Executive Summary

Virtual reality is moving from a dream to an actual reality in the travel industry, as a variety of agents, hotel chains and airlines experiment with new immersive experiences to inspire and persuade potential travelers. But even as consumers and marketers get excited, many are asking if VR is just the latest form of marketing hype or a legitimate business tool. What best practices are emerging to guide successful VR campaigns, and how are travel marketers approaching the technology as interest grows?

Many travel industry executives are excited about the potential of such devices to deliver immersive experiences that help them better sell travel products to potential customers, and a range of travel brands like Tourism Australia, Marriott and Thomas Cook have already tried out VR marketing programs. Still, the size of the consumer market for VR remains small for now, complicating marketing decisions. Industry sources predict there will be around two million devices in consumers’ hands by the end of the year, and total sales from VR hardware and software in the US are estimated to reach $1 billion in 2016.

In addition to relatively small demand for VR devices and software, many consumers are ambiguous about their interest in VR experiences. While there’s no doubt that VR travel experiences evoke strong excitement, many consumers are confused about what VR means and emphasize that they will need to try it out in person, in order to provide a better opinion on whether they want to purchase or use such devices. Another added complication is the wide range of devices and VR software formats, which can complicate production and distribution decisions for marketers.

Despite these obstacles, plenty of travel brands are already experimenting with VR travel experiences, helping to build a list of best practices and case studies that can help guide other marketers. Those familiar with producing VR experiences emphasize the importance of finding compelling experiences to capture using VR technology. 360-video, which some detractors point out is not “true” VR, has gained the widest audience, with support now available on both YouTube and Facebook. Brands like Marriott and Thomas Cook offer two great examples of travel brands that have built successful VR experiences.

Skift’s “Decoding Use Cases for Virtual Reality in Travel” report digs into each of these topics, attempting to size the potential market for VR devices and experiences, gauging consumer perceptions of VR experiences, reviewing the most popular devices and formats in use today and investigating the best examples of how travel brands are putting VR to use for their own initiatives.

Introduction

“Virtual Reality Is About to Transform the Travel Industry,” proclaimed one breathless 2016 headline. “Travel Marketers Embrace Virtual Reality as the Next Big Thing,” exclaimed another Associated Press story from 2015. “Will Virtual Reality Revolutionize the Travel Industry?” asked yet another over-eager editorial. It seems like no matter what you read, or where you look these days, virtual reality is on the tip of the travel industry’s collective tongue. But the mystery about its sudden rise is less clear. How did this seemingly futuristic technology evolve from a science-fiction movie plot point, into the next killer device on the verge of adoption by millions of consumers? And what do travel marketers need to know about it?

For those of a certain age, the recent surge in virtual reality (or “VR” for short) probably feels like deja vu. The concept behind VR, which refers to computer-generated simulations of 3D environments, has been around in various consumer forms dating back to the 80s and 90s. Users would strap on an unwieldy headset and gloves and be transported to an imaginary world where you could do anything from fly like a bird, walk through the craters of an alien planet or stroll the streets of ancient Rome.

However, even the technology’s most passionate supporters will admit these early systems often failed to deliver on their potential. In addition to having limited computing power and high costs, these “proto-VR” devices also had a nausea-inducing tendency to make viewers want to vomit due to lags in the video refresh rate. These limitations proved to be too much, and just like that, the VR industry largely faded from public view.

Virtual reality has come a long way since its days as a movie plot point from science-fiction films like Johnny Mnemonic. Cheaper mobile devices, new types of VR-ready cameras and more powerful computers have radically transformed VR’s potential for consumers and brands.

Virtual Reality and Augmented Reality: What’s the Difference?

Some readers of this report may be familiar with the term “Augmented Reality” (AR) and wonder where this fits within the larger realm of VR technology. Because of the similar naming conventions, it’s easy to get “virtual” and “augmented” reality confused, even though they’re not really the same thing.

As explained on the augmented reality Wikipedia page, AR is “…a live view of a physical, real-world environment whose elements are augmented (or supplemented) by computer-generated sensory input such as sound, video, graphics or GPS data.” This can happen by having a user look at an “augmented” world using their smartphone screen, or with a headgear-type device like Microsoft’s HoloLens System, which still lets users see the physical world while layering computer images on top.

Although augmented reality experiences have been around for some time (local search firm Yelp has had an augmented reality feature, called “Monocle,” in its app since 2009), it wasn’t until the the meteoric success of Niantic’s “Pokemon Go” mobile game that the technology truly broke into the mainstream. Using the smartphone’s built-in GPS and camera, the game places digital Pokemon characters in real-world locations, allowing players to capture, battle and train the creatures using their device. Within two weeks of its launch, the game had accumulated more than 30 million players and, as of July 2016, had more daily active users than Twitter.

A number of businesses have quickly jumped on the Pokemon Go augmented reality trend. For some businesses fortunate enough to have a game character randomly located inside their walls, the consumers came anyway. For others, the solution has been to offer discounts to players or pay to “lure” characters inside and thus encourage more foot traffic. Tourism board Travel Portland even built a special itinerary around the game. ““Portland is a really compact and walkable city, but when we first started talking about creating a walking itinerary around Pokémon, it started out as a bit of joke,” said Courtney Ries, VP of marketing at Travel Portland in an interview with Skift. “But then, since we have the back-end technology in the website to create on-demand content, we thought, ‘How can we do something more?’”

While no one is certain about the staying power of Pokemon Go, expect these same type of augmented reality, location-based, experiences to offer travel brands plenty of opportunities in the years to come.

It wasn’t until the era of smartphones began with the iPhone in 2007 that virtual reality again began to seem like a consumer reality. In 2012, entrepreneur Palmer Luckey realized he could “hack” together a relatively-cheap VR device for gamers using the low-cost electronics now available for smartphones. Luckey launched a Kickstarter campaign for his “Oculus Rift” device that year, raising more than $2.5 million in the process. Two years later, in 2014, Facebook acquired Luckey’s company for $2 billion.

Since Facebook’s multibillion-dollar VR purchase, the race among hardware manufacturers, software makers, developers and increasingly, consumer brands, has intensified. Google launched its own entry-level VR platform, called Cardboard, at its annual I/O developers conference in 2014. The low-cost virtual reality device literally uses a cardboard box with special lenses wrapped around a smartphone to create immersive experiences. Company representatives claim as many as one million of the devices are now in the hands of consumers. This significant and growing user base has also caught the attention of marketers, particularly in the travel industry.

For travel executives, the main selling point of VR has to do with its ability to “transport” users to far-away places. If a picture is worth a thousand words, then perhaps a virtual reality experience is worth a million. By combining sight, sound and touch into a single, interactive, storytelling medium, travel marketers are now being offered a new tool to engage potential travelers. “We buy leisure travel based on emotion. What better way to trigger that emotion than putting someone in a virtual reality experience of where they want to go?” said Christian Burne, business director for VR production company Visualise.

“Why do people go on TripAdvisor? Because they want to get a better feel for the place. We see [VR] as a very natural evolution that has taken place [in travel marketing],” said Abi Mandelbaum, CEO of YouVisit, a VR distribution platform and content creation company, in a 2016 interview with Travel Weekly. “From text to photos to videos to virtual tours to virtual reality. The main thing that makes the virtual experiences unique is that they’re interactive. That interactivity leads to immersion, and that immersion leads to conversion.” As a result of the medium’s potential, the range of travel brands that are already experimenting with VR is extensive and growing, including everyone from Tourism Australia, Marriott Hotels, Carnival Cruises, Six Flags Theme Park to the Las Vegas Convention and Visitors Bureau.

But even as more travel marketers jump onto the VR bandwagon, plenty of questions remain. Research reveals that a relatively small number of consumers actually own the equipment to watch such experiences, often limiting distribution of VR programs to one-offs at trade shows and events. What’s more, it’s easy to get bogged down in the confusing range of VR formats and headsets now being promoted by various industry players, complicating production decisions. Perhaps most importantly, many travel marketers wonder how to measure the success of VR programs, with some questioning if VR can actually drive business results.

VR Breaks Into Public Consciousness

Sizing the VR Consumer Market

With all the press coverage surrounding virtual reality’s potential for the travel industry, it’s easy to think the opportunity is much larger than it really is. The truth however, is that the money spent on virtual reality hardware and software by consumers is still relatively small.

One of the most recent forecasts of virtual reality activity, the “2016 Virtual Reality Industry Report,” co-published by Greenlight VR and Road to VR, estimated that consumers will own two million VR devices by the end of 2016. The report goes on to estimate that there will be 36.9 million VR units in market by 2020.

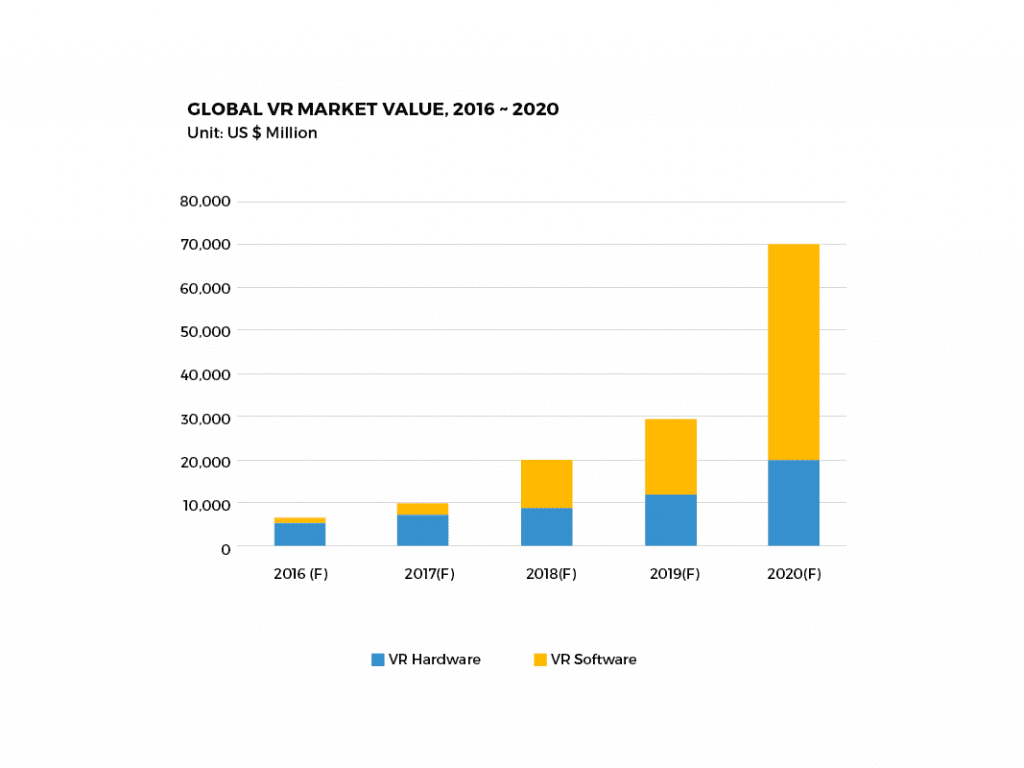

What does that look like for businesses and marketers in dollar terms? Various estimates put the potential value of VR hardware and software purchases worldwide at somewhere between $30 and $70 billion by 2020. Market intelligence firm TrendForce predicted virtual reality hardware and software companies would generate approximately $6.7 billion worldwide in 2016, with the industry predicted to grow to $70 billion by 2020. Another recent study by Digi-Capital suggested that the virtual reality marketplace will be worth $30 billion by 2020.

Market intelligence firm TrendForce predicts the Virtual Reality hardware and software industry will be worth around $6.7 billion globally in 2016.

When examining the size of the opportunity in some of the world’s top consumer markets like the United States and UK, the number is more modest. Deloitte predicts the US VR market will reach $1 billion in 2016, with $700 million of this figure going towards hardware and $300 million towards software. Meanwhile, UK-based Marketing Week predicted the country’s VR market would also approach £1 billion during the same time period.

Despite all the predictions, however, even those close to the VR industry are still not sure how quickly the expected growth will materialize. “Nobody really knows what’s going to happen with this industry and if it’s going to take off with that ‘hockey stick’ type of curve that’s being written about,” said Ando Shah, a VR director and former engineer who’s worked with a number of media companies and brands on VR campaigns.

Consumers and Marketers Confront Proliferating Range of VR Devices and Formats

In addition to the questions about consumer demand, marketers also face questions about what devices to use when making VR content. Because of the relatively early stage of VR adoption, marketers hoping to capitalize on launching such campaigns must pick between competing hardware devices, software and formats. The complexity can make launching a VR marketing campaign all the more complicated.

One of the more confusing factors for marketers to understand when considering virtual reality is the distinction between what’s called “360 Video” and “Virtual Reality,” as the two are often mentioned as the same thing. 360 video, which refers to video or still images created using a camera system that shows a full “360-degree” view of a specific place, gained significantly in popularity after both Facebook and YouTube allowed users (and advertisers) to upload such content to their platforms starting in 2015.

However, as some virtual reality insiders emphasize, 360 video content is not actually true “VR.” Rather it’s an extension of existing film and photography techniques, and one that is not always “interactive” in the sense that viewers can do anything more than simply turn their heads and look around at the nearby scenery. However, the format does have the widest possible distribution potential at the moment. In addition, more and more production companies and platforms associated with the VR space are pushing the 360 format to allow it to offer more interactivity.

Take for example YouVisit, a VR distribution platform and production firm that now offers what it calls “interactive VR.” As YouVisit CEO Abi Mandelbaum explains, “It’s not a single piece of content, but rather multiple pieces, and they have interactive ‘layers’ on top of them.” Essentially, the viewer is offered a series of VR “vignettes,” followed by a pause when users can choose what type of content or experience most interests them for proceeding.

HTC’s Vive is one of a new class of virtual reality headsets that offer “immersive” experiences.

True virtual reality, meanwhile, creates a much more “immersive” environment, complete with sound cues and the ability to interact with objects placed in the virtual world using some type of controller. As Travel Weekly defined it in a recent feature on the technology, VR is “…an eye-covering headset that closes the viewer off to the ‘outside world’ so that they can be completely immersed in the environment. The experience is rounded out by headphones (either attached to the headset or not) and some kind of controllers that allow for interactivity, including the ability to grab onto, push and pull on, shoot at and do just about anything else with or to elements of the environment.”

When it comes to the hardware powering VR experiences, there’s also a significant divergence. At the low end, companies like Google and Samsung both offer low-cost viewing devices that pair with consumers’ existing smartphones. Google Cardboard, perhaps the most popular “VR” viewing device, has shipped more than 1 million viewing devices to consumers according to some experts. “Google Cardboard is great in evangelizing VR and getting people their first experience [with it],” said Ando Shah. “Depending on what phone people use, the experience can be quite convincing even with a $5-10 piece of cardboard.”

Samsung’s Gear VR system, which starts at $99 and works with a number of the company’s smartphones, is another entry-level option. Samsung also offers the added benefit of a built-in “app store” where users can select different types of VR experiences to download to their device. That said, while these devices can be paired with other audio and sensory tools, they’re not nearly as immersive as dedicated VR devices.

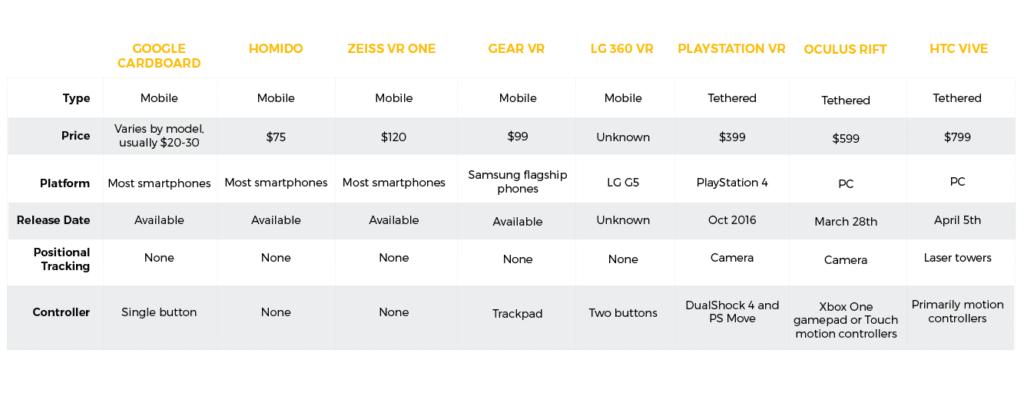

At the higher end of the market are full-feature VR headsets that connect to a computer or gaming console and offer a more immersive experience with sound and in-world interactivity using various types of controllers. Among the devices within this high-end subset are the much-publicized Oculus Rift, which retails for $599, the HTC Vive ($799) and the soon-to-launch Sony Playstation VR, which pairs with the company’s Playstation 4 device. The chart below, compiled by The Verge, offers a basic breakdown of the most popular VR devices:

An overview of the various types of VR headsets and experiences available to consumers.

Also important to the success of VR will be developers who will help create the world’s first “must-have” apps, games and experiences that encourage more consumers and marketers to try them out. “The development of the VR industry is not solely based on wearable devices launched by major hardware vendors such as Sony, Oculus and HTC,” said Jason Tsai, a wearable device analyst at Trendforce. “Much of the growth drive also comes from independent developers that contribute innovative apps to the VR industry.”

Though there’s no clear leader yet in this regard, Google is one organization that’s pushing to create the protocols used by VR game and experience designers in the near future. To further this end, the company has released a number of tools to help designers, including its Cardboard Design Lab and the new “Jump” protocol that lets filmmakers create VR experiences using traditional cameras. “We want this to be for everyone,” said Mike Jazayeri, product director for Google Cardboard, in a June 2015 interview with Bloomberg. “But for travel companies in particular, Jump provides a very natural way to take video of the environments you’d want to visit.”

Consumers Get Excited for VR Travel Experiences, But Need More Education

While it’s clear that the technology and travel industries are already excited about VR, what do ordinary travel consumers think about travel-themed VR experiences? So far at least the results are promising, although more education and product demos are needed to bring VR into the mainstream.

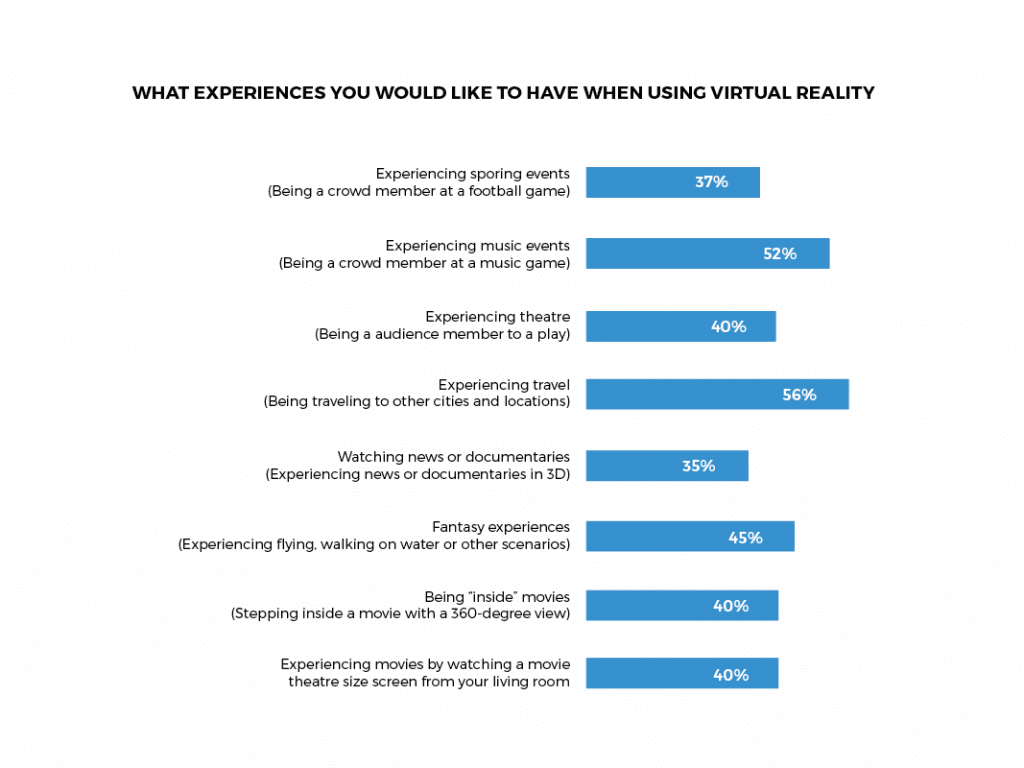

Take for example one recent study of consumer perceptions of VR, conducted by UK-based publisher Marketing Week, which found that “traveling to other cities and locations” was the most popular category of VR experience. In fact, consumers picked travel over other potential VR experiences like sporting events and movies by 10 percentage points or more.

Nearly 60% of consumers mentioned “traveling to other cities and locations” as a top VR experience, suggesting a strong potential for travel brands.

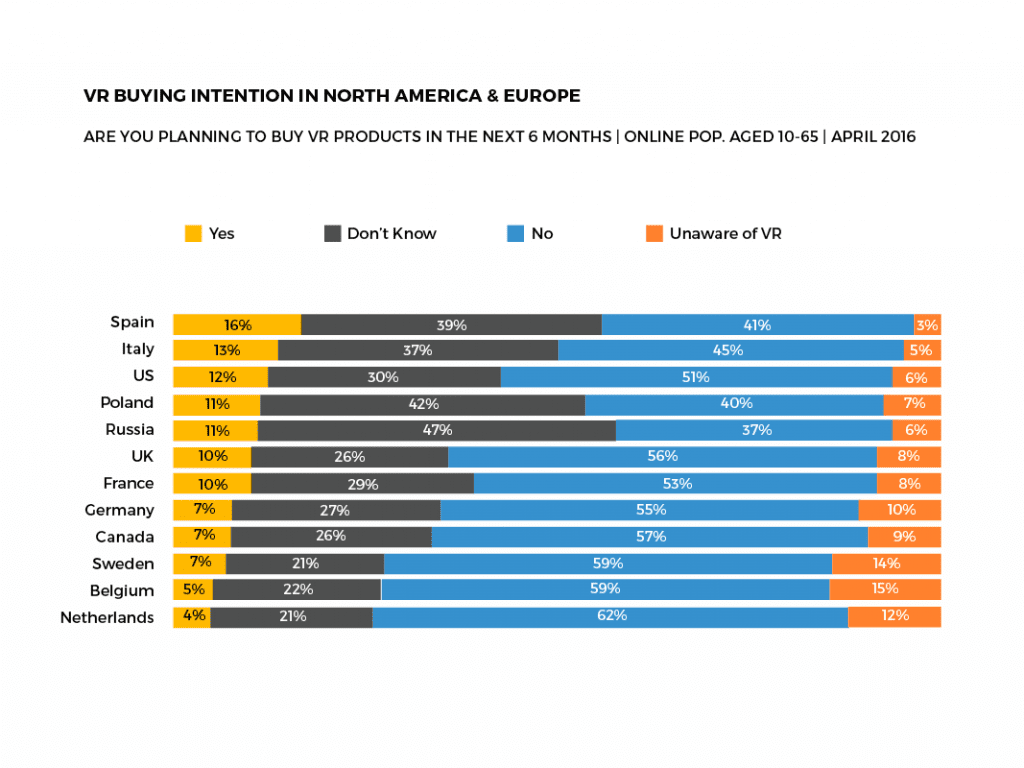

Still, even though many consumers are excited about VR travel experiences, the number of people who intend to buy a VR device in the near future is tiny. Digital gaming research firm Newzoo found that just 12% of US consumers in a recent survey planned to buy a VR product in the next six months.

Digital gaming research firm Newzoo found that 12% of American consumers planned to buy a VR product in the “next 6 months.”

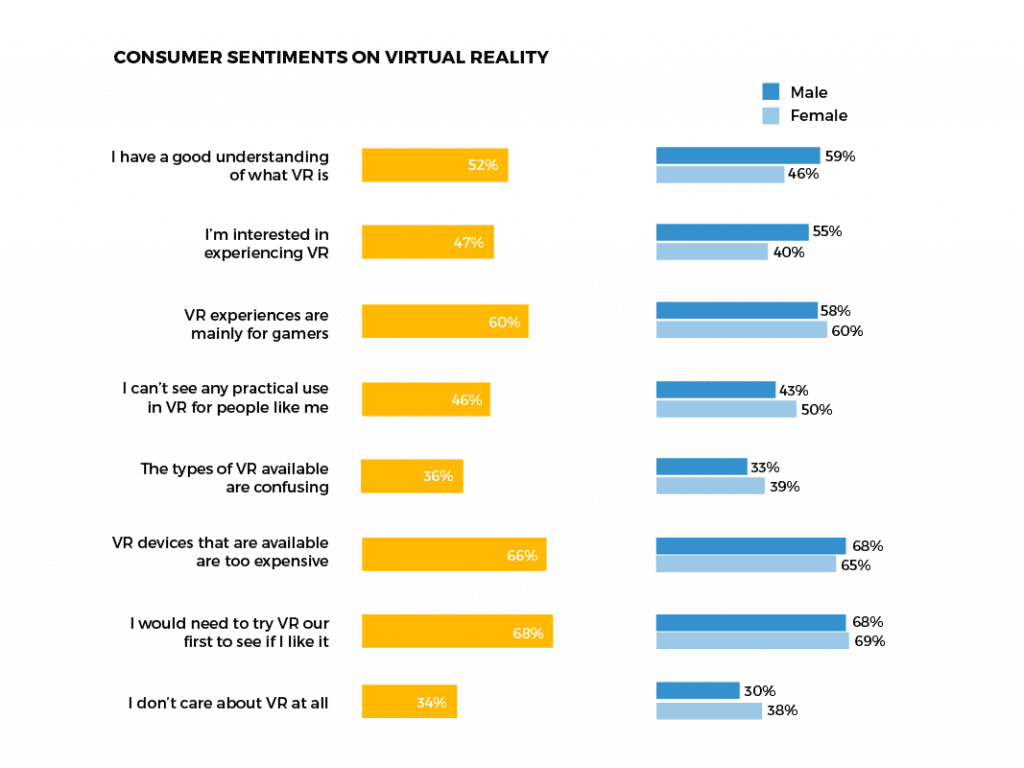

It’s worth noting here that the small number of consumers who say they want to buy VR devices may be due to an education issue rather than a lack of demand. One of the big challenges with tracking consumer interest in buying or using VR devices is that many consumers have little experience using them, making it difficult to accurately gauge who might want one. Take, for example, data from the same Marketing Week study listed above, which revealed that only around 50% of consumers “have a good understanding of what VR is.” Meanwhile, another 68% of respondents said they “would need to try out VR first to see if I like it.”

Only around half of consumers currently “have a good understanding of what VR is,” suggesting more education and trials will help spur wider adoption.

This skepticism among consumers bears out in the number of repeat users returning to VR tools like Google Cardboard. “The number of returning users for Google Cardboard apps is actually quite low,” noted Shah. “What ends up happening is people try it for the first time then it just lies around. It’s not entirely to do with the experience on the Cardboard. A lot of it has to do with access to content. It’s very hard to find the right kind of content, and there is no dedicated ‘app store’ for VR if you have a Cardboard.”

In other words, a truly “transformative” use case for VR technology and a better system for finding such experiences will likely be needed before more consumers start to see the value in VR experiences. “We believe mainstream adoption of [VR gear] will be accelerated by the development of a ‘killer consumer app,’ which will likely come from social networking in virtual reality,” said the authors of a VR report created by Greenlight VR, cited in an April 2016 article by Fast Company.

Also important will be creating an experience that feels comfortable to consumers. If too many people feel awkward wearing unwieldy headsets, or don’t understand what they’re supposed to do during VR sessions, it can make them much more likely to never use the technology ever again. “The user experience, particularly when you are using new technology, is really important,” said Tourism Australia’s chief marketing officer Lisa Ronson during a talk at the 2016 Mumbrella Travel Marketing Summit. “You feel silly enough putting the goggles on your head. If you then don’t know what to do, people will opt out.”

Travel Brands Try to Define VR Best Practices

Even as many consumers remain unsure about VR, travel marketers and the media have jumped into the emerging field with abandon. “For the advertising and brand-building market, it’s getting to be quite big,” said Ando Shah. “A lot of brands are jumping in, not just in travel, but in general.” While some see VR as an opportunity to gain a few quick news stories, for others, the goal is simply to be first to market. “It’s a race right now for content. If you’re first, you win,” said Tony Berger, founder and CEO of Relevent, an experiential marketing firm that worked with Marriott on the chain’s first VR program.

But even as many brands are running to be first to market, many others are hoping for more best practices and case studies to emerge to help them build the right type of VR experiences. “Now that the hype’s started to die down, and [marketers] are accepting that virtual reality is a part of their content mix, we’re encouraging them to look at their business and understand what part of their brand experience works better in VR than anything else,” said Visualise’s Christian Burne. Aside from the basic questions about how to create such content, many travel marketers struggle to know how to promote and distribute VR campaigns. This is to say nothing about what such experiences cost or how to successfully measure the ROI of such initiatives.

With these various questions in mind, Skift has compiled the below list of VR best practices gathered from conversations with a variety of travel marketers. It’s also worth noting that most of these best practices reflect the assumption (for now) that most VR production is focused on 360-video experiences. As more consumers and hardware manufacturers adopt true immersive VR, it’s likely more attention will be spent on understanding these experiences down the road.

Create Compelling Content

For travel marketers interested in VR, the most important question is often, what should they create? Most VR industry insiders that spoke with Skift suggest the key is to focus on original content rather than trying to repurpose an existing 360-degree video. “Most brands are creating their own original content,” said YouVisit’s Mandelbaum. “Number one, it’s not like video where you have a lot of stock footage [available]… number two, because the brands that are investing in VR want to ‘do it right.’”

With original content, another key question is cost. Sources familiar with third-party VR production companies say the typical shoot can range in price from anywhere between $15,000 and $100,000, though others emphasize that shoots can be fairly cheap given the newer consumer VR cameras that are now coming to market. “The basic building blocks are not hard at all. You don’t need to spend too much money,” emphasized Shah. “It’s effectively the same budget that you would do for a short travel video if you get one of these [low-cost consumer VR] cameras.”

Samsung’s entry-level Gear 360 VR Camera has dramatically reduced the cost of producing 360-degree video experiences.

Once the production budget is established, the next question is what type of experience to create. For many VR video veterans, the key is to simply experiment and focus on capturing a truly immersive, engaging experience. “Right now, the trend is ‘don’t bother with story,’ especially for simpler pieces. Just concentrate on immersion,” said Shah. “Telling stories is much harder, especially because [the cinematic] language is not written. How do you ‘do’ cuts? How does sound work? All of these are important questions that are being figured out right now.”

Other marketers like those at Tourism Australia caution that just because something is shot in VR doesn’t by default make it compelling for consumers. “The one thing about VR, and some brands are getting it right, others not so much, is that it doesn’t make something that is really boring suddenly interesting,” said Tourism Australia’s Lisa Ronson. “It sounds obvious but there are some brands that are going ‘oh, let’s sell our product by doing VR.’ But if the product doesn’t lend itself [to VR] don’t force it. It’s about looking at what the consumer is going to find interesting.”

Finally, marketers emphasize the need to leave enough time in video shoot timetables to properly capture VR content. “We all know 2D shoots are hard, particularly in tourism when they are subject to the weather, as we experienced,” said Ronson. “But if you are going to do VR, incorporate it into the shoot and make sure you allow plenty of time for pre-production so you are not making decisions on the fly.”

Figure Out Distribution and Promotion

Once a VR experience has been created, the next question is where to share it. “The biggest stumbling block with VR for travel [right now] is if you want to get it to the consumer, how do you get it to the consumer?” said Ando Shah.

For many executives familiar with VR campaigns, the principal channel right now for showcasing VR experiences is in person at trade shows and sales meetings using demos built for actual VR headsets. As for online options, the two biggest distribution channels are Facebook and YouTube, which both launched support for 360 video experiences in 2015. Beyond the two internet giants, Samsung also offers its own 360 video website, SamsungVR.com, as do other companies like YouVisit. “Right now you have so many different devices, so many different platforms because the industry is still in its early days,” said YouVisit’s Mandelbaum. “The way we manage that goes back to our software platform. We built a player that works on any device.”

On top of this is the question about how to promote such experiences to potential viewers. For too many brands, the answer to this question is simply PR, though some VR industry executives suggest this isn’t nearly enough. “When it comes to VR, they’re just happy doing a PR stunt,” said Mandelbaum. “You should treat VR just like every other aspect of your business. It should be an initiative that’s done with the goal of driving results.”

For those who are looking to promote their VR experience using paid media sources, YouTube allows ad buyers to promote 360 videos within its existing TruView Ad format. Facebook began offering advertisers a similar capability to promote 360 content using its own ad platform in November of 2015.

Know How to Measure Success

How should a travel brand measure VR? The answer for now depends on who you ask. “It’s important to recognize that the industry is in the early days of VR as a medium for brand advertising, and as such, measurability remains a challenge,” said Sean Whitmore, a senior analyst for VR Intelligence firm Greenlight VR in an interview with Travel Weekly. “Despite the challenge of measurability, some marketers are achieving impressive organic reach and millions of earned media impressions, while consumers are reacting very positively.”

For Tourism Australia, the key engagement metric for its 360 video program has been engagement. The destination organization claims the content has resulted in a significant spike in time spent on its Australia.com website, with the average viewer now spending 8 minutes and 30 seconds on the site. The time spent is a 64% improvement since before the campaign started.

For the team at YouVisit, however, there’s been a concerted push to use interactivity in VR content to help facilitate better insights. “We’ve built a whole suite of analytics that enable brands, destinations and hotels to understand what’s happening with their virtual experience,” said Mandelbaum. “Not only what devices are people using to see the VR experience but how much time they’re spending on it and which elements of the experience they’re most interested in.”

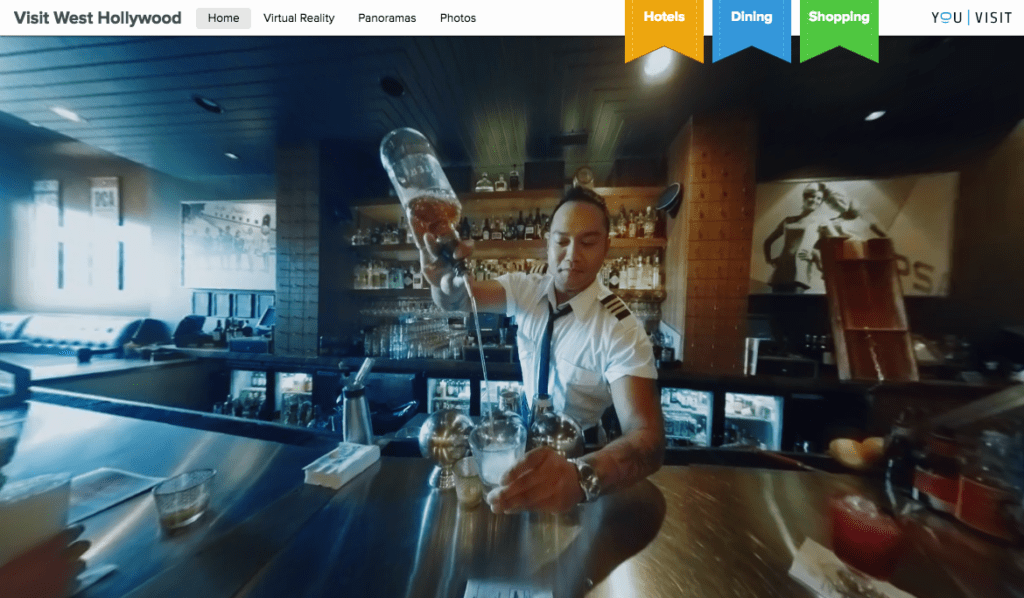

A screenshot from Visit West Hollywood’s interactive virtual reality experience created by YouVisit, which lets viewers click through for more information on topics like hotels, dining and shopping.

Mandelbaum referred to his company’s program with Visit West Hollywood as one example of how to measure VR programs. “For a client like Visit West Hollywood, their experience enables the user to interact [with the VR] in different ways,” said Mandelbaum. “If you are interested in learning more about what you can do as a family in West Hollywood versus interesting shopping versus interesting entertainment. So they can see how much time users are spending in each one of those areas. That lets them derive the kind of information that’s going to inform their future marketing campaigns.”

As Mandelbaum explains, when you capture this type of information across thousands of VR experience views, you begin to have a sense of what content and attractions are gaining the most traction, providing useful feedback for marketers to calibrate future messaging. “The interactive component is what enables you to gather that information. If not, you have a single video and no idea what people are interested in. All I know is whether they watched the video or not.”

How Other Travel Marketers Are Making Use of VR

Although VR best practices appear to still be in development, that hasn’t stopped a number of travel brands from taking the plunge. Two of the most prominent examples of successful VR campaigns come from Marriott and Thomas Cook.

Marriott offers a great example of how a brand can test the waters of VR across a variety of formats. The company launched a fully-immersive VR campaign using the Oculus Rift in 2014, followed by another test in 2015 that leveraged 360-degree video. Thomas Cook, meanwhile, is a great example of how travel brands are using VR experiences to drive business results.

Marriott – VR Postcards and Teleporter

Because the field of virtual reality travel marketing is still relatively new, many travel brands are still in an experimental phase, testing out different experiences to look for ways to get travelers excited about future purchases. Marriott is one travel brand that’s been quick to test out the medium, launching two different VR campaigns called “Teleporter” in 2014, and another called “VR Postcards” in 2015.

Marriott Hotels was among the world’s first travel brands to test a VR program, launching their “Teleporter” virtual experience using the Oculus Rift headset in 2014.

For Teleporter, Marriott built two custom telephone booth-size cabinets paired with Oculus Rift headsets, offering consumers an immersive chance to visit London and Hawaii. In addition to the normal visual and audio cues provided by the Oculus headset, Marriott added real-life wind, ocean smells and sun to the “telephone booths” to help add to the experience. The two kiosks traveled to eight different Marriott properties throughout the U.S. in fall 2014.

In 2015, Marriott built on its Teleporter campaign by launching the “VR postcards” program. Guests at the hotel chain’s New York and London properties could request the room service delivery of a Samsung Gear VR headset pre-loaded with three different virtual travel “stories” from Chile, Rwanda and China.

For Marriott executives, the two programs were less about driving specific business goals than about getting younger tech-savvy consumers excited about Marriott and travel. “For a hotel brand, inspiring travelers to take a trip is an important part of marketing,” said Michael Dail, vice president of global brand marketing for Marriott in an interview with Consumer Reports. “For so long, people could have only static, 2D experiences — flipping through photos or watching a video.” In fact, as Dail emphasized, most consumers who tried out the VR Postcards came away from the experience looking to do more traveling. “Everyone took off the headset and said, ‘I want to go there. I want to see that view.’”

As the VR medium continues to evolve, Dail even thinks that consumers may get the chance to create VR experiences of their own to share with friends and family. Marriott’s two VR tests, in other words, helped to position the brand as a company that understood these values. “We wanted to add a storytelling element because so many millennials are content creators themselves, you know they are on snapchat or Instagram sharing their travel stories,” said Dail. “It is really those kind of entrepreneurial insights of what motivates people and what they take away from travel, both professionally and personally.”

Thomas Cook – Try Before You Fly

Even if VR still seems experimental to some travel brands, not all executives are content to simply test them out as a fun novelty deployed at trade shows and one-off events. For executives at UK-based travel agency Thomas Cook, VR experiences have very quickly proven to be a powerful marketing tool to help drive actual sales. “We see virtual reality as an innovation that will change the travel business,” says Marco Ryan, chief digital officer for Thomas Cook Group in an interview with Bloomberg. “The closer you get to the destination, the more excited you are to have that experience.”

In an effort to try and drive increased bookings to some of its most popular travel packages, the agency launched the “Try Before You Fly” virtual reality campaign in 2014. Working with virtual reality production company Visualise, Thomas Cook built 12 different 360-degree video experiences, including a helicopter tour over Manhattan plus visits to the Great Pyramids and a resort in Greece. The agency then sent a low-cost Samsung Gear VR headset loaded with the videos to 10 branches of its offices in the UK, Belgium and Germany.

The early results of the efforts have been extremely promising. Thomas Cook partner Visualise reports the campaign directly contributed to $17,000 in flights and hotel bookings in the first three months after launch, a 40% return on investment. And some of the featured videos have been even more successful. Thomas Cook reports that the video helped boost revenue from their New York package tour excursions by 190%.

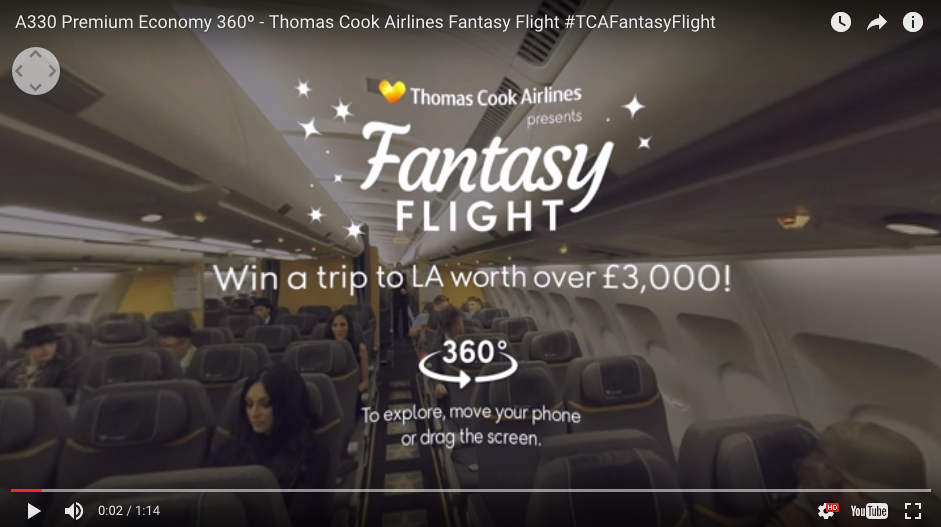

A preview of the 360-degree video campaign used by Thomas Cook to help show travelers the interior of its new long-haul aircraft.

“This is a huge sales tool that’s scalable and affordable,” said Ryan. The campaign was so successful, in fact, that Thomas Cook has launched a wider version of its initial VR program. In June 2015 the company mailed 5,000 targeted brochures accompanied by Google’s low-cost Cardboard viewing device to potential customers to help them better experience potential travel packages.

The agency has further expanded on its VR plans in 2016 with a new 360-degree video experience distributed on YouTube that lets customers take a virtual look inside the cabins of some of its long-haul A330 planes that fly between Manchester and Miami, New York, Boston, Los Angeles, Orlando and Las Vegas.

Key Takeaways for Travel Brands Interested in VR

360-video is good enough (for now). More immersive VR devices like the HTC Vive and Oculus Rift offer amazing examples of where the VR industry may eventually head. But consumers are not there yet. 360 video is the way to go for now, due to the wide variety of devices that can display it and the relative simplicity of production.

It’s all about the content and storytelling. As obvious as it sounds, make sure that any VR content you create is truly compelling and exciting for consumers to watch. Just because a consumer can see a “virtual” view of a hotel room or walk through a cruise ship in 360 degrees doesn’t by itself make a VR experience compelling. Think about what will get your consumers excited in real life and then work from there.

VR’s “newness” means experimentation is key. Because the VR industry and consumers haven’t yet settled on a de facto method to watch and find content, there’s lots of flexibility right now. Don’t be afraid to test out different types of content experiences to get a sense for what consumers like and what works best in the medium.

Push distribution beyond a PR campaign. The novelty of VR means it’s the perfect fodder for getting a quick PR hit in the travel trades and at industry events. But that doesn’t mean there aren’t distribution and promotion options online. New ad units from Facebook and YouTube offer new methods to get your brand’s VR content in the hands of consumers.

Make your first VR experience count. Travelers are excited about VR, but still skeptical. The combination of strange-looking headsets and unfamiliar user interfaces means your first campaign may require some incentives, education and compelling content to get travelers interested.

Measuring success doesn’t have to stop at engagement. The tendency with new technologies like VR is to simply measure their success using more intangible metrics like engagement or impressions. But as brands like Thomas Cook have demonstrated, VR can actually drive business results. Don’t be afraid to experiment with ways to track harder business numbers on VR campaigns.

Endnotes and Further Reading

- “How Virtual Reality Is About to Transform the Travel Industry,” Inc.com, February 2016.

- “Travel Marketers Embrace Virtual Reality as the Next Big Thing,” Associated Press, December 2015.

- “Will Virtual Reality Revolutionise the Travel Industry?” eConsultancy, June 2015.

- “Virtual Reality Check,” Travel Weekly, January 2016.

- “It May Take Years for Virtual Reality to Go Mainstream, Says New Report,” Fast Company, April 2016.

- “TrendForce Forecasts VR Market Value to Hit US$70 Billion in 2020 as Innovative Apps Enrich This Industry,” Trendforce.com, February 2015.

- “Augmented/Virtual Reality to hit $150 Billion Disrupting Mobile by 2020,” Digi-Capital, April 2015.

- “Virtual Reality (VR): A Billion Dollar Niche,” Deloitte, 2016.

- “The Ultimate VR Headset Buyer’s Guide,” The Verge.

- “How Oculus and Cardboard are Going to Rock the Travel Industry,” Bloomberg, June 2015.

- “Consumers Are Most Drawn to Travel and Music Experiences on Virtual Reality,” Marketing Week, June 2016.

- “VR Buying Intention in Europe and North America: Spain Leads in Interest, Canada in Budget,” Newzoo, April 2016.

- “Don’t Use VR If Your Product is Dull, Warns Tourism Australia Marketing Chief,” Mumbrella, April 2016.

- “YouTube 360-Degree Video Comes to TrueView Ads,” Marketing Land, July 2015.

- “Facebook Unleashes VR-Style 360 Videos for Ads and iOS,” TechCrunch, November 2015.

- “Tourism Australia Introduces Chris Hemsworth as Its New Crocodile Dundee,” Skift, January 2016.

- “Virtual Reality Goes Mainstream,” Consumer Reports, January 2016.

- “Marriott’s Storytelling Strategy Takes a Turn With Virtual Reality,” Skift, September 2015.

- “Thomas Cook’s Mobile VR Allows Travelers to Try Before They Fly,” The Drum, March 2016.