“It was in America that the commercial possibilities were understood much more quickly, particularly in the great state of California. […] They had the first-mover advantage but slowly and surely Europe is catching up.” - David Soskin, Partner and Co-Founder at HOWZAT Partners

Report Overview

This report highlights recent and historical funding trends in Europe’s turbulent travel technology startup scene. Despite an uncertain geopolitical and economic climate, the travel industry in Europe continues to attract new funding rounds with some successful exits. The recent acquisitions of Skyscanner by Ctrip Holdings and Momondo Group by Priceline highlighted an appetite on behalf of global players for European travel tech brands.

Overall, Europe’s funding has been capped due to venture capital being considered a risky investment. The funding that has flown toward the continent remains mostly concentrated within the trio of well-established tech hubs in London, Paris and Berlin. In this context, smaller cities have also gained traction as cheaper alternatives to the gateway cities, particularly as Europe’s entrepreneurial culture matures. The accompanying dataset illustrates the discrepancies between European capitals when it comes to funding in travel, and lists the largest travel companies founded in Europe during the 21st century.

What You'll Learn From This Report

- Overview of Europe's Travel Tech Landscape

- Sources of Venture Capital in Europe

- Exits and M&A in Europe

- The Rise of New European Travel Tech Hubs

- Data Dive into European Travel Funding Rounds

- COMPREHENSIVE EXCEL DATA SHEET INCLUDED

Executives Interviewed

- Naren Shaam, CEO of GoEuro

- Maximilian Waldmann, CEO of conichi

- Morgann Lesne, Partner at Cambon Partners

- David Soskin, Partner and Co-Founder at HOWZAT Partners

- Sean Seton-Rogers, Partner at PROfounders Capital

List of Figures

- Downloadable Excel Data Sheet

- The Digital Single Market

- Brexit's Impact on Entrepreneurs

- Europe's Regulatory Climate

- Startup Employment in Europe

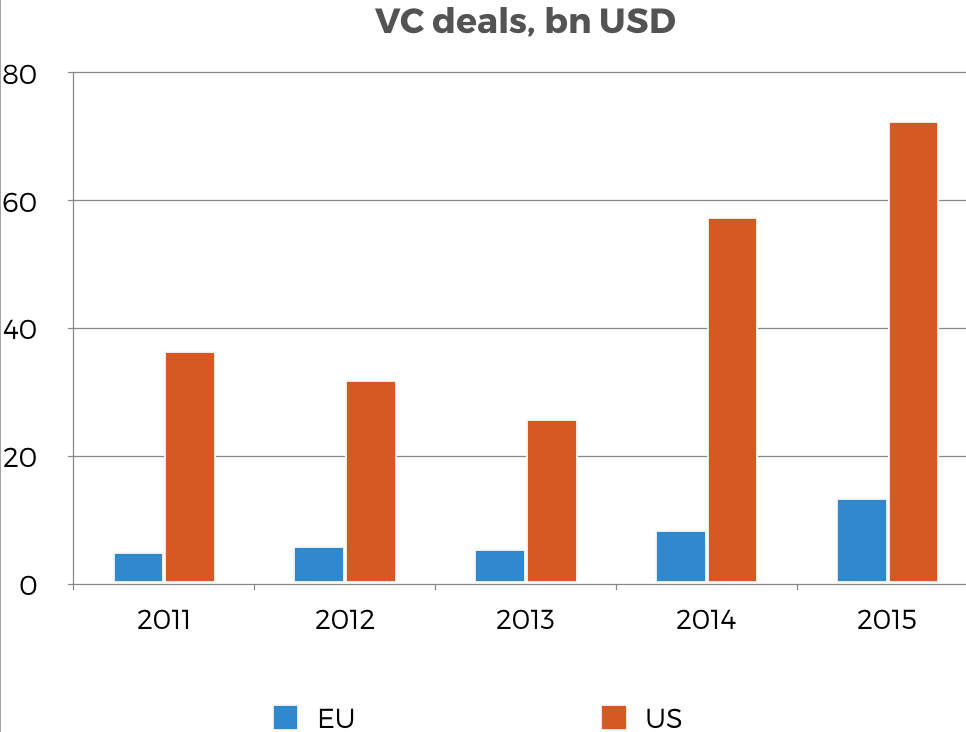

- VC Deals U.S. Vs. Europe

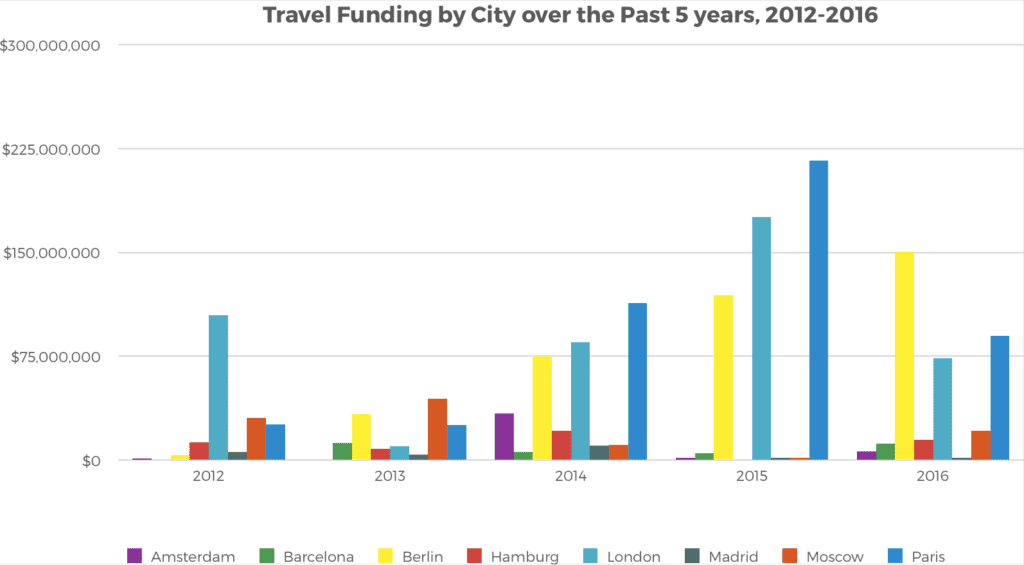

- Travel Funding by City

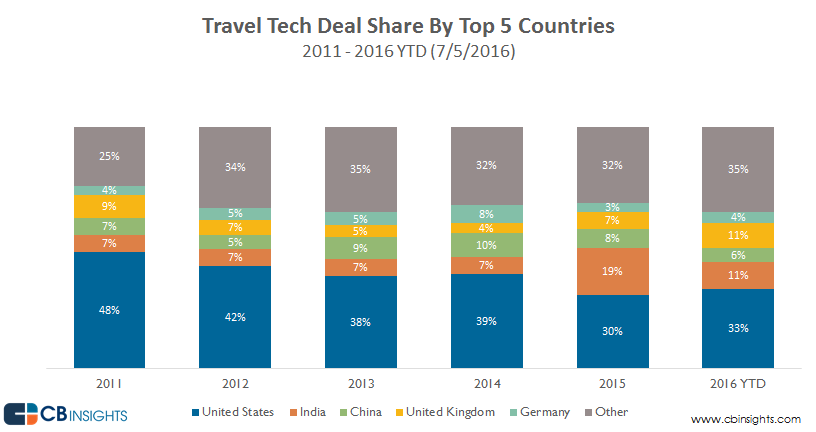

- Share of Travel Funding by Country

Introduction

Europe has traditionally been a fertile market for travel tech startups. From Booking.com’s founding in 1996 to the most recent acquisitions of Skyscanner and Momondo, Europe has played a strong role in the global travel tech industry.

Venture capital allocated in Europe is still a fraction of the capital allocated in the U.S., with a particularly strong lack of funds at early stages. As a whole, Europe has seen strong growth economically, mostly during the second decade of the 21st century, and has seen new tech hubs develop throughout the continent. The startup capital disparity between Europe and the U.S. can be attributed to multiple factors, including a lack of funding at early stages and Europe’s general risk averseness.

The output of unicorns (startups valued at USD one billion and above) in Europe is far lower than in the U.S. across all industries. While Europe counts and celebrates its unicorns, the U.S. is starting to count decacorns ($10 billion). Track record and history is a factor that motivates private individuals to invest in startups at the earlier stages, and larger pension funds at the later stages, which make up the majority of U.S. VC capital. Europe is traditionally more risk averse than the U.S., and even today pension funds regard venture capital as a high-risk investment.

London, Berlin and Paris make up the European trifecta of tech hubs, a landscape which is reflected by the travel tech scene. Yet the expansion of larger companies across Europe’s capitals has concentrated talent across the continent ranging from Spain and Portugal to Scandinavia and over to Russia and Turkey.

Accompanying this research report is our European Venture Capital Investment Landscape 2017, a comprehensive data dive into European travel. The data sheet includes travel funding rounds ranging from 2010 to 2016, as well as a list of the most funded European startups of the 21st century.

The European Landscape

To reach roughly the same population as in the U.S., a European company needs to operate in Germany, France, the United Kingdom, Italy, and Spain, which would expose it to nine officially spoken languages, vast cultural differences, different laws per country, and two currencies. Beyond the issue of being a fragmented market, Europe and the European venture capital investment have also traditionally been more risk-averse. On the whole, Europe has less money than the U.S. and therefore looks to spend it wisely and securely.

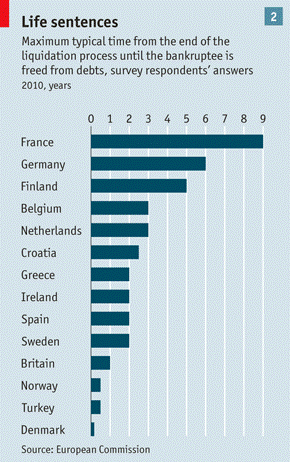

The regulatory climate across European countries differs from state to state, and as a whole, Europe has some of the toughest laws regarding liquidation, labor, and even severance. While the regulatory climate puts a heavy burden on entrepreneurs, innovation and startups have become more popular over the years. Yet comparatively, they still represent a fraction of the startup scene in the U.S.

Nevertheless, Europe also has attractive elements for entrepreneurs. It has a strong supply of engineers and developers, which can be hired at vastly cheaper rates compared to the U.S. Overall Europe also has a strong economy, particularly in the countries where the trio of tech hubs are located. Today’s Europe also has a multitude of government programs supporting startups and innovation including Startup Delta in the Netherlands, Innovate UK, German Accelerator, and La French Tech.

Europe, a fragmented market

Europe has historically been a very diverse and fragmented continent. Although roughly half the size of the U.S., Europe hosts 50 sovereign states, 225 indigenous languages, and before the establishment of the Eurozone, had different currencies in almost every sovereign state. Even today roughly 25 different currencies circulate through Europe.

Different regulations, cultures, and languages have been longstanding barriers for companies looking to expanding throughout Europe. The first treaties looking to create a single European market were passed post-World War II: the 1958 Treaty of Rome led to the creation of the European Economic Community and the 1992 Maastricht Treaty officially created the European Union and thereby the Euro. While both treaties’ intention was to create an open and accessible market, they did little for the small and medium size enterprises, particularly the upcoming digital ones.

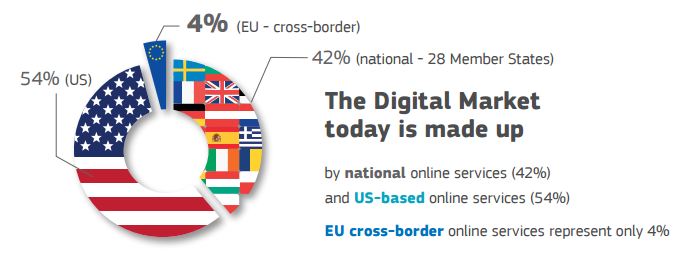

Europe is clearly not perceived as one market by smaller companies. In fact, most small digital companies operate exclusively in their domestic market. According to the European Commission, just seven percent of SMEs trade across borders, and when they do it’s usually in a handful of neighboring countries.

Some of the major challenges include language and culture. Expanding to every European country would require companies to support 25 languages and integrate into those consumer cultures, which can often be very diverse.

“The level of complexity is higher in Europe to grow a company; the domestic market has nothing to do with the U.S. one. In the U.S. you have immediate access to 320 million people who speak the same language and have the same habits,” says Morgann Lesné, Parter at Cambon Partners, which provides advisory services for M&A and corporate finance. “Very few companies out of Europe have been able to diversify geographically.”

In response to the barriers faced by SMEs in Europe Juncker’s Commission announced its plans for a Digital Single Market (DSM) in May 2015, built upon three major pillars:

- Access: better access for consumers and businesses to digital goods and services across Europe

- Environment: creating the right conditions and a level playing field for digital networks and innovative services to flourish

- Economy & Society: maximizing the growth potential of the digital economy

The European Commission estimates that an online service looking to expand into a new European country will incur roughly €9,000 to adapt and comply with the foreign regulations, after which online businesses will face at least €5,000 in VAT compliance cost for every state it operates in. It also estimates that a fully operational DSM could contribute upwards of 400 billion euros a year to Europe’s economy.

Brexit

One of the most notable recent events in European politics was the UK’s 2016 EU Referendum. The UK’s decision to leave the EU was an unexpected result for many. The potential impact on the economy had been a topic of debate ever since David Cameron announced that he would let the people vote on the decision. The leave side argued that the UK would have stronger positioning without EU regulation, while the stay side argued that the EU was essential for the UK.

Many experts, among them the government itself, predicted that leaving the European Union would have a strong and immediate negative impact on the British economy. While the pound “crashed” as the results were announced, in the months following the vote, UK stock markets have risen and the current state of the economy seems to be growing.

In early 2017 the UK government released “The United Kingdom’s Exit From and New Partnership With the European Union” whitepaper, which outlines the government’s plan to exit the EU. Regarding the single market, the paper reads: “We will not be seeking membership of the Single Market, but will pursue instead a new strategic partnership with the EU, including an ambitious and comprehensive Free Trade Agreement and a new customs agreement.” The UK imports $200 billion a year from Germany, the Netherlands, and France alone and roughly $400 billion from Europe as a whole, giving it a strong negotiating position.

Article 50 of the Lisbon Treaty, is expected to be triggered Wednesday 29th of March, and thereby negotiations with the EU would officially commence.While many questions remain on the impact Brexit will have on the UK, entrepreneurs remain confident and say that London is essential for the European startup scene for the access to talent.

“We’re actually looking at possibly opening a second location. […] For talent, the UK is still a good market, amazing talent. If anything the cost of labor went down for us because of the currency,” said Naren Shaam, CEO of GoEuro.

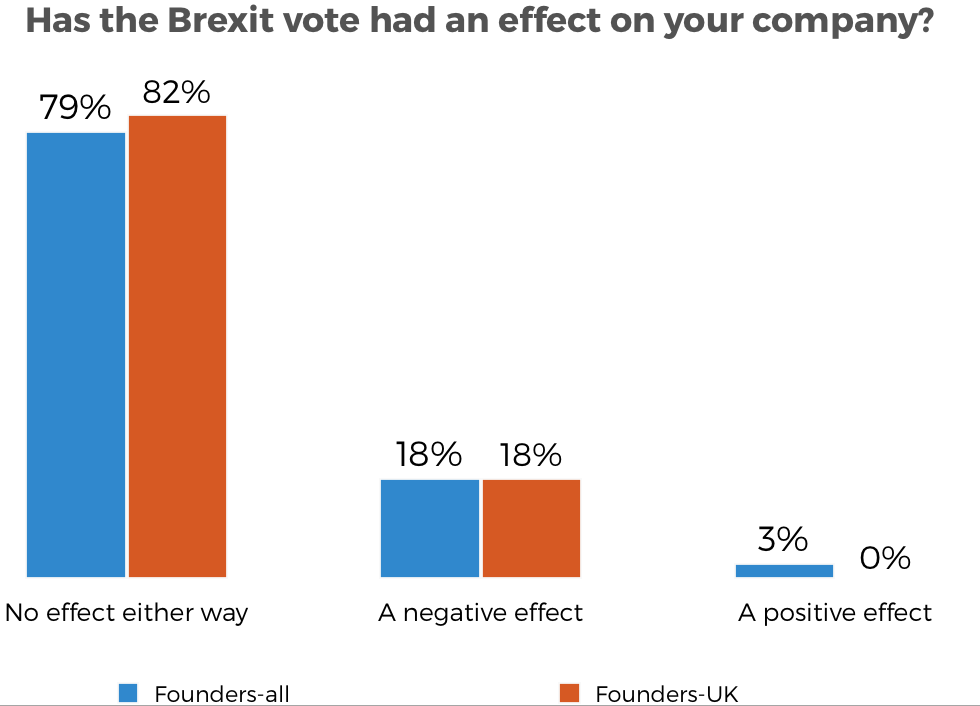

A late 2016 study by VC fund Atomico found that 82 percent of UK founders and 79 percent of all founders had not been affected by the Brexit vote. Eighteen percent of founders indicated a perceived negative effect, stating uncertainty, currency fluctuations, and impact on the market as major concerns.

Source: Atomico

Source: Atomico

In part, the UK has been a focal point for U.S. companies entering the European market, serving as a gateway to Europe. As article 50 has not been triggered yet, and negotiations are set to take at least two years, any estimate of the impact would be pure speculation. In the meantime, Facebook and Google has committed to their expansions in London.

Regulatory Climate in Europe

The regulatory climate throughout Europe differs from country to country, which can also hinder companies rapidly expanding across the continent.

As a whole, Europe has some of the toughest laws regarding liquidation, labor, and severance. An entrepreneur who goes insolvent with his company can expect to be cleared of his debt after a year in the UK, and usually quicker in the U.S. In France on the other hand, it can take up to nine years for a fresh start and in Germany up to six years, with the risk of being barred from ever assuming a senior role at a large company.

U.S. “at-will” employment is also practically nonexistent in Europe. In states like Germany and France, employers will have to adhere to laws that tend to favor the employee over the employer, and by law will have to contribute up to 50 percent of the employee’s health insurance, pension, and social security contributions.

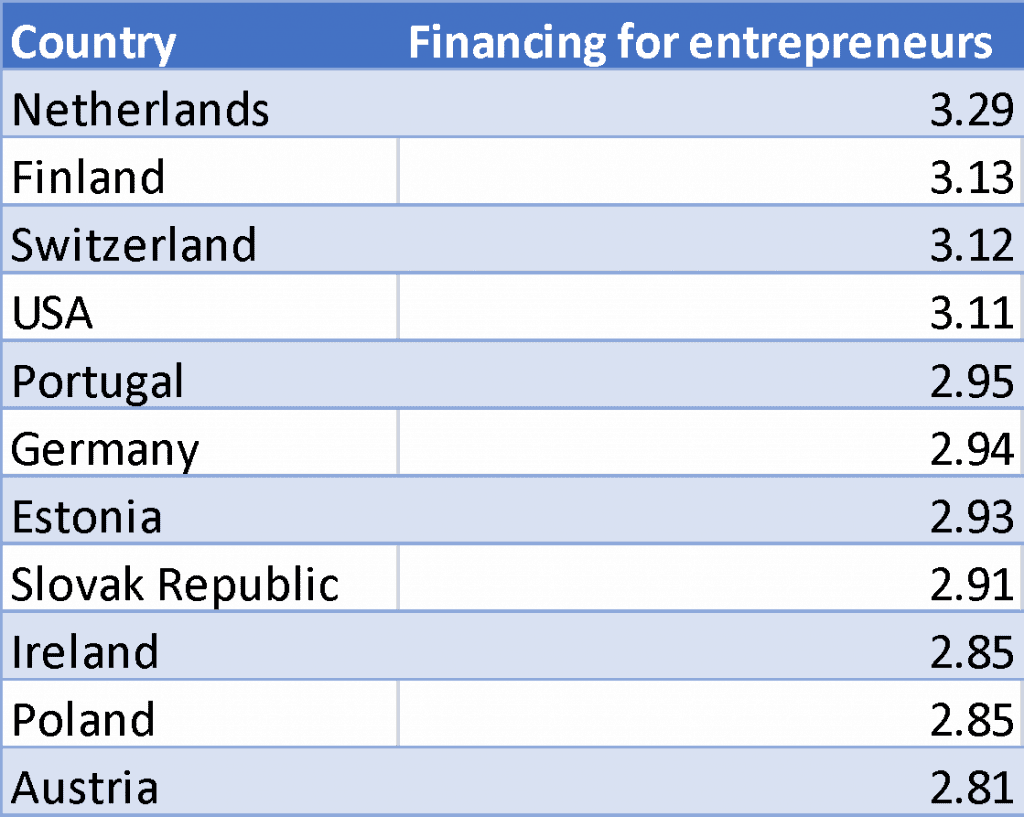

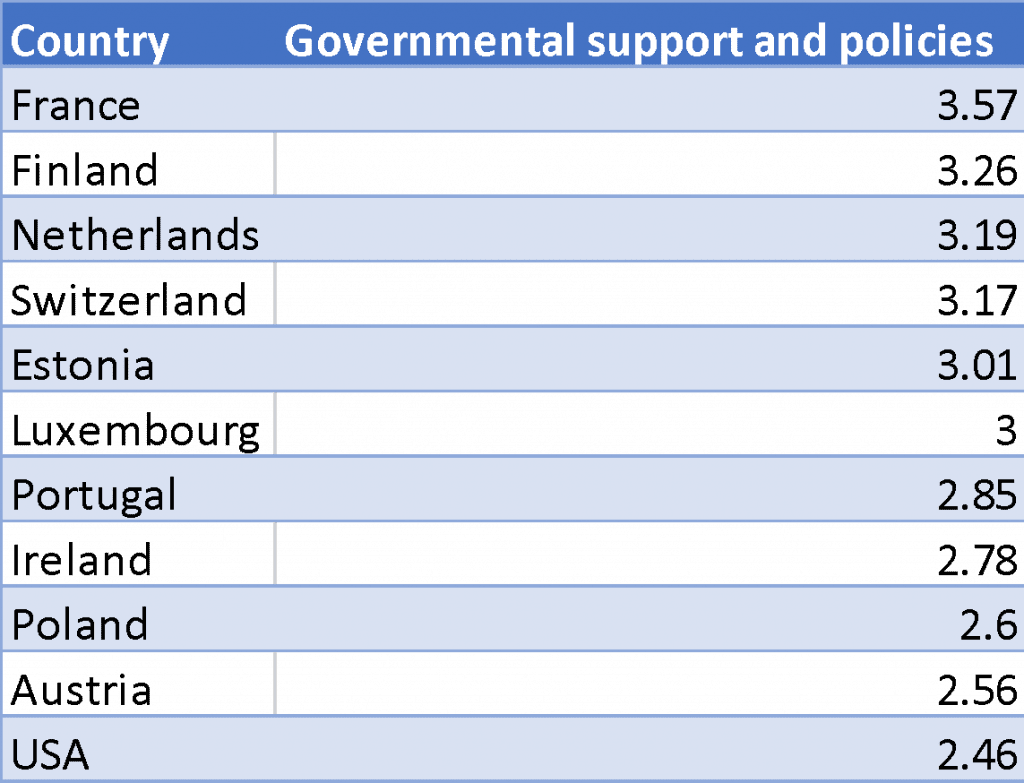

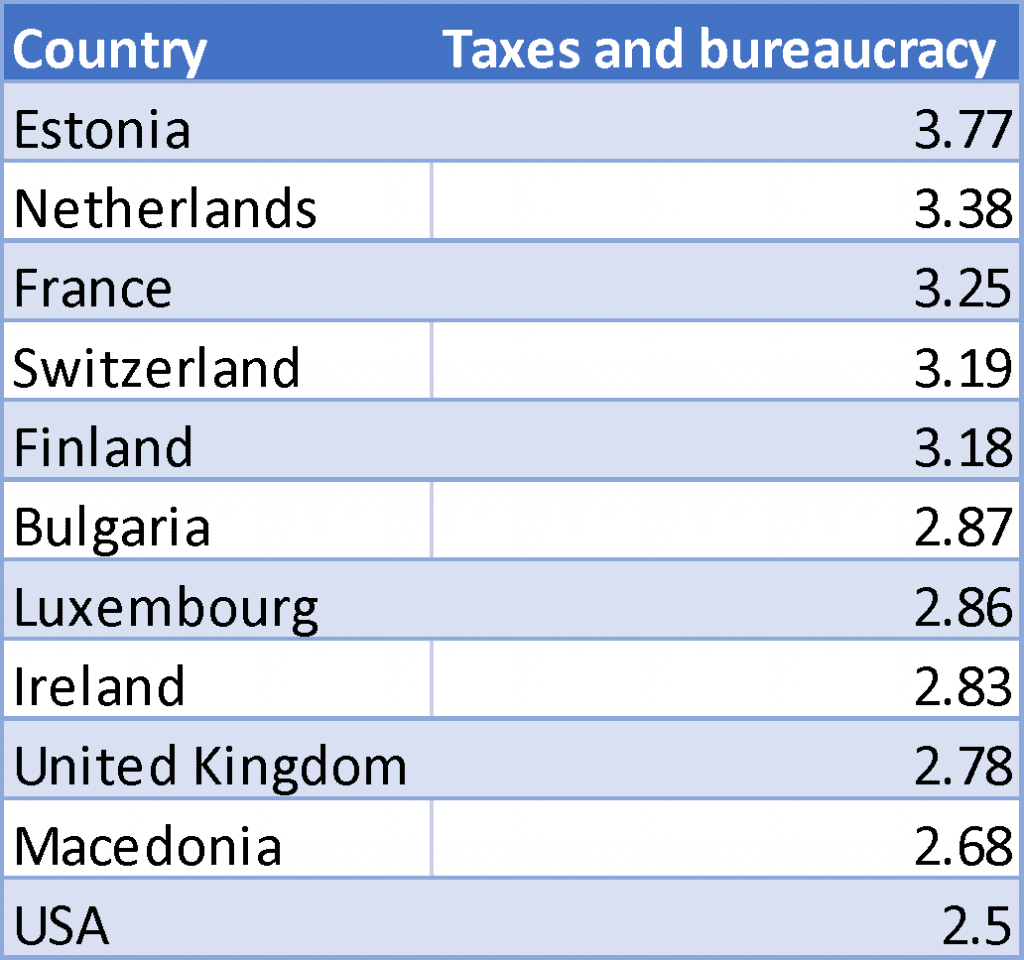

The ease and cost of doing business in Europe also varies considerably by country. The Global Entrepreneurship Monitor (GEM) ranks countries by various categories pertaining to the ease of being an entrepreneur. When comparing European countries to the U.S., it draws a picture of how diverse Europe is.

The well established tech hubs are not strictly the best in which to start a business, according to the GEM, which may indicate that the political environment is not the key driver in startups and innovation. In a similar vein, David Soskin — co-founder at HOWZAT, a European investment fund with a strong focus on travel — argues that “the success of Silicon Valley did not come out of a great directive out of bureaucracy from Washington.”

What the top tech hubs do have in common is a fairly free market and a stable economy. More heavily regulated countries such as Russia and China tend to produce more copycat companies rather than producing innovative startups with global potential, due to stronger regulation but also somewhat of a cultural dislike toward western products.

The French government has been active in seeking tech and entrepreneurial talent. Although traditionally a more regulated environment, the government has sought to create an environment suitable for entrepreneurs. Not only does it provide support for French startups, but it’s also seeking to attract talent from abroad by offering a tech visa, initial funding and an incubator program.

When it comes to bureaucracy and taxes, Germany is often considered a nightmare. The country ranks 11th in Europe on the GEM’s tax and bureaucracy ranking. Starting a limited liability company in Germany requires initial capital of €30,000 on top of paperwork and notary costs. The government recently introduced a “mini-company,” allowing startups to later transition to the normal version when they reach the required capital.

In comparison, opening the equivalent company in the UK, a limited company, takes less than a day and only requires a £12 online payment and no initial capital requirements.

Startup culture in Europe

The startup scene and entrepreneurship culture are fairly recent developments in Europe. Although becoming an entrepreneur is becoming more popular, even today Europeans overall are less interested in becoming entrepreneurs. A study by the European Union found that only 37 percent of Europeans would like to be self-employed, compared to 51 percent in the U.S. and China.

The overall difference between Europe and the U.S. again comes into play when considering the culture of innovation. Working in a startup has much more risks than joining a large company and working until retirement.

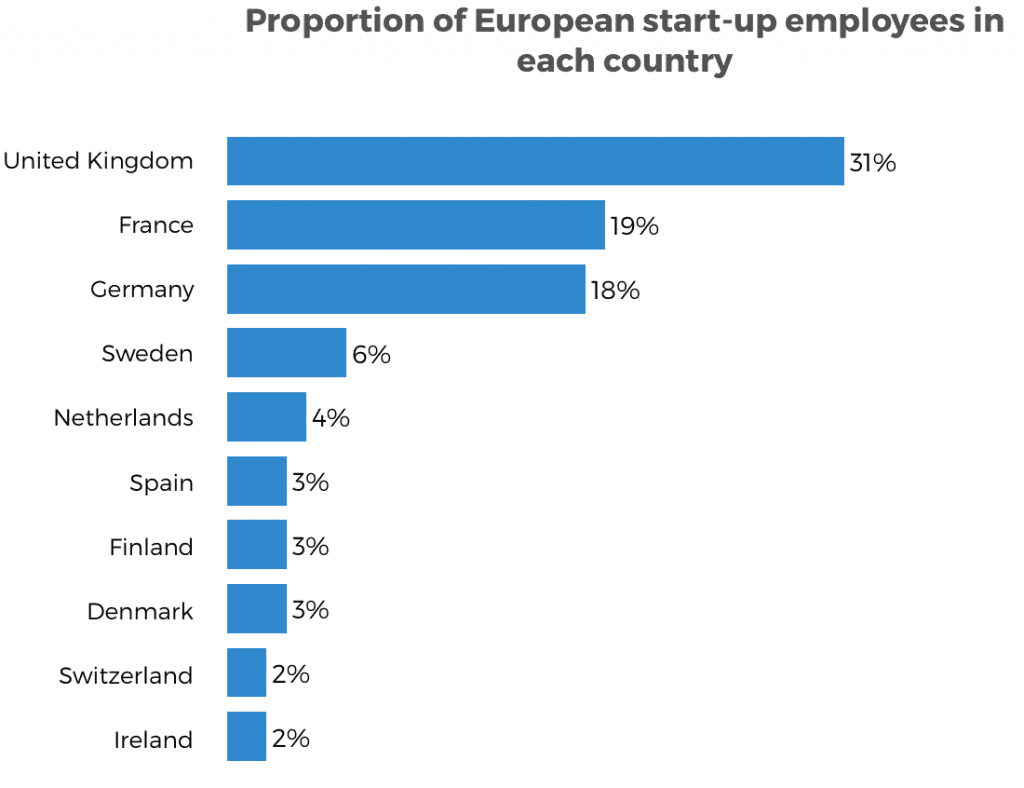

While the number of people interested in entrepreneurship may be proportionally lower Europe is slowly seeing and uptake in number of successful startups. London, Paris, and Berlin have traditionally been the center of innovation and entrepreneurial activity. The expansion of large tech corporations throughout the capitals of Europe has also helped concentrating the countries’ talent, which is at least in part responsible for the innovation and startups coming out of new cities around Europe.

Access to Talent

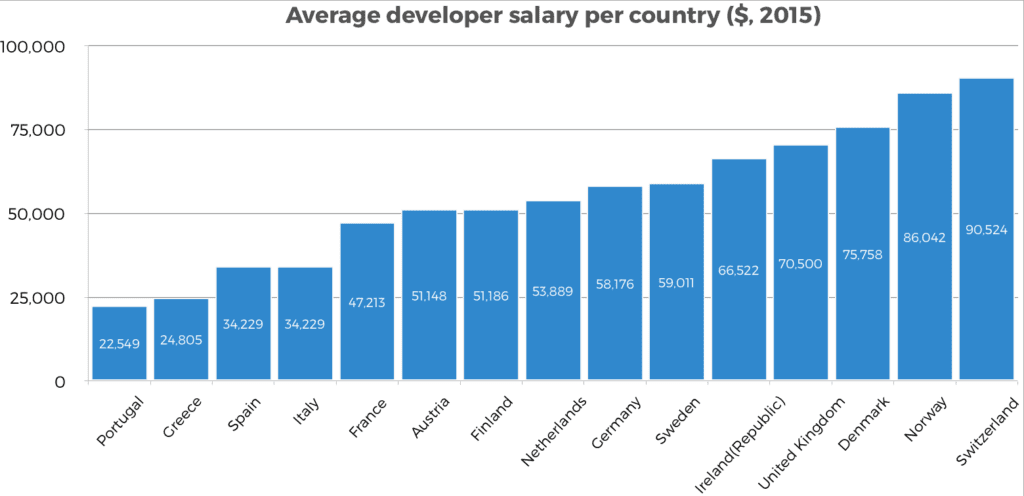

One key element for successful startups and innovation is talent. Compared to the U.S., Europe has almost the same access to talent in terms of number of developers living in the region, but Europe can tap into it at far cheaper rates.

The trend of large tech corporations opening development centers throughout the European continent has allowed for talent to redistribute in hubs around Europe. Nevertheless, the vast majority of tech talent is logically concentrated in London, Paris and Berlin.

Europe’s overall risk averseness again comes into play when attracting talent. Jobs at larger corporations are vastly more secure than working in a startup and they mostly pay better. Broadly speaking, European developer jobs are not necessarily the highest paying jobs, as in Silicon Valley. In the UK, the average salary is around $70,000, and it falls to $58,000 in Germany and $47,000 in France.

Venture Capital in Europe

When it comes to venture capital and raising funds in general, Europe has always stood in the shadow of the U.S. in terms of total capital raised. While the total and share of capital flowing toward venture investments has been increasing in Europe, the approach to funding differs vastly from the U.S. with Europe generally being much more risk-averse.

One of the most notable consequences of risk averseness can be identified when looking at the source of private equity. In the U.S., pension funds are heavily invested in venture capital and make up more than half of total VC money. In Europe, pension funds classify venture capital as a bad asset class.

VC in Europe

Although Europe has been attracting a growing amount of capital over the past years it still remains a fraction of the capital flowing through the U.S. The allocation of capital within Europe has traditionally seen its epicenter in London, with Paris and Berlin fighting for second place.

In the U.S., roughly two thirds of VC money comes from endowments and pension plans, which are far less common, or don’t exist, in most European states. The lack of pension funds in Europe is a vast differentiator for the market, as pension funds are often considered ideal capital providers for VC where a return is usually achieved in the long term, something pension plans are capable of committing to. European pension funds manage roughly $4 trillion, meaning that even a minuscule percentage committed to VC could close the funding gap. Nevertheless, European pension funds still classify venture capital as a bad asset class.

“The U.S. over a very long period has produced so many successful technology businesses that the pension funds have become used to it, and there is a portion of their funds that they’re quite comfortable investing in something which we [Europeans] would see as risky technology companies. But I think that will change as Europe produces more and more winners,” said Soskin. “The U.S. had a huge advantage despite the fact that the worldwide web was developed by an English man. It was in America that the commercial possibilities were understood much more quickly, particularly in the great state of California. […] They had a first-mover advantage but slowly and surely Europe is catching up.”

Compared to the U.S., Europe generally tends to run on a more social model. Citizens pay more tax and the higher tax rates cut in at lower wages. With more money flowing toward the state, private individuals tend to end up with less money than their U.S. counterparts and are therefore more reluctant to spend their hard-earned money in risky ventures such as angel investments or seed rounds. Some of the most successful people in the U.S. even start their own investment funds and rank among the largest and most popular funds worldwide.

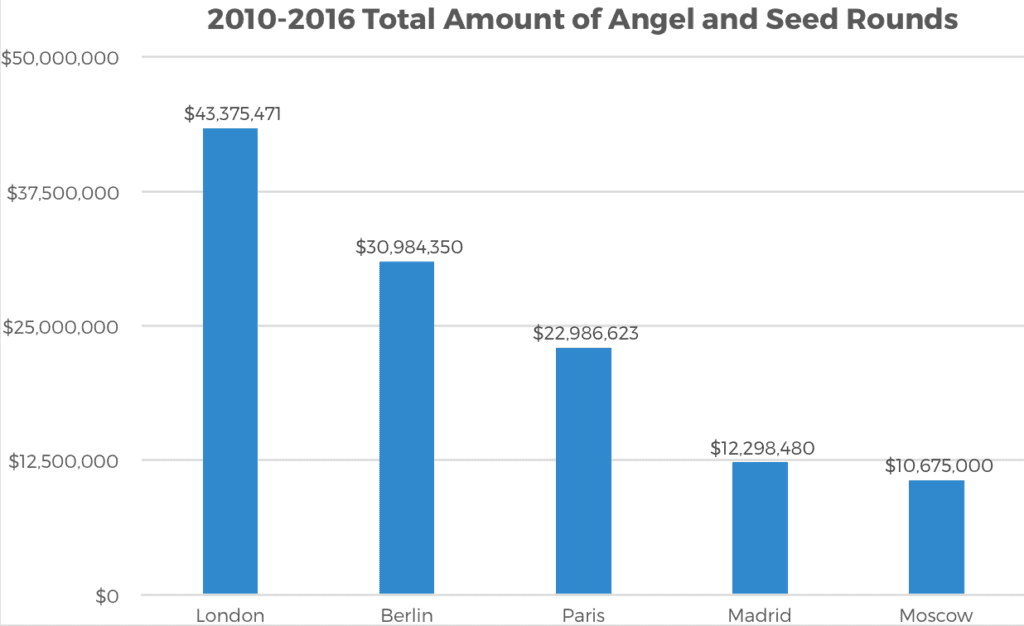

Source: Skift’s 2017 European Startups Data Sheet

Source: Skift’s 2017 European Startups Data Sheet

Seed and angel funding is harder to raise in Europe, particularly if the company is based outside of the traditional tech hubs. Although later stages could be considered less risky, Europeans alone are not able nor accustomed to fund companies with astronomic amounts. The larger the amount raised, the more likely it is that American VCs step in, particularly at the later funding stages.

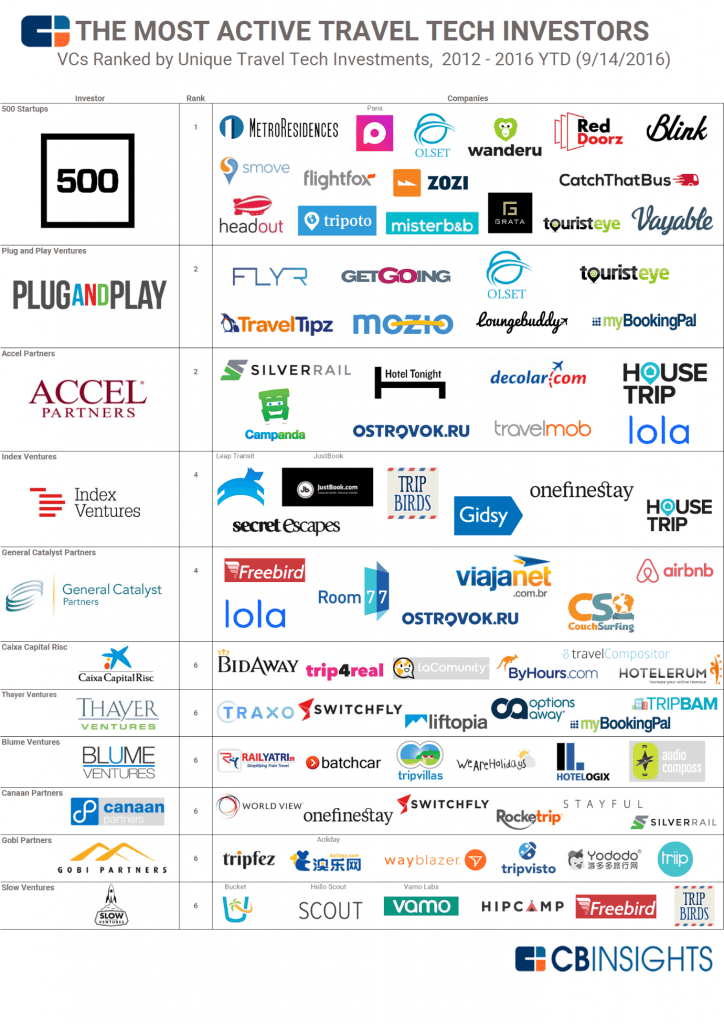

Among the most active travel tech investors, named by CBInsights, most trace their origin back to the U.S. although some have local offices in Europe. Nevertheless, the travel companies in which they invest are spread throughout the world.

Index Ventures traces its origins back to Europe, being founded out of Geneva in 1996 and operating out of London and San Francisco today. Caixa Capital Risc is based out of Barcelona and invests mostly in Spanish companies.

“There’s a lack of seed money and a lack of Series A money. The problem is at the really early stages, it’s fueled by pension funds not investing into venture capital, and we’re not talking about 50 percent we’re talking about one percent of pension funds which could be invested into venture capital,” says Maximilian Waldmann, CEO and founder of conichi, a hotel app that allows hotels to enhance the guest experience using beacons. In his experience, “It was extremely tough to raise in hospitality, everyone said there’s no money in hospitality, travel isn’t sexy.”

When it comes to origin of capital, the majority originates in Europe itself. The strongest contributors to VC come out of the traditional three leading tech states, which shed some light on the larger amount of early funding in those countries.

American startups are naturally more comfortable investing in their own market, which not only offers geographic advantages, but is a market which has over and over shown stellar returns to investors. In a similar vein, Europeans are also more comfortable investing in their domestic market.

Funding in Europe has become more accessible but is still highly concentrated within the UK, Germany and France when it comes to travel tech. The younger cities are slowly gaining traction but are held back by virtually nonexistent early stage funds, particularly in their respective domestic areas.

Exits and M&A in Europe

Many successful European companies end up getting acquired by larger U.S. companies. There isn’t a strong habit of doing M&A within Europe itself. IPOs are also far less common than they are in the U.S. Trivago is one of the few European travel companies that IPOed on the Nasdaq being based out of Germany.

One company that has recently become more active in the M&A space is AccorHotels. After the new appointment of Sébastien Bazin as CEO of the company, who experts say “has an American mindset,” and a large amount of cash flow due to the company moving to an asset light strategy, Accor has begun acquiring some European companies. Most notably, FRHI Holdings in 2015 for $2.9 billion in cash, onefinestay in 2016 for $170 million as well as John Paul, a mobile concierge app, and Wipolo, a mobile app that serves as a travel assistant.

The usual exit for European travel companies has traditionally been M&A from larger counterparts, mostly from the U.S. From Priceline’s acquisition of Booking.com in 2005 for a mere $135 million in cash to more recent acquisitions such as Skyscanner and Momondo.

One unexpected and large acquisition was that of Skyscanner in late 2016. Ctrip moved in to acquire Skyscanner for roughly $1.7 billion. A more recent acquisition that took place in 2017 was the purchase of Momondo, formerly Cheapflights, by U.S. travel giant Priceline.

The relatively low level of M&A within Europe can also be traced to the lower amount of capital available to businesses. “Europeans are not used to making acquisitions, organic growth remains the number one strategy for European companies,” said Morgann Lesné. “We don’t have strong public markets, it’s not a typical exit market for entrepreneurs. That’s a real lack we have.”

The Travel Startup Landscape

Europe has always been an active player in the travel sector. Arguably, one of the most successful companies ever in travel traces its origins back to Europe: Booking.com. The travel ecosystem in Europe has been heavily concentrated in three well established tech hubs: London, Paris, and Berlin. Yet other cities such as Moscow and Barcelona have seen significant capital flow toward their travel startup scenes.

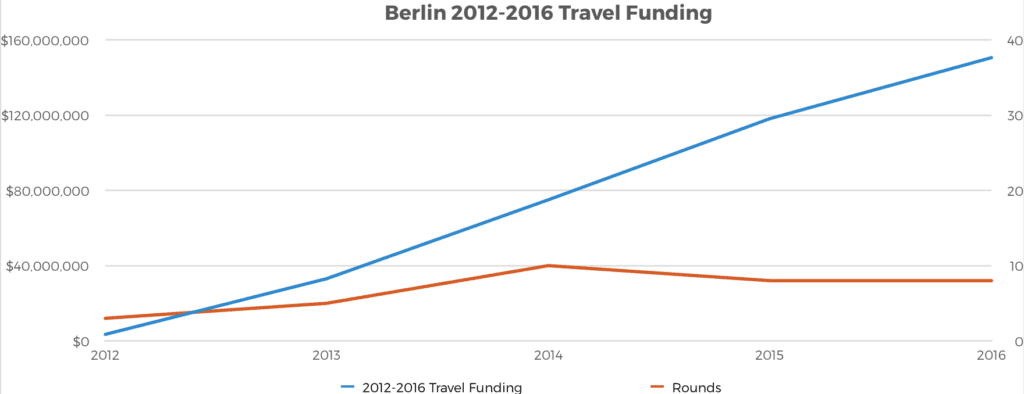

Looking at venture capital money flowing into the sector over the years, Paris and London have traditionally been the most well-funded cities in Europe with Berlin close behind. 2016 was the first year that Berlin ranked as Europe’s most funded travel tech hub. Berlin has seen strong growth over the past five years. However, Berlin only had eight investment rounds in 2016, compared to 24 in London.

Looking at the numbers from a country level also shows a different picture. While every country seems to generally have a main tech hub and smaller spinoffs, the UK’s numbers skyrocket when adding Edinburgh’s Skyscanner, which alone raised over $190 million in 2016.

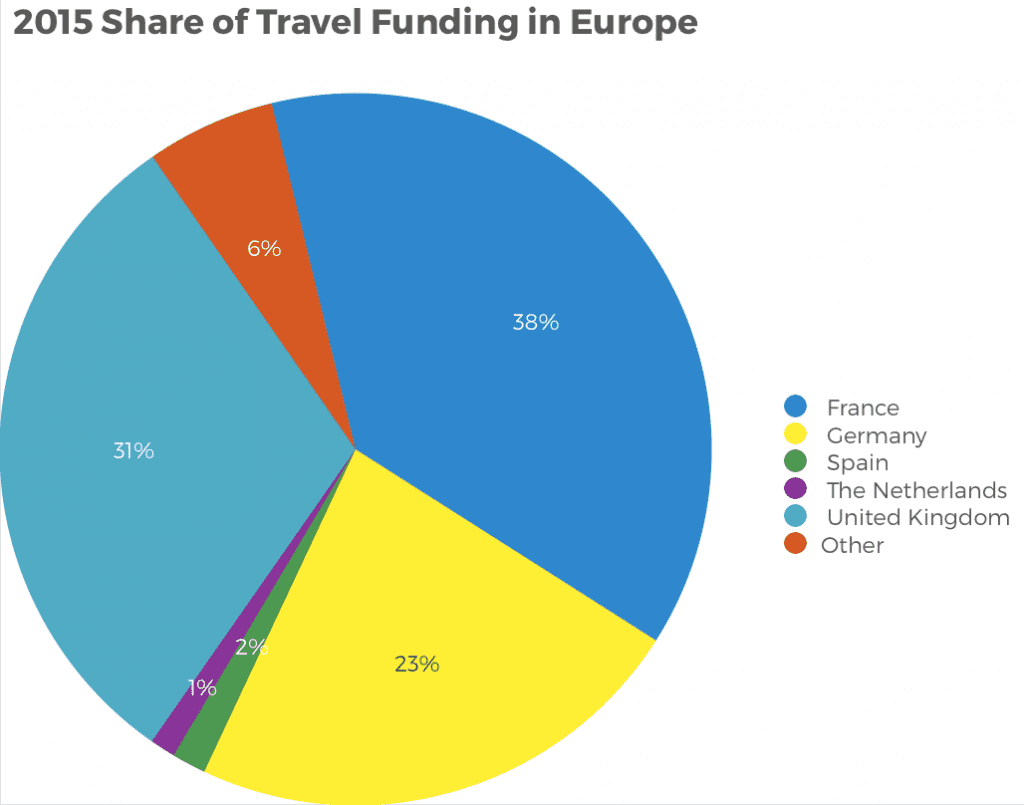

Source: Skift’s 2017 European Startups Data Sheet

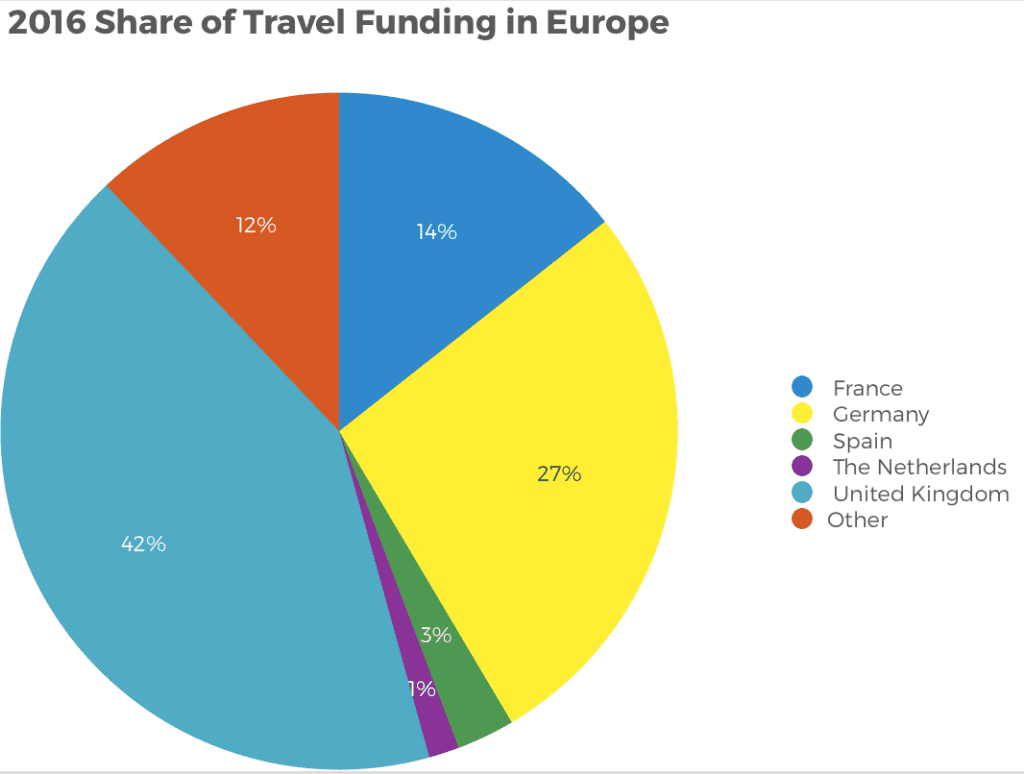

Similar to the city comparison, the landscape by country changes frequently indicating that there is no definitive travel tech-hub in Europe, but rather that capital flows wherever the innovation is.

Source: Skift’s 2017 European Startups Data Sheet

The lack of regular large funding pouring into the smaller tech hubs may be due to a lack of initial seed and angel funding.

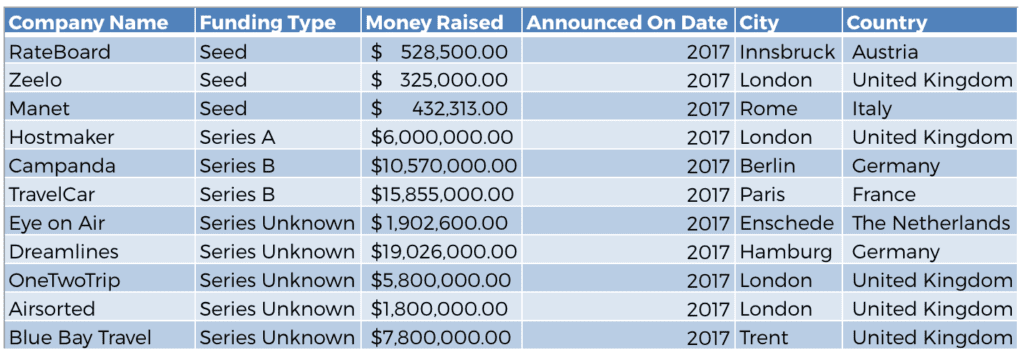

While still young, 2017 has already seen some significant investments take place in Europe.

Source: Skift’s 2017 European Startups Data Sheet

London

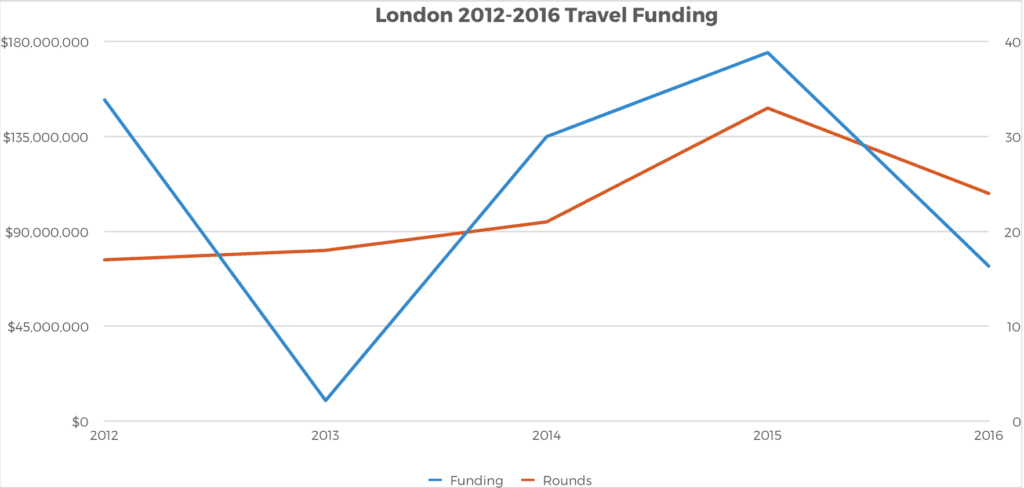

Traditionally the VC leader of Europe, London maintains its reputation in travel tech by ranking among the highest cities by funding and output of startups.

London clearly stands out from the rest of Europe when looking at the number of startups being funded. While the total funds raised are in a similar range as Paris and Berlin, London has more than twice as many rounds compared to any other European city.

The travel landscape in London is a strong mix of B2C and B2B companies. The most funded companies tend to be customer-facing, such as Hailo, onefinestay, and Secret Escapes. However, the city also has a strong presence in the B2B space, one of the largest B2B companies being SilverRail. London has seen a strong trend of vacation rental startups, most notably HouseTrip and onefinestay, which were both sold in 2016.

Source: Skift’s 2017 European Startups Data Sheet

Citymapper

Azmat Yusuf founded Busmapper due to his issue of “trying to figure out how to get back home at three o’clock in the morning,” he joked at TechCrunch Disrupt London in 2017. After his first funding round, he expanded his company to cover more than just buses, thereby entering the city multi-modal sector, and changing the name to Citymapper.

To date Citymapper has raised a total of $50 million, becoming one of the most funded travel companies out of London. It has expanded from London to 39 cities, including Sydney, Seoul, Singapore, Moscow and Sao Paolo.

HouseTrip

HouseTrip was founded in 2010 looking to rival Airbnb as a European counterpart. The company was acquired by TripAdvisor in 2016 for an undisclosed amount. HouseTrip was a logical next step for TripAdvisor expanding its reach in vacation rentals, particularly in Europe. In 2015 HouseTrip had a gross transaction volume of €77 million, of which we estimate roughly 80 percent originated from Europe. The company closed 2015 with a loss of €5 million, down from a loss of €20 million the previous year.

onefinestay

Onefinestay made press last year when it was acquired by Accor for $169 million. The company, based out of London, had been building a luxury Airbnb while also providing property management for the homeowners. The houses available on the site are carefully selected and fully managed by onefinestay, including housekeeping, assistance for guests, and the whole distribution of the property. The company charges between 30 and 50 percent of the rental price.

Onefinestay raised $3.7 million in its initial Series A round in 2011 and ended up raising a total of $80 million by 2015. Hyatt participated in the company’s Series D round. Today onefinestay operates in London, Los Angeles, Miami, New York, Paris and Rome with more than 2,000 homes. The acquisition by Accor came as a surprise to many, as onefinestay was operating in the red and hotels have traditionally opposed the vacation rental industry moving into urban areas.

Paris

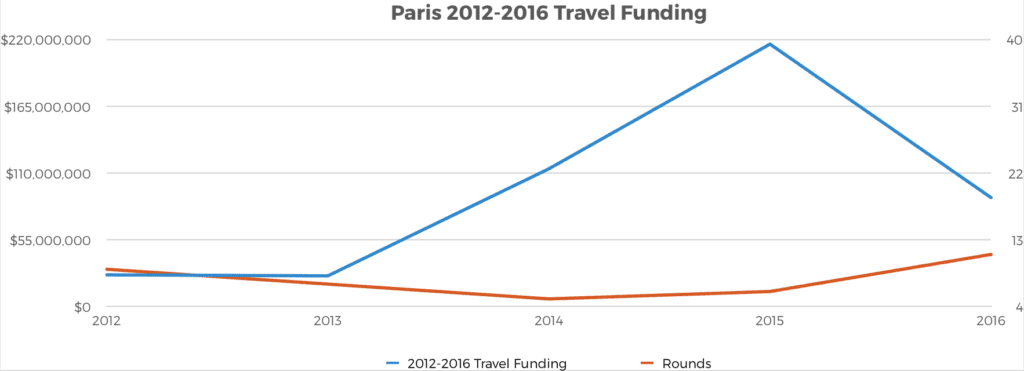

Paris is known for its startup scene and ranks high in travel tech funding. While France has seen a turbulent 2016, with funding halving, the city has seen a larger number of startups raising capital.

Paris is also home to the most funded travel startup in Europe, BlaBlaCar, which is also responsible for the strong peaks of funding in 2014, in which it raised $100 million, and 2015, in which it raised $200 million. In other words, BlaBlaCar has been keeping Paris in the travel tech funding leaderboards.

Source: Skift’s 2017 European Startups Data Sheet

Blablacar

France’s most successful company in travel, BlaBlaCar raised a total of $310 million over the past five years and unlike most European startups, has also actively acquired competitors across Europe. The company acquired direct competitors throughout Europe looking to gain a strong market share in the car-sharing sector. In 2015 the company also acquired a Mexican car-sharing platform Aventones. Today BlaBlaCar operates in 22 countries, mostly throughout Europe, but also in India, Mexico, Brazil, Turkey and Russia.

The ridesharing company focuses on long-distance journeys. It offers car owners the opportunity to take passengers on the trip and thereby split the cost of the journey.

FASTBOOKING

Tackling the direct booking wars, FASTBOOKING raised $50 million, aiming to restore hotels’ power in distribution. The company provides hotels with a set of tools — from website development and a booking engine to rate checkers with competitors and OTAs and global distribution services — to help convert direct bookings and increase one’s visibility in the digital market. The company’s largest markets are Europe and Asia, and it was acquired by Accor in 2015.

Berlin

Berlin has seen astounding linear growth in terms of funding pouring into travel tech. Similar to Paris, Berlin reaches high funding numbers through big powehouses, namely GoEuro and GetYourGuide, which together raised $165 million in the last two years.

Berlin has attracted talent and startups due to the cheap but increasing cost of living compared to Paris and London. The larger travel tech landscape is mostly dominated by B2C companies, but Berlin also holds a number of B2B startups including SnapShot, Door2Door, Distribution, and conichi.

Source: Skift’s 2017 European Startups Data Sheet

GoEuro

GoEuro was founded by Naren Shaam who, intrigued by the complexity of the European transportation system, moved to Berlin to fix it. Founded in 2012, the company raised an initial seed of $4 million, followed by a Series A, B, and C totaling $146 million in total capital raised and ranking GoEuro as one of the most funded travel startups in Europe. Investors include Atomico and Kleiner Perkins Caufield & Byers, Lakestar.

Today the company operates in 12 countries and is looking to expand throughout Europe. Shaam says that Europe is the perfect market to prove his concept about multi-modal transportation.

GetYourGuide

GetYourGuide also ranks in as one of the most funded travel companies out of Berlin, the company helps tourists stroll around a city and facilitate booking tickets for attractions all around the world. The company raised a total of $95 million and has 30,210 activities in 7,020 destinations around the world today.

The company operates in a sector in which Expedia and TripAdvisor have shown a keen interest. TripAdvisor acquired Viator for $200 million in 2014.

Wimdu

Wimdu was the German alternative to Airbnb, focusing mostly on the European market although it had listings globally. Founded in 2011, three years after Airbnb, it raised a Series A lead by Kinnevik AB and Rocket Internet in the same year raising $90 million. Wimdu was acquired by its competitor 9flats in 2011, merging the two companies together. Most recently Wyndham Destination Network, the vacation rental and time-share arm of the Wyndham brand, purchased the merged company looking to expand its distribution reach on the vacation rental front.

Barcelona

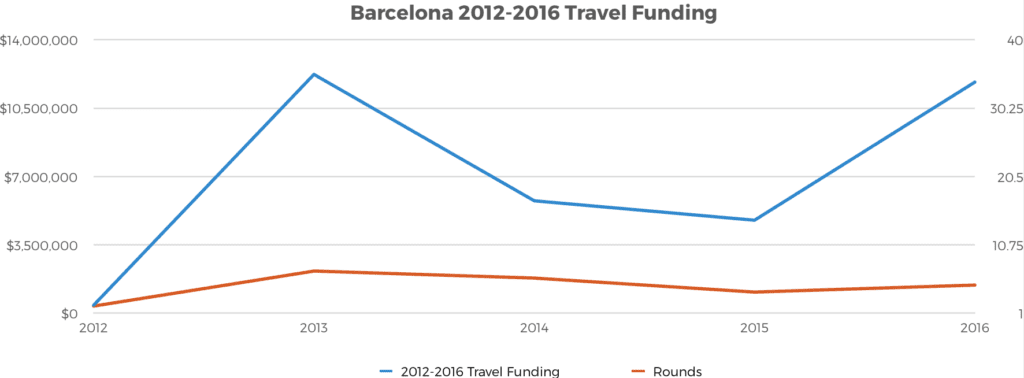

Compared to larger cities, Barcelona has a significantly lower flow of capital toward travel tech companies. While Barcelona has some active and successful travel companies, it doesn’t currently have startups heading toward unicorn valuations.

Barcelona’s handful of travel startups are mostly B2C, Travel Perk and ByHours.com being the two largest recently. Fluctuations in capital are easily caused by single large funding rounds, but the number of rounds has kept reasonably stable.

Source: Skift’s 2017 European Startups Data Sheet

Travel Perk

Travel Perk offers travel solutions for businesses, allowing business travelers to book a whole business trip through its platform.

The company raised $8.5 million in 2016, which represents roughly 70 percent of total VC funding for that year in Barcelona. $7 million was raised through Spark Capital, a Boston-based fund that has also invested in GetYourGuide, Oculus VR, and Twitter.

ByHours

ByHours.com is a consumer-facing platform that allows customers to book a hotel room for a certain slot of hours rather than the whole day. The company aims to maximize use of the hotel room while bringing convenience to business travelers or travelers with short layovers. The company raised a seed round of €600,000 in 2013, followed by a $3.6 million investment round lead by Axon Partners Group and Mediaset.

Moscow

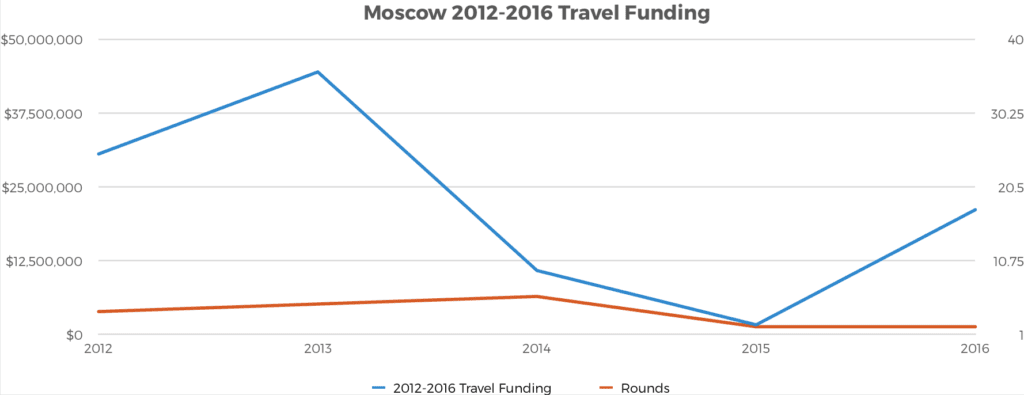

Moscow has a unique market when it comes to online services. Similar to the Chinese market they tend to use services from their own country more than those from the western world. While often considered copycat companies, these companies do specifically target and cater to those markets, which often can be very difficult to penetrate when coming from abroad.

Although the number of travel companies out of Russia is low, they receive significant funding due to the larger customer base, which usually expands beyond Russia and covers many former Soviet countries, which not only often speak Russian but also have a similar culture. Virtually all Russian travel tech companies are based out of Moscow.

Source: Skift’s 2017 European Startups Data Sheet

Zen Hotels Group

The largest Russian company is Zen Hotels Group, an OTA that runs on two domains: ZenHotels.com and the more popular Ostrovok.ru. The latter dominates the Russian market, the Booking.com of Russia. The former is the international-facing platform with which the company is looking to attract a larger customer base.

Accel Partners and General Catalyst lead Zen Hotel’s 2011 Series A round, which raised $13.6 million, which was followed by a Series B of $25 million in 2013 led by General Catalyst.

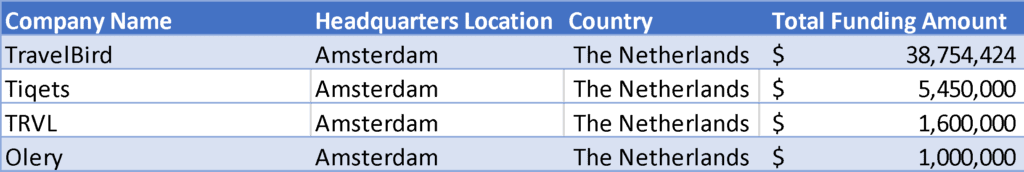

Amsterdam

Amsterdam mostly owes its reputation as a travel tech hub to the success of Booking.com. While Amsterdam retains a large number of travel startups and has good access to talent, the startups are less reliant on large venture capital.

Two fast-growing companies that stand out, having raised significant capital by Amsterdam standards, are TravelBird and Tiqets.

Source: Skift’s 2017 European Startups Data Sheet

TravelBird has positioned itself as the Groupon of Europe, offering selected travel deals throughout the continent. The company raised $38 million.

Tiqets raised $5.4 million and focuses on selling last-minute tickets for cultural attractions including museums, sightseeing, and other local attractions.

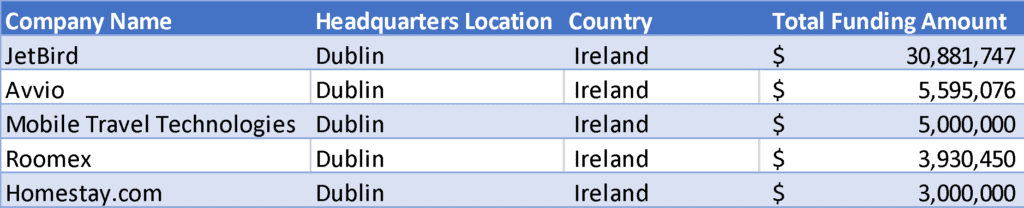

Dublin

Dublin is where most companies hold their European headquarters, but rather than being motivated by talent or access to capital, it’s due to the country’s attractive corporate tax scheme. Although corporate tax is 12.5 percent, if revenue is tied to a company’s intellectual property, the rate drops to 6.25 percent.

The most funded travel startup out of Dublin was JetBird, the Uber of the skies, which never took off. It raised $30 million total, but launched exactly during the global economic downturn, which made the company’s venture short-lived.

Source: Skift’s 2017 European Startups Data Sheet

More recent travel companies out of Dublin include Roomex.com and Homestay.

Roomex.com is a global hotel booking platform for business travel that raised $3.7 million in its 2016 Series A round. The platform allows businesses to operate custom hotel interfaces adapted to the companies’ requirements.

Homestay is Dublin’s response to the vacation rental trend. Founded in 2013, the site exclusively provides a bedroom in a host’s house. In other words, they only have private room listings. It raised $3.5 million in 2014, and today has local hosts in over 150 countries.

Takeaways

- The European venture landscape is still far from rivaling the U.S. one. However, the emergence of new tech-hubs, while currently of small impact, can help Europe develop a stronger ecosystem in the long-term.

- Funding is also still an issue, the funding-gap is mostly due to European’s risk-adverseness. While larger U.S. VC funds step in at later stages, at the very early stages raising capital can be a challenge particularly if not based out of the well-established tech-hubs.

- For larger companies looking to expand into Europe M&A remains a viable option, providing them with an established brand awareness and strong penetration into the different European countries.

- Funding in travel has seen a steady growth over the past years. London remains the European travel tech-hub capital with the largest number of startups and deals closed per year, while Paris and Berlin raise similar amounts to London they typically close far fewer deals.

Endnotes and Further Reading

- Les misérables, The Economist, July 2012

- GoEuro’s First Priority After $70 Million in New Funding Is Raising Awareness, Skift, October 2016

- GetYourGuide Gets a Historic $50 Million Funding Round in Tours and Activities, Skift, November 2015

- The Most Active VCs In Travel Tech And Their Investments In One Infographic, CB Insights, September 2016

- The United Kingdom’s exit from and new partnership with the European Union White Paper, Gov.uk, February 2017

- Promoting entrepreneurship, European Commision, n.d.

- THE ENTREPRENEURIAL ECOSYSTEM, Global Entrepreneurship Monitor, n.d.