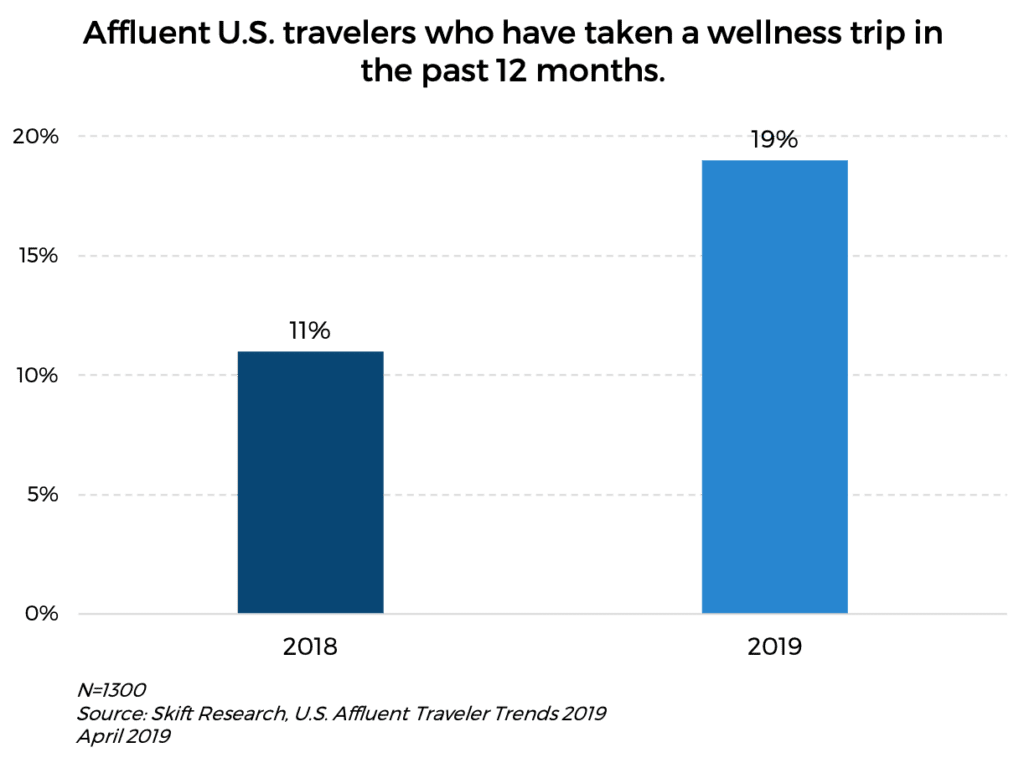

Our own Skift Research survey data reveals trends that support this forecasted growth. For example, from 2018 to 2019, nearly double the proportion of affluent U.S. travelers had taken a wellness trip in the previous 12 months.

Wellness Tourism Growth Will Be Driven by Young People and Emerging Markets

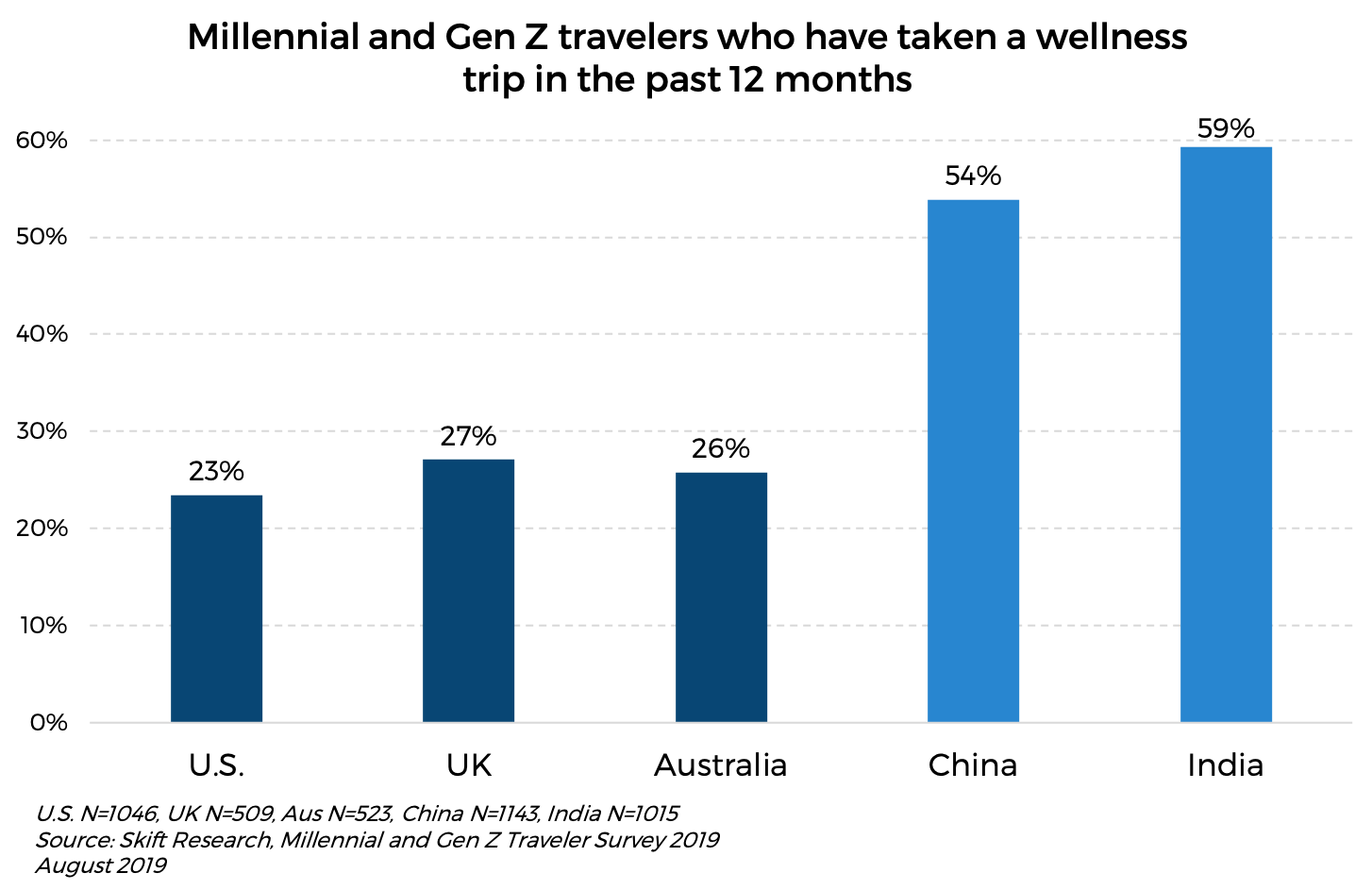

Another promising sign of growth of the sector is higher levels of engagement from younger generations. We observed this in the responses to our recent Millennial and Gen Z Traveler Survey 2019. Aggregating the responses of travelers who fall in these two generations (ages 16 to 38) shows us that nearly a quarter of those from the U.S. had taken a wellness trip in the previous year. What’s even more significant is the data from Millennial and Gen Z travelers from the other four countries that were surveyed.

Here, we see slightly higher levels of wellness trip participation among those from the UK and Australia (nearing 30%). But what is most striking is the proportions of Millennial and Gen Z travelers from China and India who report that they have taken a wellness trip in the past year, which exceeds 50% for both countries.

The relatively high engagement with wellness trips that we observed among young Chinese and Indian travelers falls in line with GWI’s estimates and projections, which show that the Asia-Pacific region experienced the most growth in the number of wellness trips and wellness tourism expenditures from 2012 to 2017. GWI also projects that this region will experience the fastest growth through 2022, with a projected average annual growth rate of 13%.

Wellness Tourism Experiences Grow in Popularity

Wellness experiences have long been an important part of travel. But today, with the driving forces we’ve just discussed behind it, they are manifesting in new and exciting ways. Experience booking platforms are also documenting their rise in popularity. Data from TripAdvisor, for example, shows that wellness-related experiences were among the top three fastest growing experience types globally in 2018. With bookings jumping 69% over 2017, this put wellness experiences behind only the “family-friendly” (204% growth) and “classes and workshops” (90% growth) categories, both of which likely have some overlap with wellness.

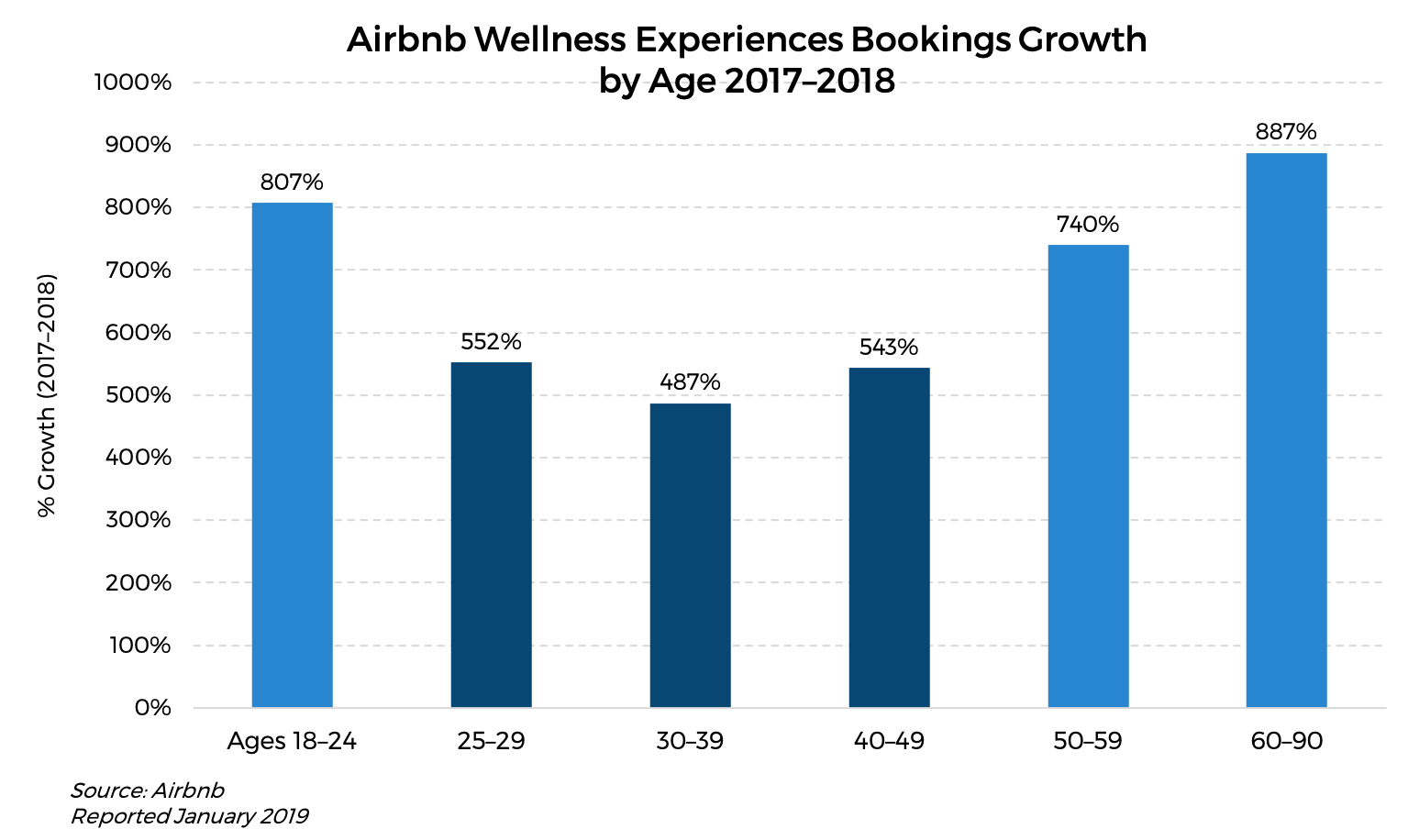

Airbnb reported even more pronounced growth in bookings of its wellness related Airbnb Experiences. According to the company, this category saw bookings jump 572% from 2017 to 2018.

Who Are Wellness Tourists Today?

Because wellness tourism can encompass so many types of travel experiences, it’s difficult to say exactly who wellness tourists are from a demographic perspective. As we have already mentioned, young people and emerging markets are huge driving forces of the segment, and almost all travelers are likely to be at least a secondary wellness tourist at some point. With that being said, there are certain types of travelers that particularly stand out as contributing to today’s rise of wellness tourism. We will discuss some in this section.

Travelers Over 50 Should Not Be Ignored as Wellness Tourists

Younger generations may be helping to drive a new wave of wellness tourism and all the trends that go with it. This isn’t to say, however, that they are pushing the market on their own. In fact, travelers over 50 years old are beginning to become a key driving market in their own right. According to Beth McGroarty, GWI’s director of research, this is one of the trends that “will explode” which travel brands need to be aware of. About this demographic, she explained, “They’ve got money. They’re refusing to age in a way that no culture has ever seen. The whole way that aging is presented and how wellness will approach the 50-plus market is becoming completely cool.” She refers to this phenomenon as “aspirational aging.” According to McGroarty, overlooking older travelers will be a mistake, “There’s been such a myopic obsession with the young and millennials and wellness. That won’t stop because they’re certainly a wellness generation. But I would say that we’re at a tipping point where the 50 plus are going to become much more important.”

As McGroarty said, older travelers tend to have the money and time that is needed to participate more fully in wellness tourism experiences, especially primary experiences. Anne Dimon of the Wellness Tourism Association (WTA), noted that this type of wellness traveler tends to be over the age of 35, despite the huge focus on young Millennials in this sector. Airbnb also noted huge surges in wellness Experience bookings by travelers over 50 in 2018 over 2017. While the company noted triple-digit increases among all age groups, the largest was observed among those 60 years or older, followed by 50–59 and 18–24.

Female Travelers Are a Key Segment of Wellness Tourists

Wellness travel is highly associated with women travelers, and has been for years. Dimon of WTA pointed out that the members of the association have overwhelmingly female clientele for primary wellness experiences. The stereotypical image of a wellness traveler has evolved from groups of female friends on spa getaways to a female solo traveler on a yoga retreat. Women continue to be key drivers of wellness tourism, and what they look for keeps changing.

McGroarty of GWI explained this evolution as another major shift that travel brands need to be aware of moving forward. Today, she explained, wellness travel is being portrayed in a new light as “rougher, more self-empowering, more feminist forward” than it has been in the past. GWI has observed that “travel destinations, … tour groups, or retreats that put that front and center are doing really, really well.” Even beyond travel, wellness itself is being “branded as feminist … taking care of yourself, empowering yourself, making yourself more resilient as a woman.”

Skift Wellness acknowledged this shift as one of its Megatrends Defining Wellness in 2019. This trend, called “Women-Only Wellness Retreats Are the New Luxury,” notes a recent wave of women-only wellness retreats opening around the world. These retreats focus on fostering community connections and some, like Escapada, hone in on addressing specifically feminine wellness issues, like fertility, hormonal issues, and insomnia.

Anna Bjurstam, wellness pioneer at Six Senses noted that this is an area the hotel company has “been researching for quite some time.” She noted that this side of wellness tourism has “really been taboo before, and now it’s not, and now everyone’s talking about it. So that’s also something that we see as a trend.”

All of this isn’t to say that women are the only primary wellness travelers. In fact, men are a growing segment of the sector as wellness becomes a higher priority in many people’s lives. Vivienne Tang, the founder and editor-in-chief of Destination Deluxe, a wellness and travel publication and booking platform, pointed out that her company has been seeing a rise in men booking primary wellness vacations, both on their own, or with their significant other.

Today’s Wellness Tourists Aren’t All Leisure Travelers

Most discussion surrounding wellness travel centers around leisure travelers. And while a primary wellness trip will, in almost all cases, be a leisure trip, it is a mistake to lump all wellness travelers under this category. According to a survey of business travelers by business travel management company CWT and Artemis Strategy Group, 42% say they incorporated wellness into their business trips in 2018 in order to stick to their regular health and wellness routines. This is slightly higher than the 38% who claimed this in 2017. The survey found that only 7% of global business travelers deviate from their health and wellness routines while traveling for work, and this falls to just 3% for those from the Asia-Pacific region.

Today’s Wellness Tourists Fall Into Two (or Three) Categories

As we mentioned before, wellness travel encompasses many types of travel experiences that can be divided into primary and secondary, the former being travel that is motivated mostly or entirely by wellness, while secondary wellness travel incorporates aspects of wellness, but this is not the main purpose of the trip. The latter group encompasses the vast majority of wellness travel. This categorization is a useful and common way to differentiate travel experiences and also to differentiate the travelers partaking in the experiences.

Emlyn Brown of Accor explained to Skift Research that the primary wellness traveler is clearly defined. They’re “making a conscious decision to go to a location to do [a number of days of] immersive well-being and wellness practice.” But as with defining what secondary wellness tourism is, Brown argues that the definition of secondary wellness tourist is “a bit gray … I think there is more room for definition within that area.” Should a person who gets a manicure or massage while on vacation be in the same group as those that do yoga, participate in a short detox program, or does some wellness-based excursions?

According to Brown, a third type of wellness traveler needs to be defined in order to make meaningful distinctions from which to inform business decisions. He proposes a third group that is more of a “tertiary” wellness traveler. Maybe they do a spa treatment or order healthy food, but they don’t take much initiative to incorporate wellness beyond that. Distinguishing these travelers from the more immersed secondary wellness travelers can be essential for travel brands that are attempting to determine their target audience and what they want when it comes to wellness.

Six Senses uses a similar three-category classification of its guests to what Brown proposes according to Anna Bjurstam, although with different self-explanatory names for each group: not interested, curious, and fully immersed wellness travelers. The bulk of Six Senses guests, she says, fall into the “curious” category. The full breakdown, she explains, varies by location and nationality (Chinese and U.S. travelers tend to be more interested in wellness, while French and UK travelers tend to be less interested, she says), but tends to be about 25% not interested, 55–60% curious, and 20% immersed. She informed us that even the uninterested are at least becoming curious in some regards, and they experience wellness by merit of staying in Six Senses properties, which integrate wellness throughout the guest experience, even in subtle ways, like sleep-improving circadian lighting.

Bjurstam and her team anticipate that fewer and fewer people will fall into the uninterested category: “I would say that five years ago the fully immersed would be 5% and not interested would be 40%. It’s really changed the past couple of years, and I see it changing even more in the future.”

The Wellness Tourism Association has also observed a rise in wellness-immersed travelers. Dimon told Skift Research that some of the association’s members — which include tourism boards, hotels/resorts, wellness retreats, travel agencies, and more — reported at least 50% of their clients were first-time participants in wellness retreats or programs.

The more travelers there are that are being motivated by wellness to travel, the better for many types of travel companies. We discussed above the GWI estimates that show wellness travelers usually spend more than other travelers. There is also evidence that wellness travelers travel more often and are more brand loyal. Accor’s Emlyn Brown spoke of this from the hotel perspective, “The thing is that well-being or wellness has a significant role in helping to differentiate hospitality, and also to help people drive a stronger rate premium and drive longer length of stay,” all sought after goals for hotels.

Research by Horwath HTL, a hotel, tourism, and leisure consulting company, further backs this up, concluding that wellness resorts are less vulnerable to challenges that traditional hotels face. The firm has found that these resorts are “the most seasonality proof product in the hospitality industry,” especially compared to traditional resorts. The primary wellness travelers who stay at wellness resorts tend to have longer average lengths of stay at 5–7 nights and are more loyal to wellness resorts, with a relatively high repeat guest visit ratio at 40–50%. This is also reflected in their booking methods, with wellness resorts receiving close to 75% of their bookings through direct channels.

Defining the New Era of Wellness Tourism

We will now turn to the key trends that make up what wellness tourism really is today. As our knowledge and understanding of wellness continues to grow and consumer demands shift, we expect that wellness tourism will change as well. But for now, we have identified five components that make up the definition of wellness tourism today and are shaping where it is heading in the future, as well as the industry sectors involved. For each component, we have included stakeholder perspectives from different travel sectors as well as case studies.

-

Wellness Tourism Is Holistic

As we have emphasized throughout this report so far, wellness tourism encompasses many types of experiences. That idea is related to modern wellness tourism’s holistic and integrative nature. As Vivienne Tang of Destination Deluxe put it, “I think that’s where we’re going, where everything is interconnected.” This is a major part of the new definition of wellness tourism.

Wellness in travel (and wellness in general) is no longer just about the traveler’s physical well-being. Anne Dimon of the WTA explained, “What is clear is, people are more educated and conscious of their overall well-being and are hungry for services and products that extend beyond eating healthily and exercising regularly.” Today, wellness tourism encompasses many facets of wellness including mental/emotional, social, and sleep wellness. Travel brands that want to incorporate wellness into their models should consider each facet.

- Mental wellness: Almost all of our interviewees brought up mental wellness as one of the biggest trends and most important parts of wellness tourism today. Interviewees brought up the need for modern travelers to disconnect from their always-on lifestyles. Accor’s Emlyn Brown explained the hotel company’s choice to focus on mental health: “There’s a recognition, and a very clear recognition, that we can’t keep working at the same pace we’re working now. We can’t keep consuming information the same way we’re consuming it.”Mental wellness isn’t a particularly new part of wellness, but it is really proliferating in the travel industry today. Yoga, meditation, and other opportunities for mindfulness are being put in place in hospitality, air travel, tours and activities, cruise, and even ground transportation.

- Case Study: Calm meditation app partnerships

Calm partnered with American Airlines in late 2018 to offer travelers custom content geared toward relaxation while flying. Calm also provides scenes of nature that are shown on the in-flight entertainment system when passengers are boarding. This was the first partnership between an airline and meditation/sleep app. This partnership was awarded “Best In-Flight Entertainment Innovation” by the Airline Passenger Experience Association.Calm has also partnered with airport spa chain XpresSpa. The company offers discounts and free trials on the app and Calm retail products, in addition to special perks for existing Calm subscribers.Finally, Calm has a partnership with Uber UK that provides content focusing on mindfulness to passengers and drivers.Abrahamian sees the travel industry as a ripe area for wellness-focused companies to forge partnerships. “Many travel businesses are looking at new ways to integrate a more holistic wellness offering to their customers both to drive revenue, and deeper engagement.” Partnering with companies that already have expertise in wellness makes it easier for travel companies to make their way into this world, with the potential for positive business outcomes. According to Abrahamian, “Partner brands (not just exclusively to travel) are not only seeing the positive brand perception lift, they are seeing interest from new customers, and more engagement with existing customers, plus increased revenue in many instances.”

- Case Study: Calm meditation app partnerships

- Social wellness: Another facet of wellness that is crucial to wellness tourism today is social wellness. McGroarty of GWI explained that this side of wellness tourism, and wellness more generally, has become increasingly significant with the so-called “loneliness crisis” that is occurring in many countries around the world and “the way that communities have disintegrated over the last century.” She sees this as an opportunity area for travel companies that can “find ways to really engage people with each other … naturally.” Our interviewees across industries expressed how they are working to address social wellness.

- Cruise: According to Brian Badura, director of global public relations and strategic initiatives for Seabourn, cruise ships are the prime setting to foster social wellness among passengers, which he sees as a key part of wellness tourism today. “I’ve never found another form of travel where you have the degree of social interaction with other people around you like you do on a cruise ship … I’ve just never seen where people tend to forge bonds and friendships with each other in a way that they do in the cruise industry.”

- Expedition Cruise: Fostering a sense of community onboard expeditions is also an important part of the wellness picture for Lindblad Expeditions. Lindblad offers choices to passengers to partake in group activities, if that’s what they feel they need. As Chief Commercial Officer Phil Auerbach explained, “If you want to just go into the gym … and be by yourself, you certainly have that option. But if you want to go and do this mindfulness hike and share that experience with 10 other people, or do cardio boot camp on the beach with 10 other people, or be out on the stand up paddle boards as a group, or doing this morning yoga with a group, that kind of fits very well with the community that we strive to develop onboard our expeditions.”

- Hotel: Brian Povinelli, SVP and global brand leader for Westin, Le Méridien, Renaissance, Autograph, Tribute, and Design Hotels envisions that social wellness will become an increasingly crucial part of wellness in travel: “There’ll be more and more elements of wellness that are actually reconnecting people to people, not to their devices.” He sees community “as an antithesis to technology that disconnects us from people.” Hotels, he thinks, are full of opportunities to help encourage social interaction and community building that aren’t being pushed to their full potential: “that can come in fitness, it can come in culinary, it can come in the way we design our hotels of creating more communal spaces.

- Case Study: A new hostel modelWhen talking about loneliness and social wellness, McGroarty of GWI discussed the new model of hostels that is emerging with a focus on addressing these issues, especially among young travelers. These hostels (or hostel-like accommodation providers) use community as their main wellness messaging. As McGroarty explained, “what’s interesting about it is that for them the message is community. That’s the wellness.” Companies like Selina (which we will discuss in more detail later on) or Freehand are good examples of this model, where community programming and common spaces are huge areas of focus. Selina even uses the tagline “Meet your tribe when you stay with Selina.” McGroarty sees this model filling a crucial well-being gap in a relatively accessible way: “For more and more young people, travel is now a way to create, or to find a community. There’s a lot of these places with coworking, and cooking dinner together, and taking hikes together, and working.”

- Sleep wellness: The majority of our interviewees also brought up the rising trend of sleep as a key aspect of wellness tourism today. Abrahamian of Calm noted that the company has seen a huge surge in consumer interest in sleep quality over the past 12 to 18 months. In response, Calm has been building out its sleep focused content and has “seen an extremely positive response to our Sleep Stories, with over 165M listens.”While sleep wellness is obviously more pertinent to certain types of travel companies, it’s something that the whole industry should pay attention to. As Westin’s Povinelli stated, “sleep is core to not only wellness, but core to the travel experience.”

- Hotel: Hospitality, unsurprisingly, is one area where sleep wellness initiatives are burgeoning. McGroarty of GWI even referred to the industry’s “huge, over-the-top obsession with sleep programming.” It makes sense, because, as Westin’s Povinelli remarked, “At the end of the day, that’s a big part of what we’re providing is a good night’s sleep.” Mia Kyricos, SVP, global head of wellbeing for Hyatt echoed this sentiment: “the quality of sleep our guests are getting while staying at Hyatt hotels dictates their overall experience.”

- Airline: Hotels might be the first travel sector to come to mind when it comes to sleep wellness, but airlines are also putting a great deal of resources and research into sleep-related innovations in order to improve the flying experience, especially on long-haul flights, and to help curtail the worst symptoms of jet lag. Betty Wong, divisional vice president, inflight services and design for Singapore Airlines named sleep as one of the main wellness-related focus areas for the company, “as we know these are the areas of greatest interest for passengers in terms of how they evaluate the quality of their inflight experience.”

- Case Study 1: Westin, Raffles, and Six Senses sleep wellness programmingYou will be hard pressed today to name a hotel company that isn’t innovating in sleep wellness. The initiatives that hotels have put in place run the gamut from sleep-friendly design choices to high-touch services rendered by trained practitioners.Westin has put a focus on sleep quality for over 20 years, starting with its Heavenly Bed. Today, the brand has added other aspects to help guests’ sleep wellness, including a Sleep Well menu that was developed in partnership with the World Sleep Society, and a Sleep Well Lavender Balm that’s included among bedside amenities.

At certain locations of Raffles hotels, guests can take advantage of the Sleep Rituals service. This service provides guests with items and amenities to help encourage healthy sleep, like cards that encourage mindfulness, a sand timer, and a branded essential oil blend designed to promote sleep. Extra amenities including a sleep-focused food and beverage menu are available to premium and deluxe guests.

Finally, Six Senses has developed one of the most in-depth sleep wellness programs, Sleep with Six Senses. According to the brand’s Wellness Pioneer, Anna Bjurstam, the program took three years to develop in partnership with sleep doctors and sleep scientists at Harvard.

One of the biggest outcomes of the research put into the program development resulted in changing “the whole infrastructure of the hotel rooms” from lighting, to drapery, to temperature regulating mattresses and bedding.

When guests check into a Six Senses property, they can fill out a form about their sleep issues and habits. Based on this form, the staff can provide specific pillows for your preferred sleeping position, a white noise machine, and other bespoke offerings to encourage quality sleep. Guests can also use a sleep tracker and get a biomarker screening and work with expert practitioners to address specific sleep issues.

- Case Study 2: Singapore Airlines and QantasTo improve the experience on some its ultra-long-haul flights, Singapore Airlines has partnered with wellness resort leader Canyon Ranch to create holistic passenger well-being initiatives. The collaboration has resulted in food menus that focus on things that are of heightened importance while flying: hydration, flavor, and nutrition. Sleep and relaxation are another focus area of the partnership. The partnership created ambient light settings with special tones and colors to help promote sleep and lessen jet lag. Video content via seatback entertainment systems offer guided self-massages, breathing exercises, and stretching routines.Qantas, another airline with many ultra-long-haul routes, has looked at how it can integrate wellness through other parts of their customers’ journeys. Through a partnership with the Charles Perkins Centre, an Australian medical research institute, Qantas is working on improving the in-flight experience in similar ways to Singapore Airlines. Additionally, it is testing ways to add wellness to its international transit lounges. So far, the Perth location has been acting as a testing ground for things like light therapy and meditation spaces.

Qantas has also found a way to encourage wellness for frequent flyer members. Using the app Qantas Wellbeing, members can earn points by doing certain wellness related activities or meeting certain goals. The Sleep Health Challenge, for example, requires users to put their phone down at least 30 minutes before sleeping in order to earn points. Simple tasks, like taking the dog for a walk or going for a run, also earn points that can be redeemed with Qantas or partner brands, including fitness companies like Adidas.

- Mental wellness: Almost all of our interviewees brought up mental wellness as one of the biggest trends and most important parts of wellness tourism today. Interviewees brought up the need for modern travelers to disconnect from their always-on lifestyles. Accor’s Emlyn Brown explained the hotel company’s choice to focus on mental health: “There’s a recognition, and a very clear recognition, that we can’t keep working at the same pace we’re working now. We can’t keep consuming information the same way we’re consuming it.”Mental wellness isn’t a particularly new part of wellness, but it is really proliferating in the travel industry today. Yoga, meditation, and other opportunities for mindfulness are being put in place in hospitality, air travel, tours and activities, cruise, and even ground transportation.

-

Wellness Tourism Is Integrated Throughout the Traveler Experience and Surroundings

This part of our definition is about how traveler wellness needs to be incorporated throughout the entire travel experience, in a more external way. There is some overlap between this part of wellness tourism and the previous, but we want to draw attention to each on its own because they are both huge parts of wellness tourism today.

Cassandra Bianco, founder of WELLBEINGS and global wellness consultant for Selina, explained that wellness should be in “every touchpoint” for the traveler. “The room should have lots of natural light, and my bath products shouldn’t have chemicals, and it shouldn’t be noisy. It shouldn’t be paper-thin walls. I think the physicality of the space you’re in is important.” Bjurstam of Six Senses echoed this idea when she described how the company defined wellness: “it’s a bit fluid, I would say, how we define it, but definitely that holistic approach is being integrated in everything we do.”

- Expedition Cruise: Lindblad Expeditions also takes a multifaceted approach to incorporating wellness throughout the experience for its passengers. Phil Auerbach, chief commercial officer, explained, “we recognize that wellness has become even more of an important component in what people are looking for in their travel experience. And so that has, I think, found its way into more elements of our experience.” This is being accomplished by building new ships with improved fitness and spa amenities, offering healthier menu items that are sustainably and locally sourced wherever possible, and having a dedicated wellness specialist onboard to host activities on the ship and in the destinations they visit. We will go into more detail about this in the case study below.

- Hotel: When asked whether she thought wellness even needed to be limited to the hotel property, Hyatt’s Kyricos responded, “Well-being in hospitality and travel is certainly not limited to the hotel property, which is why we have focused on bringing well-being experiences to life both in and outside of hotel stays.” Hyatt, she explained, has found ways to incorporate wellness at unexpected parts of the traveler journey, including times when they are not even staying at a Hyatt hotel. For example, loyalty program members can access exclusive wellness-based experiences — many of which take them off property — through the FIND platform, and the World of Hyatt credit card “rewards guests for healthy behaviors,” like by giving two-times rewards point for fitness-related spending.

- Case Study 1: Lindblad ExpeditionsLindblad Expeditions presents an excellent case study of a travel company that is successfully integrating wellness throughout the traveler experience in an authentic, true-to-brand way that also appeals to many types of wellness travelers. Phil Auerbach explained how the company does this using an example of the hikes that might be offered in the locations the expeditions visit. By their very nature, a hike in itself could be considered a part of wellness travel, but Lindblad takes it a step further for those passengers who desire a more intense, wellness focused experience. He explained that three or four hikes with varying areas of focus might be offered. One might be a slow hike led by a naturalist who offers wildlife and nature interpretations along the way, and another might be a more physically intense experience, still with some nature interpretation, as this is a key part of the brand. There would also be one with a photography element led by a National Geographic certified photo instructor. And finally, there will be one led by the onboard wellness specialist, usually with the assistance of an interpreter in order to stay true to the brand and “just in case something really cool happens and you want someone there to help interpret it.”This wellness-led hike, Auerbach explained, is “a three hour hike, and it’s really about not talking, letting people … work up a sweat and get exercise, but kind of connect with that place in their head … And then maybe halfway up the hike, the wellness specialist will stop, have everyone kind of find a spot on boulders or grass or wherever they are, and do some mindfulness exercises.”

- Case Study 2: Hotels and airlines utilize biophilic designThe term biophilia refers to human’s innate biological connection with nature and the restorative effect nature elicits. Biophilic design refers to using physical design elements to reconnect people with nature in order to produce these same benefits. This concept is being embraced by travel companies that operate within the built environment as a key part of their overall wellness strategies. Hotels have been the first to dive into incorporating biophilic design principles. Westin, for example, launched a new guest room design that “really looks at how do you bring the outdoors in … to promote peoples’ well-being,” according to Brian Povinelli. Emlyn Brown of Accor pointed out that the biophilia has been a crucial element of the Raffles brand, especially “the idea of greenery within spaces … to help create mental health and well-being support.”Anna Bjurstam underscored how Six Senses integrates biophilic design throughout its properties as a key part of the wellness experience for guests. “We have a very biophilic design in our locations where we try to bring nature in in various aspects. It can be visually, it can be sound, it can be touch, it could just be experiential as well.”

For all of the above hotels and for a number of airlines, including those we mentioned earlier in the report, lighting has been a major part of biophilic design that is being researched and incorporated at scale. The hotel executives we spoke with noted research their teams have done on the impact of lighting on mood, productivity, sleep quality, and jet lag recovery.

Some companies including Six Senses, IHG, Singapore Airlines, and Qantas have all incorporated circadian lighting elements to the physical spaces in which they operate to help travelers adjust their bodies to time changes.

-

Wellness Tourism Is About Helping Travelers Maintain Healthy Routines

Many of the experiences that might fall under the wellness tourism umbrella today aren’t necessarily things that travelers would do in their daily lives. Even so, many of our interviewees emphasized the importance of wellness being incorporated in such a way that travelers’ normal lifestyles aren’t unnecessarily disrupted. As Vivienne Tang of Destination Deluxe told Skift Research, “Nobody wants to sacrifice their hard earned healthy lifestyle just because they’re on the road.”

Especially for hotels and cruise, where travelers spend extended periods of time, stakeholders underscore the importance of allowing travelers to have access to everything they need to continue the healthy habits that they are likely to have in their everyday lives, while still providing an on-brand experience that is hopefully a level above what they’re used to at home.- Hotel: One of the key ways that Accor ventures to meet traveler wellness expectations is by taking inspiration from trends in the wellness world outside of travel. As Emlyn Brown explained, “I can go on the high street and buy kombucha. I can buy activated gut health, green juice. I can do Bulletproof coffee. I can have all these different things, and when I go to luxury or premium hospitality I expect the same.”He and his team also look outside of travel for inspiration when it comes to the hotel fitness experience. They are especially focusing on this area for Accor’s Pullman brand, of which he explained, “the exercise experience within a Pullman must be matching and mirroring the exercise experience that people are seeing on the high street … the benchmarks are no longer the big box exercise companies. They are F45. They are SoulCycle. They are Barry’s Bootcamp.”For Westin as well, focusing on helping travelers maintain routines is a crucial part of the brand’s wellness strategy. Brian Povinelli explained further, “I think what a brand like Westin and other more mass brands — we’re a global brand with almost 230 locations. We’re not trying to be that kind of detox weekend destination, right? We are trying to really focus in on the everyday challenges of travel where people are feeling more and more disconnected from their routines, how they eat, how they sleep, how they work out, and that loss of control.”

Even for a brand like Six Senses, which is more on the wellness retreat side of the sector (as Bjurstam explained, “we’re not a destination spa, and we’re not a normal hotel with a spa, we’re somewhere in between”), considering the travelers’ normal wellness routine is still an important part of the equation. Obviously, most people don’t work with sleep coaches or get biomarker screenings as part of their normal routines, but Bjurstam says that the hope is what they learn from Six Senses programming will then become part of their routines: “What we see where we get the biggest win is not actually the programs, to be honest, and what the results are they get from the program, but the lessons they learn that they can adapt when they get home.”

- Cruise: Just like for hotels, travelers also spend long periods of time on cruise ships, sometimes up to weeks for a single voyage. Brian Badura of Seabourn noted that for this reason, the cruise line is always thinking about how it can help passengers maintain wellness routines. He and his team ask themselves, “How can we dial up somehow what we can offer to a guest while they’re traveling so that they feel like they can maintain some sense of normalcy even if they’re on a ship with us for an extended period of time?” The goal is to “find ways where we can make wellness convenient for people.” By finding ways to do this, whether it’s through improved fitness amenities, offering services like acupuncture, or even by offering full on Wellness Cruises, Seabourn hopes to change consumer perceptions about cruises toward a “recognition that a cruise experience can actually be something where I can maintain a well and healthy lifestyle even though I’m traveling on a ship.”

- Case Study: WestinFor Westin, minimizing routine disruption is a key part of the brand’s wellness strategy. By identifying places in the guest experience where wellness routines are negatively impacted, Westin can innovate to find ways to fill in the gaps. This has also been a key process for the brand to go through when forming strategic partnerships with wellness companies. Brian Povinelli explained that the Westin team started to see that guests were being forced to leave their workout gear at home because airline baggage fees were limiting their packing space. They observed that guests were “giving up their workout on the road because they don’t want to pay $50 to check their bag,” so the team started to think of ways they could compensate for that. This led to a partnership with New Balance, where guests can borrow workout shoes and clothing for use during their stay.Partnerships with fitness equipment companies Peloton and TRX came about in a similar fashion, according to Povinelli, and were forged with the goal of allowing guests to keep working out like they do at home. “If we could give people access to that type of equipment when they’re traveling,” he explained, “again it fills that vision of keeping people connected and in control of their well-being.”

- Hotel: One of the key ways that Accor ventures to meet traveler wellness expectations is by taking inspiration from trends in the wellness world outside of travel. As Emlyn Brown explained, “I can go on the high street and buy kombucha. I can buy activated gut health, green juice. I can do Bulletproof coffee. I can have all these different things, and when I go to luxury or premium hospitality I expect the same.”He and his team also look outside of travel for inspiration when it comes to the hotel fitness experience. They are especially focusing on this area for Accor’s Pullman brand, of which he explained, “the exercise experience within a Pullman must be matching and mirroring the exercise experience that people are seeing on the high street … the benchmarks are no longer the big box exercise companies. They are F45. They are SoulCycle. They are Barry’s Bootcamp.”For Westin as well, focusing on helping travelers maintain routines is a crucial part of the brand’s wellness strategy. Brian Povinelli explained further, “I think what a brand like Westin and other more mass brands — we’re a global brand with almost 230 locations. We’re not trying to be that kind of detox weekend destination, right? We are trying to really focus in on the everyday challenges of travel where people are feeling more and more disconnected from their routines, how they eat, how they sleep, how they work out, and that loss of control.”

-

Wellness Tourism Extends Beyond Traveler Wellness

Clearly, the main goal of wellness in travel is to address the personal wellness of the traveler. However, our interviewees stressed that the best wellness tourism experiences today also address wellness beyond the traveler, namely community wellness and environmental wellness (which are closely tied to one another). Some even argue that these are essential parts of the holistic idea of wellness we discussed before. As Cassandra Bianco, global wellness consultant for Selina, stated, in order for something to truly be about wellness, “It’s definitely a combination of the internal and external experiences … I think the idea of the customer being the center of the universe is … pretty much dying.”

Beth McGroarty of GWI explained that, in many ways, there is an extra pressure for companies in wellness travel to pay attention to their impact on the larger systems around them, “I think there’s just this pressure towards much more sustainability, … from wellness destinations.” She also noted “There’s this big movement towards — everyone talks about slow travel — but in wellness it’s taking on a very particular kind of form, which is kind of like moving at the speed of humans again. So many walking tours, and hiking tours, and cycling tours where you move more slowly through an area. You eat local food. You go to local markets. You meet local people. You do local crafts. You walk. You’re on the ground.”

There are many ways that travel companies can take account of community and environmental wellness alongside traveler wellness. Destination organizations can play a role in promoting this part of wellness tourism by requiring or encouraging travel companies to abide by certain sustainability practices, employ local people, or by making sure wellness tourism spending is returning to the local economy.

The representatives we spoke to from Lindblad Expeditions, Westin, Six Senses, and Singapore Airlines all mentioned sourcing local, sustainable food whenever possible as key parts of their well-being strategies. Not only does food sourced in such a way tend to be fresher and more nutritious, but it also supports local communities and minimizes environmental impact.

- Case Study: SelinaWe mentioned Selina earlier as an example of the “new hostel model” that emphasizes its locations as “a place to connect with others” and form a community. For Selina, this community that is created is not just for its guests, but also for the locals. We spoke with Cassandra Bianco, who is currently the company’s global wellness consultant. She explained that Selina’s “goal is to be, kind of like, the piazza in town,” where everyone can intermingle, including members of the local community. Every location has an “experience manager” and “they’re in charge of the programming, which is daily. They’ll have workshops, events, everything from fitness to all sorts of things, really.” And locals can purchase class packs and receive discounts on certain offerings. Bianco is excited about the emerging trend of places like Selina that act as “community hubs.” These places, she said, “are attracting both locals and hotel guests. That’s a pretty awesome balance to strike, and that’s really how it should be.”

- Case Study: Singapore Airlines and AeroFarmsIn 2017, Singapore Airlines launched its “Farm-to-Plane” initiative with the goal of improving the environmental sustainability of its on-board dining, while supporting the communities it flies to and from. In 2019, the airline announced a partnership with AeroFarms, an indoor vertical farming company, as part of this initiative. According to Betty Wong, divisional vice president, inflight services and design, “SIA [Singapore Airlines’] flights from Newark will soon feature aeroponically grown greens from the world’s largest indoor, vertical farm of its kind, located just a few miles from the airport.”This partnership hits at multiple facets of wellness. For one, it supports a local Newark-based company. Additionally, as Wong explained, the greens will be produced in an efficient, environmentally friendly way, being “grown without sunlight, soil or pesticides, and with 95 percent less water than at a conventional outdoor farm.” Finally, the AeroFarms technology allows adjustments to “the spectrum of light to fully express each plant’s specific nutritional and flavor characteristics,” making it beneficial to the individual passengers as well.

-

Wellness Tourism Is Blurring Boundaries Between Industries

There is arguably no other part of travel that has blurred boundaries with other industries as much as wellness travel has. It might not be too surprising, given how all-encompassing wellness is today, that wellness travel would have this same boundaryless quality. As McGroarty of the GWI explained, “Everyone uses this buzzword of convergence … That is what’s happening in the wellness travel world.”

There are a few ways this convergence is happening. There are places like the new hostels that we discussed previously, that are traveler accommodations, community centers, coworking spaces, and more all wrapped into one. There has also been an explosion of wellness-focused companies that are claiming their own stake in the wellness travel world by creating hotels, offering wellness-themed tours, or even full on wellness retreats. And finally, wellness tourism is replete with partnerships between wellness-focused companies and travel companies, some examples of which we have already discussed throughout this report.

- Case Study: Wellness companies find a place in the travel industryOver the last couple of years, we have witnessed a surge in wellness-focused companies that have entered the travel industry on their own, staking a claim in the wellness tourism space. This is an especially evident trend among luxury gym and boutique fitness studio companies. Given their established expertise in well-being, we can expect companies like the following to continue to carve out a meaningful place in wellness tourism, thereby changing the overall landscape of the segment moving forward.

- Equinox: This year, the luxury gym company made big strides into the travel space, with the opening of its first hotel in New York City, and the official launch of Equinox Explore, its own wellness-led, multi-day luxury tours.

- Well + Good: The wellness news and lifestyle website began hosting its own wellness retreats in 2018. The retreats are curated and hosted by the site’s editors and include experiences hosted by leaders in fitness, healthy eating, and more. Well + Good partners with well-known wellness resorts like Miraval to host the retreats.

- The Class by Taryn Toomey: This New York-based, cult-favorite boutique fitness studio that offers classes it describes as “cathartic movement experiences” is expanding its Retreatment experiences, which are multi-day vacations hosted in a variety of destinations.

- ClassPass: ClassPass largely upended the boutique fitness space, making it more affordable and accessible. Now, the company is trying to do the same for wellness retreats with ClassPass Getaways. These mini retreats, bookable only for ClassPass subscribers, pack the essence of a full-on wellness retreat into a single day that includes workout classes, beauty and spa treatments, and healthy meals.

- Third Space: The London-based luxury health club chain is offering its first Third Space Escapes later this year in Morocco. Led by two trainers, the trip has a wellness focus that also gets participants out to explore the location.

- Blok London: The luxury gym company held its first wellness retreat, focused on yoga, fitness, and food, in France’s wine country this summer.

- Case Study: Wellness companies find a place in the travel industryOver the last couple of years, we have witnessed a surge in wellness-focused companies that have entered the travel industry on their own, staking a claim in the wellness tourism space. This is an especially evident trend among luxury gym and boutique fitness studio companies. Given their established expertise in well-being, we can expect companies like the following to continue to carve out a meaningful place in wellness tourism, thereby changing the overall landscape of the segment moving forward.

Best Practices in Wellness Tourism

We identified nine best practices for stakeholders in the wellness travel segment. In this section, we will briefly discuss each one, while also providing perspective from stakeholder interviews, case studies, and additional research throughout.

-

Don’t Look for a One-Size-Fits-All Approach

This is something that we at Skift Research say with many of the topics we cover, but that is because we think it is worth repeating. As we have discussed throughout the report, wellness tourism is difficult to define concisely, and in fact, has many possible definitions. This means that there are many valid ways for travel companies to enter the space, and that’s the way it should be. Obviously, a luxury Six Senses hotel will have different capabilities and opportunities to integrate wellness compared to an airline or tour operator, but both can still find a legitimate place in wellness travel that meets what customers expect of them.

Travel companies and destinations need to do some soul searching. They need to think about what their ultimate goal is with incorporating wellness into their businesses and how they can do it in a way that is true to their brand. They need to determine what kind of wellness tourists they should expect as customers (Are they primary wellness travelers? Secondary?). Finally, they must think at a local level about the communities they operate in and how they are contributing to the wellness of these communities. Having a clear vision about these things is required and will vary from stakeholder to stakeholder.

-

Build Upon a Foundational Strategy

For all types of stakeholders, the first step toward entering the wellness tourism space should be to lay out a foundational strategy to build upon. Accor, Westin, and Hyatt, for example, have all outlined categories of wellness on which they base the initiatives they put in place on their properties.

Accor’s “Five Pillars of Well-Being” are nutrition, holistic design, movement, spa, and mindfulness. According to Emlyn Brown, his team determined these were “areas that we can influence strongly within the guest and guest experience while they stay on our properties and also beyond.” Westin follows a similar model with its “Six Pillars of Well-Being” of Eat Well, Sleep Well, Move Well, Work Well, Play Well, Feel Well. Brian Povinelli explained that outlining these pillars was the first step after deciding to focus the brand on wellness. The pillars, he said, “build a framework that would guide all of our marketing and our guest programming, the entire guest experience.” Hyatt’s foundation is a bit simpler, with three “landmarks of well-being,” which are Feel, Fuel, and Function. These landmarks, Mia Kyricos explained, “guide our global strategy.”

These examples are extremely comprehensive, and for hotel brands like these, which offer a plethora of opportunity to inject wellness into the guest experience, thinking in this way is useful. For other types of stakeholders, it might not be necessary to have such a comprehensive foundation. In these cases, it is still good practice for stakeholders to consider the overall goal that they hope to achieve by entering the wellness space or adding wellness aspects to their brands. When Phil Auerbach of Lindblad Expeditions was asked about how he and his team perceive the brand’s place in wellness tourism, he responded that they started the conversation by asking “how do you go to these places, which lend themselves to this incredibly mindful experience, and then connect with them through wellness? So it’s not you’re going on a wellness retreat, you’re going to these places and you’re going to come back healthier, and fitter, and hopefully more well-rested, mind and body.” Starting with a end-goal-minded question like this helps Lindblad incorporate wellness into the guest experience in a meaningful and brand-authentic way.

-

Engage Trained Wellness Experts

No matter what kind of company or organization a stakeholder is, they can greatly benefit from engaging with trained wellness experts. GWI’s Beth McGroarty explained how wellness travel “is very high touch, very people driven, expert driven, practitioner driven … more than any market in travel.” Hiring or partnering with expert practitioners who are knowledgeable about wellness can save companies time and resources that would be required to train all employees from the ground up, and it also gives the stakeholder credibility that can be a key selling point for travelers interested in wellness. According to McGroarty, “I think coming at it as ‘I just want to add wellness and I can do that without any kind of knowledge or any kind of expertise’ is just bound to fail.”

Hotels can bring in skilled practitioners to provide wellness treatments and services, like spa services, acupuncture, and more, and they can hire them in-house to help develop their wellness offerings. Airlines work with health food chefs, sleep researchers, and more to develop their wellness initiatives. Vivienne Tang of Destination Deluxe has observed this in other parts of the travel industry too: “I see a lot of travel agents have either hired wellness experts or they’re trying to expand in that area.” And her own company, with its editorial expertise in wellness “has been approached a lot by travel agents who want to break into this market because they see it as having huge potential.”

Engaging with experts can make a huge difference in the wellness tourism space, but doing this is not a replacement for having a foundational knowledge base or strategy to build from. Six Senses’ Bjurstam cautioned against becoming too reliant on specific practitioners, in a way where the wellness programing would not survive without them. “I think one of the most important factors to be successful is to do the groundwork. You do the research and you create the system so you don’t have to depend on people.”

Seabourn Cruise Line is an excellent case study of this best practice. Seabourn has shown a longstanding commitment to wellness with state-of-the-art fitness centers and on-ship spas, which Brian Badura, director of global public relations and strategic initiatives, says have been a staple of the company’s cruises for decades. When thinking about going deeper into the wellness realm, Seabourn made the strategic decision to partner with an expert, Dr. Andrew Weil.

Badura explained that Dr. Weil, “who is seen as one of the founding fathers, so to speak, of the integrative medicine movement,” was engaged to enhance the cruise line’s spa program. As a result of this relationship, Seabourn cruises now offer more holistic wellness experiences, including crystal sound therapy, meditation and yoga sessions, and private consultations with personal trainers and mindful living coaches.

This expert partnership goes one step further with Seabourn’s Wellness Cruises, which Dr. Weil joins, along with a few other integrative medicine practitioners. Badura explains that the Wellness Cruises are “really kind of intended to be an opportunity for people to learn more about a lot of these topics that the experts are steeped in and experienced in, and to give them a chance to ask a lot of questions, interact.”

-

Form Strategic Business Partnerships

Another way for stakeholders to bolster their wellness expertise and improve their credibility with travelers is to form strategic business partnerships. We’ve already discussed some such partnerships, like those that the Calm meditation app has with travel companies and Westin’s partnerships with New Balance, Peloton, and TRX. Partnerships like these are mutually beneficial; the travel company gets to use the reputation and expertise of the wellness-focused company, while that company gets exposure to a part of the customer lifecycle they might not otherwise be able to break into.

On partnerships, Emlyn Brown of Accor said, “this idea of partnership and expertise and collaboration is vitally important to a group like us … Because you know, people like to see a brand experience. They trust a branded experience and I think that we can both create collaboration that benefits both parties. And that’s definitely how we’re approaching our way for well-being.”

Betty Wong of Singapore Airlines expressed similar logic when explaining how the airline strategically decided on partnerships with wellness brands Canyon Ranch and COMO Shambhala: “We were seeking proven, broadly recognized expertise, a long track record of success, and an impressive roster of practitioners to help develop our initiatives in a way that conveyed competence, credibility, and effectiveness.”

-

Make Wellness Tourism Offerings Customizable

Wellness is highly personal, and as we have seen, what constitutes wellness tourism can also be subjective. For this reason, it is important for stakeholders to think about how wellness offerings can be customized to fit each traveler’s needs.

Brian Povinelli of Westin summed this up when he said, “part of it is giving customers choice because it’s so personal how people define their wellness.” For Westin, he explained, this is important “especially when it comes to eating or culinary,” where “our goal is to really be able to give people the options they want when they want them and even the … portion sizes that they want.”

Another way wellness offerings can be customized is by combining them with other types of travel experiences. Vivienne Tang of Destination Deluxe told us how her company often designs customized retreats for couples, where each individual wants different things out of their trip: “Yes, they will still be on a wellness program, but it will include some cultural activities. A bit of fitness that’s maybe related to sightseeing, like a cycling tour through the rice fields in Siem Reap or somewhere.”

The potential customizability of wellness travel will only grow as technology improves and more data is available to cater wellness experiences to specific biological needs. This is exciting to Povinelli, who explained that “we’re getting to a point where you’ll soon know much more about your body composition … people have all this knowledge and they’ll expect it to be addressed and that the experience is personalized off that knowledge in their travel experience.” Hotels and other stakeholders, he said, need to think about how to use that kind of information, “what are those programs, amenities, how do we design our hotels that are going to play into that knowledge about people’s wellness and their preference to really have a personalized experience?”

It will probably take some time before this kind of tech-enabled, biologically personalizable wellness travel will be seen widely, but some brands, like Six Senses, are ahead of the game. Six Senses builds much of its wellness programing on personalized wellness analyses, and according to Anna Bjurstam, “one thing that’s kind of the spider in the web, the central piece in our wellness programs, is our asset called Integrated Wellness Screening.” This screening analyzes a person’s biomarkers in order to understand their specific wellness needs, and based on the results, expert practitioners create personalized treatments or multi-day plans to address them.

-

Avoid Wellness Washing: Authenticity Is Key